Welcome to the alpha please newsletter.

Hey frens, I’m back with another interview.

I chatted with macbrennan, the co-founder of MarginFi.

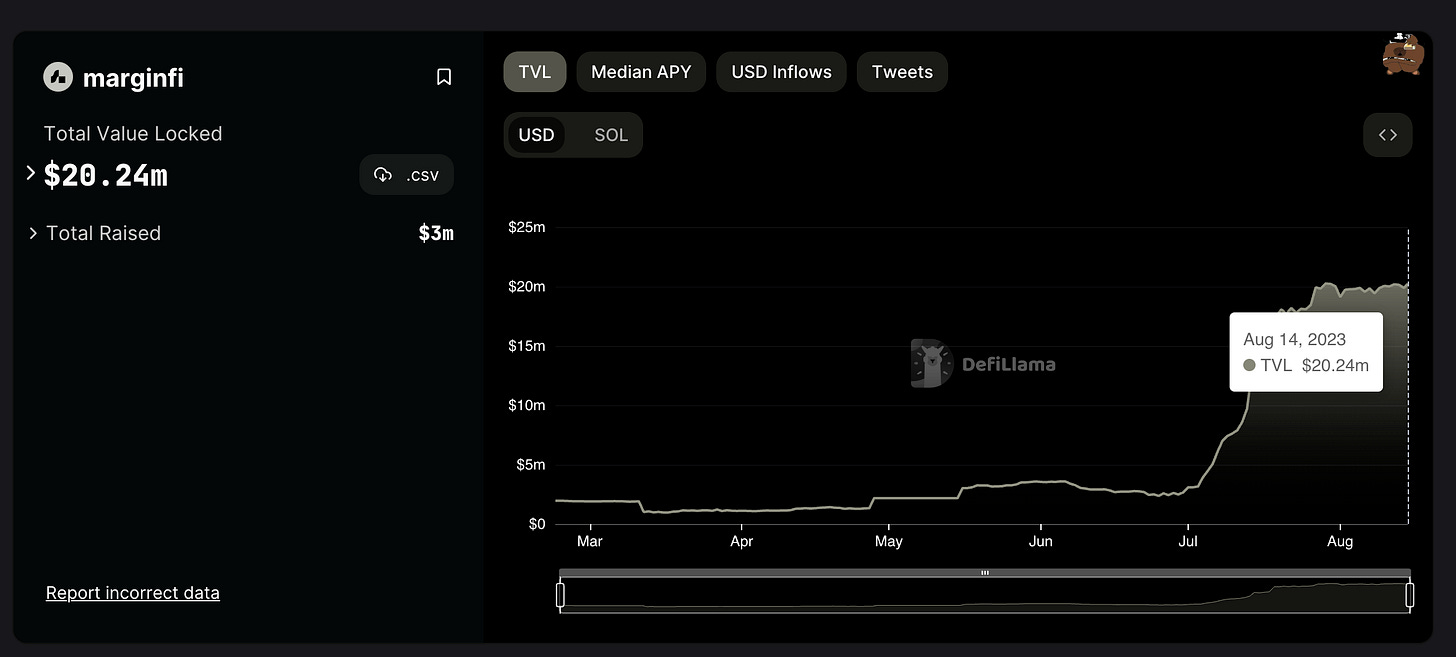

MarginFi is one of the fastest growing DeFi apps on Solana by TVL. MarginFi is a decentralized lending borrowing protocol.

You may have seen macbrennan tackling the Solana haters on Twitter.

I got to ask him a bunch of questions about Solana, DeFi and MarginFi’s growth and ambitions.

Highly recommend reading this one, certainly wouldn’t fade.

I will add resources at the end in case you want to earn MarginFi points, which will almost certainly result in an airdrop 👀

What’s your crypto origin story?

My journey began in the finance world, where I managed a hedge fund for a considerable period. Building on that experience, I ventured into a project at Morgan Stanley and a stint in a private equity firm, which further enriched my understanding of the financial landscape. It was during this time that I caught a glimpse of a promising opportunity in the realm of Health Tech.

This newfound insight led me to establish a Health Tech company, an endeavor that turned out to be a remarkable success. As the company expanded its reach across 20 countries, I was eventually able to sell it to a strategic partner. This chapter of my career provided me with a strong fusion of finance and technology knowledge, merging my expertise from hedge fund management with the intricacies of the Health Tech industry.

