The Liquidity Layer of Solana - Kamino

Investment thesis for Kamino

Welcome to the alpha please newsletter.

This is a report about one of the DeFi protocols I am using the most on a daily basis currently.

If you’ve been an avid Solana user then I’m sure you have already heard about it. I’ve had this write up in the works for a few weeks, so it isn't timed to react to any market conditions or with price in mind at this very moment. The numbers may be slightly out of date as crypto is volatile.

I think Kamino is a blue chip protocol on Solana. Kamino has ~30% of all TVL on the chain right now.

I hope this piece provides you with a good overview of what they are doing, where it is heading, and why it is a project worth keeping an eye on.

With that being said, let’s dig in.

Disclosure: I personally own KMNO tokens, and Kamino have compensated me for the time I took to write this report. I was going to write this regardless and they also helped check the accuracy of a few things. This report is not financial advice, it is purely educational content and much of it is simply my opinion.

What’s to come:

• Kamino 101 - Product overview

• Road to $10B

• Market Traction

• Demand and supply analysis

• KMNO valuation analysis

• A few ways to use Kamino today

• Main Takeaways TLDR

Kamino 101

Kamino was originally founded in 2022 by Hubble contributors as the first concentrated liquidity market maker (CLMM) optimizer of its kind on the Solana blockchain. Initially, the main goal behind the project was to enable crypto users to earn higher yields on Solana by providing access to one-click auto-compounding liquidity-providing strategies.

Since then, the project has evolved significantly and became a first-of-its-kind DeFi protocol that unifies Lending, Liquidity, and Leverage into a single and secure DeFi venue.

Product overview

The current full tech stack of Kamino is composed of four main products:

Automated liquidity vaults:

This was the first product that Kamino developed. These vaults allow users to earn yield on their crypto assets by providing liquidity to concentrated liquidity market makers (CLMMs).

The main advantage of these vaults is that they eliminate the complexity of maintaining a CLMM position. Kamino automates the entire process, from the moment of deposit through to reward compounding and position rebalancing. A way for users to earn optimized yield in DeFi with just one click.

