Welcome to the alpha please newsletter.

Been a while since I’ve brought you an interview, but I’m back with a very interesting read about KyberAI.

No, this isn’t some pump and dump AI shitcoin. This is an amazing free tool that’s been developed by Kyber Network (DeFi OGs) to help provide traders with more actionable intelligence.

I asked Kyber Network’s head of product a bunch of questions to help you understand how you can get the most of out of the product.

I will have a unique referral link at the end of the article, which will grant you access to KyberAI. It’s in private beta right now.

This interview has been kindly sponsored by Kyber Network.

KyberAI TLDR:

KyberAI is an intelligence tool powered by machine learning that provides traders with an abundance of insights to help you make better trading decisions. It is one of the most impressive analytics tools I have seen in crypto.

KyberAI provides valuable insights on 4000+ Tokens across 7 Chains. A unique insight is KyberScore, which gives you real time intelligence on whether a token is bullish or bearish. Each token’s KyberScore refreshes every 4 hours.

You can get a ton of detail about all of the activity happening on-chain with specific tokens: number of trades, whale wallet netflow, netflow to CEXs and more.

As well as technical analysis on both USD and BTC pairs. Support and resistance levels are also automatically calculated for you.

Quick example of KyberAI at work:

Pendle has seen a move up in the last week. You can see KyberAI flipped bullish on the token at around 0.64. It successfully predicted this positive price action.

Whale wallet Inflow for Pendle has been positive on Pendle in the last 7 days.

You can combine the “KyberScore” with many different indicators they provide in order to find confluence for a trade.

On to the interview:

What is the technology that is powering KyberAI?

Our core tech innovation in KyberAI is the "KyberScore," that predicts the bullishness or bearishness of a token over the next 24 hours. Using a machine learning model, it blends on-chain and off-chain indicators, considering factors like net flow to exchanges, whale wallets, number of transfers, price history and other technical indicators. We've assigned weights to each of the indicators in the model to create a dynamic score that refreshes every 4 hours. We've performed extensive back testing and have detailed documentation to ensure our model's effectiveness. You can read more about it here.

For KyberAI, we also developed all the data pipelines from the ground up for over 4000 tokens across seven blockchains. These data pipelines provide valuable on-chain insights like netflow to whales and centralised exchanges, distribution of tokens among holders, trading volume, number of transfers and much more. We monitor these insights hourly, presenting the data in a user-friendly manner. For certain data points like historical price data however, we use third-party tools like CoinGecko and Coinmarketcap.

Who is KyberAI for?

KyberAI was designed for two types of traders: those in the discovery phase seeking new opportunities, and those wanting detailed analysis of their current assets to make informed decisions. We handpicked the most beneficial insights, including our unique KyberScore, to aid these traders.

KyberAI's strength lies in its simplicity. It distills a vast amount of on- and off-chain data into straightforward, actionable insights. Its design philosophy is about keeping things user-friendly, presenting data in an easily understandable way. It offers on-chain insights, technical analysis including historical price charts, support resistance levels, and more, all combined in a single, accessible interface.

Do you have any examples of case studies or real world trades where these insights were used to make decisions?

Creating a one-size-fits-all user guide for KyberAI is not easy, as it greatly depends on each trader's unique strategy. That said, we have shared many examples on how KyberAI can be leveraged to make better trading decisions.

