The Buildooooooor - coinflipcanada of GMX

The community led trading platform doing billions in volume

Welcome to the alpha please newsletter.

Gm everyone.

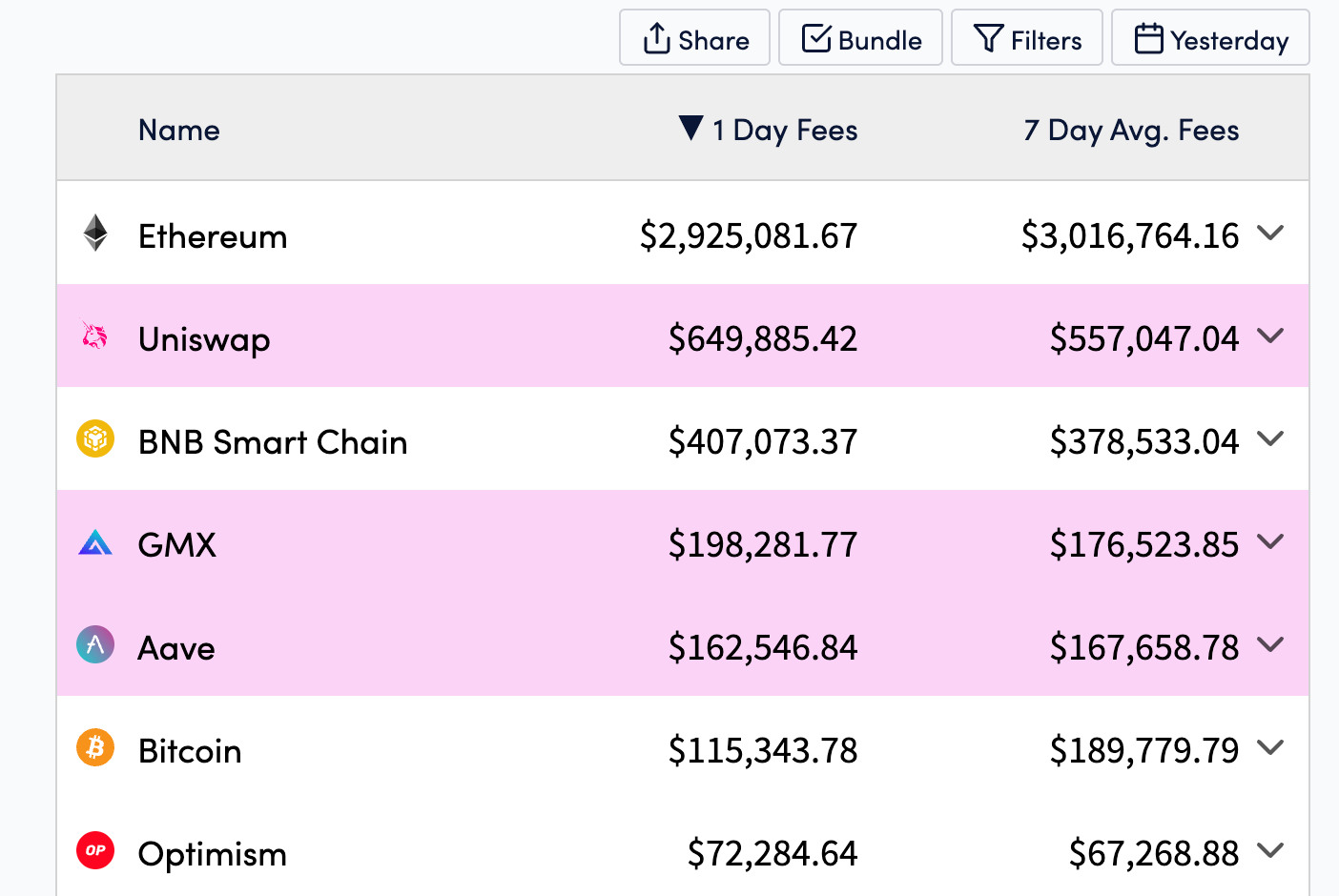

If you have been paying attention to crypto during this bear market, then you certainly will have noticed an on-chain perpetual trading platform by the name of GMX. It is fair to say it has been one of the stars of the bear market so far.

coinflipcanada is a contributor to GMX and I was lucky enough to ask him a bunch of questions.

