How to invest in Arbitrum

The Arbitrum alpha please Portfolio

Welcome to the alpha please newsletter.

Gm everyone, today we are going to discuss the Arbitrum portfolio, which we have very recently deployed on Nested. Anyone can copy this portfolio on the platform should they wish to. You will also make yourself eligible for the Nested airdrop for using the protocol.

None of this is investment or financial advice, one of us is a cartoon Pickle. Always do your own research.

What’s to come:

• Why invest in the Arbitrum ecosystem?

• Arbitrum portfolio explanation

It’s been a rough 2022 for many chains, but there is one which has bucked the trend.

That chain is Arbitrum. To be more specific, Arbitrum One, which is an optimistic rollup built to help scale Ethereum.

I did a short thread on Arbitrum recently where I looked at a few metrics to get a view on how well the chain was doing in terms of growth and adoption.

The TLDR:

• The number of unique contracts & unique wallets deploying contracts on Arbitrum is going vertical.

• Daily actives and daily transactions close to ATH, which happened in August.

• Arbitrum now 5th in TVL rankings for the first time.

• Cambrian explosion of DeFi protocols happening on Arbitrum.

We believe that the growth being demonstrated by Arbitrum makes it one of the best chains to invest in for the future.

Arbitrum has no token as of yet, but we have put together a portfolio on Nested that looks to capture upside from the growing ecosystem.

To get a full understanding of Nested and why we think the platform is so great, please read our detailed breakdown, which we released a few weeks ago.

As discussed in that article, we have a long term partnership with Nested and are active users of the platform.

Let’s get into the portfolio:

Arbitrum Portfolio

This portfolio will be entirely based on tokens available on Arbitrum. It will be more risk-on than the AWAP portfolio. Some of these assets may drop to 0 (or near enough) whereas we believe a few have 50x potential. This portfolio will be more actively managed and some tokens may be entirely removed.

Similar to AWAP, will we be DCAing a 40% USDC allocation, which will be fully deployed by April 2023, with 1/4 being added each month to the assets listed below, in proportion.

*The Arbitrum portfolio was deployed a few days ago and is currently 8% up due to a few large moves from various tokens.

ETH - 25%

The anchor in the portfolio. Even if everything else underperforms or disappears, ETH will be here to save the day and ensure you end up with more than what you put in (in a later bull market, presuming it reaches or exceeds previous all time high price which is 4x away).

GMX - 20%

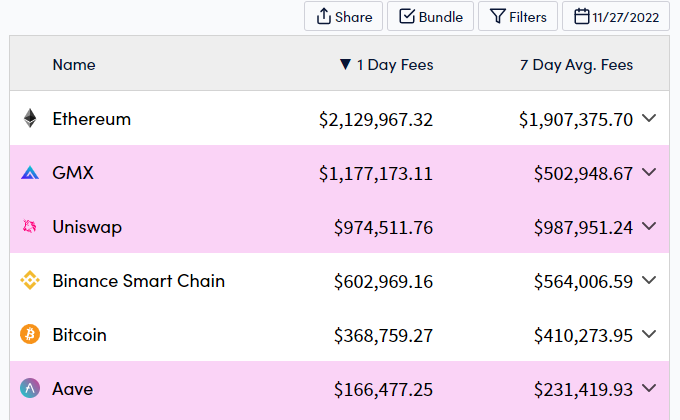

The main dApp on Arbitrum and the most profitable on-chain crypto perps platform anywhere, garnering an impressive $70 billion in trading volume to date and nearly $100,000,000 in fees. It is currently third in daily fees behind Ethereum and Uniswap (of ALL protocols in crypto, ahead of BSC and Bitcoin) .

This week, it did more 1 day fees than Uniswap for the first time ever.

We are also not blind to the risks of GLP, but believe the r/r is worth it.

Please refer to our article analysing perpetual swaps trading platforms to understand why we continue to be so bullish.

DPX - 12.5%

The main options trading platform on Arbitrum. We feel on-chain options are yet to have their moment in the sun. As pricing falls into line with CEXs and contracts get more liquid we fully expect Dopex to be one of the leading protocols. Huge untapped potential.

