Four Perps of the Apocalypse

Analysis of Four Important DeFi Perpetual Swap/Leverage Trading Protocol Tokens

Welcome to the alpha please newsletter. We curate alpha for you. That’s it; that’s the newsletter.

Pickle here. Tokenomics are doubly important in current bleak market conditions. This article will try to briefly (lol) discuss and compare the tokenomics of some of the more interesting and/or actively used leveraged trading protocols which currently exist in DeFi.

What’s to come?

Introduction

The Quiet One: $GNS

The Sexy One: $GMX

The Gigantic One: $DYDX

The Forgotten One: $PERP

What’s the play?

Introduction

I’m not going to be diving deep into all the platforms themselves from a user/trader’s perspective, but primarily evaluate their token value accrual mechanisms. This is for the sake of brevity (double lol) and to keep the article focused. I may revisit the topic at a later date.

To be clear, I have used these platforms myself to test them, but some only a handful of times. I am not a trader and can’t give a definitive answer to which has the best UX/UI. I have my opinions, they shouldn’t hold weight in this area.

I’m going to assume most people understand what leveraged trading or perpetual swaps are. Binance have a simple introductory article for those that don’t.

Most popular leveraged trading platforms are via centralised parties that typically provide the best UX and UI. Why do we need decentralised protocols then?

The obvious reasons are the same as for most dApps:

Self-custody of funds (or funds controlled by a smart contract and not confiscatable at the whim of a centralised party).

Lack of KYC (although this isn’t the case for all…).

Theoretically better uptime due to being on the blockchain (we’ve all seen that the most popular centralised platforms have serious issues during periods of high trading demand and high volatility of prices while DeFi platforms have weathered those conditions much better).

During current market conditions, where there is uncertainty in crypto, as well as most other asset classes, on the background of an unfavourable macro-economic environment, people will still trade.

Yes, volume goes down, but volatility ensures that crypto is one of the more ‘tradeable’ asset classes during both bull and bear cycles and as an investor. Whether you directionally trade or not, you may still be able to profit through tokens relating to those trading platforms.

Let’s get started…

The Quiet One: Gains Network and $GNS

Marketcap: 60m (fully diluted, all circulating)

$GNS is the the native token of the Gains Network. The platform started life on Ethereum in early 2021 as Gains Farm and the token $GFARM2. This underwent a 1:1000 split to become $GNS and was bridged via a liquidity pool to Polygon, where the protocol resides now.

Few people are aware of Gains Network so I’ll expand on this protocol more than the others.

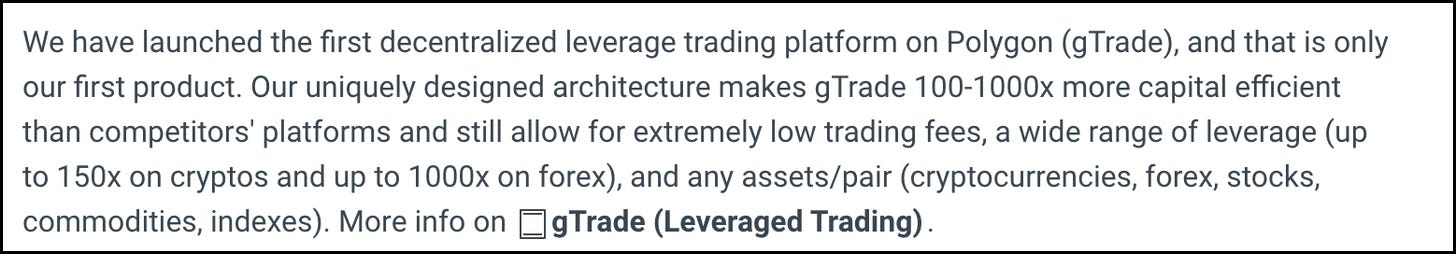

gTrade is the only product from Gains Network so far; currently v6 with v7 expected soon. It operates a synthetic asset model where individuals do not require the traded assets, but simply DAI to deposit into the platform to get going. This allows for significant flexibility of tradable assets and far more trading options than all other platforms discussed later.