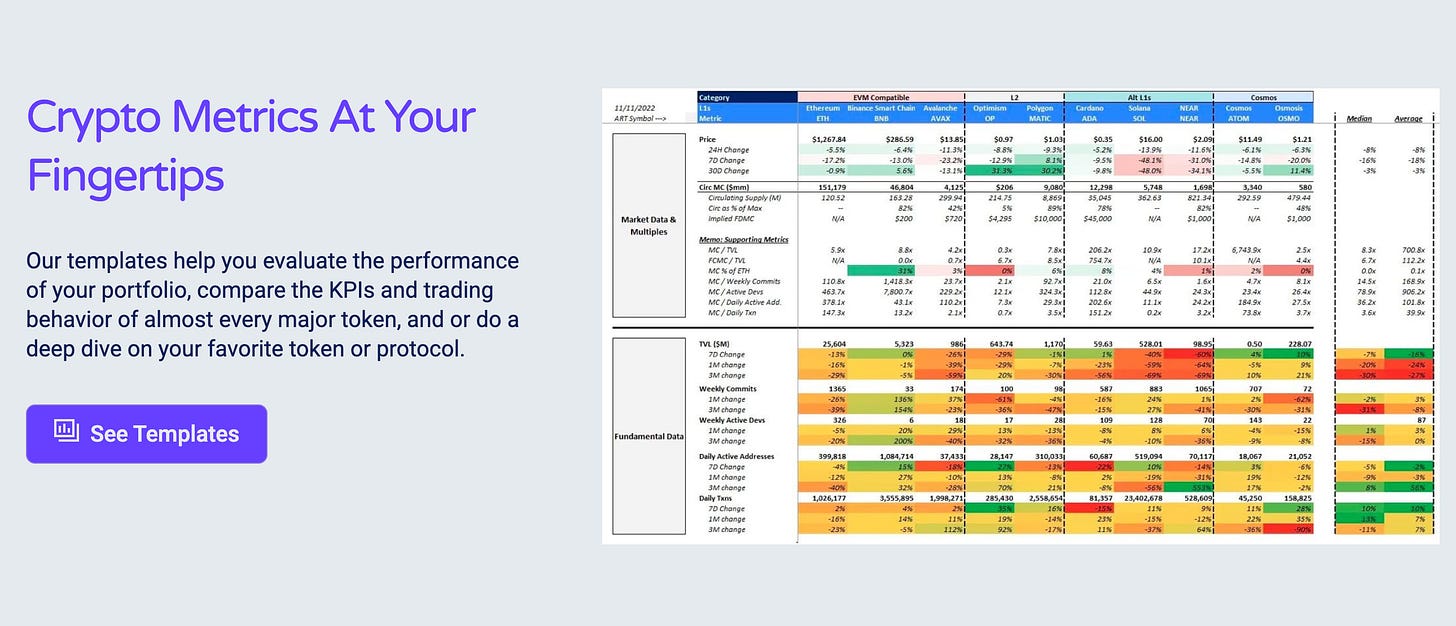

Today’s newsletter is brought to you by Artemis.

Artemis Sheets is the easiest way to automatically get L1, protocol fundamentals and key metrics in Google Sheets or Excel. Artemis Sheets now supports pulling data straight from your favourite Dune dashboard into your Excel / Google Sheets workbook. Try the =ARTDUNE() function today! Click the button below to get started, or reach out to the team at team@artemis.xyz to get onboarded today.

What’s your crypto origin story?

I think my crypto origin story is like wine. It's like vintages. Guess I'm a 2017/2018 vintage. I had been watching Bitcoin from the sidelines, but not really getting into it. Made my first investments just before things really started getting interesting in 17/18. I still try to go back to figure out if I bought Ethereum or bitcoin first. It was probably 50-50. Ethereum got me more interested than Bitcoin. This idea of smart contracts, being able to take agreements and being able to ensure that they were executed and not have to rely on other people for that verification was so conceptually interesting. More so than Bitcoin as digital money.

Went through that cycle, spent a lot of time looking at a lot of ICOs use cases, things that could have happened. But the reality is that at that stage it felt like the only thing we were actually doing was launching ICOs.

It felt like no one was talking about building, and nothing had been built yet. At a certain point life and other things took me in different directions. So kept an eye out, but really wasn't active, neither trading or investing.

