Why SOL Remains One of Crypto's Best Long-Term Opportunities

The State of Solana: Network Stability, DeFi Maturity, and Institutional Adoption

Welcome to the alpha please newsletter.

Since the end of January, the crypto market has been on a downward slope, with rising macro uncertainty and weak market sentiment. But recently, we’ve witnessed a shift in momentum.

While still early, it seems we might be at an inflection point for crypto. This got me excited to write a comprehensive report about the state of Solana.

To me, Solana still stands out as one of the strongest L1s in the market. It’s the fastest-growing ecosystem in crypto, one of the few with real organic traction, and it has even surpassed Ethereum on many on-chain metrics.

With that being said, let’s dig in.

This newsletter is brought to you by Kamino

Kamino Meta-Swap now gives you the best price execution for any swap on Solana. Kamino aggregates prices across Pyth Express Relay, Jupiter, DFlow, Raydium, Autobahn, and more.

You actually get the number of tokens you are quoted rather than a different number when you actually execute the trade.

I think it is the best place to swap tokens on Solana, and highly recommend using it.

What’s to come:

State of the network

Overview of on-chain activity

Ecosystem development

SOL price analysis

State of the network

To begin our analysis, let's take a step away from price and focus on the fundamentals. Here, we note that Solana, as a network, appears to be in one of the strongest positions it has ever been in.