Despite having an eye on the crypto world for some time, I hadn't yet delved into creating something directly within it. It was during a lucky encounter with my co-founder, Edgar, in Miami – both of us attending a conference – that the idea for MarginFi began to take shape. Edgar's background, which encompassed risk analysis at Goldman Sachs and his work on AI/ML systems at Strava and Uber, blended seamlessly with my own experiences.

Our team, though small in number, boasts an exceptional array of talents. These include individuals with deep-rooted expertise in high-frequency trading, cybersecurity, robotics, digital identity, and traditional finance. It's worth mentioning that everyone on our team, Edgar included, brings unique strengths to the table. I'm constantly amazed by their prowess and dedication.

Why did you choose to build on Solana?

Our choice of Solana for MarginFi stemmed from the unique advantages it offered over other platforms. Our V1 of MarginFi, which is still aligned with our grand vision, was made possible exclusively on Solana. It's a protocol that uniquely facilitates parallelization, high throughput, and low fees, as opposed to the sequential ordering and high fees of the EVM. We achieved a groundbreaking feat by building the first protocol in the crypto space to provide universal margining across derivative DEXs on-chain, along with the pioneering implementation of under-collateralized lending for derivatives trading.

This innovation was simply unattainable on the EVM. Solana's environment, particularly during that time, enabled us to work on decentralized exchanges with extreme liquidity. While we encountered challenges along the way, platforms like Drift, and Zeta made remarkable progress, and liquidity is quickly resurging. Our product offerings have been diverse, catering to algorithmic traders and prop shops, which was a significant success. Our transition to over-collateralized borrowing and lending was prompted by market volatility, creating an immediate need for reliable infrastructure.

Solana proved to be the right ground for us to bridge this gap. While the incumbent platforms were experiencing challenges, we found Solana to be a solid foundation for our efforts. Our current direction is set on establishing universal margining across derivative venues, allowing traders to operate with more flexibility and efficiency.

So you didn’t feel like you could build MarginFi on the EVM?

There's an ongoing meme within the Solana community highlighting the concept of "only possible on Solana," and it's particularly apt in our case. Take this as a prime example of something that couldn't be constructed on any other blockchain – a financial primitive that essentially embodies the functions of a prime brokerage clearing house. This intricate structure, crucial for many financial operations, faces limitations on the EVM due to its low throughput and high fees. These factors compromise the integrity of processes like timely rebalancing and liquidating positions, as well as accurately attaching trade sizes to positions.

One major hurdle on the EVM is the lack of parallel processing, which significantly hampers its capabilities. In contrast, Solana shines in enabling parallel operations, allowing us to tackle these challenges head-on. So, when we say this achievement is practically exclusive to Solana, it's not just a tagline – it's a technical reality.

Was it too early for Solana DeFi last cycle?

The landscape of Solana DeFi has shown remarkable growth and potential. There's a vibrant trading activity and high volume of usage, painting a promising picture. However, like with any new technology, there were hiccups along the way. Solana was in beta and had a single validator client, creating vulnerabilities in chain integrity. But solutions like Firedancer are coming and advancements by teams like Jito, and the big chain updates have been pivotal in addressing these issues and enhancing chain integrity.

Early on, new teams were finding their footing on Solana, and not all managed to withstand the initial challenges. However, the standout teams are now hitting their stride, much like Ethereum's journey from ICO hype in 2017 to the emergence of robust primitives in 2018. Just as Ethereum faced the DAO hack and the subsequent fork, Solana too encountered hurdles in its fast-paced development.

Similar challenges are occurring on other chains like Arbitrum, Optimism, and zkSync. Such hiccups are a natural part of technological progress, and it's a factor that all tech enthusiasts must be mindful of. Now, on Solana, a lineup of strong projects is gaining momentum. Projects like Jito, Kamino, Zeta, Drift, Squads, Tensor, and Phoenix are making remarkable strides, and what's fascinating is that all these projects are pre-token stage. This signifies an early yet highly promising phase.

Each project is witnessing substantial growth. The recent stats from Jito and our project are all impressively on the rise. As these projects progress and attain effective decentralization with their tokens, governance and trading activities will further enhance Solana's ecosystem. This is the natural trajectory of technology, a phase that I find intriguing and exciting.

So is Solana having its 2020 DeFi Summer moment right now?

In 2018, Ethereum was just getting started with DeFi, tokens were just getting started and experimenting with governance. In Solana's case, many of the initial token projects were part of a wave of opportunistic protocols that, while they may still have Total Value Locked (TVL), have lost their user base due to unsustainable tokenomics. The community has grown more discerning and is moving beyond predatory token models.