In 2020 I sat down and started looking at what was happening in crypto again, and what was starting to happen in DeFi. You could see what I thought about a few years ago starting to come to fruition. That's where I went all in on DeFi. Spent a lot of time talking and engaging with other contributors on different protocols and slowly that interest went from there to advising to now being a full-time contributor on GMX. That's sort of been my journey to date.

How did you get involved with GMX and what’s your role?

The GMX DAO came into formation in late 2021 and it was really the joining of two existing communities. One was Gambit, which was a perpetuals platform on BSC, and the other was XVIX. Was fortunate that somebody said, there's this project and they are doing some interesting stuff. This was back in 2020. I think I was just trying to discover spaces to keep applying my own thinking about a lot of concepts.

The anonymous developers were very active in the Telegram groups and soon more volunteers joined as well. Everybody was providing ideas and thoughts and we could really see a lot of applications well beyond what was already being done. We were talking about a token that had a negative rebase, which sort of reflected inflation mechanics in the real world, innovative staking mechanisms that sort of dissipated those impacts, mint and burn functions etc. Just a lot of tools that have over time actually carried on and become parts of GMX and other protocols.

For me, it really ended up being about a community of people just trying to build interesting things. Everyone was very engaging and friendly. These protocols merged together and GMX carried on that identity.

GMX was really a number of community members who just kept coming together, starting with this idea that we are going to go and build a decentralised perpetual trading platform. It was just an outgrowth of what everybody in the community became most interested in, and being able to have some wonderful devs, who are just honestly out of this world, that just want to spend their time building community projects.

Today people think of it as this protocol doing billions of dollars of trading volumes and hundreds of millions of market cap etc. It really was just a community project. And to a great extent, every day there are ideas coming up in the chats and they just keep driving what's being done. And that incidentally leads to what I do, which is partnerships and strategy.

So much of what we've also done is partnering with many people within DeFi, and where possible, letting them build and try to be a good partner for anybody who wants to build.

One of the great things about DeFi is you are building these, as they say, Lego money blocks and we're just a piece of the puzzle. You have people building trading vaults, you have people building delta neutral yield strategies, you have people building auto compounders, you have countless different versions, you have people who are using GMX to build hedging so that they can build options protocols and other DeFi primitives. The goal is to build this nice clean base layer for everybody else to build on top of.

How do you explain GMX's rise from a community project to one of the biggest revenue generating protocols in all of crypto?

Well, knock on wood, we've been doing well, but things do change and we try to always stay as grounded as possible. But it's almost a case study of why web3 is a very different paradigm in terms of how you build products and how you interact with the people who use the products.

The fact is that the distance between the people who provide liquidity, which is one of the lifebloods of the platform, and the traders who are trading on these markets, is so small because these protocols have now had an opportunity to have so many people very close in providing those inputs. This has just made such a huge difference.

There's no big central guiding force building this protocol independently and just saying, now here we deliver you this grand protocol. It's all thoughts and ideas of the community that are coming together and refining the experience. We were born with two ears and one mouth, and you should use them in that ratio. We just try to keep listening.

I think that’s a cliché, but it's actually the truth. When liquidity providers have expressed concern about the amount of open interest exposure they might be taking. How does that work? What is the risks? Those concerns led to a system where, compared to a lot of protocols, all liquidity, all trades, and everything that happens in GLP is backed one to one. You open a long and there is literally bitcoin set aside for that long. You open a short, there are stable coins set aside to settle that short. Even if bitcoin were to go to zero, hypothetically, that means that we're taking some risk exposure, but the pool is never going bankrupt. There's no reason to have a run on the bank, you can see and withdraw without restriction. There's no risk that way, and it's all transparent. And then as new contracts are being built, taking that a step further, to make sure that if people only want exposure to certain markets, then that’s possible.

Taking input from traders as to what parts of the experience they've most enjoyed, but creating a system that works really well for big traders and really well for small traders. And making sure it is executed fairly and openly for everyone - there's nobody who gets a special deal on GMX. It also creates an efficient market for everyone.

Just getting that community input, taking it, understanding it, and then just moving forward with it, creates very little distance. Maybe that's why we don't need to do a lot of focus groups. Our community is our focus group. They are the users and they're the ones providing the inputs.

GMX has had its fair share of FUD & criticism on the timeline. What would you say to a community member who asked you, how safe is GLP?

