Welcome to the alpha please newsletter.

I’m sure you have heard a lot about real world assets coming on-chain. Well, I’ve got quite the interview for you here.

Backed have changed the face of DeFi forever by becoming the first company to deliver the first-ever major security on-chain.

I had the privilege to talk with Adam Levi, the co-founder of Backed.

So how does DeFi 100x from here? You better read on:

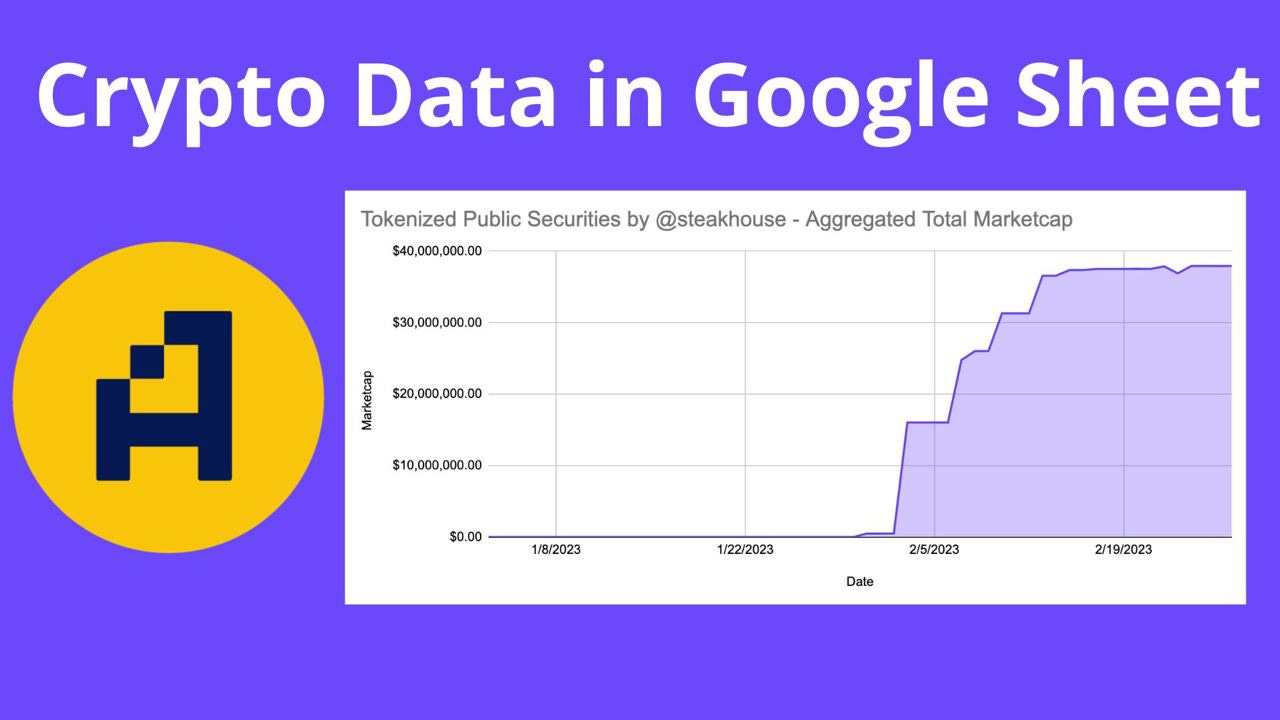

Today’s newsletter is brought to you by Artemis:

Did you know tokenized public securites are $40m in marketcap up from $0m in late Jan ’23? Get a real-time view of tokenized public securities in Google Sheet by pulling data from Dune via Artemis Sheets. Just like Backed is making history, Artemis is changing the game when it comes to getting access to crypto data. Get started with a sample template and 14 day trial today.

What’s your crypto origin story?

I entered the world of crypto back in 2013. I thought it was already too late to join, it took me about two years to realise how early I was. At that time, Bitcoin had already made its debut and some exchanges had already been built. It fascinated me both on the tech side, and the monetary/economic side. I was also interested in Mastercoin (later rebranded as Omni), which tried to add features on top of Bitcoin, which had a strong Tel-Aviv centre.

After finishing my PhD, which studied quantum effects around black-holes, I had the opportunity to go to the States for a postdoc, or I could focus on the emerging world of crypto. I decided to go full-time into crypto and later became the CTO for DAOstack, a DAO platform, for four years starting in late 2016. At that time, it was a hard pitch because not many people knew what DAOs were. And the ones that did, mostly recoil from it, due to Slock.it The DAO hack, leading to the Ethereum fork that created Ethereum Classic.

Even now, we do not really understand the full potential of DAOs, and the types of organizations they enable. Legal-arbitrage is probably the only product-market-fit we have seen for DAOs to date. It's unfortunate to say, but one has to be honest with the market. However, I do believe that there will be many use cases for DAOs in the future. There is space for a lot of experimentation, still.

At what point did you want to move on from DAOstack?

When I left DAOstack, I wanted to focus on product instead of technology, as many companies in the crypto space had brilliant technology but lacked a good product. So I left and joined forces with two colleagues from DAOstack, and together we were just interested in working on projects we cared about. One profound thing we noticed was the stablecoins revolution and how it transformed the crypto space.