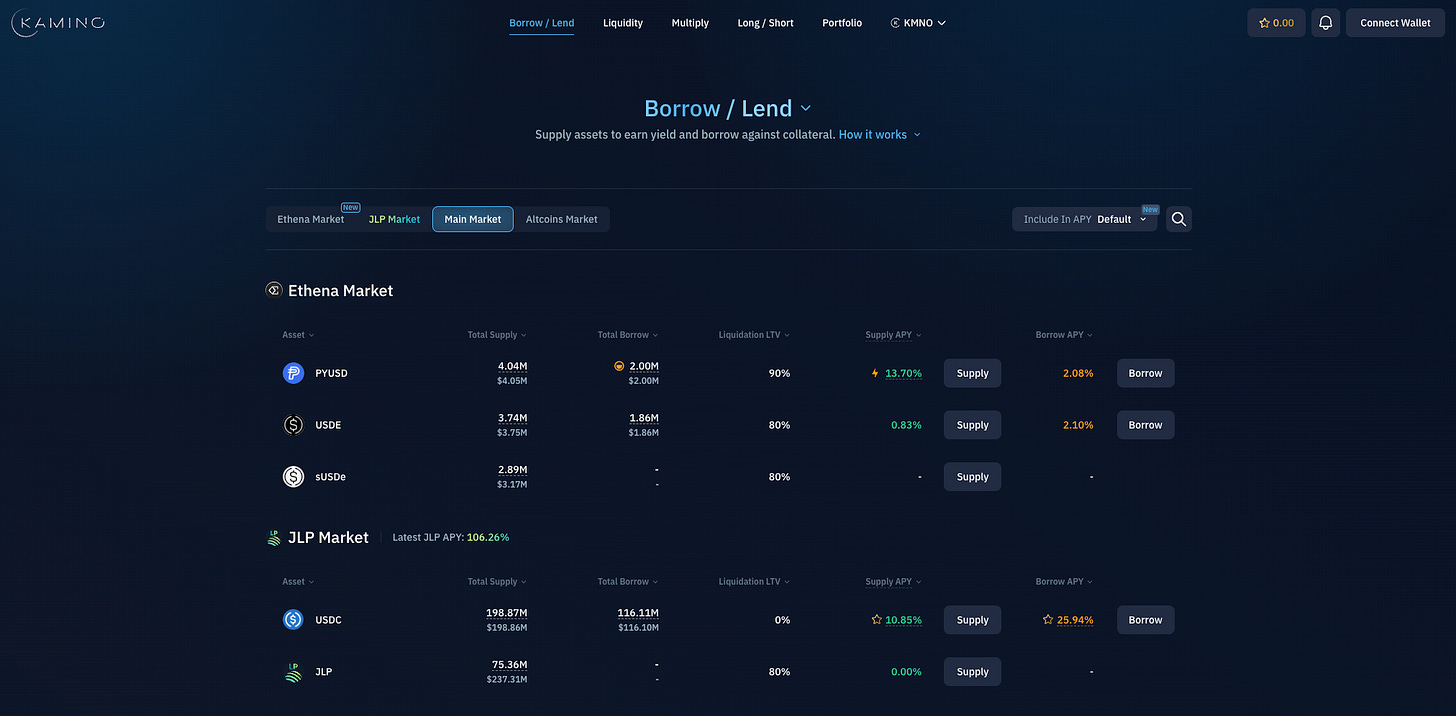

Borrow/Lend

Kamino can also be used as a stand alone peer-to-pool borrow and lend market. Put simply, users can supply assets to a pool to earn yield and use it as collateral, or borrow assets against deposited collateral. Here, the maximum amount a user can borrow is dependent upon a defined loan-to-value (LTV) ratio threshold that is acceptable.

