Real World Assets - All assets will move on-chain

Exploring the future of capital markets & 10 projects for your watchlist

Welcome to the alpha please newsletter.

We are at an important moment in history for crypto.

Over the past few weeks, we've witnessed in real-time a 180-degree shift in the US stance on crypto. Against all odds, all eight Ethereum ETFs have been approved by the SEC. Additionally, the US House has not only approved the crypto FIT21 bill but also passed legislation to prevent the creation of a Central Bank Digital Currency. But what's even more striking is to see that crypto is even starting to become a significant topic in the upcoming US presidential campaign.

So if you are a big financial institution, the message is clear: Crypto is not going away so you better get familiar with it and start exploring its different use cases if you don’t want to be left behind.

In that sense, it seems like a no-brainer to think that the real-world asset tokenization sector has massive growth potential ahead.

But what exactly is this trend, why is it generating so much hype, and how to make the most of it? This is what we are going to explore in this piece.

Stay tuned as it is going to be full of alpha.

The case for RWA

If software is eating the world, then real-world asset tokenization is eating capital markets.

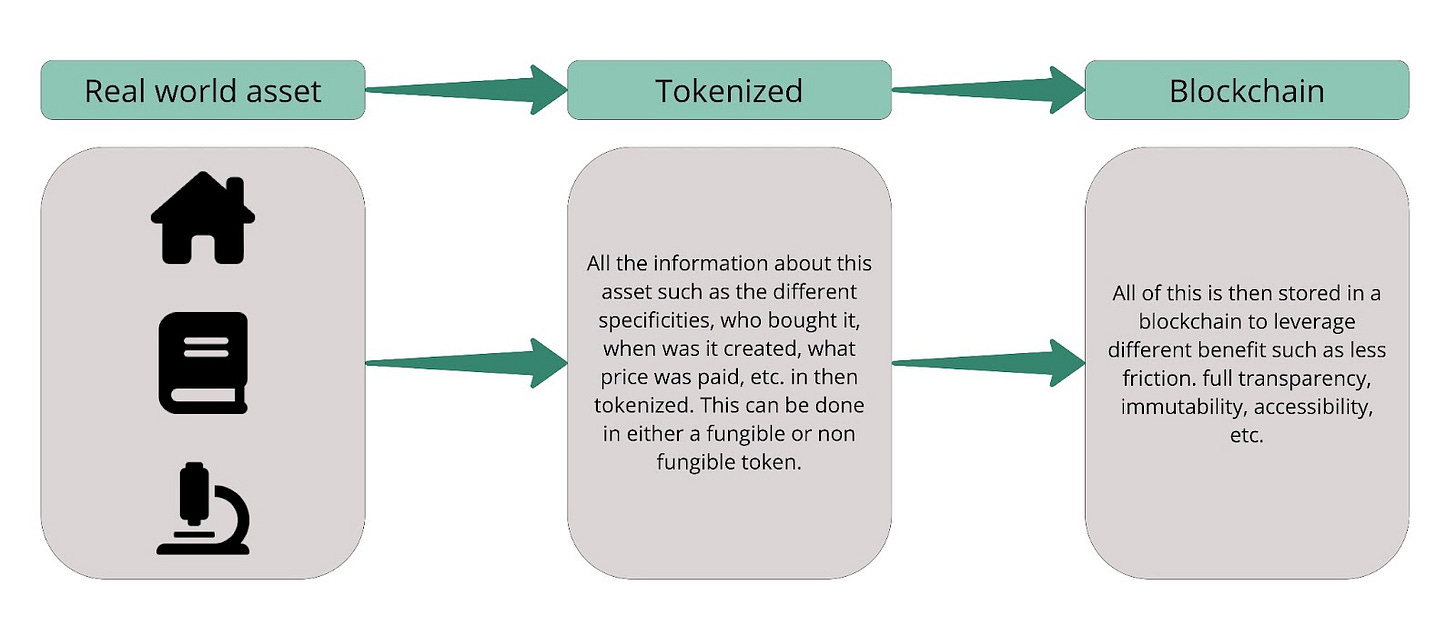

In recent years, the RWA (Real World Assets) sector has emerged as one of the most promising use cases of blockchain technology and by bringing real-world assets on-chain. The case for RWA is simple: to bridge the gap between the stability and value proposition of real-world assets and the innovative features and potential efficiencies of blockchain technology and DeFi (Decentralized Finance).

