Why has this cycle been so hard?

POV: You hold alts and not BTC

Welcome to the alpha please newsletter.

Firstly, the cycle has been hard, so don't let anyone larp to you that it hasn't. But, the reality is that every cycle is harder than the previous one. You are playing against a bigger pool of people, and the number of sophisticated participants increase, and ultimately you get more losers.

If you weren't majority BTC or SOL from the bear market, then you probably haven't made any money and are tearing your hair out. I certainly would have struggled had I not denominated in SOL.

Yes, we have had a lot of big individual winners, but I would guess that if you are taking big swings on these types of assets then you likely end up giving some or a lot of it back. Especially as it's not like people just ride off into the sunset with their one big win. They say "there's still time in the cycle" and they think they can run it up more, which is how they give it back.

Play stupid games, win stupid prizes will never not be true. Sometimes it just plays out across a longer time horizon for traders and gamblers.

So, why has this cycle been so hard?

1. PTSD

We have two examples of big alt coin cycles where most of them went down 90-95%, and due to the Luna and FTX unwind, which caused contagion across the entire industry, stuff went possibly even lower than it should have gone. Big, big players were carried out, and we haven't seen crypto lending desks return this cycle.

This PTSD has deeply affected crypto natives. And the way that the alt coin market trades in particular is a result of "everything is a scam" being the predominate view this cycle. "This tech is the future" was a bigger belief in the previous two cycles, but that is now a more minority view, or equal alongside "everything is a scam".

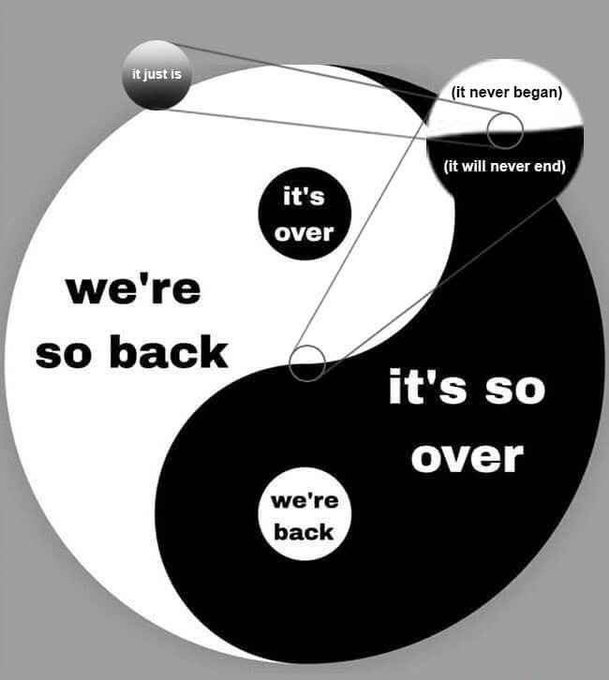

No one wants to hold anything longer term, because they simply never want to lose a big chunk of their portfolio again. It creates the max jeet cycle. This also gets reinforced on CT, as participants fuel even stronger emotional swings with everyone constantly looking for the top of the cycle.

The psychological impact extends beyond just trading behavior - it's affected the entire ecosystem's approach to building and investing. Projects now face much higher scrutiny, and the bar for trust is exponentially higher. This has both positive and negative implications: while it helps filter out obvious scams, it also makes it harder for legitimate projects to gain traction.

2. Innovation

There is more iterative innovation, and infrastructure keeps improving, but not as much 0->1 and as many eye popping breakthroughs like DeFi. This makes it easier to argue crypto hasn't moved forward etc. and also leads to more "crypto has achieved nothing" type narratives.

The innovation landscape has shifted from revolutionary breakthroughs to incremental improvements. While this is a natural evolution for any technology, it creates challenges for narrative-driven markets.

We are also still lacking in break through apps, which are needed to take crypto to hundreds of millions of onchain users.

