MegaETH - Make Ethereum Great Again

An interview with 0xBreadGuy about the most radically different L2 in development

Welcome to the alpha please newsletter.

In the increasingly crowded Layer 2 landscape, MegaETH stands out with an ambitious vision: bringing real-time, Web2-level performance to Ethereum.

As someone that is currently fairly bearish on general purpose rollups, I think MegaETH is different, and am cautiously bullish on their approach. I honestly think they have a decent shot at “Making Ethereum Great Again”.

I sat down with 0xBreadGuy, a core contributor at MegaETH, to understand their unique approach, vision for the future of Ethereum, and why they can compete with Solana.

I think this is very much worth your time.

*I have no affiliation with MegaETH. I am just intellectually curious here and sharing what I learned.

TLDR: What is MegaETH?

MegaETH is a new Ethereum Layer 2 solution with a radically different approach to blockchain scaling. Unlike other L2s that prioritize decentralization, MegaETH optimizes purely for performance, aiming to bring Web2-level speeds (milliseconds rather than seconds) to crypto.

Key Points:

Built by performance engineers rather than traditional blockchain developers

Uses a single powerful sequencer instead of trying to decentralize block production

Targets 10 millisecond block times (compared to 2+ seconds on other chains)

Maintains security by anchoring to Ethereum and using a rotational sequencer model

Launching mainnet within 6 months

The Big Idea: While other L2s try to make blockchain more decentralized, MegaETH is betting that what users and developers really want is speed. Think of it as bringing the performance of web2 to crypto - enabling everything from real-time trading to responsive gaming, all while keeping enough blockchain properties to make it meaningful.

The Trade-off: More centralized block production in exchange for dramatically better performance. The bet is that this trade-off makes sense for many applications, just as we've seen with Solana's success despite being less decentralized than Ethereum.

How did you get involved with MegaETH?

I was initially doing content creation in the space, writing about protocols. Through that, I saw MegaETH's raise in July and dug into their whitepaper. It really resonated with me because it was counter to all the L2s being created. I was buying into the monolithic Solana vision - one single thing as big as possible. The MegaETH whitepaper had this contrarian view on sequencers. Instead of seeing them as something to decentralize, they thought "what if we optimize it and make it the biggest, baddest sequencer possible while maintaining L1 properties like force inclusion?"

I started writing about their vision and commanding some mindshare on Crypto Twitter. The team initially told me I could just join their Discord, but I kept writing because I was interested. They eventually realized they needed someone telling their story as a technical project, so they reached out again to bring me on as part of the core team for community growth.

We have many L2s already. Why do we need another one and what makes MegaETH different?

It comes down to design decisions. All these other L2s are defined by horizontal versus vertical scaling. They're called rollups because they post their proofs and data 100% to Ethereum. Because they're posting everything to Ethereum, they're "Ethereum-aligned." If you look at the numbers, that's about 200 TPS spread across 40 L2s right now. Solana is doing 1100 TPS by itself.

But what makes us truly different is our founders' background. Our original founder, Yilong, has a PhD from Stanford in low-latency distributed systems - he made his living optimizing data centers at the nanosecond level. He paired up with Lei, who co-wrote the paper on EigenLayer and has deep blockchain expertise. They're not trying to play nice with other L2s - they're trying to build a system that's super performant, sitting on top of around 20-25 engineers focused purely on optimization.

What does "real-time" actually mean in the context of MegaETH?

Think about a bid and accept flow. On any L1 with consensus, when you submit a bid, it has to get included in a block, then everyone has to agree it's valid, and then it can be shown in applications. On base, with 2-second block times, that's a 3-4 second time lag total. Research shows that if something takes more than 100 milliseconds, it starts feeling non-instantaneous. At 1 second, you're starting to lose your train of thought. At 10 seconds, you're completely distracted.

Because we're an L2 and don't need a distributed validator set, we can shrink that turnaround time to as small as possible. Our blocks are 10 milliseconds - effectively streamed.. Click "Place Bid" and in about 250 milliseconds - about the time it takes to send a Discord message - that bid is processed, on-chain, and displayed back to you. That's real-time responsiveness.

How do you respond to skeptics who say this is "just another L2"?

Most L2s today launch with small tweaks - Blast does native yield, Arbitrum has their time time boost, but they're all playing within the same basic constraints. We're building something fundamentally different because our founders come from a different world. Our lead architect made his career optimizing data centers at the nanosecond level - he saw blockchain performance and thought "I can crush what these guys are doing."