In fact, many see this sector as the new big thing in finance. Recently, we’ve even witnessed the biggest names in finance, like BlackRock and Franklin Templeton, showing a deep interest in this field and launching their own tokenized funds.

Theoretically, any real-world assets that can be easily tradable could be tokenized and brought on-chain. This includes both tangible and intangible assets, as well as fungible or non-fungible assets. Below is a non-exhaustive list of some of them.

But why is tokenization such a big deal?

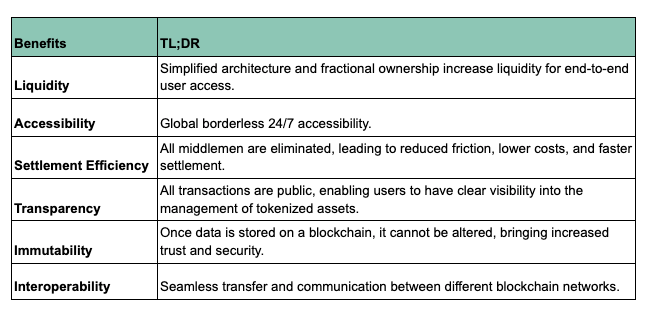

RWAs would not have gained so much traction if there were no clear advantage to bringing assets on-chain, right? Find below a table explaining the main benefits of tokenization.

The core thesis behind DeFi was that blockchain could create a better standard for exchanging different assets seamlessly. In that sense, RWAs are simply about recognising DeFi's value proposition and extending it to every tradable asset to build the next generation of markets—one that is more transparent, secure, fair, and open.

Understanding the RWA meta

We are entering the tokenized era of markets. Slowly but surely, all assets will move on-chain, challenging the status quo of the past 30 years in global capital markets. This is especially true when we consider that the RWA meta is right at the intersection of two trends shaping the world today: the financialization and digitalization of everything.

• Financialization: Today, finance has no frontier and economies are becoming increasingly borderless, with individuals transferring ownership of assets among peers worldwide. Everything has a market, everything as a price, and everything is becoming tradeable. Thus, it makes increasingly sense to build market mechanisms that are more efficient, more transparent, fair, and open.

• Digitalization: The world is moving increasingly digital. We have connected phones, watches, and, soon, connected brains. In that sense, it seems that the logical progression is for proof of ownership of assets to migrate onto blockchain networks.

In that sense, it feels that RWA is perfectly positioned to capture these two trends.

Main challenges

Without a doubt, real-world assets on-chain offer really interesting properties. But it also comes with many challenges. The main one revolve around:

• Regulation: Right now, there is no clear answer to where to establish a market for tokenized assets without encountering a complex regulatory environment. However, this could change as the perception of crypto continues to evolve over the years.

• Liquidity: Providing the right market structure for the liquidity and market-making of real-world assets can prove challenging, especially for highly illiquid markets that trade 24/7.

• Education: It will take a long time before everyone understands the real value proposition of bringing real-world assets on-chain as blockchain technology and its tradeoff can be hard to grasp at first.

The evolution of RWA

USD-pegged stablecoins

Fiat-backed stablecoins were the first killer use case of real-world asset tokenization and In recent years, this market has grown massively. Today, the two biggest fiat-backed stablecoins (USDC from Circle and USDT from Tether) have a collective market capitalization of over $130 billion, up from around $5 billion at the beginning of 2020.

Commodity-backed tokens

The tokenization of precious metals also emerged as another popular application of RWAs. Some examples include Tether Gold (XAUT) or PAX Gold (PAXG) which are tokens backed by physical gold. While this is a relatively nascent market, it is growing fast, and the market caps of XAUT and PAXG collectively amount to around $840 million.

Tokenized treasuries are growing fast

The last big trend in RWAs was the tokenization of US Treasuries. Based on data from 21co, we note that the market cap of this field increased super fast and to reach over $1.3 billion. But what’s more interesting to note is that big TradFi institutions are entering this market. For example, Franklin Templeton, represented by the BENJI token, has amassed around $370 million in deposits, while BlackRock's BUIDL token has already secured over $380 million in deposits.

The beginning of the next chapter

This tokenization trend is just getting started and is expected to continue growing fast. According to the Boston Consulting Group, the tokenization of global financial assets is estimated to be a $16 trillion market by 2030 and could finally be the bridge that we have all been waiting for between TradFi and DeFi to build the next generation of markets.

Looking ahead, we can envision a future where not only pure financial assets but practically all easily monetisable assets—from luxury watches to art to real estate—will be tokenized on a blockchain. This is the future of finance.