Network stability

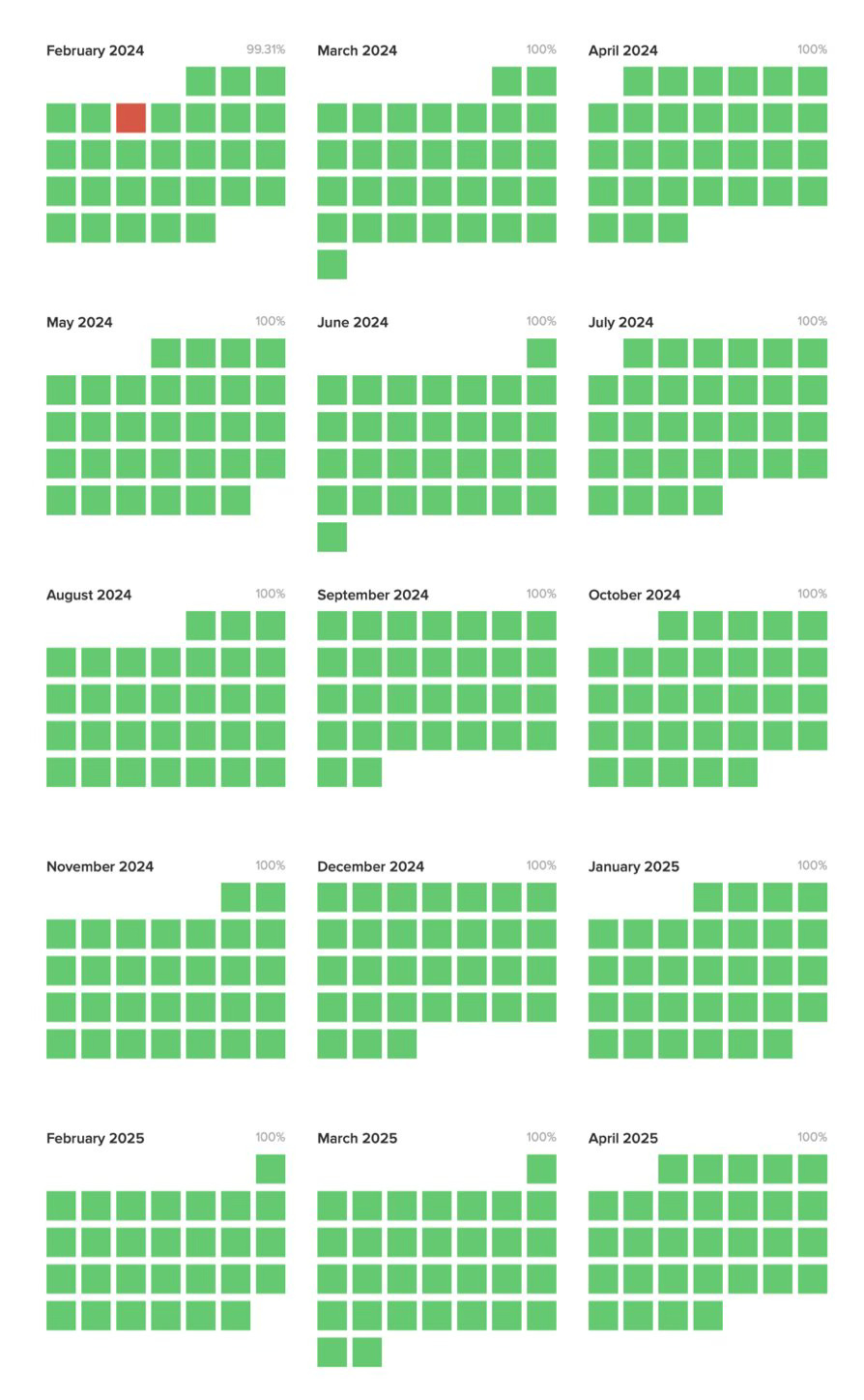

In its early days, Solana suffered numerous criticisms over network outages and instability. However, it seems that this is a thing of the past. Since February 2024, there hasn’t been a single outage.

Lindy effect is a powerful force in crypto. It’s a strong indicator of trust and reliability. I think that’s a big part of Ethereum’s success with big institutions so far: it’s been live since 2015 and has never experienced a full network outage.

While Solana is still a bit behind on that front, the stats are promising. As uptime improves, so do trust and reliability. And that's a big deal.

