The Protocol fixing the NFT Market

Enter MetaStreet

Welcome to the alpha please newsletter.

Gm friends, today we are learning about MetaStreet.

I spoke with the founder of MetaStreet David Choi and I think you will find his answers really interesting. MetaStreet are aiming to solve the problem of making hard assets liquid on-chain.

They are still a tad under the radar, but gaining awareness pretty rapidly. They have proven their tech with Crypto Punks and I think they could become a monster protocol in the future, as they can help to underpin the whole NFT market, including blockchain gaming assets.

They raised $24M (seed and series A) and have some prominent backers like DragonFly and Delphi Digital.

They have a short points campaign running (MSTR - good ticker - will be launching as an improved ERC-404 ), and I will include a strategy for that at the end of the piece, which could help you land four different airdrops.

I am actively working with them, and they have sponsored me to write some educational content about their platform.

Enjoy the interview with David below:

MetaStreet TL;DR:

MetaStreet is a yield infrastructure protocol. It structures sources of high yield into a tradable asset.

Structuring is enabled through MetaStreet's v2: The Automatic Tranche Maker ("ATM"), a permissionless lending protocol that automatically organizes capital in a pool based on depositors' risk and return (rate) profiles.

Tradable Assets are enabled through Liquid Credit Tokens ("LCT"), a liquid, composable ERC-20 representing each lender's position within a pool.

Why should people care about what MetaStreet are doing?

The question really starts with Crypto Punks. Because if you try to look at any industry, and how it scales an asset class, you almost always need to have enough participation to enable that asset to grow. This enables the asset to flourish. And this isn't just NFTfi. It's actually GameFi as well. And if you solve this problem for NFTfi you have effectively invented an entire new industry.

Let’s use Crypto Punks as an example. There are 10,000 Punks. Who's willing to buy a Punk at $200,000? In the entire world, the number of participants who would have bought a JPEG for that price is very small. Yes, we could have hedge fund institutions come in, but that’s less likely than BTC. And as a result, how do you enable the next incremental buyer?

If you look at the world, aeroplanes, equipment, shopping malls, houses, automobiles is my favourite example, the size of the market increases yet affordability is maintained and ownership is distributed. That's because you have the existence of the yield market. With houses you have mortgage backed securities. I think people demonise that a little bit because they've seen The Big Short, and they've seen that it's a bad thing. But that product allowed the existence of a bond, a yield product. And this allows for participation that goes beyond 10,000 users.

So now if you had a million people buying the yield for Crypto Punks, then suddenly the asset can grow.

As you can imagine, this metaphor can go beyond just NFTs. Let's look at Axie Infinity. There's 50,000 participants in the game. Are those the only participants that can support the game? Or could you have people that would buy the yield for axies, and you now have a million participants. This is just how the economy works.

So why people should care is because I think this is eventually the bigger market, because you've invented hard assets on chain, which is kind of like main point of blockchain. But you also let that entire industry scale, NFTs, GameFi, anything that's a hard asset.

You will not be able to solve this issue with AMMs. You will not be able to solve this issue with exchanges. This always comes down to like how do you have more more participation and very fast way to rapidly socialise that risk. And everything you see today doesn't rapidly socialise the yield doesn't rapidly socialise the participation in the market.

That's why we invented LCTs (liquid credit tokens), as we call them, because you know, you can have more than 10,000 people holding the yield of an NFT collection, but they don't have to own the NFT.

Just like when I buy a yield for automobiles, like car loans, those banks don't want those automobiles, they want the yield. And those people that buy those auto loans from the banks, they don't want the automobiles either, they just want the yield. So on the other hand, what do the DeFi people get? Well, they get the highest APR product in the market today.

If you look at traditional finance, the hottest market is always the capital markets, it's never the money markets. You're giving loans to securities, it's like really shitty yield. Whereas if you get yield against like foreign assets, like automobiles, cars, aeroplanes, that's really high yield. So, people really like that. That’s why people should care. It's an industry that could easily become one of the biggest in the space. And it's the highest yield bearing opportunity for DeFi people.

And I think in the future it is going to become a core component of what GameFi really is, because people talk about GameFi, but where is the Fi? There's no real economy behind it. There's some level of labour but there's no liquidity for these hard assets.

