Bringing the $400T Interest Rate Derivative Market to DeFi

An interview about Pendle

Welcome to the alpha please newsletter.

I’m back with another interview for you.

I chatted with TN, the co-founder of Pendle, who have been one of the star DeFi protocols of the bear market.

They have gone from $8M to $127M in TVL in the last 12 months.

The interest-rate derivative market in TradFi is one of the largest sectors, but remains one of the smallest ones in DeFi. Pendle are hoping to change that.

If you are interested in DeFi then you need to understand Pendle.

Pendle TLDR

Pendle is a permissionless yield-trading protocol where users can execute various yield-management strategies.

In DeFi, you put your assets into a yield farming pool, and get an APY that fluctuates over time. Now with Pendle, you can do some DeFi magic and potentially get a much higher APY (by multiples) if you do it right. This DeFi magic is called yield trading.

Pendle is currently one of the best places to earn yield on your ETH.

I will add a link to Pendle’s educational resources at the end of the interview, if you want to master DeFi yield trading, or simply want to understand the basics.

What is your crypto origin story, how did you get involved in the space?

I started out a while back when I was still a student, I was a research assistant to a professor and I was tasked with looking into different fintech businesses in 2014. I was looking into different business models and I came across a remittance business that was using Bitcoin as a tool for money transfer between Singapore and the Philippines. The use of bitcoin set them apart from other remittance businesses as they were able to offer the same kind of service at a fraction of the cost. I found this really interesting so I got deeper into it and quickly came across the white paper for Ethereum. I thought smart contracts were really quite something because if they did what they proposed to do, the possibilities were endless.

Around 2016, I witnessed remarkable projects in Iran using Ethereum to raise millions for charity, which was truly inspiring. Initially, I assisted with community management for a couple of these projects. Then, my fortunate moment arrived when I came across a white paper, authored by a group of PhDs and students in NUS. Being close to the university, I reached out and connected with Loi (co-founder of Kyber Network). About a year and a half later, Loi approached me with the idea of Kyber and asked if I would join the team for community management and business development. I eagerly accepted, marking the beginning of my professional involvement in crypto and opening many doors for me.

In 2019, I felt it was time to move on from Kyber and explore new business ideas. After a series of unsuccessful attempts, I co-founded Pendle. Interestingly, most of the co-founders of Pendle were part of those previous unsuccessful projects. Our shared experiences and challenges have fostered a strong working relationship, helping us understand our strengths, weaknesses, and ultimately enabling us to work better as a team.

What problem are you trying to solve at Pendle?

We designed the product largely to cater to the needs of fixed rate products in the space. The motivation for Pendle stemmed from the DeFi summer of 2020 when all the shit coins were offering 10000-20000 APYs. My colleagues and I were farming loads of these shit coins and as much as we liked the APYs, we knew it wasn’t sustainable in the long term as there was no way for us to lock in the rates.

This got us comparing DeFi and TradFi and led to us looking at ways to lock in rates which was largely absent in DeFi at the time, when you compare this to traditional finance fixed rates are one of the most important verticals in the industry.

We thought that if crypto was going to grow to the scale of TradFi at some point then these trades were going to have an increased role in the space as well. It’s something that we could see happening already. There was a consistent flow of capital into the ecosystem between 2020 and 2022 and psychologically a lot of people value certainty.

We like the idea of a predictable income, putting your money in an investment and a year later we get exactly ‘X’ amount out of this investment. So that’s what inspired us and from then on we were just focusing on solutions to cater to these needs.

What was your unique approach to solving this problem?

There were two things that were fundamental to how we thought about the product design. Firstly we were a small project. At this point the DeFi summer had already happened and Aave, Compound, Uniswap etc, all these big protocols in the space collectively must have had around 15-20 billion dollars in liquidity. So for a small protocol like us with no traction or precedents in the space, it made more sense for us to build on top of these protocols rather than compete for liquidity. Additionally composability is one of the biggest propositions of DeFi so we thought it would make more sense to support these protocols and have their yield bearing assets as our source of liquidity. Which is why in Pendle, instead of depositing USDC or other base assets into the protocol, its always yield bearing assets that is at work, even though we have improved the user experience to support a wider range of assets.