I'll say this. If you were in the business of being a market maker, obviously it would be great if every day was an up day. But the reality is that you are in the business of providing liquid markets, and that means that there will be occasions where somebody who trades against you will be up and somebody who trades against you will be down. But in that entire process, they are paying you for that privilege, because you are able to provide these liquid markets.

There's no scenario where GLP gets liquidated because there's no leverage in GLP. In many ways, GLP is allowing other people who want a capital efficient way to leverage and to pay for that privilege. Whereas GLP is effectively saying we hold a basket of assets, if on any given day we have a little bit more exposure to bitcoin, or a little less exposure to bitcoin, so be it. As long as it's within a general range that’s alright. Ideally we want that exposure to be, let's say 15% of the portfolio. Maybe on some days that exposure is 12%, and sometimes it's 18%. But we're okay to be a little agnostic to that exposure, because over time, it'll revert to where we expect it to be. And there's a lot of mechanisms in the protocol to have that happen.

I think it’s a concern a lot of people want a complete riskless return. And to be clear, there's no such thing. I mean, if you're receiving yield, and GLP has consistently been one of the best generators of yield in the market, you are invariably taking some amount of risk in that.

And if you want to take no risk and need to be “positive” in every minute, then GLP may not be the right vehicle for your capital. Over a longer period of time, we feel that the model holds well. We think that there's improvements coming with GMX synths, which is sort of a successor set of contracts, which again, helps to maybe shape the market a little differently and hopefully will allow a lot of the constraints that we've also put on.

You have to be comfortable with the level of risk that you're taking on. Can you be in a situation where there's a bull market and you miss out on a lot of “upside”? Absolutely can happen. But you need to be comfortable that you're receiving compensation along the way for giving that opportunity up. Compensation may have been 100 days where people were paying you and there was not a lot of movement, and some days where they're paying you and there was a lot of movement and you did get to enjoy some “upside”.

Speaking from my own experience, if I was so good that I knew when there was going to be days where there was upside and when there wasn't, I'd be a trader. But I'm not. So instead I rather just provide passive liquidity, and allow the market itself to provide me a return. There's no free in this world. There will always be risks.

A certain actor has been attempting “profitable trades” testing various DeFi protocols. How reactive is the team to new risks, actors or attack vectors that might appear?

I think that the approach of the community is to be as conservative as possible. Obviously you are creating markets and structures that in some ways have existed for centuries, but have also never existed before in the way that they're being implemented. So, you have to look at them in a certain way.

It's been a bit of an evolution as to how integrated DeFi is now becoming. If you think about two years ago, the conversation was all only about MEV and really having people try to use, effectively, no capital to create returns. And a lot of the hedging and protection efforts were around that.

To talk about actors, with what is presumed to be Avi. Technically he's never claimed credit, but his wallets are tagged. That's a very different set up, because it requires deploying tens of millions of dollars of capital. It was not a risk free return, which is what a lot of initial DeFi exploits or attempts to economically exploit protocols were. And that means that you need to start to be prepared for a lot more edge cases, not just risk-free attacks.

That's where protocols like AAVE, or GMX, or others in the space, need to probably to be a little more conservative. Because being able to deliver a consistent positive return, doesn't mean consistent every day. Delivering a positive expected value is far more valuable than to maximise that expected value. That maximised expected value could also include edge cases which take things to zero. In our view that is not an acceptable risk. If you want to do that, be a trader. Maybe somebody can even build products that are happy to take those extremes.

But to track your statement, you have to be reactive and ideally you try to find more and more ways for that to happen automatically, have it happen based on hard numbers. And, if need be, contracts be potentially updated, but to again work within a framework.

How big do you think synthetics will be as a catalyst for the next stage of GMX's growth?

What's really interesting is that the term synthetics has probably created a lot of confusion, because, for most people, synthetics typically means synthetic assets. I think of synthetics meaning eventually synthetic assets but also synthetic markets.

We think that there's a lot that will happen with synthetics to help create more robust markets on chain, relying on certain off chain information from leading venues, which could be both CeFi and DeFi venues, but to help just make the trading experience on these public blockchains a lot more efficient.

And these markets operate in an even more permissionless fashion. As an example, it's about contracts that are ingesting, not just price, but instead taking considerably more off chain data to create efficient markets. All of which would be metrics that you would say a traditional market maker would take into account when trying to figure out how they should best price their own bid, ask and depth offerings in the market. If you're a small trader, you'll probably be able to trade around the middle of the market as you do on a centralised exchange, and exactly as market makers are making liquidity available.