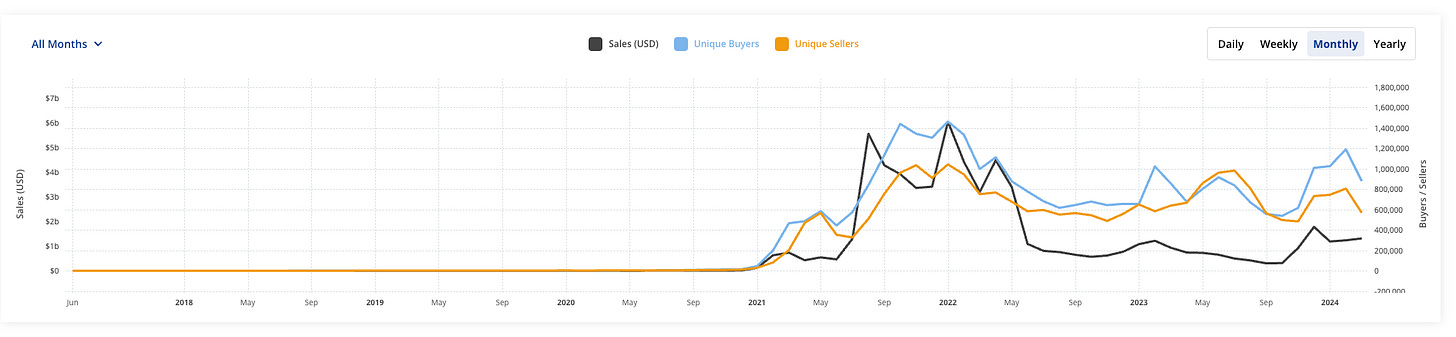

How do you assess the NFT market today?

I think it's fundamentally broken and will continue to be so. I used to work in the art world and the exact same thing happened there actually. How do you get liquidity for art work? You sell it or you borrow against it. There's only two paths available. And the incremental buyer becomes limited. Art survived in the traditional art world because the Chinese came in and they were the incremental buyer, that's how the market was sustained. But then it tapers off because who's gonna buy the next art piece because they just don't have the money to support it.

There are institutions that are getting the yield on our platform that would have never never interacted with Blur, OpenSea, or owned an NFT, yet they are buying the yield. And they're supporting and elevating the entire crypto punk market.

We're getting close to 2% of the Punks supply now being locked up completely on MetaStreet and not being sold for six months. Because more and more non NFT participants are helping lock up that supply. And that was never possible before.

If you wanted to do an NFT loan, you had to be an ultra specialised and know how to do those various inputs. But now we just mint an LCT. And that might feel complicated, but in reality it's a yield bearing token. It's just like staked ETH. You can go on Uniswap or Curve ,and you just buy it. So it's in fact a lot easier. Now you have participation of 1000s of wallets now elevating the asset. And that kind of dynamic is what elevates an asset.

I think NFTs will have a very hard time “recovering”, because who's the next buyer after us? Yes, you'll get new participants but you have to convince them that this asset has been going down for months, is going to be a good community. In reality, for PFP NFTs, the price is the function, where there's no utility like gaming assets might have. How do you get past that?

Creating a really strong model that lets ownership thrive, so that any participant, not just a rich guy, can come in. The price goes up, or the value of it goes up as the universe gets much bigger.

Punks have survived because they are six or seven years old, and they have like historical precedent. They were kind of like lucky just being the first. But when it comes to Azuki, and these other worlds, they are trying to grow by launching a token or more collections, but that is diluting the underlying asset. So all these models are somewhat broken.

We're just one attempt. I think we give a nice peek into the future of how to accelerate the ownership model. You can own 0.01 LCT, Punk stETH or Azuki stETH. And that just elevates the underlying market.

What are your biggest challenges right now? How do you go to the next level?

Yeah, this is giving a little peek into our product. What we've developed is the automatic tranche maker and the liquid credit tokens, which are sequential technologies that enable the rapid, rapid socialisation of the risk, like you can really quickly share this LCT across thousands of participants and the technology is scalable.

But, you know, people will only deposit the APR is high enough, right? Or if the yield is good enough. So, if other APRs are very high, then people will depart from this. APRs are crazy because of airdrops right now. There are other ways to extract to ETH APR. In this market, NFT loans don’t really look worth the risk.

We are actually launching a new product that deals with this volatility of the underlying asset. NFTs are volatile and sometimes the risk isn't worth the reward, even though the reward very high, but it’s just relative to the market. Because if the ETH APR changes from 3.5 to like, say closer to 10 as a risk free rate, well, then 20% APR alone for NFTs doesn't seem that worth it. Because this fluctuates a tonne, and I'm taking away more than 2x risk.