To enable trading, the DAI vault and GNS/DAI pool provide liquidity for users. By replacing the typical orderbook model which we see with most leveraged (and normal) exchanges, and instead using the DAI vault to provide liquidity for all trades of all synthetic assets listed, the platform boasts the most capital efficient model out there. This partly accounts for how such high levels of leverage are possible even on low volume, infrequently traded assets.

This unique approach also means listing new synthetic assets in the future is relatively easy. Currently there are 50 cryptocurrencies and 10 forex pairs listed. Stocks, commodities and indices are all part of the roadmap later this year.

There are longer term plans to branch out and have features closer to a prediction market/gambling/casino elements, which would be a perfect route to onboard retail and less sophisticated users.

Lunaman kindly shared some progress with regards to this (and some other very big moves which the team will reveal when the time is right).

They have also instituted a novel second by second pricing model which uses a hybrid Chainlink oracle model and DON (Decentralised Oracle Network) structure.

This frequency of price feed update is required in order to allow for such high leverage, where a 0.1% move can lead to liquidation. This would be extremely gas intensive but the hybrid model allows for it to be much cheaper, with Chainlink oracles being the gold standard against which other API price feeds are measured.

While all other leverage platforms use their own derivative prices, which often ends up in prices that do not correspond to the real price of the asset, we use our custom real-time Chainlink node operators network to get the median price from up to 7 data sources […] Since we aggregate our prices, this means traders are protected from liquidation scam wicks and other unfair events of this kind that happen on only 1 exchange. We are the first and only leveraged trading platform to offer this kind of protection to traders.

For more details, see the team’s discussion with Chainlink below.

The primary benefits for users of the platform are:

No funding fees for open positions (as assets are synthetic and no borrowing of assets is required to fund long/short positions)

No ‘scam wick’ liquidations

Lowest fees for opening/closing positions across leverage trading platforms

Guaranteed stop loss owing to the pricing mechanism involved (we’ve all heard of or experienced stop losses being blown through and liquidating people on high volatility days)

The team consists of four core members, including Seb who is the anonymous founder and developer. You can read about them here. Despite being a small team currently, looking at what’s been accomplished so far, you have to be impressed.

$GNS Value Accrual

The total and circulating supply of $GNS is roughly 28.7m at the time of writing this. This is hard capped to 100m but in reality, it is deflationary (supply has reduced from 38m equivalent $GFARM2 in January 2021). At the current inflation rate, the supply will reduce by 22% in the next year.

To earn from $GNS, you can simply hold it in your wallet and hope for it to go up, partly as a consequence of deflation, or you can LP and stake it.

Currently this involves adding it to a GNS/DAI Quickswap pool on Polygon and staking the LP token you receive on the Gains Network platform.

This has resulted in APRs ranging from 25-100s% since the beginning of 2022 (52% at the time of writing this).

This is real yield, majority of which is in DAI returns (tiny amount in $QUICK from swap fees in the pool) and none from GNS inflation.

The snippet above explains the mechanism from a zoomed out perspective. The other major takeaway here is that incentives of the team and the public token holders are entirely aligned.

They profit from the token in the same way as you.

They’re not asking you to stake arbitrarily in order to then dump unlocked tokens they hold on you (for more on misaligned token incentives and pseudo-staking see the recently published Cobie article).

How is it deflationary?

I will attempt to simplify the trading process to explain this.

You need be aware that there is a DAI Vault, in addition to the GNS/DAI LP pool. The DAI vault can be deposited into as a user seeking yield, but earns significantly less APR from the protocol fees compared to the GNS/DAI pool.

Samuel deposits DAI to the platform which goes into the DAI vault and opens a trade on $ETH, going long, with 10x leverage.

$ETH dips 15%, Samuel is liquidated, his deposited DAI remains in the vault. The protocol ‘wins’. The DAI vault is starting to become ‘over-collateralised’.

The vault reaches 110% of the original deposits consisting of DAI deposited by users of the DAI vault seeking simple yield, as well as traders losing money as described above.