Taking advantage of this opportunity

After reading this, I am sure that you are now asking yourself: "Okay, I get it, but how could my portfolio take advantage of this new trend?" Don't worry, I got your back and prepared an RWA watchlist for you (+ a BONUS at the end).

But before diving in, a word of caution. Right now, crypto is experiencing significant levels of speculation, and it is essential to exercise a lot of caution. So as always, what follows aren’t predictions; they are just ideas. And ideas do change a lot as data becomes more available and time separates the noise.

This isn’t an exhaustive list, just projects I have managed to dive into that I think are worthy of paying attention to. There is much more going on in this category, and I have obviously missed a ton of projects.

RWA projects

Ready? Now let’s explore different projects you might want to add to your watchlist:

1 Chainlink ($LINK)

TL;DR: Chainlink have recently updated the way that they describe the network to “The universal platform for pioneering the future of global markets onchain”. By acting as the bridge between real-world data and the blockchain, Chainlink are key to making the tokenization of real-world assets a reality.

I wrote this tweet below a while ago, but it remains truer than ever today. Chainlink are actively working with Swift, The DTCC and some of the largest banks in the world today. These aren’t hype partnerships. Very real pilots and case studies to prove the tech have already been conducted and it is simply a matter of time until you see full-scale settling of RWAs on-chain.

I continue to be super bullish on Chainlink long term.

2. Ondo Finance ($ONDO)

TL;DR: Ondo is building the next generation of financial infrastructure to improve market efficiency, transparency, and accessibility. It allows retail and qualified investors on-chain access to bond markets through products like USDY (a tokenized note secured with U.S. Treasuries) and OUSG (short-term U.S. Treasuries).

Here’s a few things to know about ONDO:

ONDO has been the best new performing token of 2024. I think this project is super interesting and had a lot of momentum recently. But might be a bit too hyped and overvalued right now. Nonetheless, it is definitely something worth adding to your RWA watchlist.

3. Pendle Finance ($PENDLE)

TL;DR: Pendle is a decentralized finance protocol that allows users to tokenize and sell future yields. It is an innovative tokenization model solution to provide users with flexible and dynamic yield management options.

This is also a great protocol to farm points.

4. TrueFi ($TRU)

TL;DR: TrueFi is a modular infrastructure for on-chain credit and connects lenders, borrowers, and portfolio managers via smart contracts governed by $TRU.

5. Mantra Network ($OM)

TL;DR: Mantra is a security first RWA layer 1 blockchain that aims to adhere to real world regulatory requirements.

Dive deeper on this project with this thread:

6. Polymesh Network ($POLYX)

TLDR: Similar to mantra, Polymesh is an institutional-grade permissioned blockchain built specifically for regulated assets.

You can check out this thread if you want to learn more on why this project matters:

7. Centrifuge ($CFG)

TL;DR: Centrifuge provides both the infrastructure and ecosystem to tokenize, manage, and invest into a complete, diversified portfolio of real-world assets. Asset pools are fully collateralized, investors have legal recourse, and the protocol is asset-class agnostic with pools for assets spanning structured credit, real estate, US treasuries, carbon credits, consumer finance, and more.

8. Dusk Network ($DUSK)

TL;DR: Dusk is a permissionless, ZK-friendly L1 blockchain protocol focused on real world asset tokenization.

You can dive more into Dusk here.

9. Clearpool ($CPOOL)

TL;DR: Clearpool is a decentralized finance ecosystem that's all about bringing the first-ever permissionless marketplace for unsecured institutional liquidity.

10. Polytrade ($TRADE)

TL;DR: This is a marketplace for real world assets. It brings together tokenized t-bills, credit, stocks, real estate, commodities as well as collectibles, art, IP, creator royalties, luxury goods from all chains to a single platform.

BONUS: The easiest way to get exposure to this trend

If you don’t want to spend a lot of time researching and monitoring the different projects, I have another option for you: The RWA Thematic by SwissBorg.

Think of it as a basket of RWA tokens where the choice of tokens and their allocation are automatically rebalanced for you depending on market conditions. It's like an ETF, but for the RWA sector.

This is a way to gain exposure to the entire RWA sector, hassle-free and with just one click.

And that’s your alpha.

I also have my own Telegram channel if you want to subscribe. It’s free.

It features weekly updates including market briefs, DeFi and airdrop opportunities & good reads.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.