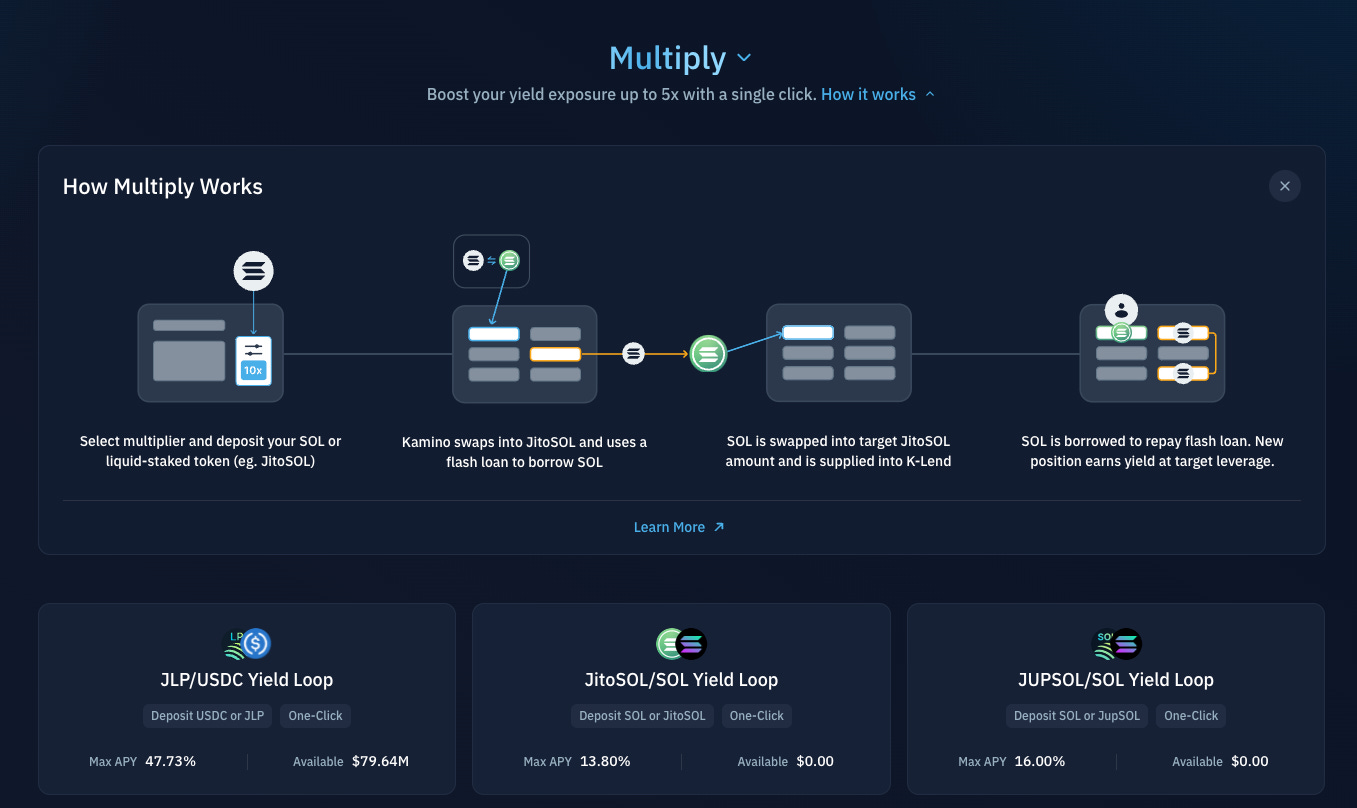

Multiply

This product enables users to get easy access to leveraged exposure to yield-bearing assets by borrowing an underlying asset, supplying its pegged counterpart, and looping them up. For instance, in a JitoSOL/SOL Multiply vault, JitoSOL is supplied, and SOL is borrowed. This position is then looped up to a target leverage amount.

But because Multiply opens up a debt position, users are at risk of liquidation. This can occur in two main scenarios: 1) if the borrow interest rate is higher than the LST yield for a sustained period of time, where a higher leverage leaves less buffer to avoid liquidation, or 2) if there are exploits in the LST smart contracts, as the Multiply vault involves an LST token and a SOL loop.

Long/Short

You can take spot leverage with Long/Short via Kamino Lend and pay much cheaper and more predictable funding rates. This is considerably cheaper than doing the same on a Perps Dex. I have been told there will be a UI interface update coming which will make the experience much more akin to traditional perps dexs.

Here’s what is coming (Road to $10B)

Kamino keeps building its stack and they recently announced exciting new products in the pipeline in their “Road to $10B” paper. Here is a glimpse of what's ahead:

Kamino Lend V2

Kamino Lend V2 will introduce modular lending to Solana, and evolve Kamino Lend into a more powerful, open lending primitive. We could soon see new use cases emerge on Kamino like RWAs, P2P, Orderbook Lending and more.

New products

Kamino is currently talking with various DeFi protocols that will leverage the new V2 infrastructure for new product features. Some of these projects are well-known Solana native projects as well as non-Solana projects that will soon onboard to Solana via Kamino Lend V2.

Risk management tool

Alongside the development of V2, Kamino also improves its risk management stack, with better risk tooling, collaborations with external risk managers, more extensive internal smart contract testing, and ongoing external audits. Some initiatives to improve security and UX include external risk dashboards, loan risk notifications, stress testing and penetration testing, and more.

Strong market traction

As of this writing, Kamino has amassed around $1.4 billion in total value locked (TVL), representing more than 30% of Solana's entire TVL. This is a solid figure that positions it as the second-largest DeFi protocol on Solana by TVL, just behind Jito.

Moreover, we note that Kamino’s market share is growing as its TVL relative to the entire TVL of Solana has been in an uptrend since inception. A good sign that Kamino is establishing itself as a go-to DeFi venue on Solana.

Supply on Kamino has been growing at a faster rate than other established lending protocols across all chains.

