Onboard your mum into DeFi in 6 minutes

Introducing Nested and the "All Weather Alpha Portfolio"

Welcome to the alpha please newsletter.

Gm everyone, today’s newsletter is a bit different.

With the FTX collapse it has never been more crucial that we move away from onboarding new users to crypto using CEXs.

Time after time we have seen centralised exchanges be exploited or hacked leading to loss of customer funds (Mt Gox, Bitfinex) or worse yet, knowingly misuse and steal customer funds (FTX, Bitgrail).

“Not your keys, not your coins” is the most important thing a newcomer to crypto needs to understand.

We’re excited to say we’ve formed a partnership with Nested, a non-custodial platform which is a huge step forward in the way that people can access to DeFi and onboard in to crypto. This is the right platform to emerge from the FTX ashes.

Partnerships are very rare for us. We would rather “have fun staying poor” than promote anything that is detrimental to the space, or our readers. The brand/platform has to be incredibly net-positive for all you guys reading the alpha please newsletter for us to even consider it. We think Nested meets our very high standards.

DeFi is amazing, but most platforms still cater for a small niche of crypto native users, and CeDeFi took advantage of this.

Nested is literally built different.

This is not an average platform. We didn’t actually believe the tech until we used it. We are going to explain how Nested works in detail and how you can even profit from a potential airdrop.

We will be launching a few portfolios on Nested (run by Aylo & Pickle) that anyone can copy, so make sure you read to the end of the newsletter and we will explain our 'All Weather Alpha Portfolio'.

We are also going to send $500 USDC to one wallet that copies the portfolio with at least $100 (or equivalent) deployed into it, as a thank you for the support!

Before I go further, I will just put this disclaimer here: There is always smart contract risk in DeFi, nothing is risk free in this life, but you are trusting code not people. Never risk more than you can afford to lose. None of this is financial advice. We are simple amateur investors and one of us is a Pickle.

What’s to come:

• What is Nested and how does it work?

• Nested Roadmap

• The Tech

• The Nested Airdrop

• The 'All Weather Alpha Portfolio'

What is Nested?

The fact that you read this newsletter suggests you know a little bit about crypto and DeFi. Have you ever had a friend or family member shoot you a text message a bit like this:

I’m guessing you never really know what to say. Do you launch into a stream of consciousness explaining blockchain, smart contracts or how J.Powell is probably not going to hike that much more, so it might be an ok time to buy? Or do you send them a bunch of links to read, hoping they might do their own research and absolve you of responsibility?

Well, Nested is actually a solution to the problem of getting a random “give me crypto investment advice” message from a close one.

I’ll explain.

Nested has a big vision: to become the platform that onboards hundreds of millions of people into DeFi.

They have built a platform that has reduced all of the barriers to entry when it comes to investing in digital assets, constructing portfolios and taking advantage of DeFi strategies.

I know you don’t believe me and you are probably thinking this is some CeDeFi bullshit. No, it’s not. Fully non-custodial. All on-chain.

You can fire up nested.fi, log in with an email address, social account or web3 wallet, and purchase up to 12 different tokens across six major EVM chains (Ethereum, BNB, Avalanche, Polygon, Arbitrum & Optimism) using your debit/credit card in one transaction.

It takes about 6 minutes.

Find me a platform that can beat that. I’ll wait.

You can rebalance your portfolio whenever you want to in less than 1 minute.

Copy the best investors

The other challenge for newcomers to crypto is they have no idea what they should be investing in, or how to construct a portfolio and weight it by risk.

Nested are not only making it easy to onboard users from an ease of access point of view, they have also brought copy trading to crypto.

You can simply copy another investor’s portfolio with one click of the button. You will have access to those assets as long as you have your Nested portfolio NFT in your wallet.

This is great for newcomers, but also anyone investing in the space.

You can find experienced investors/traders and just let them make the decisions for you.

Investors/traders earn royalties when they are copied by other users, which incentivises them to create portfolios on the platform. This revenue is split 50-50 between the investor and the Nested protocol, which will be run by a DAO next year.