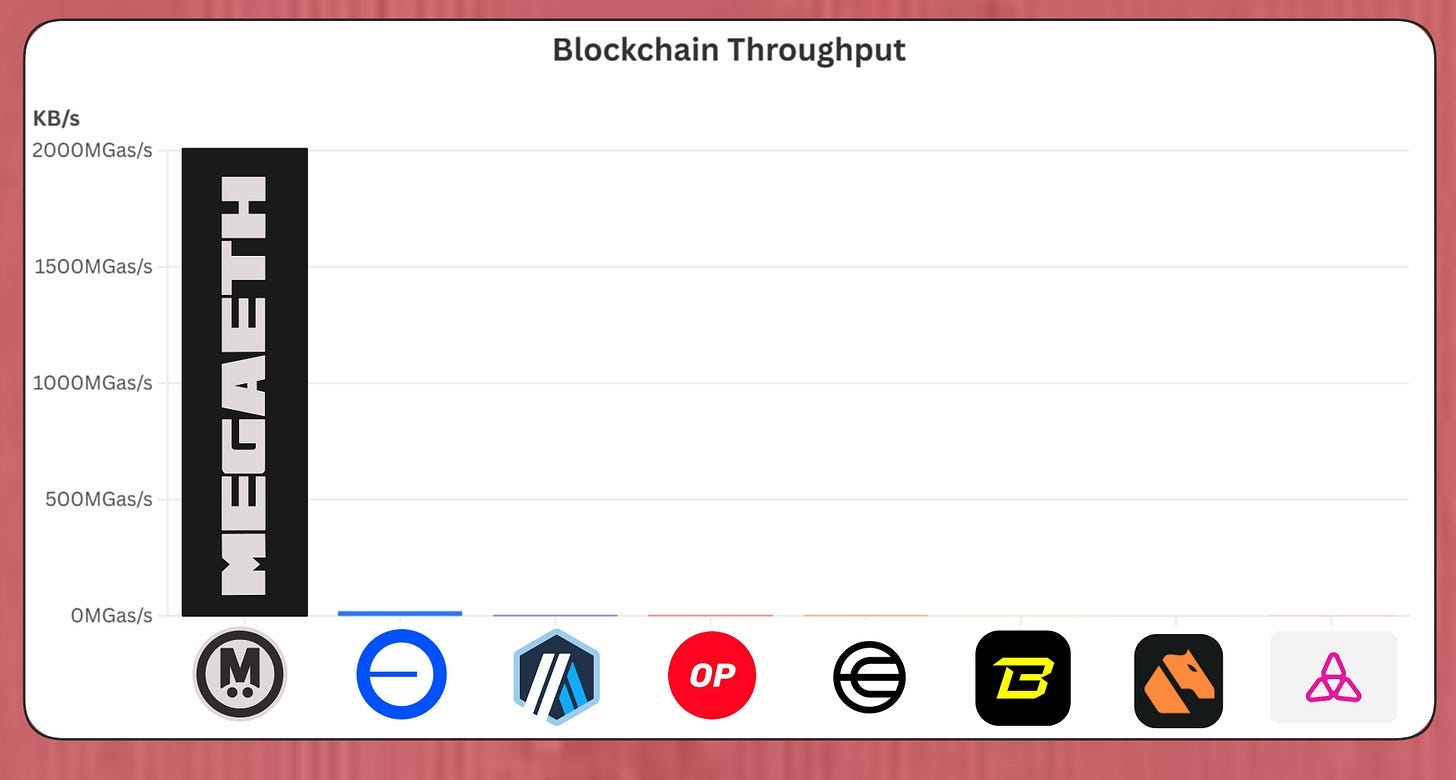

The meme numbers we posted at launch - 10 gigagas per second, 100k TPS, sub 10 ms-blocktimes - people thought it was a scam because they've seen those inflated claims before. But our team has been incubating this for years with 20-25 engineers focused purely on performance optimization. We're not trying to slightly improve on existing L2s - we're trying to bring Web2-level performance to crypto.

How should people view MegaETH in comparison to Solana?

Ironically, we're learning more from Solana's vision than other L2s. Everyone else is trying to decentralize their sequencers and reintroduce the same L1 problems, while we're saying "Let's make this thing super performant." If you look at the numbers today, it's around 200 TPS spread across 40 L2s, while Solana is doing 1100 TPS by itself.