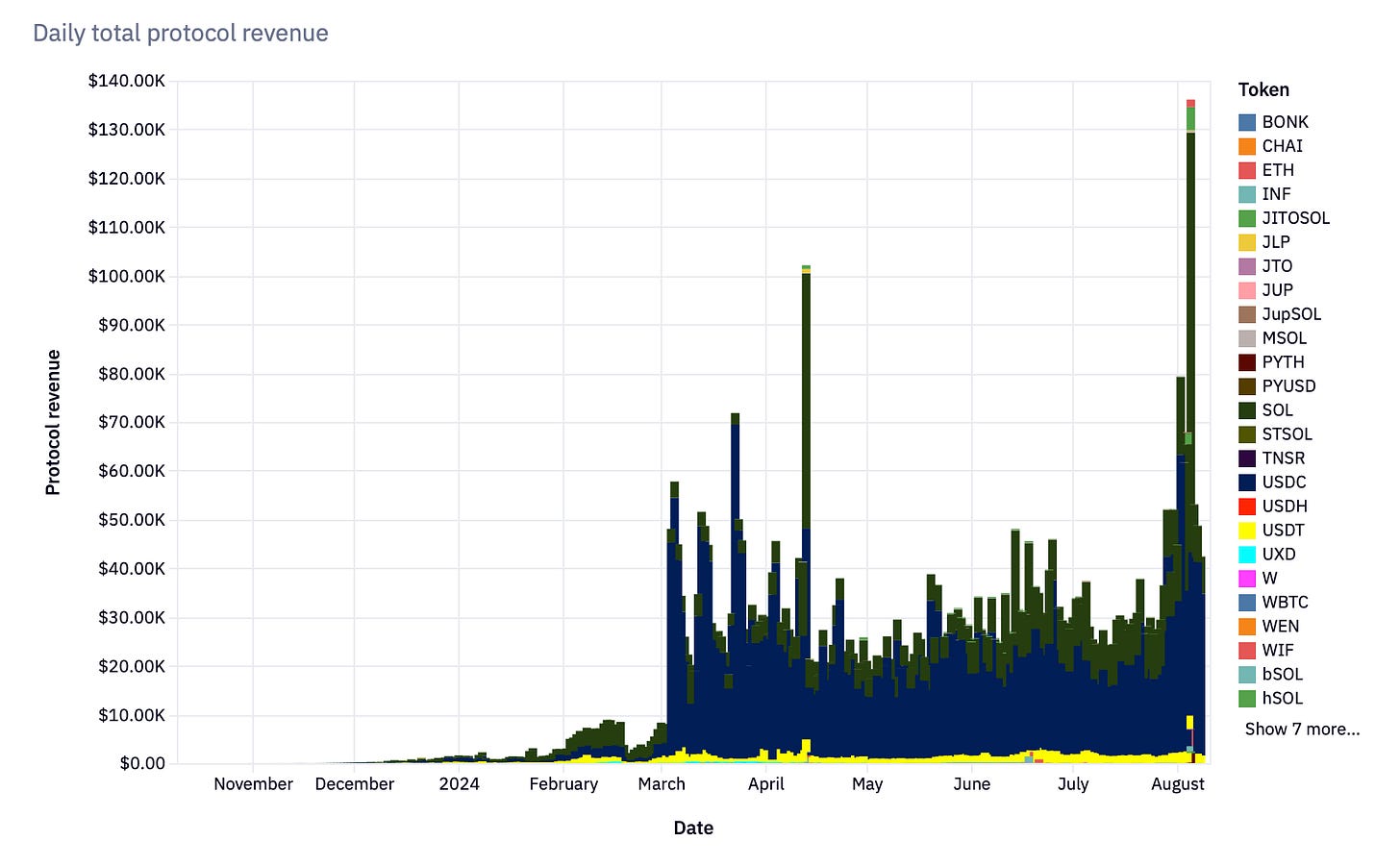

Another key metric for DeFi protocols is revenue. It is only with sustainable protocol revenue that a product, community, and governance will continue to thrive. As a rule of thumb, revenue on the rise means that the protocol is being used more and more. And this is the trend we see with Kamino. From near 0 in the beginning of 2024, Kamino reached a state of consistent $30-40k days and with a recent peak of around $135k on the recent capitulation. This puts annualized revenue of Kamino at $17.4M, which is currently more than 25% of the KMNO token circulating market cap.