The fees are 0.3% on operations that don’t reduce protocol TVL on Nested (deposits, swaps, creation of porfolios etc.)and 0.8% on operations that do reduce TVL (withdrawals, selling tokens and receiving them outside of a Nested NFT e.g web3 wallet - Metamask etc.)

Users will also be able to set a performance fee on the portfolios they create, this is next on the roadmap.

You can set up push notifications for when the investor/trader you are copying has changed their portfolio, so you can accept the updated portfolio, making the buys/sells in your Nested portfolio automatically for you.

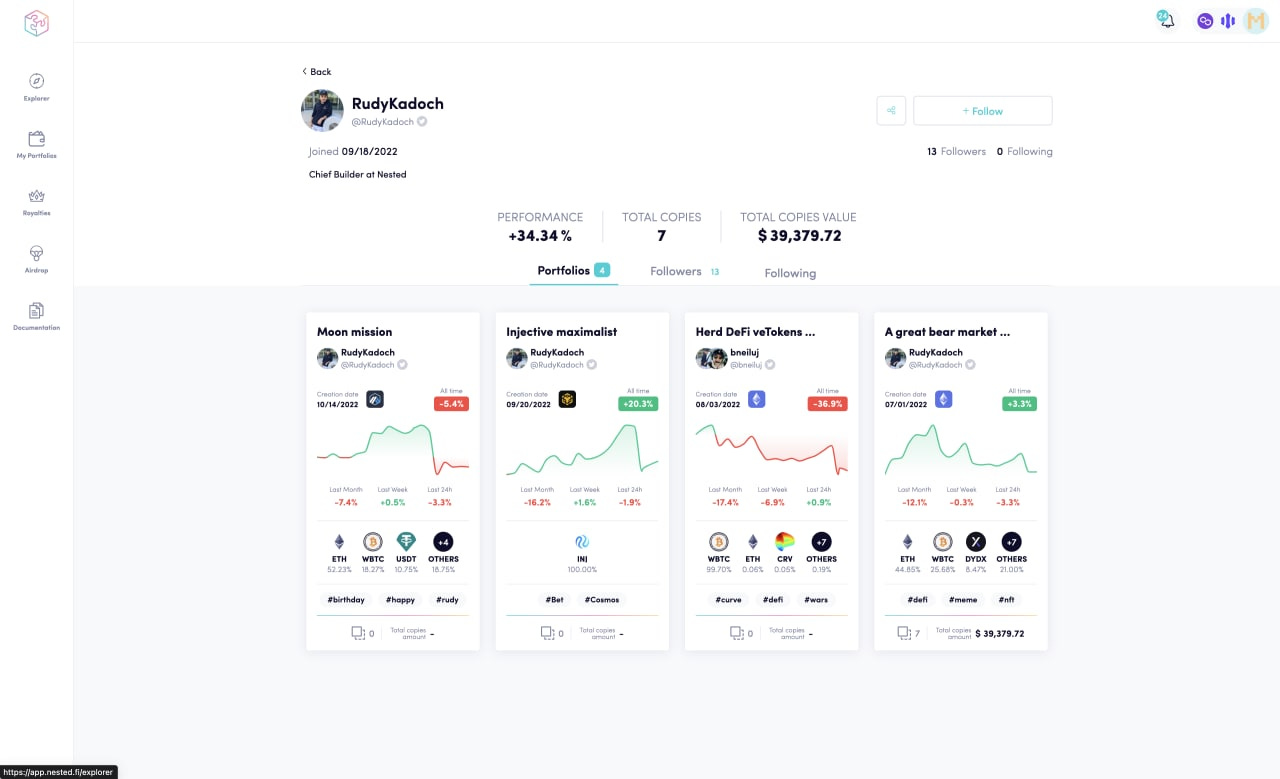

Create a profile

Nested is DeFi, but it’s also social finance.

Profiles give everyone the opportunity to see who is behind record-breaking strategies, you can follow them and keep up with their activity.

As a result, Nested also becomes a great place for finding new investment ideas. I’m hearing a social feed will be coming to the platform as well, so users will be able to post more detail about their portfolios and any trades they have made.

