Mantle's Next Chapter (Interview with DeFi Maestro)

A conversation with Mantle's DeFi Maestro on strategic growth, institutional adoption, and the evolution of liquid staking

Welcome to the alpha please newsletter.

While all other Layer 2 tokens struggled through 2024, Mantle's MNT quietly outperformed Ethereum. This kind of sustained performance demands some attention I think.

I had the pleasure to chat with Mantle's Head of mETH Protocol (DeFi Maestro is one of my favourite accounts on CT), and I got some key insights into Mantle’s focus in 2025. From a new institutional product that's been in stealth for months, to an AI-targeted approach, and some specific views on the bull and bear case for Ethereum in 2025 (price predictions at the end).

Below is our edited conversation.

*I am a Mantle ambassador and have been working with the team for over one year and hold MNT & COOK.

Can you tell us about Mantle's focus for 2025?

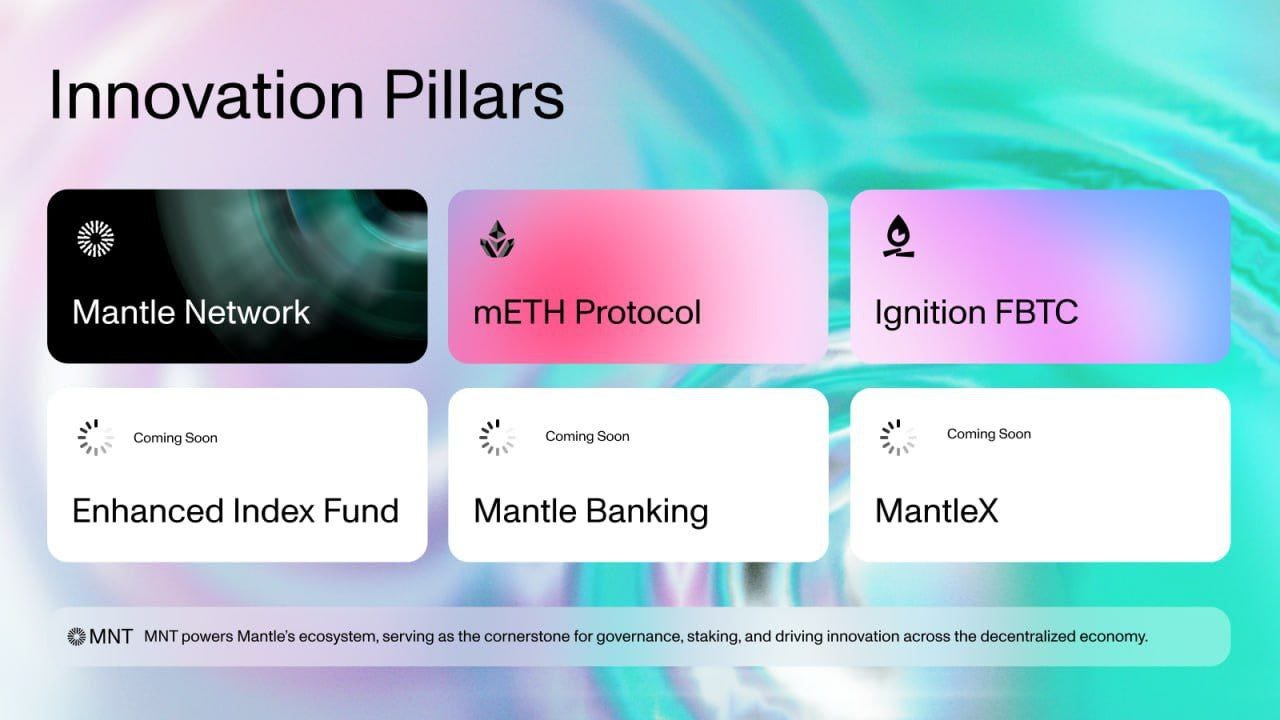

There will be a heavy focus on AI moving forward. We'll be announcing a rebranding that includes a new organizational structure and even a new tagline - "innovating the future of on-chain finance", as well as a fourth new product (Enhanced Index Fund) to sit alongside Mantle Network, mETH & FBTC, as well as two more innovation pillars on top. Mantle Banking is also something we just announced (Revolut but onchain), but more details will come about that later.

From February, we should start seeing AI-focused dApps being deployed on Mantle. We've also done significant groundwork in the LATAM region, running accelerators and meeting with local communities and builders. We're working on getting payment solutions up for the LATAM region and partnering with various entities that we'll announce in the coming months.

One of our key priorities has been institutional adoption. From the mETH team specifically, we have two people focused on ecosystem growth and another two working exclusively on institutional adoption. We expect to start seeing the results of these institutional efforts in the next two to three months. The institutional side has very specific requirements and asks that we're preparing for.

Mantle's token (MNT) has been one of the strongest performing L2 tokens, outperforming ETH. What's driving this success?

One of our key focuses has been on cadence. Unlike projects that front-load their announcements and tokenomics, MNT is a mature token with zero emissions. We've prioritized rewarding our community and token holders. The Reward Station was something we wanted to do for a long time, and when we launched it, it became the glue for our community and MNT holders.

We've also built strong relationships with upcoming protocols. We worked closely with Ethena in their early stages, providing substantial support, and now they're one of our key partners. We got cmETH listed on Pendle, currently our highest yielding pool. User attention in crypto is fleeting, but building brand loyalty requires a strong cadence of delivering value and engaging the community. We've done this well over the past year while also building strong institutional relationships interested in acquiring MNT.