If you want to go a little bit wider, there will be price impact slippage, a lot of other mechanisms that were just not very easy in the initial stages to build in an AMM, but now these synthetic markets should better be able to handle.

We definitely think it will be a catalyst for both improving the experience on large cap tokens, but finally creating a mechanism for tokens with lower liquidity. You'll be able to create markets that can better handle the characteristics of that type of a market because the Bitcoin market is not the same as the DOGE market, and is not the same as the number 50 token. It’s about making sure you create a framework, but can address, in different ways, these different markets and appreciate that they are different.

How are you going to incentivise the bootstrapping of liquidity for each new synthetic asset?

I'll speak in general terms because there's been a lot of ideas that have been coming from the community as to how to approach this. I think the ETH and BTC markets have sort of proven themselves to be self sustainable and there should still be a wrapper similar to GLP for people looking at a comparable exposure. There will be a lot of slightly more exotic markets, and we would definitely love to see them develop, but we don't want people to feel forced into those markets.

Some amount of activity might be working with the chains of the protocols that back those tokens if they'd like to have more robust trading markets for their tokens on-chain and that is a positive development for them.

The market makers might contribute liquidity. It might be that they want to find ways for the community to be able to earn passively from being a liquidity provider in those markets. So no different than theoretically being an LP, for example, just on AMM, but with a very different approach to it. No IL in the traditional sense because you're never giving away value, you're working with the current market price. Price discovery is through oracles as opposed to arbitrage.

In terms of bootstrapping liquidity, it may be that governance will want to package a number of these markets together and incentivise people who provide liquidity across all of them. Maybe it's about providing liquidity support or some incentives on specific ones.

These contracts are being built with a view to the future. There may be a lot of markets that aren't ideal today, but the infrastructure is being laid down for markets in the future, that’s where synthetic assets do start to come in. You can start to have markets for commodities, forex and other assets be provided. They're not fully backed in the same way that ETH and BTC market might be, but you're still able to create those markets. And I think that will be very interesting to see what direction people want to go in, because in theory, anybody can launch a market now on these new contracts.

How close is the launch?

The contributors have been heads down. An article was published saying what the contributors were thinking about, which was to get the base code out for audit during Q4. This has already happened, audits are ongoing. This is actually a reflection of how much GMX is growing. Multiple audits are being commissioned, really trying to make sure there are as many eyes as possible, both in terms of private and kind of public challenge audits and bug bounty campaigns. We also have our very large $5 million Immunify run bounty that backs all contracts that GMX has, which is our way of saying if there are flaws, and there may well be, come collect a fair bounty. GMX has generously paid out under that program anytime somebody has come in with a valid issue.

We're working with our oracle partners to do a lot of innovative stuff. There are a lot of joint development efforts that are happening there. Our goal is to go live once they're ready. We will have the contracts go live with limited liquidity, and really scale up over the course of this coming year. A lot of this is also going to come down to what governance wants to support and how they want to support these markets.

Could you explain X4 and why it's needed?

I'm actually going to speak about X4 in a more general sense. In some ways when we announced the idea, or the thinkings the contributors had around X4, it was simply a reflection that the typical AMM was just not doing a good job yet of serving protocols.

We have immense respect for the simplicity and elegance of Uniswap v2, because it really made things dead simple. But there was probably a need for more features, some of which we've started to see other AMMs start to integrate.

There has been a lot more innovation in the last number of months in the space, but there’s a piece of the puzzle missing, in terms of creating liquid markets that we also want to put our hand towards. Right now our focus really is on continuing to evolve these deep synthetic markets that we've focused on from GLP and continuing with that.

A lot of the thinking just continues to evolve around X4. We think there's even further layers of ideas that can be applied and ways to basically create more efficient spot markets. Those that really do a better job of assisting protocols with their entire life cycle, in terms of not just pipes discovery from an AMM, but how it can integrate within the protocols themselves.

In terms of the roadmap, what does that look like?

I would still say that the contributors work on what they find most compelling, obviously taking feedback from the community. Right now a lot of the effort is on the existing GMX GLP model and then on synthetics. That’s where everybody feels their contributions can be the most impactful on the industry.

There's a lot of people building on top of GMX and GLP. Every innovation that we do today helps to unlock better efficiency, some new opportunities for almost 100 partners. That's probably where the bulk of the focus is.