Decentralization

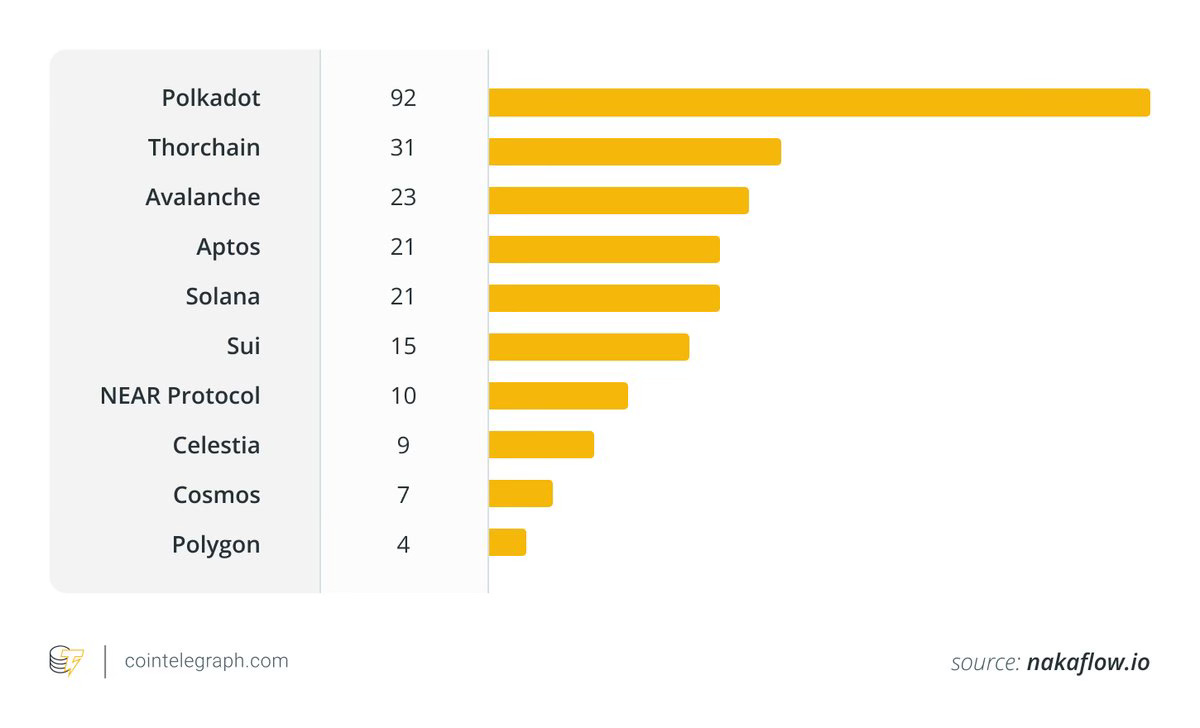

Decentralization is a guiding principles of blockchain networks. This is what distributes power, and decision making across nodes, and what makes the network resilient. One easy way to measure it is through the Nakamoto coefficient where the higher the number, the better. According to recent data from CoinTelegraph, Solana is well positioned with a Nakamoto coefficient of 21.

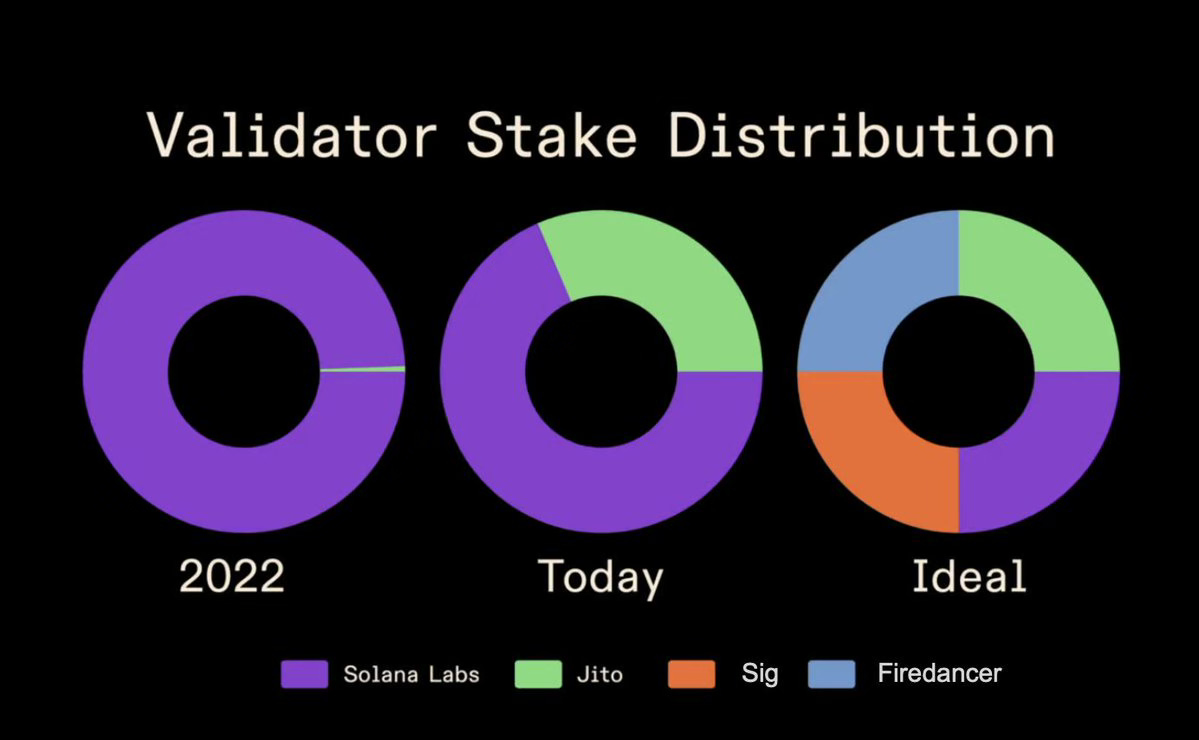

Another critical aspect of decentralization is client diversity. Multiple validator clients reduce the risk of a single point of failure and is essential as a blockchain matures. Currently, only Ethereum has multiple independent validator clients. For now, Solana has only one: Solana Labs (as Jito Labs’ version is basically a fork, not an independent implementation). However, two independent clients are in development: Firedancer by Jump, and Sig by Syndica. Once live, they will significantly improve Solana’s decentralization by removing reliance on a single codebase and introducing true client diversity.