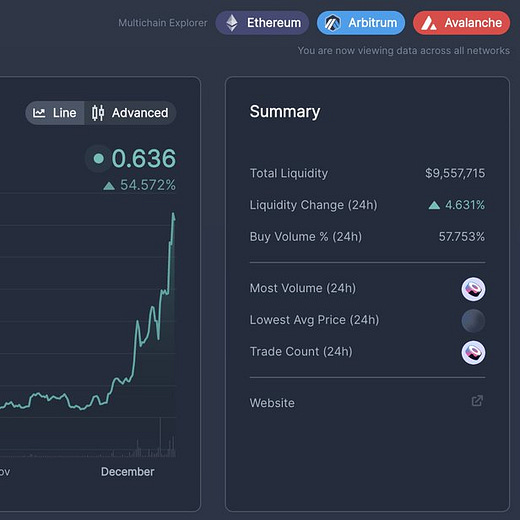

MAGIC - 12.5%

Treasure is the ‘Nintendo’ of gaming protocols. Whilst MAGIC is far off its ATH in price, Treasure just recorded a new all time high in weekly active users across its ecosystem. It has multiple NFT platforms, its own NFT marketplace, its own swap mechanism and numerous games in development. As Aylo has recently pointed out, the games are getting better, and far better than what we saw only 12 months ago (this blows away DFK and earlier MAGIC games). See his thread for details.

There is a lot of potential here. Of all the gaming platforms & protocols right now, nothing is as interesting, as wide-ranging or has a community as strong as Treasure's.

MAGIC is one of the tokens which has had a large move since we deployed this portfolio.