The Nested Roadmap

Nested have an ambitious roadmap, which I think will cement their place as the one-stop-shop for DeFi.

A few things coming up in 2022/23:

2022/23

Generating passive income

The underlying assets of each user’s portfolio will be invested in various DeFi platforms to generate yield.

Simply holding a portfolio will generate passive income.

Usually you would have to manually deploy your crypto assets to various platforms in order to access DeFi yield. Nested will do this for you.

Dollar-Cost Averaging (DCA)

Users can purchase a specific token on a regular basis, regardless of the token price. This process will be implemented through Gelato.

Trading competitions (1st batch):

There will be two different trading competitions:

Those owned by Nested without any restrictions: they will set the prize pool and the rules. Users will be able to link their portfolios to these competition.

Those owned by Nested with restrictions: we will set the prize pool, rules, and a whitelist. Nested will be able to whitelist users according to a selection of NFTs/Token at the beginning of each competition. For instance, they could organize trading competitions for BAYC holders.

Most of these features will be developed in Q4 2022, some will be available to the public only in Q1 2023

2023

Borrowing money

Users will be able to use their Nested portfolio as collateral to borrow money.

Nested will interact with the most trusted borrowing platforms such as Aave and Compound.

I think this is going to be a killer feature. Again, this is happening all within the same platform. The Nested protocol will do the money legos for you.

The $NST token will be generated.

Token Generation Event (TGE)

Nested will pre-mine all the tokens, and each token purchaser will receive their due.

The locking, lockups, and vesting are implemented at the protocol level.

Governance

Token holders will be able to participate in the DAO once the token is live.

They will be able to vote on things like the buyback ratio, platform fees, and the requirements for VIP membership.

They will also be able to vote for proposals.

Social trading competitions, which can be owned by various communities.

Trading competitions (2nd batch):

There will be two additional kinds of trading competitions:

Private trading competitions: users can create a trading competition between themselves and others those they whitelist. It will work like a poker party amongst friends.

Community-owned trading competitions: users will be able to submit public trading competitions to the governance. Once approved, all details such as prize pools and rules will be determined by the governance in place.

2023 Q3 & Q4

NFTs of NFTs and copy trading of NFTs portfolios

Users will be able to add their NFTs (BAYC, CryptoPunks, or another Nested Portfolio) to an existing Nested portfolio.

We will disrupt the copy trading market by enabling the copy trading of Nested's portfolios containing NFTs.

This will be another first in the industry. Users will be able to copy trade NFT portfolios.

Limit orders

Users can set a limit order to their underlying assets contained in their Nested portfolio.

Once the underlying value reaches this target, the trade is processed.

Cross chain

This will be the time to start diving into cross-chain protocols (possible using CCIP or Layer Zero). Nested are hopeful the technology will be mature enough to abstract networks and build a cross-chain platform, allowing users to create cross-chain single portfolios contained within one Nested NFT.

The Tech

I’ve got to say something about the tech. From what I have seen the Nested devs are pushing the boundaries of DeFi, composability and smart contracts.

Nested want to abstract complexity away for DeFi users.

They have been trying to answer this question:

How to provide maximum flexibility and features, without having to audit, deploy and maintain nightmarish smartcontracts that are essentially supposed to do *everything* ?

That is why they came up with HyVM.

This thread is going to be to too technical for most to understand, but Nested are pioneering a new way to make DeFi safer and easier for the user.

The HyVM is a smart-contract that acts as a virtual machine. It can dynamically execute EVM bytecode, without having to deploy it.

It's difficult to chain operations in DeFi because when you swap assets you don't really know what the exact amount will be. Slippage and price impact are not enough to get the exact amount.

For example:

Swap : 90 UNI -> 500 USDC

Lend : 500 USDC on Aave

Usually, you get a little bit more / less than 500 USDC so the transaction can be reverted during the supplying step on Aave.

With the HyVM it doesn’t matter.

Swap : 90 UNI -> Y USDC

LEND: Y USDC on AAVE

The HyVM allows Nested to chain operations without knowing the exact amount of tokens you need to use at each step.