The Excess DAI above this amount is used to buy GNS from the GNS/DAI pool and burn it.

This means GNS stakers from the GNS/DAI pool earn fees from traders using the protocol, swaps fees from the pool itself, which in itself is substantial, as well as deflation of the token making it scarcer and sought after.

The process described above can be reversed, where traders win and not the protocol. In such instances, if the balance of the DAI vault falls to below 100%, some GNS from the GNS/DAI pool is sold for DAI, which is deposited to the DAI vault to slowly help collateralise it again.

There are limits in place to prevent this becoming to major an issue resulting in heavy under-collateralisation:

Collateral per trade is limited to 1% of the usable balance of the DAI vault. If there’s only 2m in the vault freely available, 20k in collateral can be taken out for a single trade. Whether that’s a 1000x position on $20 initial or a 2x position on $10k.

Only three trades per user can be open for one synthetic asset.

A user’s maximum winnings are limited to 900% per trade.

DAI vault depositors can only remove 1/4 of their original deposit per day. This is primarily to prevent a sudden bank run.

The protocol needs the ability to ride out periods of trader success long enough for the prevailing trend to continue, which the aforementioned limits described should achieve.

Long term, we know traders lose money more than they win, based off most market data going back as long as modern trading has been possible. The house eventually wins.

This is even more likely in high-volatility, high-leverage environments, and indeed is seen with GNS having been deflationary since going live and burning over 20% of its supply already.

Platform issues and discussion

Limits on how much collateral can be borrowed for higher value trades may keep whales away.

Lack of additional incentives to trade on gTrade, which may limit growth vs somewhere like dYdX that uses it’s token for liquidity mining (however, there are trading competitions with rewards mainly from Polygon ecosystem funds).

People will be attracted to a one-stop shop for their leveraged trading needs. If Gains Network is successful in rolling out all of their roadmap with various other asset classes and casino features, then this alone could attract more adoption.

Being present on chains beyond Polygon would also be helpful, and this is likely to happen sooner than later, with their ultimate plans being a transition to a ZK-rollup.

Improving tokenomics will go hand in hand with increased trading volume which will remain limited until the pools expand.

Finally, it can’t be understated that being a protocol with a pseudo-anonymous team, no KYC and using a decentralised stablecoin makes it far less censorable than many competitors and therefore attractive to traders.

Token issues and discussion

If $GNS price goes up, but trading volume doesn’t go up, APR in the GNS/DAI pool drops. Trade volume needs to be increasing alongside $GNS price.

Impermanent loss can occur if you deposit the token to the GNS/DAI pool.

If APR drops low enough, many may prefer to just hold $GNS in their wallet, which limits pool growth and ultimately limits the platform’s growth and ability to service bigger whales, high-value trades or greater volume.

These problems are currently being worked on, and single-sided staking is imminent. Essentially, there will be a transitioning process to Protocol Controlled Value (PCV) via its own GNS/DAI pool. The fees earnt by this will be distributed to single-sided stakers.

In this future system, as $GNS value goes up, the PCV goes up. This results in and attracts more liquidity, which allows traders to put on bigger trades (and whales to enter), increasing fees and APR for $GNS stakers, which in turn increases $GNS demand and thereby value, pool size etc etc.

I know ‘flywheel effect’ is practically a meme phrase in crypto these days. But screw it. This is a potential flywheel effect.

For a further and more comprehensive review I would suggest reading this post on Reddit. The docs on the Gains Network website are useful but require an update, which will be made shortly according to the team. Their discord is also a good source of information.