Additionally, Kamino has also managed to establish partnerships with very reputable non-crypto native firms. One recent example is the Kamino x PYUSD campaign where Kamino became the first Solana lending protocol to onboard Paypal’s stablecoin, PYUSD. PYUSD supply on Solana has now overtaken PYUSD on Ethereum. This is reinforcing Kamino as the most trusted liquidity layer on Solana, and shows how effective the protocol can be for new tokens.

Demand and supply analysis

On April 30, 2024, Kamino launched its KMNO token as a central component of the entire Kamino protocol.

The total supply of KMNO is fixed at 10B, and the distribution is intended to balance the needs of the ecosystem and align all stakeholders. To achieve this, a portion of the tokens is allocated for network rewards, incentivizing early adopters and contributors, while another portion is reserved for development and ecosystem growth. As such, the theoretical distribution of KMNO is as follows:

On the other hand, the demand for KMNO is driven by the usage and utility of the token in Kamino’s protocol. For now, the main axes are:

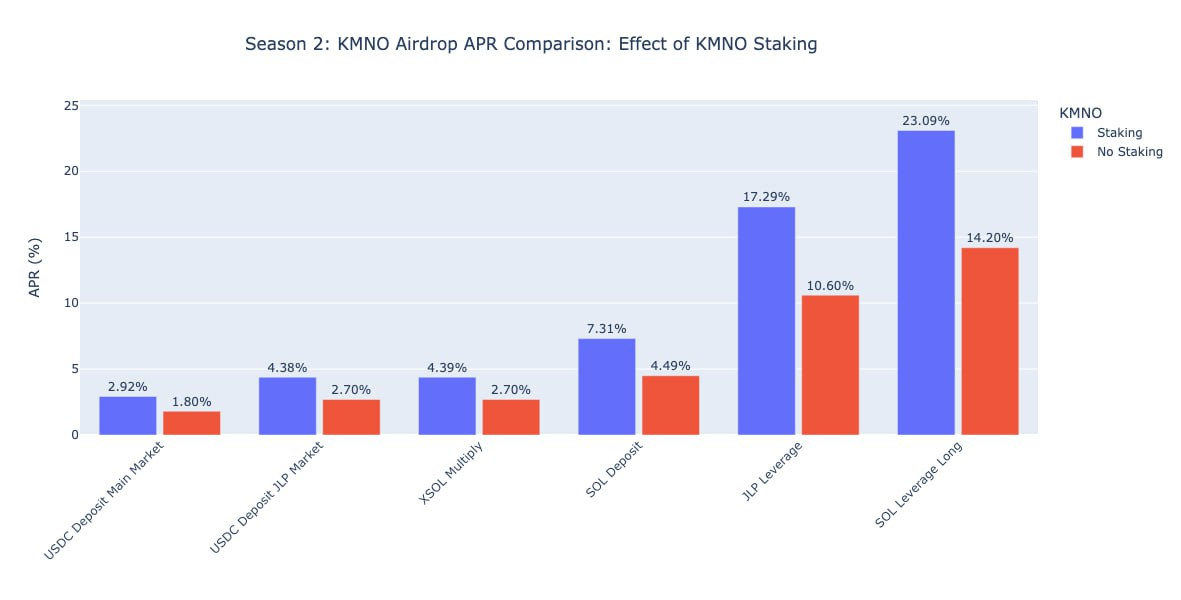

-Staking: Holders are able to stake their KMNO natively on Kamino. For now this can enable users to earn staking boosts and boost their current points earnings.

-Governance: In the near future, Kamino plans to introduce a protocol governance program which would include voting on key feature of the protocol such as user reward campaigns, protocol grants, revenue allocations, or certain aspects of risk management.

-Speculation on future cashflows: As this DeFi protocol matures, there is a case to be made that some sort of revenue allocations mechanisms might be put in place, especially as a governance program rolls out. This could boost the demand for KMNO.

-Modular partners: DeFi risk managers may need to stake KMNO to curate a lending vault on Kamino where they customize the parameters and earn a % of fees (this is tbc and speculation).

Show me the incentive and I’ll show you the outcome

For new crypto projects, achieving a strong network effect is key to success. Kamino’s strategy to kickstart this growth was to implement a point program mechanism to incentivize users to explore the Kamino product line until they became sticky users.