Right now all assets are pooled in a single self-custodian smart contract. Nested will deliver a new version of their contracts where every portfolio's assets will have its own reserve. Think of them as “vaults”. Asset segregation is much safer for everyone.

The HyVM is the only way Nested can chain dozens of operations in one transaction.

In one transaction, you will be able to lend, swap, stake, leverage trade assets contained in your portfolio.

The Nested airdrop

The token generation event is set to happen in 2023.

A part of the minted NST supply will be airdropped to the community.

The higher your usage of the platform the bigger the airdrop you will receive.

How to score the highest possible?

The formula that computes your score for every event/snapshot looks at the following factors:

The total value of all your portfolios

The total number of copies and their total value

The diversity of networks used to build your portfolios: Ethereum, BNB Chain, Avalanche, etc.

The volume of activities – create, manage, copy, deposit, withdraw, sell all – on Nested

Full details on the airdrop here.

NST token

The NST is primarily a utility token designed to facilitate and incentivize the decentralized governance of the protocol. It is also meant to boost the user experience by unlocking unique features.

They are inspired by the best DeFi tokenomics including $CRV (Curve), and $SNX (Synthetix).

All decisions concerning the usage of the ecosystem and rewards reserve will be done with the DAO.

NST use cases

Governance - Stakers of NST can change Nested platform parameters as well as vote and submit proposals to improve Nested Protocol. Governance will be live at Rubik launch.

Staking rewards - There will be two types of rewards: - $NST tokens from the ecosystem's reserve. - A part of the protocol fees. They are still waiting for a final compliance approval.

Bribes - Users will be able to feature portfolios on top of the explorer. They must bribe governance for that.

VIP tiers - $NST token stakers stand to get a discount on Nested platform fees.

Premium contents - Users can unlock private portfolios by paying a monthly fee to their owners - same mechanism as on Onlyfans.

Tips - Users will be able to tip other users in $NST tokens.

If you think the Nested protocol is cool and potentially valuable, then feel free to try and earn it through the platform.

I have absolutely no idea what the value of the token will be on launch or in the future.

But some napkin maths on potential protocol revenue.

If Nested manage to generate $20M in daily trading volume, Nested will generate between $60k and $160k in daily revenue ($22M - $60M per year).

The crypto market currently generates more than $20 billion in daily trading volume.

You can get more info about the tokenomics and vesting schedules here.

All Weather Alpha Portfolio Thesis

Thanks for making it this far! As a disclaimer, we are just amateur investors, this is not financial advice, it’s just our opinions and what we are doing.

We believe the AWAP portfolio will result is significant appreciation eventually, and should weather an extended bear market, where more speculative tokens and protocols could fade away to irrelevance.

That crypto twitter darling of the month might not be here in 2024-2025, whereas the tokens we’ve put in this portfolio we believe will be, and will be higher in price than they are currently. Simple.

We do not believe this will achieve the significant outsized returns more active traders seek. This is not a 100x but a ‘set, DCA and forget’.

We will DCA the 40% USD allocation in proportions that the portfolio will start at, to be fully invested by early Q2 2023. We believe that this should catch the bottom of the market (if not already in) whilst also allocating a sufficient amount now to not miss out on any bullish price action.

We are not trying to time the market, this portfolio won’t be adjusted based on general market movements, but tokens may be removed if there is a legitimate chance of absolute failure (think along the lines of Terra $LUNA).

We do not plan to rebalance the portfolio unless any one token significantly outperforms, and this will be signaled at the time. We will largely be ‘letting winners ride’ which seems to be a successful strategy when applied retroactively to previous crypto bullmarkets.

We will be creating this portfolio on BNB chain because:

Low fees

Most wide ranging group of assets (including wrapped or synthetic assets) available, which are needed in order to produce the portfolio we desire on one chain.

We understand some people will disagree with the use of BNB chain due it being less ‘cypherpunk’ and further away from the decentralisation ideal that crypto aims for. Some compromise had to be made until cross chain portfolios are available in Nested, as we wanted to make it as easy as possible for people to copy one portfolio on one chain.