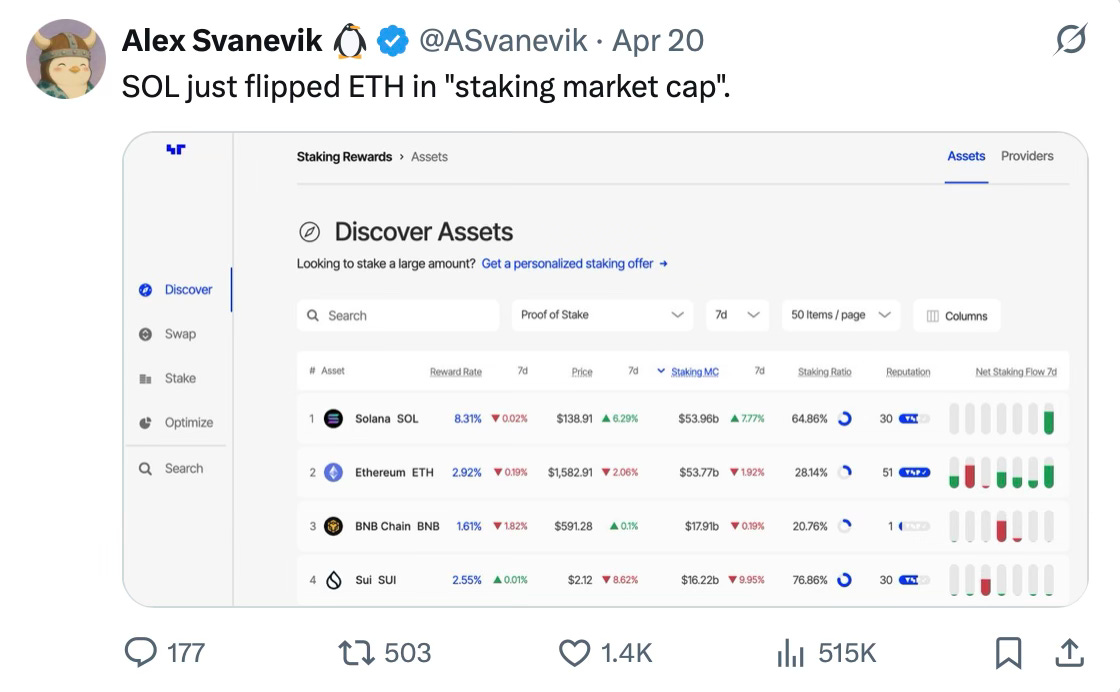

Staking market cap

Solana also recently flipped Ethereum to become the number one chain by staking market cap. Taken at face value, it suggests that Solana now leads in terms of "economic security." This will be especially relevant once slashing is live on mainnet.

(PS: I know this "economic security" topic is a heated debate and involves many shortcuts, etc., but for the sake of this post, I'll argue that staking market cap is a good enough heuristic).

