It's not over for Bitcoin

Analyzing the current state of the crypto market

Welcome to the alpha please newsletter.

gm friends, today we have a market update that we hope you find useful.

Four months ago, Bitcoin broke its past all-time highs (ATH), and the general market sentiment was euphoric. Many altcoins showed impressive performance, the on-chain fundamentals of major blockchains appeared stronger than ever, and even the largest traditional financial institutions (TradFi) discussed the bullish case for crypto. Fast forward to today: Bitcoin is down 25% from its previous highs, most altcoins have suffered dramatically, and market sentiment has deteriorated substantially.

As of this writing, it is hard to find many bulls standing. However, during these moments, maintaining a clear mind, gaining perspective beyond the day-to-day noise, and trying to see things from a higher level is the most valuable thing one can do.

So let’s analyze the current state of the crypto market.

Where are we standing today?

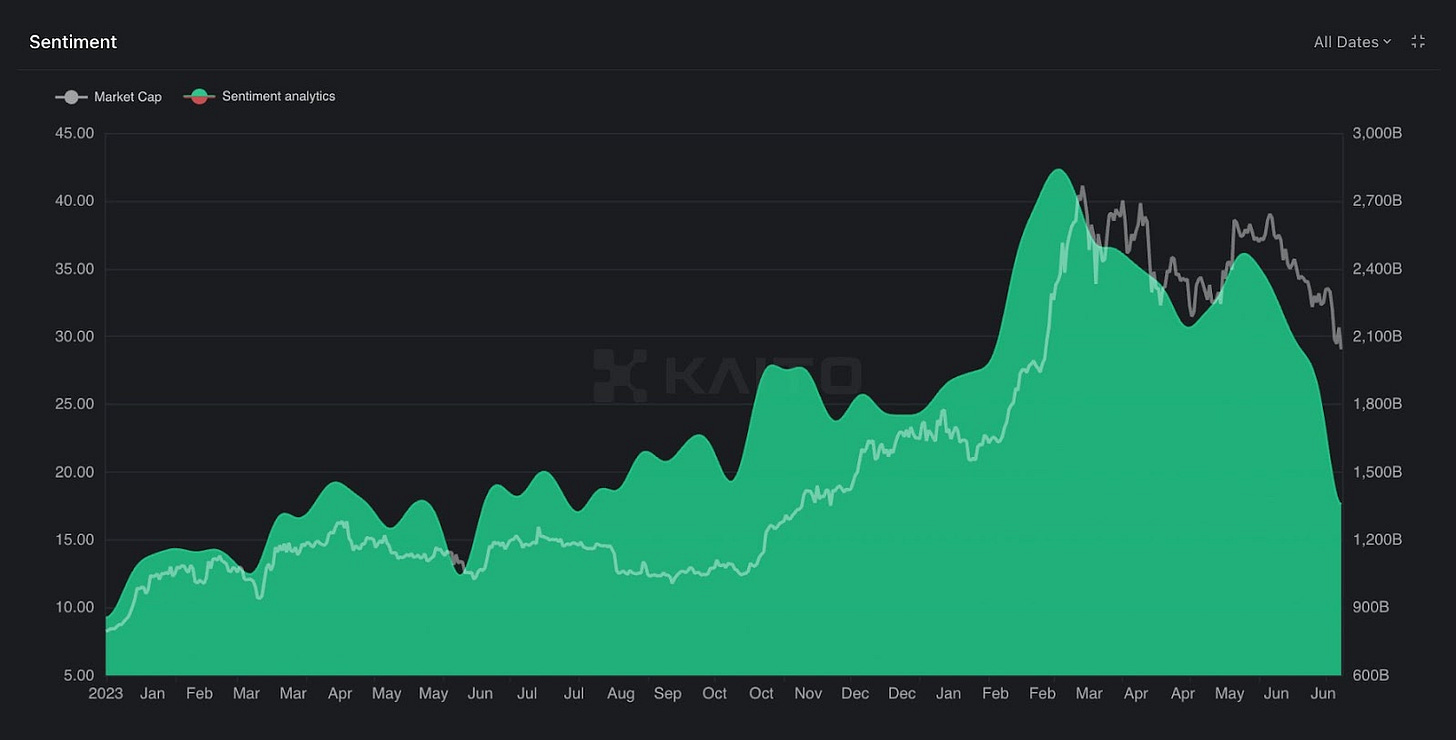

Current market sentiment

This recent market correction we experienced was accompanied by a lot of FUD (Fear, Uncertainty, Doubt) in the market, and the general sentiment fell off a cliff. This has primarily been driven by concerns about a possible large sale of Bitcoin by Mt. Gox, an old crypto exchange, to repay its creditors. Moreover, the German government is also presumably attempting to sell a large amount of Bitcoin, which has further contributed to the bearishness.

Moveover, funding rates are also at the lowest they have been this year. This is another signal that there is not a lot of excitement and optimism in the market at the moment.

It is important to remember that such negative market sentiments are usually a sign that we are near local lows. While this does not guarantee that the market will rise in the short term, it suggests that the best investment opportunities often arise during periods of significant fear and doubt.

In the words of the legendary investor John Templeton, "To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage, but provides the greatest profit. Bull markets are born in pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

The highest winning streak ever on Bitcoin

Moreover, this recent correction also ended Bitcoin's all-time longest winning streak after 427 days without a 25% drawdown. In retrospect, this was inevitable as a pullback like this one was well overdue. In past bull markets, we saw several 30-40% pullbacks that were completely healthy and didn’t put the longer-term bull market into question. This reinforces that the current correction we are experiencing is in line with historical trends.