Our DAO has never been really a roadmap DAO. It's really been what are the immediate activities that we see fitting together? And one of the things that has really been helpful is now that we have this whole ecosystem of other people who are building. And hearing from them in addition to the community is just helping to create a short term roadmap.

I'll just use a small example. There was a set of updates to the GLP contracts recently. We removed the 15 minutes mint burn speed bump that was sort of built into the contracts. They were put in place as a protection mechanism initially. Over time, other pieces have been added to the puzzle, in terms of how we look at swap fees, minimum pool assets, maximum pool assets, so that minting and burning of GLP is a comparable experience to swapping. But that change is opening up a lot more opportunities for people who are building products. Like a protocol called Sentiment, who is now taking GLP and allowing GLP to be a collateral within their leveraged ecosystem that they're creating. That was something that may not have been possible if the mint burden was there.

Taking that feedback, changes have been made. We've been working with a lot of different protocols who are working with building up GLPs’ collateral. Listening to them to make the system more fluid and more efficient.

What are the considerations for expanding to different chains?

I spend a lot of time dealing with partnerships and chains are definitely a group we spend a lot of time talking to on a regular basis. So, for example, we're definitely in touch with the team at Polygon. If you name any of the top 10 EVM chains, we've had discussions and they've all reached out. And it's sort of an enviable position that there is all this interest.

Most contributors have shared their feedback and we feel that chain expansion is probably something to do after synthetics launch because we think these new synthetic markets are just a better version of how markets should be deployed.

I'll just share my own personal perspective because ultimately the community will decide. I focus on three things when thinking about GMX expanding to additional chains beyond Arbitrum and Avalanche, which have been wonderful homes.

Do they introduce GMX to an additional new subset of existing or prospective future users who are not being addressed in these existing markets? Meaning they help to expand GMX's reach and exposure so that it's not just moving existing users somewhere else.

Understanding if there's an ecosystem on that chain that can also build on top of whatever GMX is doing. Having a robust developer ecosystem and other protocols over there is very valuable. From our experience, when we started on Arbitrum and Avalanche, we were really able to help jump start a lot of interesting partnerships. We feel that we bring more to a chain where we can help to amplify what's happening.

And the last is leadership. Even decentralised chains have leadership. Can their leadership find ways to help GMX bootstrap and really get off the ground in the initial stages, and show that they really want GMX to be there. You're going to see in the coming days proposals from other chains.

The community has shown interest in some potential chain expansion. It's just going to come down to how many and how much time it takes to do that.

What about non-EVM chains?

If you think about a lot of the things that I mentioned previously, it had to do with is there an ecosystem, or are there developers? EVM environments have been able to leverage that existing strength. I think there's some wonderful coding languages and other blockchains that our current contributors don’t have much experience with. Maybe that will change. Hopefully, if more people want to be contributors, we can expand what GMX does into new environments.

If you take a slightly longer view, obviously there's a lot happening with Layer 0 as a concept. There's a lot of things that could happen where dApps could exist in a relatively chain agnostic fashion with people interacting through bridging. We don't think that the tech stack and the communications are secure enough, or safe enough yet. But it's definitely something that could happen in the future. You want to be available in as many places as possible and as efficiently as possible across all those environments.

It’s been an insane couple of months. The DEX vs CEX narrative has definitely been hotting up. Has GMX benefited from FTX's collapse?

My view is things will continue to move in the direction of DeFi and secure self custody solutions. But yes, there was obviously an immense immediate pickup of activity in terms of people coming in, joining the community, trying to learn about it. And some of that has slowed down in the sense that now back to that normal pattern where people are discovering, people are understanding.

There's a lot of people who will now not enter crypto through a centralised exchange. That's where the change will happen because today it's really the existing users who are maybe moving over from centralised exchanges to DeFi venues.

We definitely think mobile adoption is a really big part of this, seeing all of those pieces come together. Our hope is that when you decide to trade perpetuals or do margin trading, your first experience is on-chain and that is just the experience that you come to use. And then you'll be picking between the experience that GMX provides or Perpetual provides, or GNS, or dYdX, or whoever it might be that provides this type of experience that you enjoy but working from your own self sovereign wallets.

It may not fully take hold until the next bull market. But in the interim you're just going to have the DeFi share of the pie keep growing compared to CeFi. It's just a matter of time until an inflection point where it really takes off further.