Developer activity

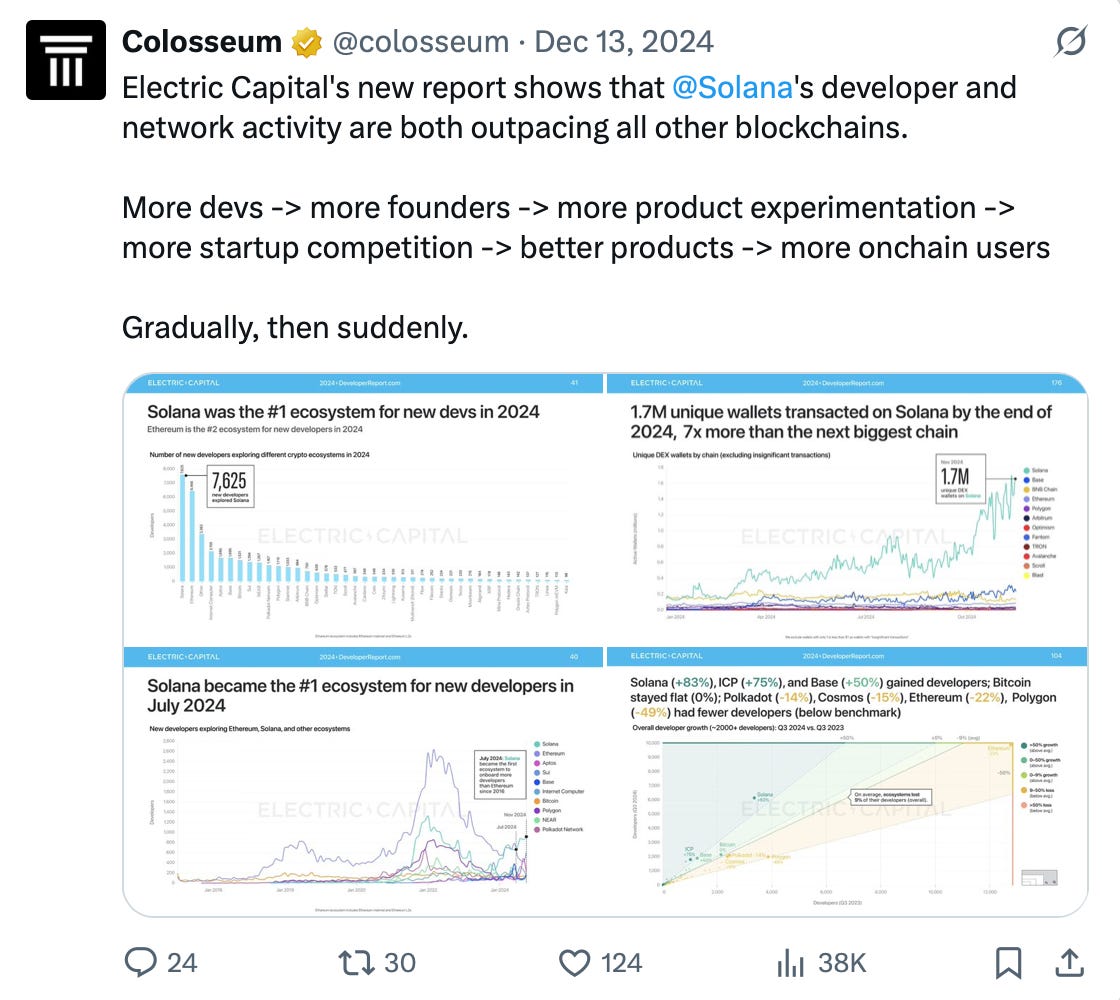

State of developer activity is another important metric to monitor. Ultimately, this is what is shaping the future of a blockchain network. Recent reports from Electric Capital shows that Solana was the number one ecosystem for new developers in 2024.

New initiatives coming

Last but not least, new initiatives aiming to improve Solana’s performance at the communication layer, like DoubleZero, are emerging. That’s another important vertical to monitor going forward.

On-chain activity

Since the beginning of 2024, on-chain activity has been in a big secular uptrend, with numerous new initiatives, and a DeFi ecosystem that is thriving. This can be seen through different metrics.