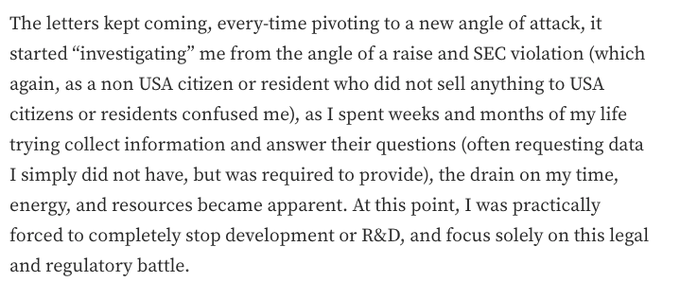

3. Regulation

The corrupt SEC caused havoc. They hampered the progress in the industry, and stopped certain sectors that could have had more PMF with a wider audience, such as DeFi, from progressing further. They also stopped all governance tokens from passing on any value to holders, and therefore created the "all these tokens are useless" narrative, which was sort of true.

The SEC drove builders away (see Andre Cronye's account of how the SEC made him quit), stopped TradFi being able to interact with the industry and ultimately forced the industry to raise with VCs, and created bad supply and price discovery dynamics where the value was all being captured by a few.

We are seeing some positive changes here now with Echo, Legion and more public sales.

4. Financial Nihilism

All of the above has fed into financial nihilism being a big factor this cycle. "Useless governance tokens" and the high FDV, low float dynamic cause by the SEC pushed a lot of crypto natives into memecoins to seek "fairer" opportunity.

It's also true that young people have to gamble their way upwards in today's society due to rocketing asset prices, and wages not keeping up due to fiat's endless devaluation, so the memecoin lottery is attractive. Lotteries are always attractive because they provide hope.

Because gambling has PMF in crypto, and we got better tech around gambling (Solana and Pump dot fun etc.) then the number of tokens being launched skyrocketed. This is because a lot of people want to hyper gamble. There is the demand for it.

"The trenches" was always a thing in crypto, but it has become a widely understood term this cycle.

This nihilistic approach has manifested in several ways:

The rise of "degen" culture becoming mainstream

Shortened investment time horizons

Increased focus on short-term trading vs. long-term investing

The normalization of extreme leverage and risk-taking

A "nothing matters" attitude toward fundamental analysis

5. Previous Cycle's Experience Has Been a Hindrance

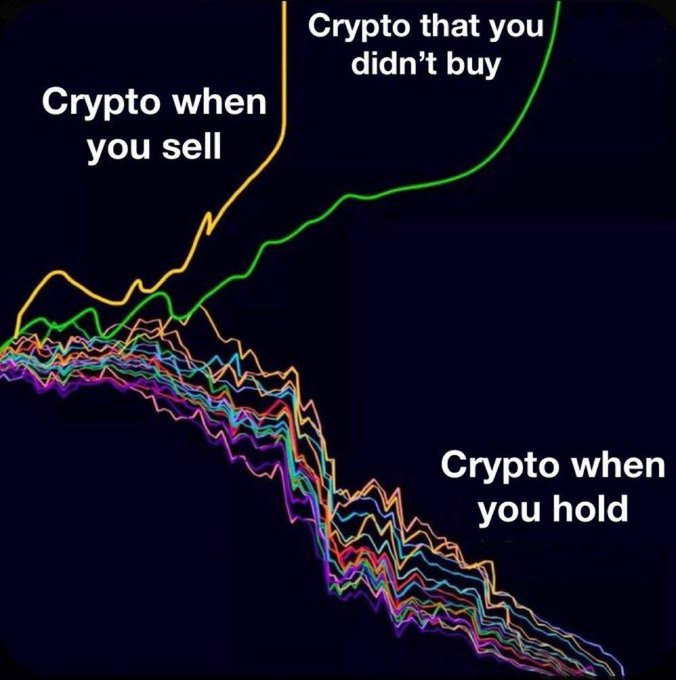

Last few cycles taught you that you could buy some alts in a bear market and eventually be rewarded by outperforming BTC.

Hardly anyone is a good trader, so this was the best path for most in the past. And largely speaking, even the shittiest alts got a turn.

This cycle has been a trader's market and has suited sellers more than holders. Traders even got the biggest payday of the cycle with the HYPE airdrop.

This cycle narratives haven't sustained for very long and there have been few convincing ones. The market has more sophisticated participants that are good at extracting value more efficiently, so mini-alt bubbles haven't got particularly big.