Season 1 of this program ran from January 19, 2024, to March 31, 2024 and as a reward, participants received a genesis airdrop allocation worth 7.5% of the total KMNO supply. This was a strong move to reward early contributors and it definitely paid off.

Directly after the genesis airdrop, Season 2 points kicked off and concluded at the beginning of August. 3.5% of the KMNO supply has just been distributed to participants in the network. Now we are off to Season 3 and the objective for this season will be to align the protocol, points and governance mechanisms to achieve Kamino’s goal of reaching a TVL of $10B.

KMNO valuation analysis

Price action

Upon launch, KMNO experienced a bit of volatility followed by a downward price action, likely attributed to selling pressure from initial airdrop farmers and then got beaten up by the recent market-wide crash.

However, after finding a bottom near the $0.019 levels, KMNO rebounded strongly and seems to currently be the Solana DeFi project which has shown the greatest relative strength recently.

Just prior to publishing this the KMNO season 2 airdrop happened, which has provided another pullback.

Circulating supply & unlocks

With the recent season 2 airdrop, there is now 13.5% of the supply circulating, which hasn’t yet been updated on coingecko. This makes the circulating market cap roughly $52m at current prices.

Outside of the season 3 airdrop, which has no confirmed date or amount of supply to be distributed, the first unlock is quite a long way off at 252 days away. Investors will start to unlock with linear vesting. There will be no supply shock.

We could assume the season 3 airdrop will be of a similar size to season 2, which was 3.5%.

I personally prefer to focus on FDV when making longer term investment decisions, but it is worth knowing that supply will be relatively low for the foreseeable future, especially if you prefer shorter term trades.

Relative valuation

To better understand Kamino’s relative valuation, we can first compare it to two different basket of tokens: 1) different DeFi project in the Solana ecosystem, and 2) major DeFi comparable.

Solana DeFi ecosystem

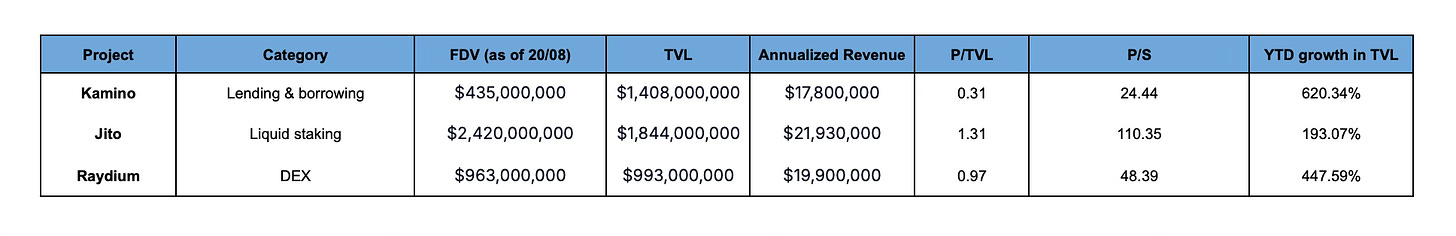

Comparing Kamino's position relative to Jito (the main liquid staking platform on Solana) and Raydium (one of the leading DEXs on Solana), we note that Kamino stands out as one of Solana fastest-growing protocol by TVL. Further, it also trades at the respective lowest P/TVL and P/S ratio. A strong case for Kamino’s potential.

However, it's important to note that lending and borrowing protocols typically trade at lower multiples compared to other DeFi sub-sectors. To get a clearer picture of Kamino's relative valuation, it would also be insightful to compare it to its major DeFi peer.