The post-halving era

In April, we experienced the fourth Bitcoin halving, where rewards dropped to 3.125 bitcoins per block. Historically, Bitcoin has followed a 4-year price cycle related to the halving, with the most explosive gains typically occurring post-halving. So far, Bitcoin's price action is still in line with previous cycles.

Spot Bitcoin ETFs

Sometimes it is hard to realize that fifteen years ago, this industry that we all cherish didn’t even exist. We should all take a moment to acknowledge how much this space has grown in such a short time.

Looking back, who would have thought that we would have a spot Bitcoin ETF. Yet, that it would represent the most popular ETF launch of all time? Now, with around $15 billion flowing into these ETFs since January, the message is clear: TradFi institutions are getting increasingly interested in Bitcoin and crypto more generally. Adoption is a one way ticket and while there are countless forces that shape Bitcoin prices, this is a reality we keep coming back to.

The state of altcoins

So far, this bull run has been mainly driven by Bitcoin, with the exception of a few outliers. Currently, we are near a record low for altcoins performance relative to Bitcoin. However, we expect this trend to reverse at some point as investors shift their focus back from Bitcoin to quality altcoins who’ve demonstrated a lot of resilience. According to this chart, this potential market rotation could happen sooner than later.

Source: Capriole

Different catalysts ahead

It is also important to keep in mind that there are also a lot of upcoming catalysts ahead for crypto. Below is a list of some of the major ones to monitor:

• Spot ETH ETF down the road: Without a doubt, this is a big catalyst for crypto in general as it tells a strong message and reinforces the value proposition of crypto as an established asset class. Given the success of the spot Bitcoin ETF, there is a lot of reason to be excited.

• Improved regulatory clarity: More than just a potential source of new demand, the approval of the ETH spot ETF also brought much-needed clarity regarding the status of crypto. We all know that markets, in general, love clarity, so the more regulatory issues around crypto are resolved, the better.

• US presidential election: Crypto has become a significant topic in the upcoming election. On one hand, Donald Trump, the current favorite, has firmly established himself as pro-crypto. If elected, this could be a positive catalyst for crypto adoption. On the other hand, Biden’s administration has been somewhat unclear on the subject but has shown signs of easing up. Overall, the outlook is net bullish.