The exciting part is that the new teams I mentioned earlier are well aware of these challenges. They are thinking critically about their tokenomics, learning from past mistakes. It's a promising development, and I'm eager to witness the innovative solutions they come up with.

The phenomenon of low token supply and high Fully Diluted Valuation (FDV) isn't unique to Solana; it has extended to various platforms, including Layer 2 solutions like Optimism, whose tokenomics are atrocious. The shift towards more thoughtful tokenomics indicates a maturation process within the ecosystem. Just as the 2017 ICO frenzy paved the way for the emergence of solid primitives, a similar progression has unfolded on Solana.

What differentiates MarginFi from AAVE, Compound or other lending protocols?

There are several crucial advancements underway that make us unique. We're combining these advancements with the introduction of two new products, making significant headway in risk management. In a recent instance, AAVE encountered substantial issues with Curve's token, creating a stir in the DeFi community. At MarginFi, we possess a robust risk background. For instance, we're likely the sole team across DeFi to incorporate slippage from liquidating assets into our risk engine. This provides a real-time perspective on safely liquidatable positions, a critical aspect given the significance of liquidation capacity and execution.

Further setting us apart are the unique advantages Solana offers. Users can engage with us without incurring exorbitant $100 transaction fees. This is crucial as such fees exclude a substantial portion of the global population from participating. Solana enables an aligned user base that can afford these fees, enhancing accessibility. Additionally, our platform allows lending with minimal amounts like $100, $50, or even $20, enabling users to actually earn from their investments, a feat that's challenging on EVM-based platforms.

Excitingly, we're on the brink of launching a stable swap and a stable coin. These will unify liquidity, risk, and margining across all three structures, creating a seamlessly intertwined experience. This integration will set new standards in terms of capital efficiency, pricing, and returns for liquidity providers. It's a game-changer, and while we're waiting for audits to conclude, this move is set to revolutionize the field.

Observing Ethereum, teams are beginning to recognize the strength of combining these components. They act like force multipliers. We see this in the AAVE, Curve, Maker products.

On Solana, these markets are open and promising, and I'm confident we'll succeed on the stable swap and stable coin front. Our rapid growth is evident in metrics such as TVL and supply, indicating Solana's dynamic DeFi landscape. As this expansion continues, we're poised to become the AAVE, Curve and Maker of Solana, offering a unified risk profile and a seamless user experience across our products. This journey excites me tremendously as we evolve into the go-to platform for spot assets on non-EVM chains.

You are one of the fastest growing DeFi apps on Solana. How do you explain your growth?

Something pretty big is happening right now on Solana, and most don’t realize it. At present, Solana holds around $9 billion in USD value, staked to validators. Interestingly, only 3% of this total resides in liquid staking tokens (LSTs). In comparison, Ethereum boasts 60% of its staked assets in liquid staking tokens. The disparity is significant: Solana has begun with a mere 3% in LSTs, but this is swiftly changing.

The movement is evident in cases like Jito, Marinade and Lido, which funnel assets through staking and ultimately into the DeFi space. Our own product, for instance, holds over 10% of every Jito Sol ever minted. This showcases that individuals prefer maintaining exposure to Sol while also leveraging it in DeFi operations. MarginFi is uniquely positioned as the sole venue enabling borrowing against liquid staking tokens, be it Jito Sol, Lido Sol or Marinade Sol.

These dynamics are unfolding in real-time, evident in our stats and those of Jito. Similar trends are likely visible in Marinade and Lido. As the 3% of Solana staked assets in LSTs inches towards the 20% mark (a third of Ethereum's equivalent), it translates into billions of inflows. Solana, boasting exceptional liquidity, rapidly becomes the second most liquid blockchain in the crypto sphere. All of this is happening without accounting for new liquidity, users, or additional teams launching their governance tokens. Platforms like Pyth, Wormhole, or even Magic Eden are juggernauts and have no token.

Large Solana stakers have been awaiting the right initiatives. This scenario, combined with the TVL explosion, is a microcosm of what lies ahead. Solana's potential is immense, and we're positioned to capitalize on this impending wave.

What’s your growth strategy?

We’ve mostly been talking about our borrow/lend activities. However, a major development is on the horizon as we prepare to launch our stable swap and stablecoin. These two areas hold immense growth potential, and we're poised to capitalize on them. A fascinating feature will be the ability for liquidity providers within the margin ecosystem to efficiently rebalance between borrower/lender and stable swap. This dynamic offers superior returns compared to standalone options in both categories.