So how do you juice the upside for a bond like product? Given the bonds high APR is that enough and will participants to want to deposit money in order to support these assets? And there's actually one company that has done this really well. And our MetaStreet ticker is going to be MSTR by the way, that’s a soft hint. But effectively, you're having a convertible LCT with token upside. Essentially, if I do this deposit, I will have the call option in the future. A call option provides equity like returns for bond like risk. Because that's what people are really looking for. That's what you're getting in the market.

MicroStrategy would have never done their billions in deposits unless there was this convertible structure. From a risk perspective, how could you give a US dollar based loan against this asset, unless you have the upside. Unless you can convert it into literal proxy for that BTC.

So we are leaning towards that direction where we might be enabling a new kind of meta, a new kind of product again, we are very much financial engineer types. So we are trying new things. But that's one product and we're leaning towards that people can be excited about. Technically, points can represent that as well. Because obviously our points have no value. But it does represent your activity on our platform.

What would be the next market focus for MetaStreet? I’m guessing it’s gaming?

Yeah, I think so, it addresses the huge problem that a lot of gaming companies are always reaching the limitations of NFTs. Our product is an interest rate protocol, we're trying to figure out a way to create a very fair interest rates for owning these assets. A game economy to me is no different from a sovereign economy. But really debt is what deals with the capital and the hard asset.

So you saw the early instances of people trying to scale game economies by renting out their assets, and then borrowing. I think gaming is not only the next biggest market, but I think it's one of the best use cases of blockchain.

A billion users can be can come in two different ways. They can either buy the token or they can buy the yield. And that other half buying the yield doesn't exist yet. Because no products have ever tackled that problem well. And so as a yield infrastructure protocol, that's something we were directly trying to tackle.

If gaming economies are just mini digital nations, does infrastructure like MetaStreet truly help to bring about Ready Player One style Metaverses?

I think it’s inevitable.

I worked at Deutsche before I worked in art, and I’ve worked with assets that are much worse than NFTs, but they all have the same structure of getting liquidity. An NFT to me is actually a great asset, yes a bit “shitty” right now, but it’s quite liquid, unlike some other really illiquid assets out there. It’s not really productive, that is the only issue, but with gaming that changes the entire dynamic.

We’ve always had this idea that GameFi was the inevitable feature, but we had to solve this initial problem. And we had to start with the most lendable asset and that’s Crypto Punks. And it is exciting for us as we are seeing institutions come in and give loans to Punks.

It's the first indication that this can be something, that our solution does address this problem, which is highly turn illiquid assets into yield. And that is really our core function. It’s about solving this one problem, which is more participation, to enable more liquidity.

Do you think MetaStreet has enough awareness in the space yet?

Yeah, I think people think of us as an NFT lending protocol, in reality, we are yield protocol, and that's all we are, we create the highest yield products. And I think, I think a lot of people kind of misconstrue us for that, because we've dealt with mostly NFTs before. And well, we'll be expanding to new assets to kind of like, rebrand our case studies. And I think most people know us as NFT lending, which kind of conflates us with lower tier tech. And they're like, yeah, it's the same thing. I'm like, no, it's quite different.

Frankly, I think we really came to Limelight in 2024. So I think folks are starting to really become aware of what we're trying to achieve, which is true financialization. Not just money markets, but the entire capital markets.