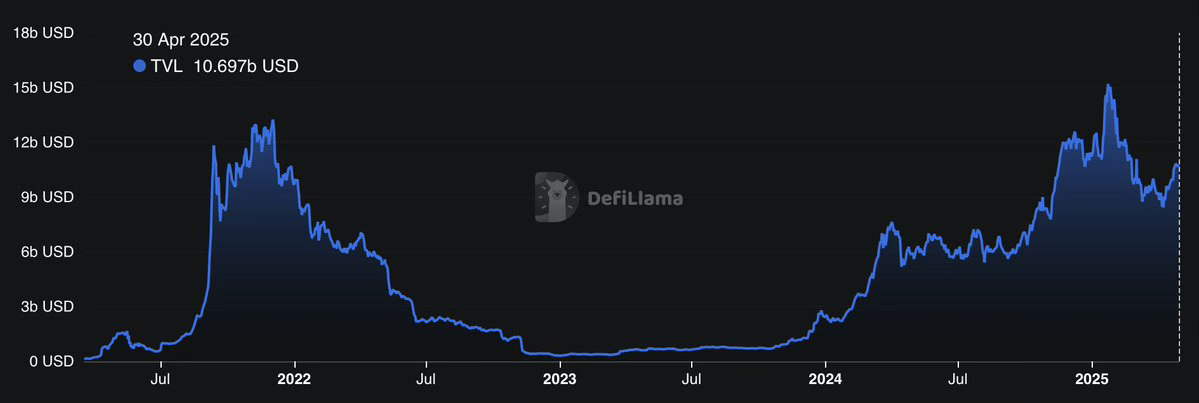

TVL

TVL went from less than $1B in end of 2023 to a new all time highs of over $15B in early 2025. While TVL is slightly down since, it's still consolidating around the $10B level, and is showing strength.

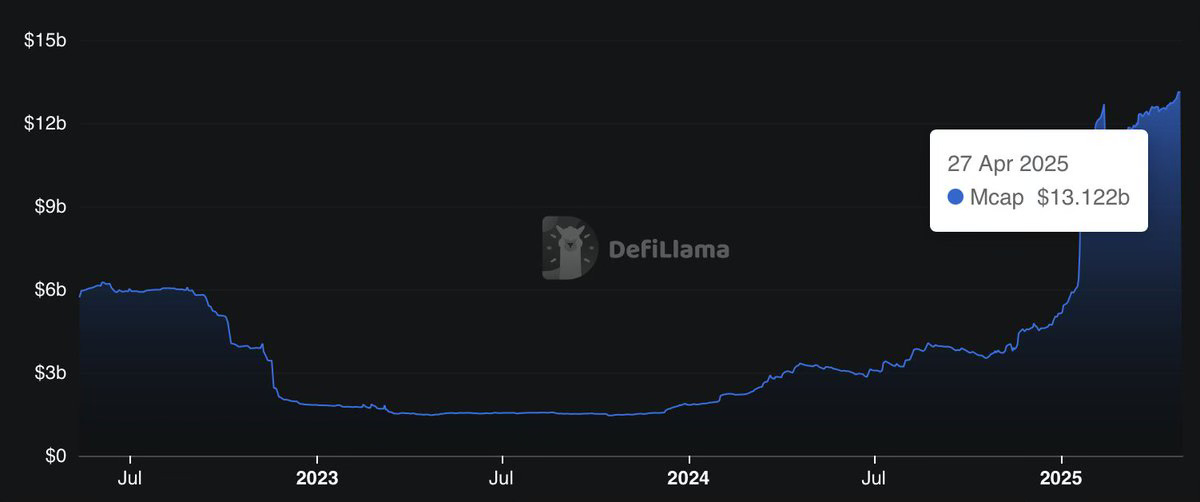

Stablecoins market cap

The chain has also seen a strong surge in stablecoin inflows over the past year. As of writing, the stablecoins market cap on Solana is at an all-time high of $13.2B. This is a clear signal of growing adoption and trust in the network.