Our thinking was that instead of competing for USDC against for example Aave, we would take in aUSDC as a source of liquidity and then tokenise it into YT and PT. By doing this not only are we not competing for liquidity but we become complementary to these primitives and there is also less opportunity costs for our users. Secondly, we thought that having AMM would make more sense for a new derivative that might not be super liquid. At the time, there wasn’t a clearly defined idea of how to determine the price of yield tokens. This would then make it hard to use an order book system for the yield token trades. It’s much better to delegate the price discovery to a maths formula. For example, at the time ETH was appreciating in price every day and using the order book system wasn’t sustainable because of the gas consumption involved. Every time you want to make an adjustment you pay gas, every time there is a settlement you pay gas. Therefore we thought that AMM made more sense for the project. These were the two most important things that helped shape the first iteration of Pendle.

What has your growth been like during the Bear market?

Well I don’t think we got it right the first time, that’s why there is a V2, and I think this is a really important part of the product design development cycle. When we launched the V1 in June 2021 we didn’t have a lot of traction. We managed to establish a couple of yield markets and there was a small amount of buzz on twitter but ultimately the common theme across social media was that the product was too complex which I think was true.

Pendle is still relatively complex and the user experience is something that we are continually improving. But if you really dig deep and attempt to understand the various components of the protocols it can be pretty overwhelming if you don’t have a derivative background and if you don’t understand finance well.

We took the whole of 2022 to revamp our product. The changes we made were based on observations and data that we collected from the V1. For example with the V1, PT and YT were traded at different venues. From a liquidity provision standpoint and also in terms of user experience this doesn’t make sense because if you want to provide liquidity for both YT and PT you would have to do it across two different venues for different pools. So when we thought about the design of the V2 we looked at the data points and went back to the core idea of AMM, thinking about how we wanted to structure the product around considerations such as impermanent loss and user experience.

Impermanent loss for an AMM or a derivative product like ours can be quite hefty. For example, the price of YT against USDC can fluctuate greatly and in the event that the price diverges and converges too drastically from where the entry was can result in impermanent loss, which nobody wants. So with that in mind, we developed the Pendle V2 AMM to minimise of even eliminate impermanent loss considerations. On top of that, we also have the pool to support the trading of YT and PT against the same pool. So instead of having to provide liquidity across two different venues, users only have to provide liquidity for PT against the underlying, and this pool is able to support both PT trades and YT trades.

The other important thing is the ability of the protocol to stack yield. We know that our users value APR and in this current environment if the APR doesn’t make sense nobody is going to provide liquidity therefore we needed to make sure that the APR is competitive. We achieved this through composability as well as an accounting system which accounts for incentives from the underlying protocol. Therefore the effective APR for the depositor is higher than if they don’t participate in Pendle. For example, if you provide liquidity into Stargate for the Stargate USDT and then you take the Stargate USDT and deposit this into Pendle, you are going to receive rewards not just from Pendle but also from Stargate and the lending APY from Stargate. So collectively that makes the APR more attractive and it makes for sense for users to provide liquidity through Pendle.

What type of users are you currently targeting?

I think our core users are still the more sophisticated retail users with an appreciation and understand of derivatives. But over time we are going to release new interfaces to remove the barrier to participation so that we can open up the protocol to a wider audience. We are working on some features for the remainder of the year that will help to achieve this. For example, trading YT and PT is complex, you need to understand the nature of YT and PT and you have to monitor the yield movements and maybe even track the factors that could affect the yield movement. We think creating a vault strategy that allows users to express a view in a certain yield asset without having to go through the whole process of understanding YT and PT will be really helpful. This is something that is currently in the works.

Can you give an example of a simple way that you can use pendle right now and a more advanced way that you can use pendle right now?