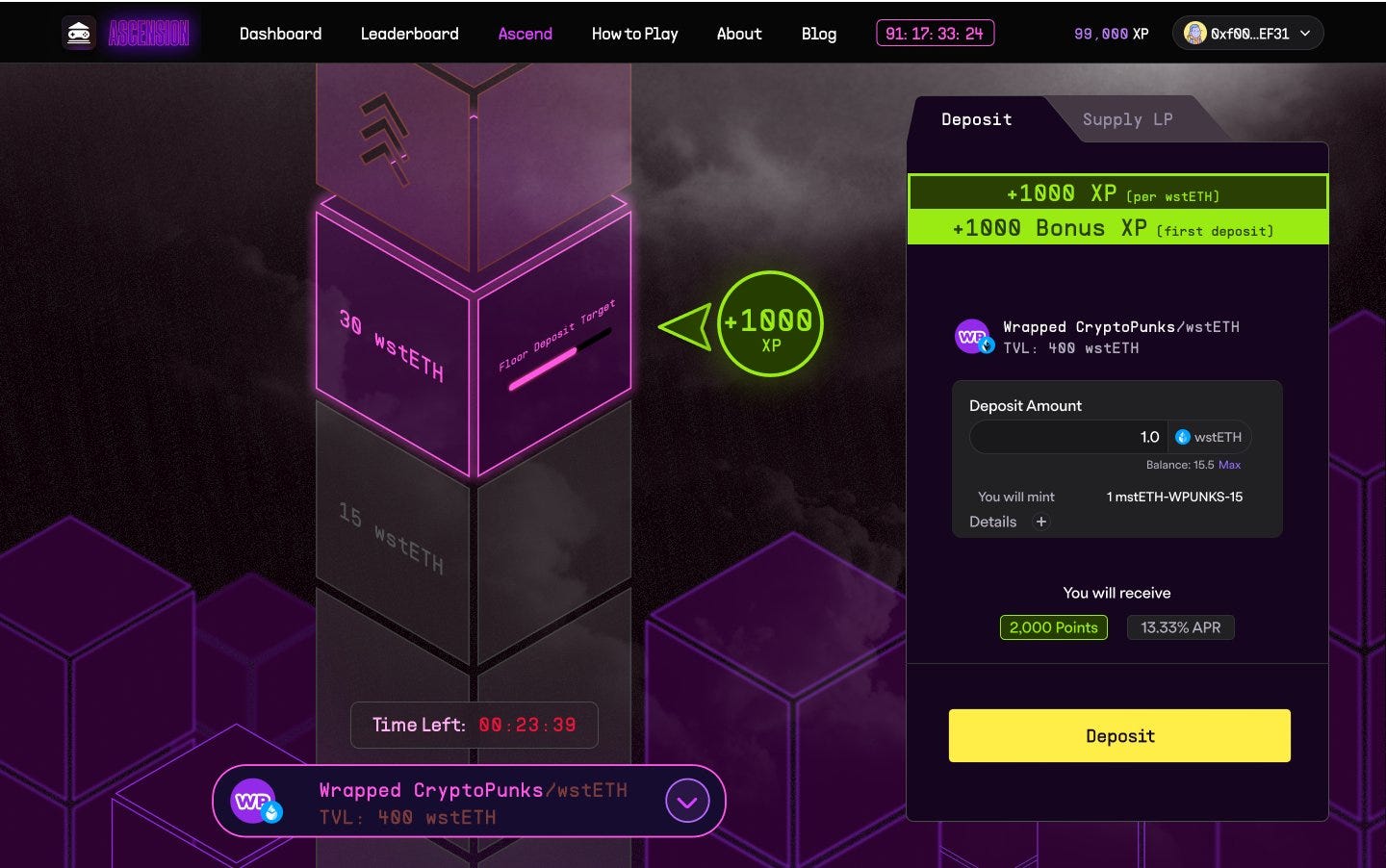

How’s the Ascend campaign going?

I think our TVL has been up and to the right, we're having participation that never existed before, which is very different from 23 and 2022. But now you're seeing participation that we never really had before. Now you're having thousands of people holding LCTs. That’s already like a 50x improvement on the participation side. We ended up doing the largest NFT loan in history, which is a $10 million loan against Crypto Punks, because this market scaled.

Now people can buy the LCT, they can enter and exit.

The points programme has really helped with our growth. And we're kind of looking for the next step. Season one is going to last a few more weeks. And we have some exciting announcements leading up to it and product launches as well. We are still operating on just one Layer 1, and one Layer 2 (Blast), which is definitely interesting because I think a lot of users and participants and capital are stuck on layer twos or other layer ones. So we're looking into this as well.

MSTR XP strategy

Disclaimer: Don’t risk more than you are willing to lose. As always, there is smart contract risk. The strategy is designed to maximise points and hit multiple airdrops (MSTR, Blast, Thruster and Particle), so involves multiple platforms, but you can simply just mint an LCT to start earning MetaStreet XP and this will limit your smart contract risk.

Use my invite to get started, this link will take you to MetaStreet’s Ascend platform.

Deposit wstETH into a tower (choose a pool based on your risk - mwstETH-WPUNKS:20 should incur the least risk) - this will mint you an LCT

Bridge that LCT to Blast - can do this from the Ascend interface

Deposit the Thruster LP into Particle - choose existing liquidity tab

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

It is a little strange to see actors that supported the destruction of NFT floors are involved in this project.

First Machi that paperhanded many NFT's, destroyed floor price to get the max blur aidrop

yield host on BLUR that create this NFT nuke system, blur is a blockchain that only favor whales and influencers.

This is so broken system, to make rich richer.