Stablecoins made exchanging value using crypto real and feasible, unlike before when people were treating them like poker chips you cannot cash out. We saw stablecoins as the first instance of tokenisation of real-world assets and believed it was part of a bigger class of assets going on-chain. This concept was not widely understood or recognised, as people saw stablecoins as separate from other assets. But we viewed it as the same thing, and this helped us develop our strategy in the beginning, as we had a playbook we could use for tokenising real-world assets.

When did you start working on Backed? And what problems did you have to solve to be where you are today?

When my partners and I began working on this idea early in 2021, we were initially doubtful about our chances of success due to the high regulatory barriers that we faced. However, we decided to give ourselves some time to research and identify a solution. As we delved into regulatory research across various jurisdictions, we met an exceptional lawyer in Switzerland who understood how to navigate the law better than most.

Around the same time, the Swiss Parliament approved the DLT Act, which permitted the creation of security tokens in Switzerland. This was a brilliant piece of legislation that acknowledged that the creation of security tokens was not a new asset class but rather a technicality. It allowed for the tokenisation of major assets, such as Tesla, which had the necessary stability, liquidity, and price discovery.

Our two-pronged thesis was that we wanted freely transferable tokens, and we needed to tokenise the most liquid assets. We believed that by tokenising Tesla, for example, we would make it accessible to investors and that they would want to buy it. We came up with the solution of issuing a new security, a tracker, that can be issued as a token because of the DLT Act. Thus, the Tesla token was not a Tesla share but a tightly related derivative. It was collateralised by the underlying asset and could be redeemed for the cash equivalent of the Tesla share.

In summary, we were able to engineer a financial solution that allowed us to tokenise major assets such as Tesla. Our success was due to the convergence of factors such as the DLT Act, our lawyer's expertise, and our two-pronged thesis. As a result, we created a unique product that appealed to investors looking to gain exposure to major assets on-chain, and we were one of the pioneers in this new asset class.

What is your business model?

Our business model at Backed is straightforward. We charge fees on the issuance and redemption of assets. However, unlike Circle, we don't invest in the underlyings. Today, holding USDC means holding Treasury bills without getting the yield. With Backed's products, one can have real exposure to the underlying one chooses.

Okay, so you just simply hold the real world assets, you don't do anything with them?

We simply hold real-world assets and do not engage in any investment activities. While generating yields on assets like Tesla is possible, it also carries a degree of risk. For Circle, holding Treasury bills instead of USD may be considered slightly riskier, but the difference is not significant. This is not the case for Backed, so we solely charge fees, and the assets just sit in designated collateral accounts with our custodian.

How permissionless is the process of adding assets to Backed?

The process for adding assets is not permissionless at all, as Backed is a CeFi company and not a DeFi protocol. However, we're creating financial primitives that could be used on secondary markets, including on-chain.

So Backed is a regulated legal operation in Switzerland?

Backed is not a regulated operation since its activity does not require it to be regulated according to Swiss law. It is operating in full compliance with applicable regulations, which is a slightly different thing. To make our products retail addressable, we went through the nine-month process of filing and approving a prospectus for our products within the European Union and Switzerland. And while Backed only sells its products directly to accredited investors and licensed resellers, retail investors could also participate by buying from licensed resellers.

Who are your clients?

Our clients are mainly accredited or professional investors who invest or trade in assets as part of their business activity. Similarly, some of Circle's clients are professional traders who engage in arbitrage to keep the value of USDC stable at $1. These traders can buy USDC at a discount in secondary markets and then redeem it with Circle for a profit. Backed does not sell directly to retail customers, but eligible retail token holders (Non-US and KYC dependent) can redeem their tokens with Backed.

But your platform could be integrated by a secondary platform like Nested, for example?

Nested has two types of users, KYCed and non KYCed. For the KYCed ones, its possible to create an integration that will allow them direct access.

Generally, Backed sells its products only to professional clients who pass KYC. We can not integrate directly with DeFi platforms unless they KYC their clients.

So Backed is a CeFi private company with equity and there is no token?

Correct, there is no Backed project token, and we have no plans to release a native token. But as this is crypto, never say never.

Would you ever want to turn Backed into a community owned DAO?

This isn't really a realistic idea, given the amount of regulation around this kind of business. A DAO cannot manage bank accounts, report to government institutions and withhold taxes (to give just a few out of many examples).

What we could do potentially with backed product owners and with DAO-like mechanisms is to allow our product owners to participate in corporate voting events, say if we tokenise Nestle shares, we could allow token holders to vote on shareholders' decisions and then propagate that vote with the actual underlying shares held as collateral. I believe this has the potential to unlock a lot of cool possibilities for our platform, and I'm excited to see where it takes us.

But this is not where things are now. Right now, our assets do not convey any rights related to the underlying (Voting, Dividends). They are just a tracker of the market value of the asset.

So your platform went live very recently, how did the launch go?

We're in the early stages of the soft launch of our platform, and we also released our first token, Backed Core S&P 500, or bCSPX. We've seen a lot of interest in both our platform and the tokens, and the response has been overwhelmingly positive. Some more interesting products will be launched soon, so we're confident this growth will happen quickly.