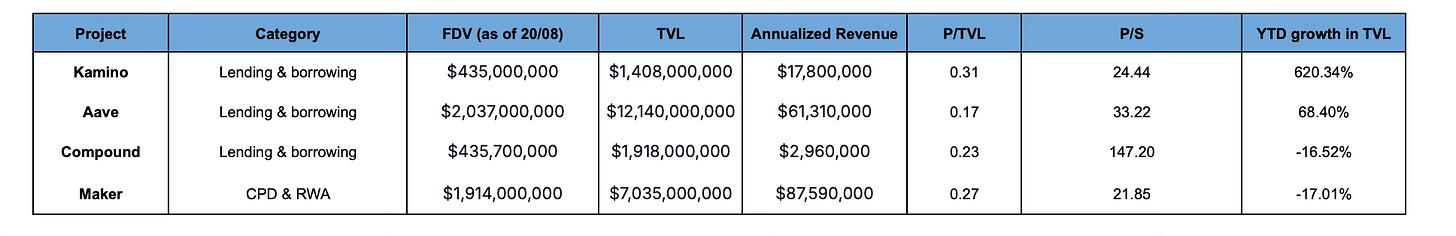

Major DeFi comparable

Hence, when we compare Kamino to Aave, Compound, and Maker, we see that its relative valuation is more in line with peers both in terms of P/TVL or P/S ratio. However, Kamino’s growth clearly stands out and this is a strong reason to be bullish.