• A potential spot ETF for Solana: A few days ago, VanEck announced that they were filing for a SOL ETF. While the probability of this ETF being approved is low, it is definitely something to monitor, especially if the Trump administration is elected. In any case, this is another element reinforcing the paradigm shift that crypto is experiencing right now.

• FTX payout: FTX is set to distribute a minimum of $14.5 billion in cash to users who lost funds in the exchange bankruptcy. While it is hard to estimate with precision the impact of these payments, K33 analysts argue that this could create a “bullish overhang” for the market and neutralize the selling pressure of both Mt. Gox or the German government.

• Rate cuts are coming: Right now, we can all agree that the worst is behind us in terms of quantitative tightening. In the coming months, the market expects that the central banks actions will be looser with the first rate cut expected around September this year. All in all, this is expected to be positive for the crypto market in the mid-to-long run.

Some things to keep in mind

As with all things in life, it pays to maintain a critical eye. Therefore, when analyzing the global outlook for crypto, it is also important to remain aware of potential drawbacks that could negatively impact the market:

• Selling pressure in the short term: As stated earlier, the potential selling pressure from both the Mt. Gox repayments and the German government could continue to impact the market. Even though it can be argued that those events have been greatly amplified by the market, it is important to remain cautious about how this situation will evolve.

• Concentration of US equities: Since the beginning of the year, the stock market has been in a long-term uptrend. However, this performance has been primarily driven by a handful of stocks that have shown incredible performance, leading to an unprecedented level of market concentration. If those few market leaders start to correct strongly, this could impact the market as a whole. Additionally, this could hurt crypto, at least in the short term, if the latter is seen as a high-beta of tech stocks.

• A structural change in the crypto market: As crypto matures as an asset class, it can be argued that it will become increasingly difficult for altcoins to perform well if they don’t show clear product-market fit. This is especially true given the recent surge of criticism around projects launching at super high valuations and low float without any strong community or traction behind them. Hence, this implies that it is becoming increasingly challenging to select the right basket of altcoins to overperform the global crypto market.

The data below on the performance of new projects which conducted airdrops shows just how difficult it has been to outperform BTC so far this cycle. It also demonstrates how many new launches we have had across different verticals. Many more tokens, not enough liquidity.

• Unexpected macro events: It is important to remain aware that even if the global outlook is bullish in the mid term, there are a lot of unpredictable events that could impact the market and impact the global market outlook.

All in all

After Bitcoin’s longest run without a 25% drawdown, the recent price actions have been quite disappointing, and the general sentiment has fallen off a cliff. But when we zoom out, there is a strong case to be made that this bull market still has room to grow. For now, the positive catalysts for crypto vastly outweigh the potential drawbacks. Furthermore, past data suggests that such a market correction is perfectly healthy in a bull market and in line with historical trends. Lastly, important indicators are still bullish and haven’t shown much sign of excessive irrationality yet.

With that in mind, it can be argued that this market correction could represent a strong buying opportunity. Bull markets need a wall of worry to climb, and this is what we have right now. Even though people believe that this time is different for crypto, it is likely that, in fact, this time is like every other time. History doesn’t repeat itself, but it often rhymes.

And that’s your alpha.

Let us know if you would like to see more of this type of content in the comments.