The AI agent first hype cycle was an example. It was probably the first time where people felt "here is the new thing we've been looking for". It's still the earliest of early days for that, and longer term winners probably haven't emerged yet.

6. BTC Has New Buyers and Alts Mostly Don't

The bifurcation between Bitcoin and everything else has never been more pronounced.

BTC has unlocked the TradFi bid. It has an incredible new source of passive demand for the first time, and it now has central banks discussing adding it to the balance sheet.

Alts are struggling more than ever to compete with BTC, and that makes sense because BTC has such a clear target ahead with the market cap of Gold.

Alts don't have new buyers really. Some retail returned at BTC new ATHs (but they bought XRP 💀), but largely speaking, flows from new retail are lacking, and crypto still has a reputation problem.

7. ETH's Changing Role

BTC dominance coming down is largely influenced by ETH's market cap growing. The trigger for many to call "alt szns" is ETH going up, but this heuristic hasn't worked so far this cycle because ETH has done very poorly due to fundamental reasons.

Many traders and investors have struggled with ETH not being a good trigger for more risk taking and it has actually continually acted as the end of mini alt-szns in contrast to how it used to work.

Many traders still believe ETH needs to run for a proper alt szn, despite evidence of narratives and sectors running without ETH doing anything.

There are more reasons than this, but these are the ones that come to mind for me, whilst I drink my coffee and just let my mind unload.

So, What Should You Do From Here?

Work harder, or work smarter.

I remain convinced that fundamentals always play out on a long time horizon, but you have to really understand the project you are backing and how they are going to actually outperform BTC. There are candidates, but only a few right now.

Look for projects that have:

Clear revenue models

Actual product-market fit

Sustainable token economics

Strong narrative to complement the fundamentals (AI and RWA the ones that fit here for me)

I think due to the US regulatory unlock those with stronger fundamentals and PMF can finally add value accrual to their tokens and those are the less risky plays. Revenue printing protocols are set up to do well now. This is a significant shift from the previous "greater fool" theory that dominated many token models.

If your strategy is "I will dump on retail when they arrive" then I think you are in a lot trouble. The market has evolved beyond simple retail-driven cycles, and sophisticated players are likely to front-run such obvious strategies.

You can choose to become a better trader, try and develop an edge and focus on taking more shorter term trades, as this market does provide many consistent shorter term set ups. Onchain will offer bigger multiples but also be less forgiving to the downside.

The barbell portfolio is still the way to go for most, who have no clear edge. BTC & SOL (70-80%) and give yourself a smaller allocation for more speculative plays. Regular rebalancing to maintain these ratios.

You need to understand how much time you have for crypto, and adjust your strategy accordingly. Competing in the trenches with zoomers that sit there for 16 hours a day isn't going to work if you are a normal person with a job. Passively holding underperforming alts and waiting for your turn also isn't going to work this time around.

Another strategy is to try and combine different areas. Have a base portfolio of solid assets, and then look to something like airdrop farming (harder now, but opportunities are still there for less risk), or identifying up and coming new ecosystems and being early and in position (HyperLiquid, Movement, Berachain etc.), or specializing in a chosen category.

I still believe the alt market is going to grow this year. The set up is there, we are still correlated to global liquidity, but meaningfully outperforming BTC & SOL will be limited to a few sectors and a smaller number of alts. Faster alt rotations will keep happening.

If we get some insane money printing then maybe we see something closer to our previous traditional alt seasons, but I think it is less likely than likely, and even in that scenario most alts will just provide market average returns. We still have a number of big alt coin launches to come this year and liquidity will continue to be thinly spread.

It's not easy, but I will offer some hope: I've never seen someone that has consistently put the work into crypto for years fail to make meaningful money.

There is still so much opportunity out there and a lot of reasons to feel optimistic about the growth of this asset class.

Ultimately, I don't know anything more than anyone else, and am just adapting to what I see in front of me this cycle.

And I will add that we are not early in the cycle. That is clear. The bull market has been going on for a long time, whether you have made money or not does not change that fact.

"Manage the downside; the upside will take care of itself."

This quote will always remain true.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Best article I've read all year. Great summary and really captures the current sentiment. Long btc, have some degen plays. Be patient 🤞🏼

Bro, what a great post. A lot of valuable conclusions here. Thanks :)