Currently we have two different interfaces, a simple UI and a pro UI. The simple UI is for users that don’t really know derivatives but want fixed rates. This is achieved by buying a principle token, which are structured like a zero coupon bond. This means you’re buying it at a discount and then at maturity you can redeem the underlying in full.

The pro UI is more catered towards sophisticated users therefore this is where the trading of YT and PT can take place. For example if a user thinks that the stETH yield APY is going to be more than 5 or 10% in a year then the user can buy YT and hold it until maturity to realise the gain. This is much more capital efficient compared with acquiring stETH and realising the yield until maturity. Conversely if a user thinks that the APY for stETH is going to drop then they can sell YT tokens and convert it to cash. Essentially it offers more ways for users to express views and in terms of strategies there are more possibilities, permutations and combinations.

Do you know what percentage of users are using the simple and the pro UI?

Back in April the percentage was around a 20/80 split for the simple and pro UI respectively. So we started looking into this and our conclusion was that the product was not optimised to cater to retail. So we made some changes and through marketing and growth attempts we were able to increase this to rate from 20% for the simple UI to 40-45%. But we were still expecting a higher rate of participation for the simple UI compared with the Pro UI and the reason that it’s not as high as we had hoped probably comes down to two things.

Firstly, when we explained to users that there is a way for them to buy assets at a discount using the simple UI, the follow-up question that they usually have is how does the discount take place? So then we have to go through the whole process of explaining difficult concepts which can be off putting to some users.

Secondly, crypto users tend to be more familiar with the notion of APY as opposed to discount. Even though we can frame it differently by saying if you’re buying at a discount and then you redeem the asset 1:1 then you’re effectively exposed to fixed rates, this doesn’t seem to resonate with the crypto community which is something that we are hoping to change in the next few weeks.

What is your growth strategy for the future?

Targeting a bigger user group and also converting the more sophisticated users, whether it’s institutions or retail - sophisticated retail is critical in fact. We need to be able to leverage a couple of different protocols in order to establish use cases and there are a few ways that we can do this.

Number one is integration, we need to integrate with other protocols in order to grow community leverage and offer better rates to their users. This could be either integration with another decentralised protocol or a centralised venue, either way works because ultimately we are looking at TBL and TBL can come from anywhere.

Number two is about simplifying the product because the barrier to entry for the product is still relatively high and I think we need to continue improving on the UI UX front. Like I said, we have a couple of things lined up, we are going to restructure the simple UI and we are also going to be working on a vault to help with trading of yield.

Number three is something that I feel strongly about and that is to allow permissionless listing of assets on the protocol. Currently the pendle team are writing the contracts for all the assets that are listed, every time we do that we have the use our internal resources to study the counterparts contract and then write the contract before having it audited, all of which takes time. In fact the shortest that we can achieve this in is one week and its really not scalable. From a scalability standpoint it makes more sense if we can encourage other protocols to write their own contracts because they know the assets and the protocol much better than we do. We would then provide guidance on how certain parameters are set and then get the yield market going. We have the contract already able to allow permissionless listing but we don’t have the UI yet. Hopefully we can enable the setting of yield markets as easily as you would set up a full Uniswap, so you would basically deposit the asset, define the parameters and you’re good to go. And anyone should be able to do that. That’s it for product features. Also business development is really important because I don’t think our product has a natural product market fit right now like the main market and AMM’s. So we need to keep trying to get more liquidity into the protocol. There is a lot of money sitting on the sidelines for example, with institutions. There are institutions that raised money during the bull run and are now looking for venues to deploy capital, they could be a good target for us. The other group of users we could target are the DAO’s. DAO treasuries have assets that are probably sitting idle and Pendle could be a venue for yield for them.

Finally, I think the fourth aspect is the expansion of token utility. How do we get more users to adopt PT and YT? This is key for us to increase adoption. A good case study would be FRAX who started in 2021 and over the course of two years have managed to increase the adoption of their assets drastically through various integrations. We would like to achieve something akin to this.