Valuation analysis

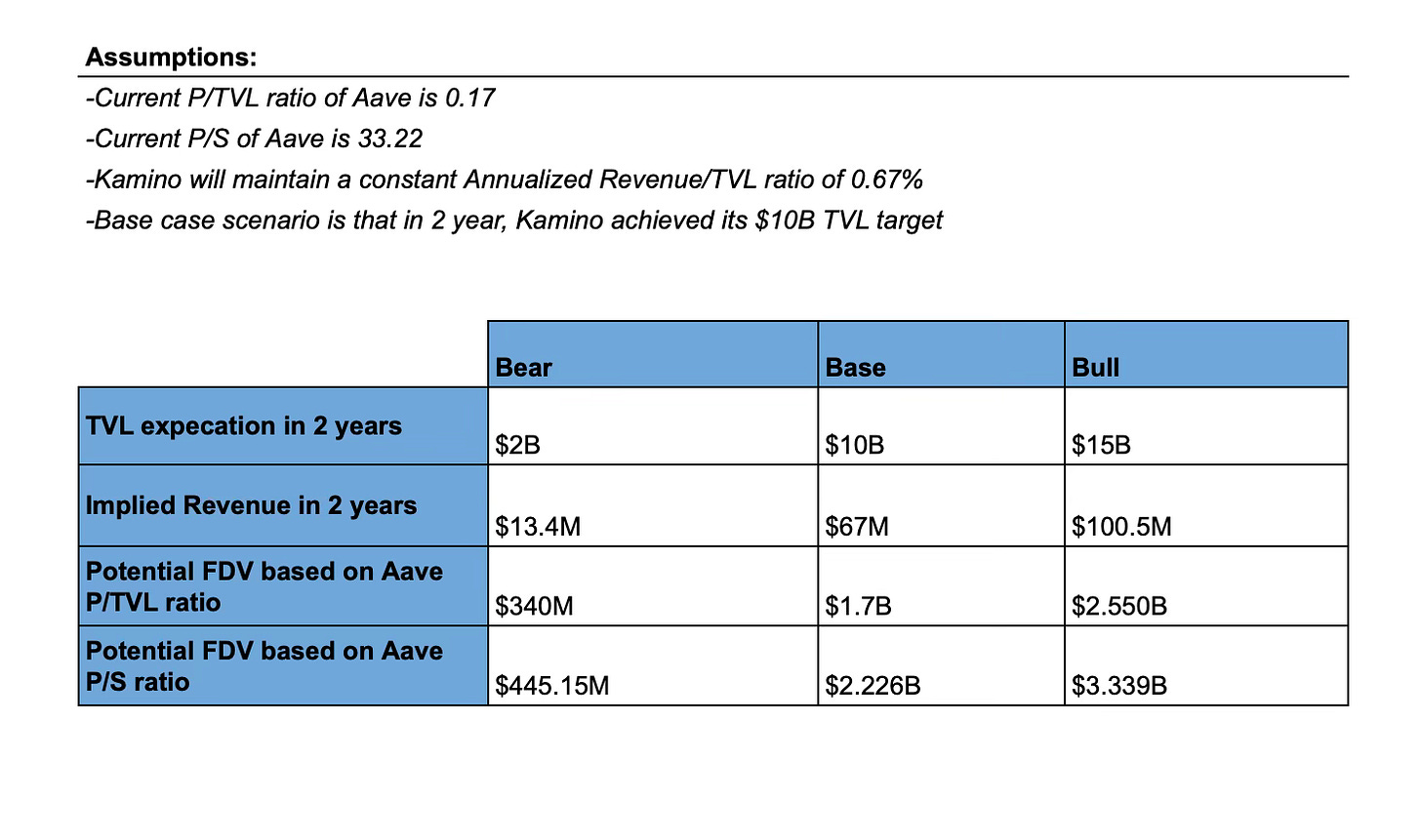

A different approach to derive a valuation analysis for Kamino would be to draw a simple scenario analysis.

For this study, we are going to assume a base case scenario where Kamino reaches its $10B TVL target in 2 years while maintaining its current revenue margin ratio. Further, we will also assume that Aave current multiple is a good representation of a mature lending and borrowing protocol Kamino will trade closely to those multiples 2 years from now.

Given all of this, we can derive different estimates on the performance of KMNO with a 2 year timeframe in mind:

This is only a short analysis with a lot of shortfall and strong assumption. It should only serve as a reference point. But nonetheless, it gives some insight on the potential bullish case for Kamino.

The bear case would be that Solana fails to grow from here, and TVL stays fairly small. If you aren’t enthusiastic about Solana’s growth opportunities then it is unlikely you will be interested in Kamino.

Additional thoughts:

Solana native teams dominate on Solana. The Solana community is extremely loyal towards teams that built during the bear market, and the Kamino product, track record to date and brand is a strong moat. For reference, Lido shut down their staked SOL LST because they failed to generate traction. This shows it will be difficult for existing EVM teams, like AAVE, to come and disrupt Kamino should these protocols decide to pursue growing on Solana.

Main takeaways TLDR

Kamino is firmly established as the most trusted lending protocol in Solana, with the largest liquidity and user base, the widest feature set, and the most sophisticated risk management.

Key offerings:

Automated liquidity vaults

Leveraged exposure (Multiply)

Lending/borrowing

Long/short trading

Market position:

$1.70 billion in Total Value Locked (TVL)

Over 30% of Solana's total TVL

Second-largest DeFi protocol on Solana

Growth indicators:

Increasing market share on Solana

Rising revenue (annualized at $17.4M)

Partnerships with major players (e.g., PayPal's PYUSD)

Recent developments:

Launch of KMNO token

Development of Kamino Lend V2

Valuation and potential:

Currently trading at multiples similar to mature lending protocols

Rapid growth suggests significant upside potential

Ambitious $10B TVL target

Future outlook:

Continued innovation through roadmap implementation

Potential for further growth if trajectory is maintained

A few ways to use Kamino today

• Earn Stablecoin yield with PYUSD & USDe (~17% APY+)

• Multiply your yield without worrying about LST depegs - JUPSOL yields 16% APY with a 4.6x multiplier. Just pay attention to SOL borrowing rates. The main risk would be that being elevated over a long period of time. It’s very unlikely though, as people would inevitably lend more SOL to make the most of increase in lending rate, which would normalise the borrowing.

• Multiply JLP exposure, which is a basket of assets (SOL, BTC, ETH & stablecoins) + fees generated from Jupiter perps - APY can be as high as 48% APY, but 40% APY is achievable currently with a 2.15x multiplier, which gives a safe LTV of 53%.

• LONG/SHORT SOL and pay less fees than other Perps DEXs.

Potential Risks to be aware of

• Smart contract bugs. This is a challenge for all DeFi protocols.

• Solana fails to generate institutional interest in DeFi, and Solana doesn’t grow in DeFi marketshare vs Ethereum + L2s.

• Regulatory issues.

• Surpassed by another project - Drift Earn, Jupiter lending etc.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Great write up! I'm not seeing anywhere close to the yields you described for JPL in Kamino. Am I missing something?