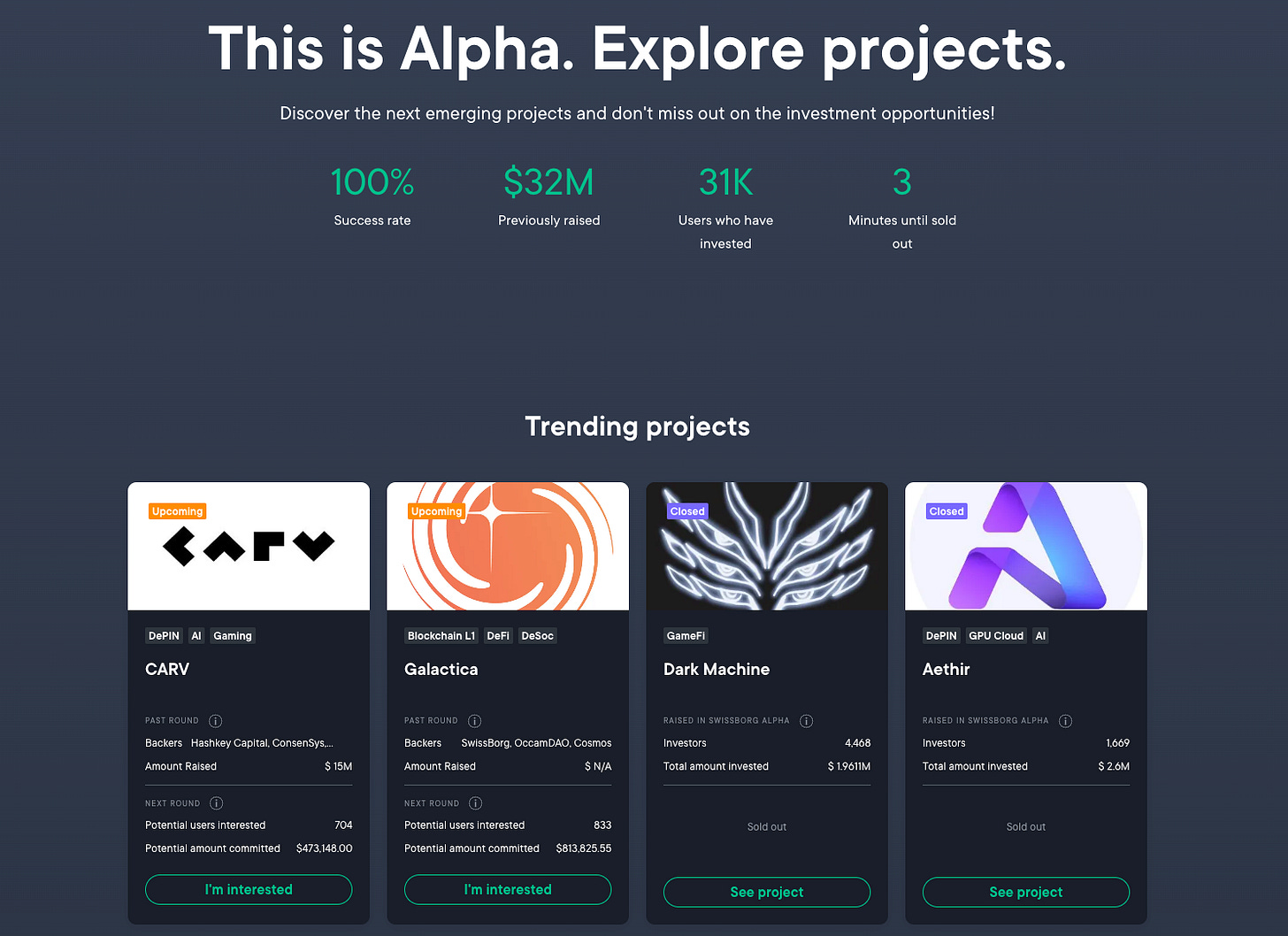

Join Swissborg to get involved with alpha deals

Swissborg launched alpha deals as an additional product within their app (similar to Coinlist). They combine a token raise with a WL mechanism designed to help a project increase their community & number of real users. It's a great product which aligns all participants.

We have a Telegram channel if you want to subscribe. It’s free.

It features weekly updates including market briefs, DeFi and airdrop opportunities & good reads.

I also have my own Telegram channel if you want to subscribe. It’s free.

It features weekly updates including market briefs, DeFi and airdrop opportunities & good reads.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.