Why are the GMX contributors anon?

I don't think any of the contributors started up with this idea of we're going to go build a perpetual trading platform that's going to do billions in volume. One of the great things with anon projects is that the focus is on the protocol itself. It's not about the identity of this person and who's leading it.It's really about letting the work speak for itself. There's a certain level of personal security and safety for anybody who's involved and anonymity has its benefits. I would tell you that most contributors probably operate on the basis that you assume people know who they are.

Who do you think your closest competitors are from a GMX perspective?

I don’t really like this question, because we've created some industry groups where we just try to get as many of the perpetual platforms to work together.

I can’t recall us spending any time thinking how do we protect or gain volume from other people in the DeFi space. The majority of what we've been doing has been focused on how do you build a product that takes people over from centralised exchanges and create future markets.

Maybe a better question would be which other sort of perpetual platforms do you admire?

dYdX, obviously. Their structure is very different than GMX, but I really admire that there's a type of product that they're trying to create and it's probably a very hard one to do within a decentralised environment, but they're really putting that effort in. I give them immense credit. It's a different approach than how we've done it, but I can respect the game and the approach there.

There are other platforms like, say, GNS who are doing interesting things with assets and probably they're taking on maybe more risk than we are comfortable to take on. But I give credit because you have to find ways to push the envelope and they're trying to showcase more of those experiments, whereas we've been a little more focused on the core product that sort of helps the industry as a whole by having big liquid markets.

Buffer are trying to do something that's akin to kind of like binary trading but using perpetual markets. I definitely think there's going to be interesting ideas in around those. I look at what everybody is doing and I find a lot of interesting ideas.

Drift are building on Solana and they're utilising the benefits that that blockchain has to create a product that would be different than what you created in the EVM environment.

The bear market seems like it has been great for GMX, right?

It's been a lot easier for us to focus on building out the protocol, building out the product. And I don't actually think that the bull market or bear market had much of an impact on that.

I'm going to give the community a lot of credit. It's not like when the market was pumping, people were saying why aren't you juicing things? Why aren't you doing more? It was never the conversation. The conversation was always around the product and the protocol. How to improve and how to make better markets. That conversation has stayed the same.

I don't want to say the bear market makes no difference, but we've also been very lucky. We were very prudent. Most of the treasury has slowly built up. It's just been sitting in stable coins, not even staked, not even earning a penny of yield. Most of it's not even in GLP. A little bit is obviously in GLP, but it's just sitting there because it's there to serve a very specific purpose, which is to ensure that the protocol keeps building.

What is your length of runway?

In terms of the treasury, I don't have an up to date number, but a couple of months ago we had at least a two year runway. I would say today it's much higher than that. It's sizeable.

Any alpha you want to share?

Synths are soon, and we are super excited by them.

What are you bullish on for the future?

Innovation, in a very broad sense. Every time somebody has said, this is what we'll all be doing five years from now, they've been wrong.

I'm obviously super bullish on the blockchain space, but I'm not sure what that catalyst will be. For most people, it's always been about DeFi but it may just end up being something else that really helps to be that catalyst. I'm sure VC money will change and won't be as active. We won't have as much money sloshing around tech. But I don't think that's going to slow down innovation. It just feels like there's so many smart people who are willing to challenge what's happening right now in the world. It's just not going to slow down.

Any advice for crypto investors right now?

Put your money where there are teams, communities or contributors working that are committed to the mission that they've taken on.

I have personally bought tokens in protocols before GMX, and will likely continue buying for a long time because I just believe in the people and communities who are building. I believe in what they're building, and what they're doing. Token goes up, token goes down - it doesn't bother me as much. I'm just comfortable with what they're doing. Take that time to make sure there are committed people working and you’ll be fine. This is definitely not the moment to be going crazy. I would say there's never a good moment to be going crazy, but just generally be patient. Obviously not financial advice but the way I personally look at it.

Don't ever be bothered that you didn't make the most money. There's nothing wrong with taking a bit of money off. De-risking a little bit. 80% or 90% of upside is fine, it doesn't have to be 100%. You can be very committed to what you're doing without having to be all in.

And that’s your alpha.

Thanks again to today’s sponsor Artemis! ➡️ Get started with their sheets for free!

If you enjoyed the interview and want to give GMX a try, you can use our referral link to get a 10% rebate on fees: gmx.io/?ref=alphaplease

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.