Allocation breakdown

The portfolio will be 60% allocated initially, in the assets below, and as mentioned above, 40% in USDC which will be dollar cost averaged (DCA) at 10% (meaning 25% of the USDC each time) every 4 weeks into these assets at the the outlined ratios, to be fully deployed before Q2.

Note the image above shows slightly different % allocations due to movement in price from the launch date (14/11/22) and because only 60% of the funds have currently been deployed (for example, 60% of the 35% ETH allocation is 21%, as per the pie chart).

ETH - 35%

This shouldn’t need much explanation. Arguably the safest crypto asset alongside Bitcoin. Lots of recent and ongoing bullish developments.

BNB - 12.5%

Mostly heavily used L1. Most used centralised exchange by a huge lead. Billions in dollar reserves. CZ. A bet for BNB is a bet for the most competent and effective businessman in the space. Easy pick.

SOL - 7.5%

The elephant in the room. We like Solana for it’s very different approach to Ethereum - focus on speed and low transaction fees over uptime (‘move fast and break things’). Different programming language and VM resulting in a completely different ecosystem of protocols and users. Adoption is relatively high for an alt L1. Toly is an evenly tempered good lead for such a project. No ‘main character energy’ or fall from grace due to hubris seems likely here.

With the fall out from FTX/Alameda there’s been significant fear regarding the token and ecosystem which I won’t rehash here. I think this could be the equivalent of the ETH DAO hack for Solana, and if the token (or a forked version to get rid of toxic allocations…) survives we believe it could have a similar run to ETH this past bull market (60x from the floor).

ATOM - 7.5%

2.0 rollout will eventually begin, interchain security will give the token more value. Like Solana, a very different approach to scaling compared to Ethereum, with a vision of use specific appchains with secure and fast bridging (IBC) between. Recent move of dYdX to the Cosmos ecosystem shows the belief developers have in it.

AVAX - 7.5%

Arguably the closest EVM competitor to what Ethereum is trying to achieve - decentralisation, security, scalability, cheap fees. If the vision of Ethereum is achieved on another L1, it would likely be Avalanche. For the same reason, because it’s aims are similar, being in direct competition with Ethereum makes it more vulnerable than something like Solana.

MATIC - 7.5%

The sidechain/L2 solution on Ethereum with the most adoption and users as it stands, with an incredible business development team who have snagged major partnerships alongside a large treasury, and several projects in the work to create various rollups. Polygon may well end up eating all other L2’s lunches one day.

AAVE - 7.5%

The preeminent money market protocol that is constantly innovating. Multichain and eventually cross chain with the v3 rollout, once a cross chain messaging protocol is built out and ready (CCIP). Native stablecoin $GHO coming soon. JPM experimenting with a forked version. Probably the most important protocol to shine through DeFi Summer that is going to be around for years to come, with (importantly) a low issuance rate and few to no VCs.

LINK - 7.5%

The most important infrastructure protocol on Ethereum. Has enabled much/most of DeFi to exist. Plans to expand far beyond its current main functions (oracle and VRF). CCIP (cross chain bridging/messaging protocol) will likely enable another wave of innovation on-chain. Chainlink Economics 2.0 in the coming months to start the process of making the token much more valuable with staking rollout in December.

DOGE - 7.5%

Most memecoins may come and go, but DOGE is going to stick around. It has a tendency to have isolated runs compared to ‘bluechip’ tokens which makes it worthwhile having as a diversifier in a portfolio. With Elon’s acquisition of Twitter, suggestions of DOGE integration will continue to provide speculative rallies every so often.

You can head to Nested here and copy this portfolio if you want to!

We are also going to send $500 USDC to one wallet that copies the portfolio with at least $100 (or equivalent) deployed into it, as a thank you for the support!

Stay tuned to our weekly newsletters for changes to this portfolio and new portfolios we’ll be launching in coming weeks.

And that’s your alpha.

This alpha please newsletter will always be free, but if you feel like contributing anything to the team then you can send anything you want to alphaplease.eth

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Great article, I will give it a go, it's great to pay via card, how about getting your funds out

Great work