By the time we launch, which will be this year, we'll be about 150 times more capable of producing throughput than Base. We're not trying to play nice with everyone else - we're trying to build the biggest, most performant environment possible and keep iterating on that, similar to what Solana has been doing with their IBRL (increase bandwidth, reduce latency) improvements.

What potential use cases are unlocked by having real-time capability?

One example is what GTE, our native DEX, is doing with real-time trading. We have an app called Euphoria introducing "tap trading" where you can literally tap a button and make a trade instantly - Robin Hood style with confetti, but it's all actually happening on-chain in real-time.

Because our performance constraints are so much higher, we can also enable more complex on-chain applications. Traditionally in Ethereum, you'd just put your assets on-chain because you couldn't do much else. But with our performance, you could have actual player movement in games be on-chain, which means it's composable with DeFi, social graphs, whatever.

We're also looking at HQ trivia-style massively multiplayer online quiz games - anything that requires instant feedback and responsiveness. Instead of being limited by technical constraints, developers can focus on building emotional value into their applications.

How will MegaETH help ETH as an asset?

We're with Ethereum both literally through technical reasons and socially - our name is MegaETH after all! I'm changing my view to see that Ethereum plus MegaETH is almost like a single symbiotic thing. We can't leave because we'd lose the predictability of our sequencer and all our performance advantages.

More importantly, we're going to make Ethereum great again because we're creating an environment that enables cool stuff to be denominated in ETH. Think of Solana - people don't buy SOL for fees, they buy it to access things built on Solana. By creating a high-performance environment with real-time capabilities, we'll enable new types of applications that drive demand for ETH. It's not about direct fees - it's about maximizing the money-ness of ETH by making it the asset that enables the most interesting applications.

How does MegaETH plan to handle concerns about centralization with a single sequencer model?

The sequencer does give us unilateral ability to censor transactions - that's the same power Base and Arbitrum have today. Our mitigation strategy is two-fold. First, we'll rotate sequencers instead of having one running indefinitely. We'll have maybe 15 sequencers that are live, run by different entities. If you get censored by one, eventually another sequencer will step in that might let you in.

Second, each sequencer will have slashable stake on Ethereum mainnet. If they're found to be censoring or misbehaving, they have economic stake that can be taken from them. For liveness concerns, we'll always have a passive sequencer ready to step in if the active one goes down.

It's similar to Solana's design - their leaders rotate every 1.2 seconds. The difference is our rotations will be longer, maybe hours or days, and our leaders will be bigger. But the principle is the same.

What's your go-to-market strategy and how are you building the ecosystem?

We've already got a lot built through our "Mega Mafia" program - about 20 teams that we've been working with for building truly native apps that are unlocked by MegaETH's performance. For example, GTE is our native DEX/aggregator that's working directly with market makers who can co-locate with our sequencer for ultra-low latency trading.

We've been very hands-on with these teams. We've done long co-building sessions, helped with their fundraising, and even lived together for 30 days in places like Chiang Mai and Berlin. They want to see each other succeed and are integrating with each other's products. Our SocialFi, stablecoin, perps, and leveraged lending protocols are all going to work together from day one.

What's the timeline for launch and how can people get involved?

We have a private testnet going now, and just announced that public testnet will be available within 30 days. Mainnet is measured in months from that point - we’re looking to be aggressive. For getting involved, we believe strongly in community ownership. We did the Echo round earlier, and we're planning another distribution with 10,000 NFTs in two tranches. All will come with allocation to the network.

We don't want Discord grinding or forced engagement - just follow our main account and we'll announce opportunities to participate. When testnet is live, you'll be able to actually feel what the chain can do.

My thoughts:

MegaETH represents a fascinating contrarian bet in the Layer 2 ecosystem. While everyone else in the L2 space is obsessing over decentralization and playing nice with Ethereum, these folks are basically saying "Nah, let's make this thing blazing fast" and not apologizing for it.

With a team led by low-latency systems experts rather than traditional blockchain developers, they're approaching the scaling problem from a completely different angle.

However, the centralization trade-offs are significant, and the rotational sequencer model won’t roll out at launch. The next six months will be crucial as they move toward mainnet and we see if developers and users embrace their "performance first" approach.

What's particularly interesting is how MegaETH positions itself within the Ethereum ecosystem. Their belief is that by enabling real-time, high-performance applications denominated in ETH, they can help make Ethereum "great again" by enhancing its utility and monetary properties. The name has a lot of memetic power.

My gut says the Ethereum L2 ecosystem has over indexed on decentralization at the expense of performance, and MegaETH is uniquely positioned to take advantage by offering something completely different.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.