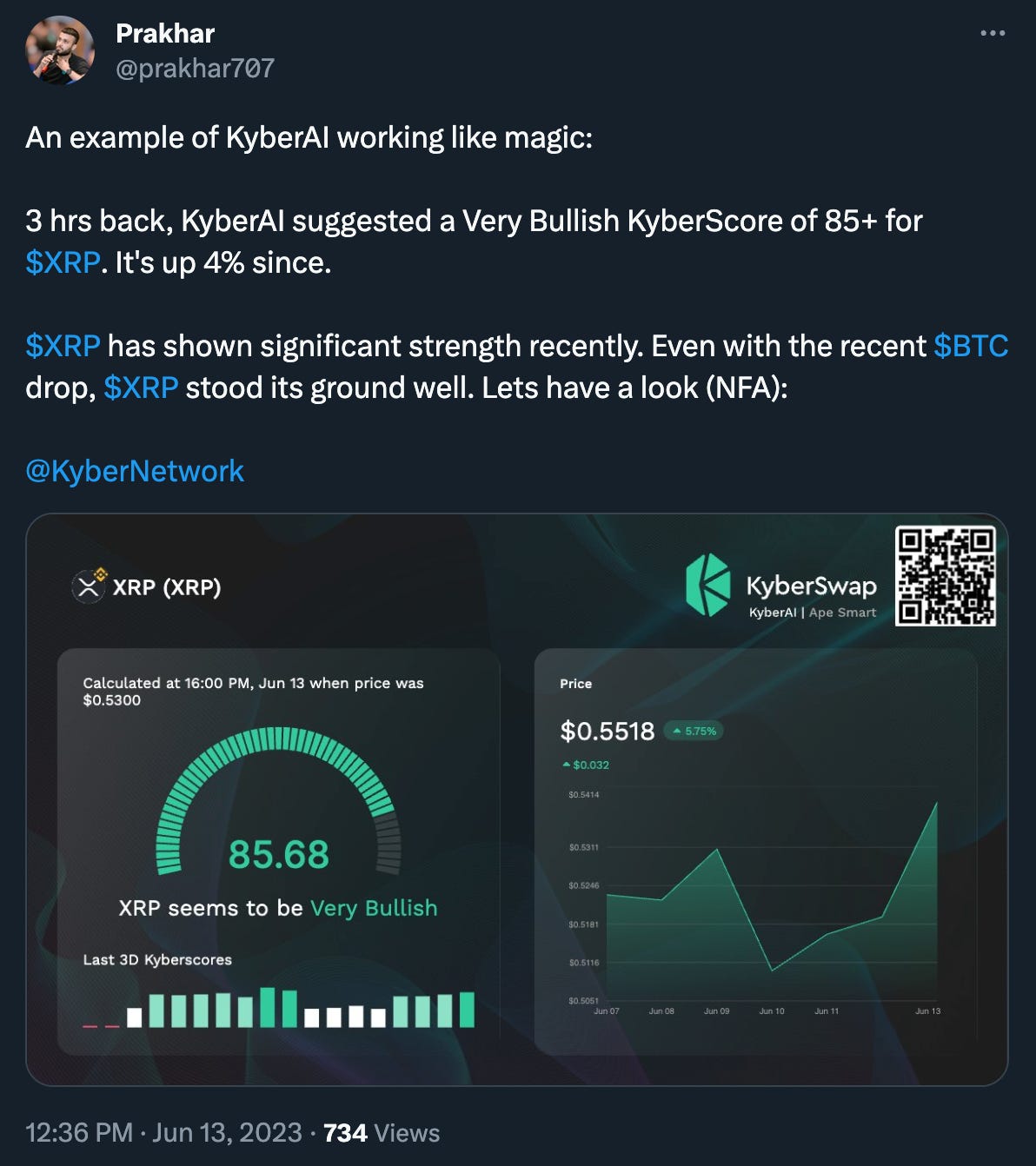

I recently posted a real-world example with XRP on Twitter. I saw the KyberScore for XRP was bullish, and despite fluctuations in the next four hours, several indicators like increasing buyer volumes and strength of XRP against Bitcoin confirmed the trend. Using KyberAI's XRP/BTC chart, I saw that XRP was continually gaining against Bitcoin, so I decided to make a trade. It turned out successful. It's these kinds of personal insights that KyberAI can help provide.

We’ve talked about how traders should use KyberAI, but how shouldn’t they use KyberAI as well?

While the KyberScore is a good starting point, we recommend using it in conjunction with other insights offered by KyberAI to support your trading decisions. So, when I consider investing in a token, I may for example look at the KyberScore, trading volumes, number of buys, netflow to CEXs and price charts. In other instances, I may choose a different combination of indicators to support my analysis. All these pieces of information combined can offer a more comprehensive view and a more robust trading strategy.

What does the future roadmap of KyberAI look like?

The long term vision is to provide numerous insights that will allow traders to make better decisions. At the moment, we are focusing more on trading and how traders can benefit from these insights to increase their profits.

In the future, we also want KyberAI to house or provide insights that can assist users with their risk management. For example, if a trader has invested in too many meme coins or they are too invested on a particular blockchain or in a particular category and are not diverse enough. Another insight that we could give in the future is if the distribution of a token among holders is too concentrated for example 10% of holders have 70% of the token supply. These are the kinds of insights we want to be able to ultimately provide to users.

How does AI further the goals of Kyber Network?

The vision for Kyber Network was to aid users on KyberSwap throughout their trading journey by providing valuable insights to facilitate better decision-making. This led to the creation of KyberAI

Initially, KyberSwap allowed traders to execute actions such as limit orders and adding liquidity to pools. While KyberSwap catered to the execution part of the trade, it was often challenging for traders to make informed decisions (e.g. which token should I consider buying or selling, what might be the appropriate price point to buy or sell a token), which is where KyberAI came in. This AI-powered tool was designed to provide better insights to traders to help them make more informed decisions.

The idea was conceived from an existing feature on KyberSwap called Discovery, which used a set of technologies called TrueSight. Discovery was a proof-of-concept that demonstrated the potential of AI in providing trading insights. Building upon that, the development of KyberAI took 8 months, during which an entire infrastructure was built from scratch, involving data collection from seven different blockchains, synthesising it, and displaying it in a user-friendly interface.

Now, KyberAI offers a variety of insights, including a unique scoring system based on its machine learning algorithm. Although the journey was challenging, it has proved fulfilling, especially considering the value it brings to traders.

Finally, what do you think about the convergence of AI and crypto?

AI brings immense benefits to blockchain analytics platforms, particularly for trading and risk management. AI's power is leveraged by platforms like KyberAI and others to offer predictive analytics, which enriches trading strategies. KyberAI uses on-and off-chain data and machine learning for its analytics. The intersection of AI and blockchain analytics gives rise to enhanced DApps like KyberSwap that incorporate AI-driven insights from these platforms into their models.

If you want to be one of the first people to test and use KyberAI then sign up with this link and you will be moved straight to the top of the waiting list. It’s free!

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.