Furthermore, universal margin comes into play between these products. It allows users to maintain a lending position in MarginFi, earning interest, while simultaneously using that as collateral to execute swaps on MarginSwap. This efficient approach eliminates the need to withdraw and redeploy capital across DeFi platforms, enhancing user experience.

On the stable coin front, we're introducing a game-changing concept. Stablecoins issued from MarginFi will be backed by a basket of assets confined primarily to Liquid Staking Tokens (LSTs), capturing staking yields, Miner Extractable Value (MeV) capture, and lending yields. Staking yields on Solana currently stand at 7%, higher than Ethereum's 4%. Moreover, by integrating LSTs like Jito Sol and Marinade, we can implicitly or explicitly capture MEV. Additionally, our CDP structure enables users to lend their assets in MarginFi and mint stable coins against them.

This innovation is a vital part of our growth strategy, offering a native gateway into new crypto ecosystems. It obviates the need for extensive infrastructure building to access various chains like Arbitrum, Sui or ETH L1, allowing seamless cross-chain transitions. The stablecoin product enables users to traverse different protocols while earning interest and yields. Our launch strategy involving stable swap and the pairing of mUSD with USDC and mUSD with USDT on stable coin exchange pairs will attract liquidity and drive growth.

The potential here is boundless, as we envision the stablecoin's utility across centralized exchanges, payment systems, and multiple blockchains. With a well-defined go-to-market strategy and promising partnerships, I'm deeply enthusiastic about the prospects this offers. It's an exciting journey to witness and be a part of.

Wen token?

I hold a strong belief in the potential of token systems. They're fundamental for decentralized financial primitives, providing explicit decision-making processes crucial for decentralization. In our case, we're actively working on our own token with novel governance and utility systems in the pipeline. These innovations encompass concepts like futarchy, fee tiers, and an efficient decision-making mechanism to prevent unnecessary governance hold-ups. We're pioneering a governance model that leverages price discovery, a proven method to synthesize complex information, ensuring more informed decisions. This approach, commonly seen in markets, like the stock market, facilitates better governance outcomes.

We're meticulously approaching this initiative to ensure its effectiveness and value, aiming to launch during this bear market phase rather than during a speculative frenzy. This will enhance immediate participation and value for users. Rest assured, we're taking tangible steps in this direction, focusing on thoughtful implementation rather than hasty release. It's a substantial internal effort that holds great promise for MarginFi's growth and governance enhancement.

A word on the MarginFi points system?

I think we pioneered this approach within the realm of DeFi. It's gratifying to observe other teams now adopting and adapting our concept, as it indicates the effectiveness of our efforts. Seeing other projects embrace similar strategies validates our success in this regard.

We ventured into uncharted territory by implementing this gamification and incentive system. It served as a framework to leverage gamification, incentives, and flywheel effects to amplify specific aspects of our product. This, in turn, drew attention, fostered usage, and contributed to community engagement. The experiment was resoundingly successful, offering us valuable insights into optimizing these mechanisms.

I want to emphasize that this is only the beginning. We're far from finished with this concept. The current version of our point system is merely a glimpse of what's to come. We have ambitious plans to further develop and enhance this approach, building upon our achievements and expanding its capabilities in ways that will undoubtedly surprise and benefit our users.

Why does Solana still get so much hate?

There's a tendency for some people to become tribal and protective of the platforms they support, often viewing competition as a threat. This dynamic is akin to politics, with influential figures swaying opinions. While understandable, this mindset hampers progress. It's crucial to realize that different technologies serve distinct purposes and can coexist. EVM and SVM are not in direct competition but cater to different needs. Our collective goal is to decentralize control and empower personal freedoms, which should unite us. Embracing applications that abstract blockchain complexities can foster harmony and shift focus to cost, efficiency, interoperability, and composability. As the industry matures and practical applications expand beyond finance, the divisive sentiment will probably disappear, promoting a healthier ecosystem.

What are you bullish on for the future?

I'm bullish about the prospect of reaching new markets through MarginFi in the realm of DeFi. This includes expanding to diverse languages and regions, potentially drawing users from various corners of the world. The idea of providing equal opportunities and a level playing field for everyone in the realm of finance really excites me and makes me incredibly optimistic.

Resources

• Start providing liquidity on MarginFi and earning points (I get some bonus points if you use my link) - They have just raised the lending caps on various assets!

• Follow macbrennan on Twitter

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

let's go!