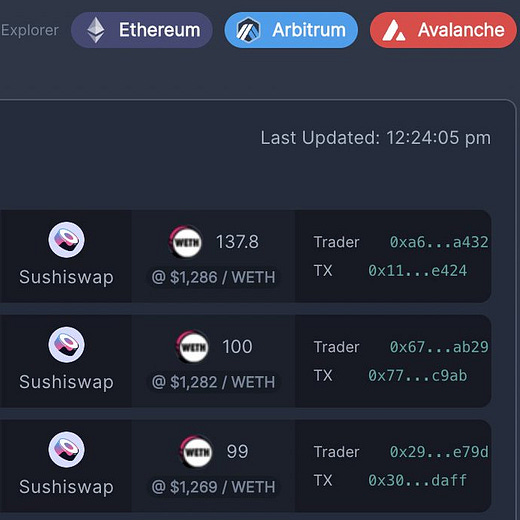

̶S̶U̶S̶H̶I̶ ̶-̶ ̶7̶.̶5̶%̶

N̶o̶t̶ ̶s̶t̶r̶i̶c̶t̶l̶y̶ ̶a̶n̶ ̶A̶r̶b̶i̶t̶r̶u̶m̶ ̶t̶o̶k̶e̶n̶.̶ ̶S̶u̶s̶h̶i̶s̶w̶a̶p̶ ̶h̶a̶s̶ ̶h̶a̶d̶ ̶a̶ ̶t̶u̶m̶u̶l̶t̶u̶o̶u̶s̶ ̶t̶i̶m̶e̶ ̶o̶v̶e̶r̶ ̶i̶t̶’̶s̶ ̶t̶w̶o̶ ̶2̶.̶5̶ y̶e̶a̶r̶ ̶l̶i̶f̶e̶.̶ ̶A̶f̶t̶e̶r̶ ̶t̶h̶e̶ ̶m̶a̶i̶n̶ ̶t̶e̶a̶m̶ ̶w̶e̶r̶e̶ ̶l̶a̶r̶g̶e̶l̶y̶ ̶o̶u̶s̶t̶e̶d̶ ̶o̶r̶ ̶l̶e̶f̶t̶ ̶e̶a̶r̶l̶y̶ ̶i̶n̶ ̶2̶0̶2̶2̶,̶ ̶t̶h̶e̶y̶ ̶h̶a̶v̶e̶ ̶b̶e̶e̶n̶ g̶o̶i̶n̶g̶ ̶t̶h̶r̶o̶u̶g̶h̶ ̶a̶ ̶p̶r̶o̶c̶e̶s̶s̶ ̶o̶f̶ ̶r̶e̶b̶u̶i̶l̶d̶i̶n̶g̶ ̶w̶i̶t̶h̶ ̶f̶r̶e̶s̶h̶ ̶i̶n̶t̶e̶r̶e̶s̶t̶ ̶f̶r̶o̶m̶ ̶i̶n̶v̶e̶s̶t̶o̶r̶s̶ ̶s̶u̶c̶h̶ ̶a̶s̶ ̶A̶v̶i̶ F̶e̶l̶m̶a̶n̶ ̶a̶n̶d̶ ̶G̶o̶l̶d̶e̶n̶T̶r̶e̶e̶ ̶i̶n̶v̶e̶s̶t̶m̶e̶n̶t̶s̶,̶ ̶a̶n̶d̶ ̶a̶ ̶n̶e̶w̶ ̶t̶e̶a̶m̶ ̶h̶e̶a̶d̶e̶d̶ ̶b̶y̶ ̶J̶a̶r̶e̶d̶ ̶G̶r̶e̶y̶.̶ ̶S̶U̶S̶H̶I̶ t̶h̶e̶ ̶t̶o̶k̶e̶n̶ ̶a̶c̶c̶u̶m̶u̶l̶a̶t̶e̶s̶ ̶f̶e̶e̶s̶ ̶u̶n̶l̶i̶k̶e̶ ̶U̶N̶I̶ ̶a̶n̶d̶ ̶w̶h̶i̶l̶s̶t̶ ̶U̶n̶i̶s̶w̶a̶p̶ ̶m̶a̶y̶ ̶c̶u̶r̶r̶e̶n̶t̶l̶y̶ ̶d̶w̶a̶r̶f̶ ̶i̶t̶ ̶i̶n̶ v̶o̶l̶u̶m̶e̶ ̶t̶r̶a̶d̶e̶d̶,̶ ̶w̶e̶ ̶t̶h̶i̶n̶k̶ ̶t̶h̶e̶r̶e̶ ̶m̶a̶y̶ ̶b̶e̶ ̶a̶ ̶r̶e̶d̶e̶m̶p̶t̶i̶o̶n̶ ̶a̶r̶c̶ ̶i̶n̶ ̶t̶h̶e̶ ̶n̶e̶x̶t̶ ̶c̶o̶u̶p̶l̶e̶ ̶o̶f̶ ̶y̶e̶a̶r̶s̶.̶

SUSHI has been removed from the portfolio, and swapped to ETH due to recent governance proposals, please see our tweet from 07/12/22 below.

VSTA - 7.5%

One of the main Arbitrum native lending protocols, with its own stablecoin (VST) and mechanism to allow interest free lending with maximal capital efficiency. Whilst the initial hype has died down, the market cap is tiny, this is a moonshot bet we couldn’t pass up.

UMAMI - 7.5%

This protocol aims to become the delta neutral place to stick your stables and earn ‘real yield’ of reasonable APR. The initial launch hit some snags and was wrapped up early, but the team are preparing to launch again, and have doxed themselves to emphasise their commitment. If they can manage to get things to work in all market conditions, this protocol TVL could be absolutely massive, with the token likely doing well alongside this.

CAP 7.5%

Alternative perps platform to GMX. Currently the volume is small (<$3 billion since going live) and only BTC and ETH derivatives are available, but this is likely to expand with time, and we’d consider it a small hedge against GMX on Arbitrum, whilst also having a small enough marketcap to be able to create its own niche alongside a successful GMX and perform extremely well.

You can copy this portfolio or another one on Nested, as we said earlier, you will also make yourself eligible to earn the NST token airdrop.

We are also still running the below giveaway. We will be running it until Christmas and will send the the USDC on Christmas Day!

We are are going to send $500 USDC to one wallet that copies the AWAP portfolio with at least $100 (or equivalent) deployed into it, as a thank you for the support!

And that’s your alpha.

If you are looking to trade with leverage on-chain, we’re big fans of GMX.

Use our referral link to get a 10% rebate on fees: gmx.io/?ref=alphaplease

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Great job! I am you big fan.

As usual, great article! I'm curious what your thoughts are on rDPX. I assume you feel DPX gives you enough Dopex exposure, but I've just seen so much talk about rDPX over the past few days.