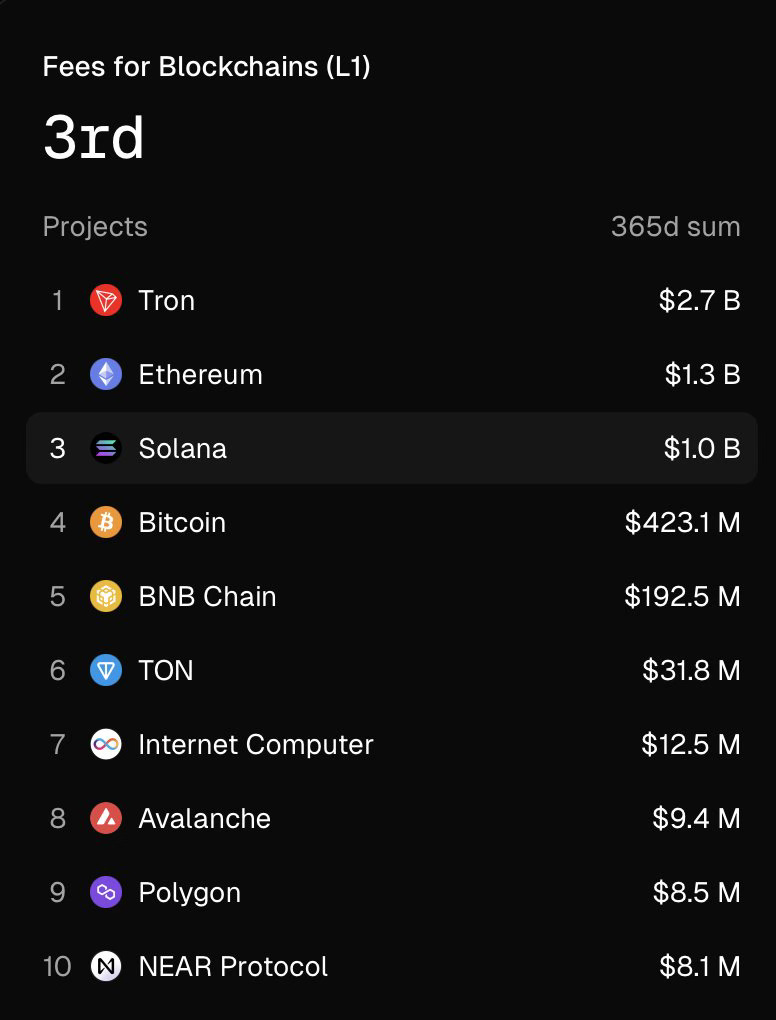

Fees

Taking the sum of last year fees, Solana is the third L1 in terms of fee generated, and really close to Ethereum. Yet another metric that points towards high on-chain activity and demand for the network.

Ecosystem

At the end of the day, a blockchain exists for applications to be built on it and thrive. While haters will say that Solana is a success simply because of Pumpdotfun and the meme coin mania, I think it misses the big picture: Solana is the fastest growing ecosystem in all of crypto, that is increasingly driven by real use cases.

In fact, I believe we can even go as far and say that in the long run, the fact that meme coin mania happened on Solana is a net good. It acted as a carrot that put Phantom wallets on millions of phones worldwide. This solved the "cold start problem" every new network faces.

Now, with that user base already onboarded, the chain is well-positioned to support more meaningful applications and continue its growth trajectory.

DeFi is Maturing

DeFi on Solana is maturing. As shown earlier, it’s now the second-largest L1 by TVL and one of the few chains from the last cycle to reach a new all-time high in 2025. That signals sticky users and real traction.

First wave of DeFi on Solana in 2021 was mostly experimental and driven by hype. But today, growth looks more sustainable, with stronger fundamentals and clearer PMF.

Some protocols I think are worth mentioning include Jito, Kamino, Marinade, Radium, or Jupiter.

And to gauge how fast Solana is growing, here are some of the developments from May alone:

As well, we are also witnessing a new wave of DeFi primitives emerging. Some worth introducing are:

-Yield trading with projects like @RateX_Dex, @ExponentFinance, @sandglass_so , or @pyefinance

-Liquid restaking with @KyrosFi

-New stablecoin primitives with @Perena__, @global_dollar, or @KASTcard

-Yield aggregators like @uselulo or @DeFiCarrot

-Oracles with @switchboardxyz

-And the list goes on and on.

Solana also continues to attract existing protocol. One recent example is @1inch, which just went live on the chain.

DePIN szn

Beyond DeFi, we're also seeing the rise of DePIN. According to @Dune, 46.5% of total DePIN market cap is currently on Solana with top-notch projects like @helium, @Hivemapper, or @rendernetwork.

And they collectively distributed over $400m to people who participated in this initiatives. This is huge.

Consumer app breakthrough

While still early in this meta, there is a strong push to break into the consumer app segment. This is a challenging one that will take a lot of time and trials to crack, but seeing guys like @nikitabier joining Solana as an advisor makes me optimistic.