Do you think that Backed is going to change the game?

We believe we have changed the game by becoming the first to put major real-world assets on-chain. Our tokens are fully collateralised by the underlying assets and fully transferable. 10 years from now, this will be remembered. Maybe we'll be the MySpace, or maybe we'll be the biggest, but one thing is for sure: we'll be able to say we were the pioneers of bringing real-world assets on-chain.

Do you think tokenization of real world assets is inevitable?

I believe it is. When we started Backed, I wasn't very familiar with traditional finance technology, but as I delved deeper into it, I realised that it was outdated and broken. Even though sometimes it is coated with Robinhood-styled UX wrappers, it is still very flawed. Most of us know how inefficient the fiat banking system is compared to stablecoins; well, the securities system is 10x worse.

In one year's time how many assets will Backed have listed?

This is a game of depth rather than breadth. As an issuer, we do not have any specific agenda or preference in terms of which assets to tokenise. Our aim is to understand the market and provide what our customers want. If there is demand for Tesla or Coinbase, we will provide those tokens. On the other hand, if the market wants to invest in European ETFs or real estate in Europe, we will offer those options as well. Our priority is to provide our customers with the assets they want to invest in.

Will you have a lot of exchanges as customers as well?

Exchanges are not really our clients as they are more like platforms where our products will be available. However, there are some requirements for centralised exchanges to be able to offer our tokens, such as obtaining the necessary licences. Fortunately, major exchanges are now obtaining these licences, which is a good thing for us. The exchange market is becoming very flat, and it's challenging to have a unique value proposition.

Have you had conversations with exchanges?

With some of the big ones, yes.

Why is Backed helping crypto?

At Backed, we believe that everyone should have access to reliable financial services and world-grade financial assets, including the billions of underbanked people around the world who currently cannot access them. You will be amazed, but it's almost impossible to buy securities in Brazil, for example. While DeFi has been an important development, we believe that it cannot continue to grow at the same rate using crypto native assets alone. DeFi cannot grow its collateral assets by 100x without RWAs. The securities market, which is over a $100 trillion market, offers the potential for much greater growth.

Can putting real-world assets on-chain be good for DeFi?

I believe it can be very beneficial for the DeFi ecosystem. By putting real-world assets on-chain, it allows for more diverse and secure collateral options for lending protocols, which can increase liquidity and decrease risk. It also opens up access to traditional financial assets for the crypto-savvy demographic, which can help bridge the gap between traditional finance and crypto. The group that likes to buy banknotes is dying. Think about if Binance closed at four and did not even open on Sundays. It's crazy!

When the TradFi markets close, what do you think will happen on chain?

It's a question of size. As the secondary market operates 24/7, it becomes like a prediction market for what will happen on Monday. However, once it gets bigger, it dictates what happens on Monday. Imagine if the Tesla factory burned down on a Sunday, and you were left holding Tesla shares.

With the traditional stockbrokers and hedge funds only paying attention to the markets from nine to five, they'll have to change their activities and expand their staff to keep up with what's happening on-chain. While 24/7 trading is financially efficient, it's not good for your health! But once it's there, it's unavoidable. It's impossible to even have a discussion about only having Bitcoin traded within certain hours.

The narrative we're powering is huge for crypto and the image of blockchain, moving beyond just volatile crypto tokens. Crypto enables superior payment rails compared to 80's securities technology. This gets lost in the noise of volatility, especially in a bull market.

How does Backed deal with censorship?

Backed is a standard company which has to comply with applicable regulations, so we do have a permissioned aspect to our platform. In the case of sanctions, such as the US sanctioning an address like with Tornado Cash, we would blacklist the address as well. It's clearly stated in our terms and conditions and enforced by our smart contracts. We also use both on-chain analysis and off-chain services to check transactions. It's a good type of regulation that only stops the bad guys. If regulators follow this approach, it would be beneficial for everyone.

Lastly, What are you bullish on for the future?

Of course, I'm bullish on real-world assets and integrations, particularly with stablecoins, but I think we're only seeing the beginning. Projects like Monerium are already providing a better user experience and eliminating the need for traditional banking. Additionally, I believe that zero-knowledge with scaling, specifically through account abstraction, I think it will help a lot with security and bring the next billion users. Lastly, in reference to a previous point I made, I believe good products and UX are crucial to achieving success.

*Some big news to finish with which came out after this interview was recorded.

bCOIN has been issued.

And that’s your alpha.

Thanks again to today’s sponsor Artemis! ➡️ Sample their tokenized securities sheet.

Free blockchain analytics tool

I wanted to share Arkham with you all (not sponsored, just a tool I like). I tracked everything happening with the FTX and Alameda wallets last year using the platform. It is still in beta, but I have found it very useful.

A few things you can do with it:

• Build dashboards to track entities’ transactions

• Visualise wallet flows across many blockchains

• Analyse wallet holdings and filter by value, token, time & counter party

You can sign up with referral link and you will get moved to the top of the waiting list for platform access. It’s free to sign up and use.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.