How do the Pendle tokenomics work currently?

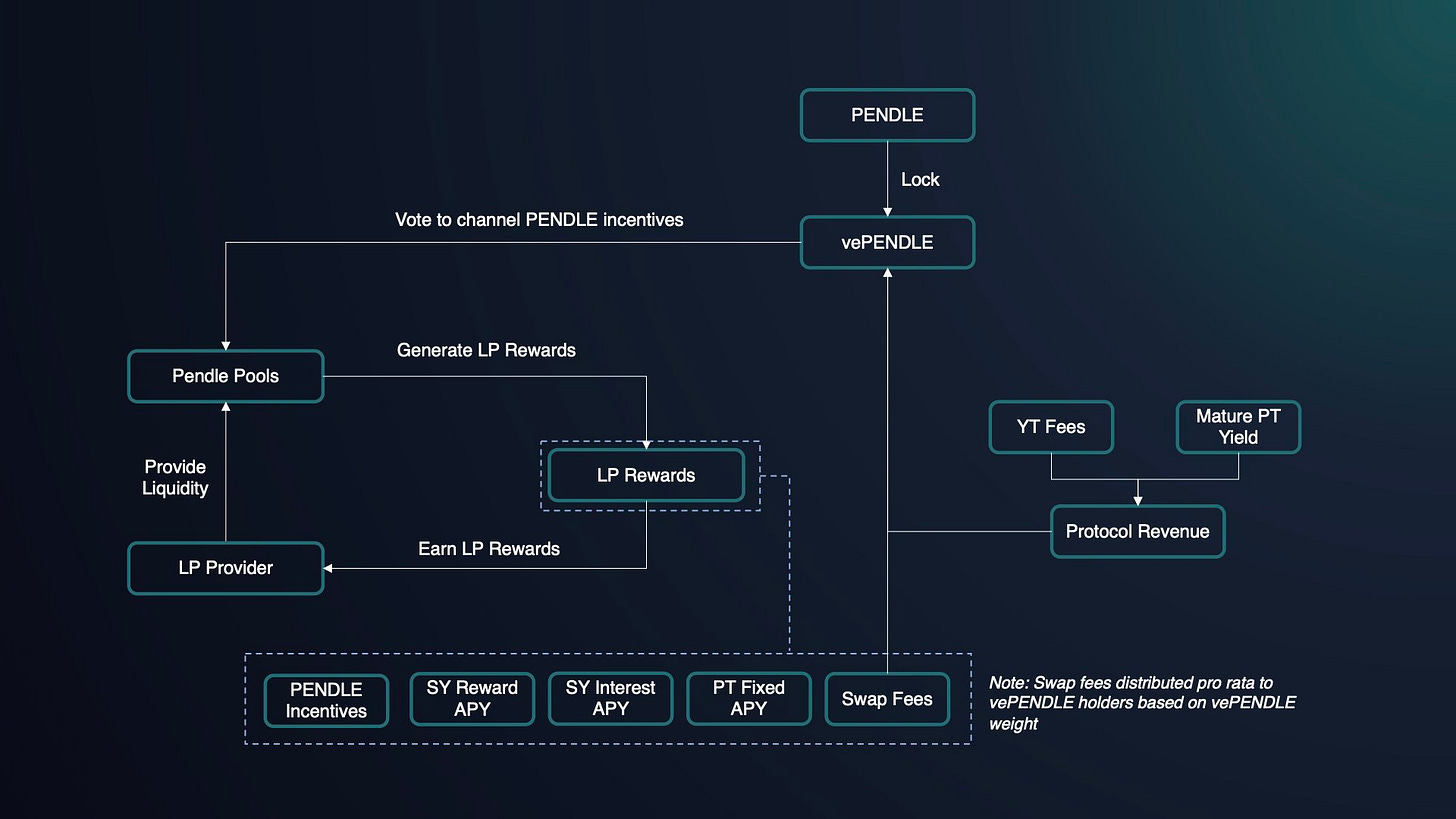

The Pendle token itself does not have any utility but then its locked up between one week and two years for vePendle, the vePendle can be used for several utilities.