Right now, there’s truly no better place for crypto builders. Solana is attracting top-tier talent and offers one of the most supportive environments, with active ecosystem funds, lot of hackathons, and a strong builder culture. The startup energy out there is real. And this is reflected in the stats. According to @QwQiao, Solana will soon become the largest ecosystem of Alliance founders for the first time.

This makes me believe that among L1, Solana has the highest probability of being the place where the first breakthrough crypto consumer app emerges. If it does, this can be a really positive thing for the network. To be followed.

Strongest community

So far, we've looked at a lot of metrics and tangible things to access the network. But I’d argue that Solana’s biggest strength is intangible: its community.

They say the communities that go through the worst (like the FTX collapse) come out the strongest, and I think that’s part of the story. Another key factor is the @superteam community. They are doing an outstanding job at nurturing talent and keeping the momentum alive.

In my opinion, this is one of Solana's secret recipe to success. And one that's really hard to replicate. No other chain in crypto has this level of culture.

Institutions are coming

Institutional interest in the network is also accelerating. One recent example is the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) expanding to Solana after Ethereum. There are many more similar examples, but I think this is enough to make the point: TradFi has growing confidence in the chain’s infrastructure.

Further, Solana is likely the next crypto asset to have its spot ETF approved in the US. Polymarket currently prices a 77% chance of approval in 2025. An ETF would further legitimize SOL as an investable asset, and Solana as a network of hightrust and integrity. This could open the door to a new class of institutional and retail investors.

SOL price analysis

Looking at the price, we see that SOL went through its first phase of hype in 2020–2021. But like most new protocols, its infrastructure was underdeveloped, the ecosystem immature, and the hype quickly faded as crypto entered a bear market in 2022. The FTX collapse made things worse, and many saw Solana as a dead project.

Unlike most protocols that struggled to recover, Solana came back stronger. After around a year and a half of consolidation, SOL broke out of its range for the first leg of a new bull market. In fact, it became one of the few 2021 L1 to reach a new all-time high, this time with a real and strong ecosystem behind.

Right now, we are in a setup where, after dropping nearly 67% from its January all-time high, SOL has rebounded strongly and currently sits at around $170. While this might be a bit of an overbought situation in the short term, the mid-to-long term setup looks explosive.

Among the major L1s, SOL has also demonstrated a lot of relative strength. Indeed, SOL/ETH is in a clear uptrend and near ATH.

What's ahead

Now of course, it's impossible to predict where the price will go from here. Instead, what we can do is build a framework to better assess an opportunity in terms of risk and reward. A simple heuristic I like to use is to compare the change in fundamentals and price of an asset from a point A to a point B in time.

Right now, what I see is that you can buy SOL at the same price people were willing to pay back in the 2021 frenzy. Back then, Solana was nothing more than a dream. No PMF, a really nascent DeFi ecosystem, etc. Today, the state of the network is promising. It is the fastest growing chain in crypto, with real users, real application, and growing institutional interest.

Further, I also think the market structure is evolving, where networks/operating systems will continue to be the place where most of the market value accrues.

In that sense, here is my line of thought:

Crypto networks are going to get more valuable as things continue to be built on them, the regulatory landscape remains favorable, and adoption continues. Ultimately, every investor in the world will want to own a piece of it

Beyond Bitcoin, I think L1s will continue to be the place where most of the value accrues (they are the operating systems of crypto land).

For all the reasons we mentioned previously, I think that within L1s, Solana is in a really good position.

This leads me to believe that for anyone with a long-term view on crypto, SOL still represents one of the best opportunity.

Lastly, I will leave you with this:

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Yup… the metrics can’t be denied. For sure, it’s next up for an ETF and the first ‘large cap’ the institutions will bite into in a meaningful way after BTC, ETH… on. Three yr view, large caps will outperform small once the institutional money starts to enter. They won’t fish in small cap space, outside of a small allocation. It will be very much like stock and other allocations within diversified portfolios..