Can you share details about Mantle's upcoming fourth product?

We've been speaking with various family offices and traditional funds, and one key pain point is the lack of an easy way to get sector-wide exposure without setting up multiple custodian accounts.

So, we're building an index fund with four components - stables/yield bearing stables, BTC, ETH/mETH, and SOL/bbSOL. These assets via a risk committee so these are tentative selections.

The goal is to make it very attractive to traditional family offices and funds, ensuring it's legally sound and transparent. Everyone can verify there's no double-dipping or questionable activities. All funds will be in good custodian accounts, giving peace of mind while providing crypto exposure. Based on our conversations with family offices and funds, the response has been very encouraging. This could potentially become one of our biggest product lines when we launch.

How committed is Mantle to Ethereum, and what's your perspective on the relationship between L2s and Ethereum's ecosystem?

We're definitely ETH aligned, and this alignment works on multiple levels. Without Ethereum, Mantle couldn't function as an L2 - all our underlying transfer expenses depend on ETH. Ethereum provides credibility and is better tested; it's one of the largest networks in the world. ETH is the credibility layer for all L2s, and we build on this better-hardened layer.

The relationship between L2s and Ethereum is actually synergistic. While some argue that L2s steal fees from Ethereum, I think about it differently. If there weren't cheap options for these users to actually access the network, a lot of them would have just moved to other services outside of ETH entirely. By keeping users with cheaper transactions, we're actually benefiting Ethereum - smaller users who are price sensitive to fees can still access ETH without worrying about costs.

We're also showing our commitment through technical development. Mantle was built to be deployed with modular architecture and then integrated with Eigen DA. While we're technically still using Mantle DA, the migration from Mantle DA to Eigen DA is in a pretty advanced stage and will be happening soon. We believe DA is still superior to blobs in terms of stability and scalability.

Even looking at infrastructure, moving away from Ethereum would require massive changes - we'd need new bridging pathways, security measures, and infrastructure for deploying apps, oracles, and subgraphs. Ethereum already provides all of this reliably. The only scenario where we'd seriously consider moving away would be if Ethereum faced serious security vulnerabilities. Instead of considering such moves, we're focusing on improving the user experience while staying on Ethereum - we just did a successful upgrade using ZK proofs to increase transaction finality speed between our chain and others.

It's worth noting that profitability alone isn't enough reason to move away from Ethereum. We can be profitable running an L2 on Ethereum while benefiting from its security and infrastructure. Our goal is to help scale Ethereum and reach a wider audience who might not yet be involved in crypto.

mETH protocol has gained significant traction with strong TVL and user loyalty. What do you see as its key advantages over competitors in the liquid staking space?

We did really well initially because of our double dose campaign and strong relationships with whales and funds that trusted us. But what really sets us apart is our approach with cmETH. We designed it because we saw huge potential in the restaking space. Unlike other protocols that are aligned with just one restaking protocol like Karak, EigenLayer, or Symbiotic, we built cmETH as a vault where users can deposit funds, use them in DeFi, and have them automatically allocated across different restaking protocols.

How are you planning to grow mETH and cmETH in 2025?

For the past year, mETH's growth wasn't quite what we wanted, which is why we've restructured with a dedicated team just for mETH growth. Previously, we were only focused on L1 and Mantle, missing many opportunities. Going forward, we're taking a highly targeted approach to ecosystem expansion. When we launch in a new ecosystem, we'll have a dedicated BD team ensuring all protocols can reach out to us and vice versa. We'll drive communications for integrations and discuss incentivization strategies. We're targeting one to two ecosystems every six months, giving us time to properly grow there and engage with their communities.

Hyperliquid is one ecosystem we're currently in discussions with, along with Ethena when their chain is ready. We're being selective about partnerships, looking for alignment in goals and vision. We want partners who are interested in working closely with us, not just seeking widespread reach with different LRTs and LSTs. We're particularly excited about the Hyperliquid launch, though we're still waiting for their launch timeline confirmation.

The COOK token was recently launched. How does it fit into your broader strategy?

COOK will be the glue linking various communities using mETH and cmETH. For example, when we launch on Hyperliquid, we don't want their community feeling we favour Mantle over them. COOK is specifically used to reward cmETH holders. We started with about 200 cmETH of rewards going to COOK holders, and as more restaking tokens launch, we'll funnel as much value as possible to token holders. The Mantle Treasury holds some COOK supply too, so there's alignment between MNT and COOK holders.

What's your view on Ethereum's potential price range for 2025? What are the bull and bear cases?

The bear case would be if Ethereum loses mind share and developers choose to deploy on L1s instead. We've seen a rise in SVM (Solana VMs), and while unlikely, if another chain achieves cheaper, better scaling and higher TVL, that could challenge Ethereum's legitimacy.

For the bull case, ETF staking could be a major catalyst if adopted by institutions. There's also potential for countries to use ETH as reserve assets. I think for 2025, these will be key catalysts. The lower bound might be around 1k-2k in the bear case, but if everything aligns - ETF staking adoption, institutional interest, and potential country adoption - we could see 15k as the upper bound.

Here are some ways you can get involved with Mantle:

• Explore the Mantle ecosystem

• Post about Mantle to earn Kaito Yaps

• Check out Mantle’s reward station

• Hold cmETH and earn COOK powder

• Lock COOK to earn cmETH rewards

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.