Firstly, vePendle functions as a yield booster which is a concept inspired by Curve. So if you’re a liquidity provider on Pendle, having a vePendle position helps with your APR.

Secondly, it gives you voting rights. If you’re a vePendle holder, you are entitled to vote for incentives to be distributed to the pool of your choice.

The third is a claim to the protocol treasury. Because there are two sources of revenue for Pendle and all revenues collected by the treasury are redistributed to VePendle holders.

I’ve seen some buzz on Twitter about the Pendle Wars, is that part of your business strategy?

Yes this is part of our business strategy. We have examples of protocols with very successful tokenomics already such as Curve. Curve launched their token, the Ve contracts were enabled and then Convex and a couple of other protocols were finding incentives on Curve so a different layer of protocol ecosystem was established. We’ve always had this case in mind for how we wanted to establish utilities for the protocol token but it took some time to execute. It’s difficult to build an ecosystem if the protocol has no utility and traction. Fortunately for us we were able to gain some traction a long the way and over time it caught the attention of a few of teams. We held talks with them and they agreed to build on top of Pendle, so currently we have three teams using Pendle, these are Equilibria, Penpie and Stake DAO. Staked DAO was the first to launch a liquid token and they are currently working on a Vault for user deposits. This leaves Equilibria and Penpie as the two full protocols that are currently sitting on top of Pendle and collectively they have around 13 million units of VePendle which will probably increase over time.

Do you have an Pendle alpha for our readers?

I think mainly having new Pendle implementations on other ecosystems always on the table, in fact we have another one coming up soon. Also new product features that I am personally excited about which will be being release throughout the rest of the year.

How do you make decisions about chains? What kind of data are you taking into account?

So in terms of chains, the way that we think about it is actually pretty straightforward. When we evaluate the chain it’s all about the primitives that are on the ecosystem. For example if the ecosystem doesn’t have an AMM or money market of vaults or any venues that generate yield then it probably doesn’t make sense for us to have Pendle there. Because going back to the core principle of Pendle, its designed to be a second order derivative and we need to have primitives in place. Secondly, the TVL across the board, especially among these primitives have to be healthy, ideally a couple of hundred million to a few billion dollars because if it’s too small it doesn’t make sense for Pendle to be there. Because lets say usually we see 10% conversion from the LP tokens to Pendle, if its 10% and it’s a million dollar pool size, its going to yield 100K off conversion. So if the TVL across these primitives is small, we are going to see a very small amount of Pendle as a result which is not a very good use of our time. So we usually target chains with the primitives in place and with health TVLs. Looking at the DeFiLlama, there aren’t that many at the moment, mainly just Arbitrum, Binance, Polygon, Optimism etc.

Where do you think DeFi is right now as an overall market in terms of its lifecycle?

It’s still relatively nascent. Theres definitely a lot of room for growth because we are seeing mostly spot trades in DeFi right now and we are not seeing a lot of derivatives. Once people get used to the idea of derivatives, I think that’s when we will see exponential growth in DeFi. At this stage there is still a lot of innovation that can take place at the primitive level. For example for AMMs, Uniswap just released their v4 white paper and contracts so there’s still a lot of growth and development potential. Also the more interesting protocols such as Ambient and Maverick are a real testament to how much more innovation can take place in a space that is still growing. I would say that retail interest in the space has faded quite drastically compared with a year or two ago but I’m hopeful that it will come back again when the market condition improves.

I’m pretty optimistic that we’ll surpass the previous high of 180 billion TVL. I’m long-term bullish for sure.

I hope you enjoyed the interview and are motivated to learn and use Pendle.

Stack that liquidity, don’t be stuck playing 2D chess.

Pendle education

If you want to learn how to yield trade on Pendle, then click on the image below. The Pendle team have made it very fun and engaging to learn in-app.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

good read

Awesome interview. Can't wait to read more content from you brother