The Sexy One: GMX and uhh $GMX

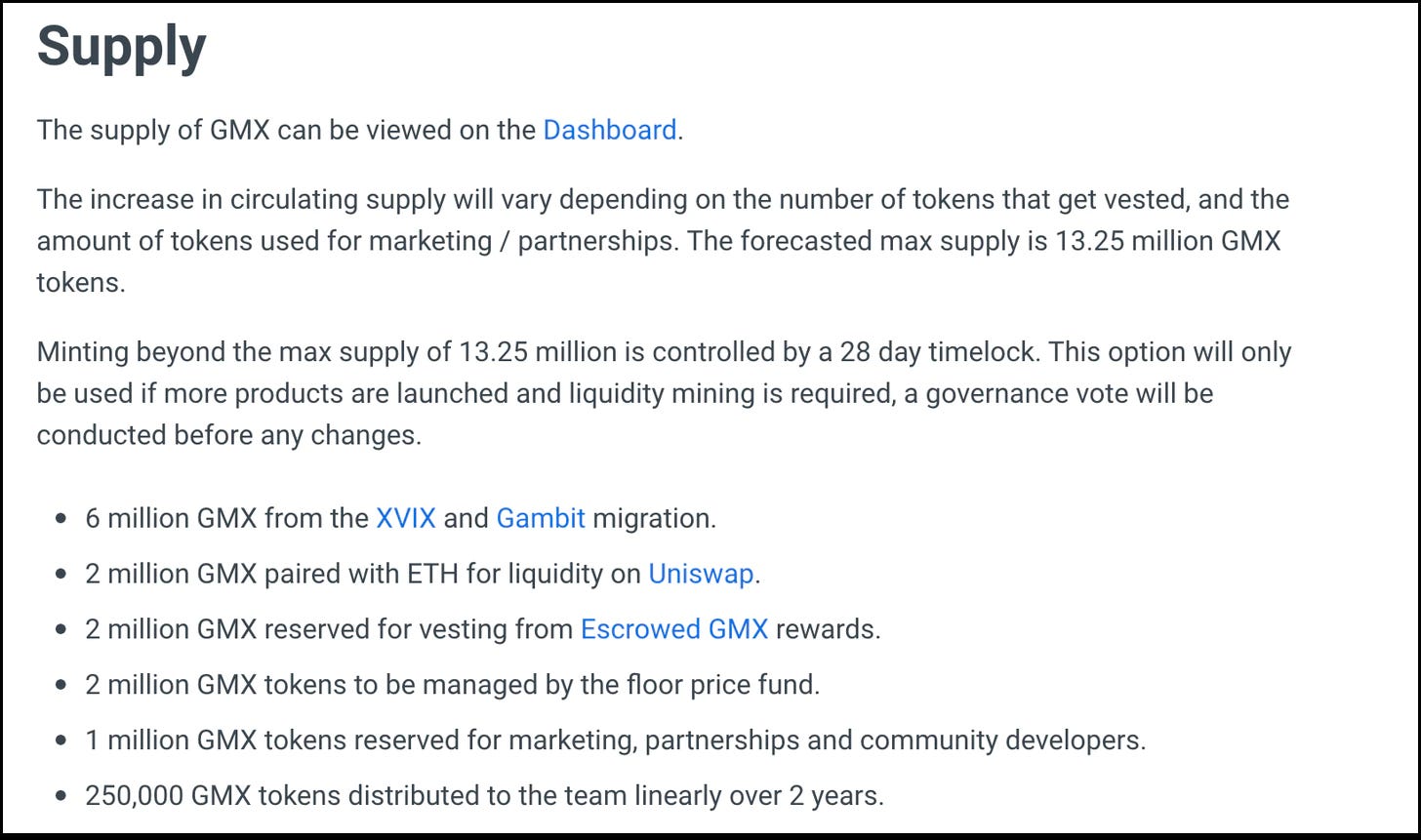

Market Cap: $220m circulating ($390m FDV)

$GMX is the native token for the GMX platform which is currently live on Arbitrum and Avalanche. Whilst being a relatively underground project, it’s started gaining momentum and awareness in the past six months, partly due to the excellent performance of the token relative to the market.

Where ETH is mentioned, AVAX is interchangeable for the Avalanche version of the protocol.

In their own words:

GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero price impact trades.

Trading is supported by a unique multi-asset pool that earns liquidity providers fees from market making, swap fees and leverage trading.

Dynamic pricing is supported by Chainlink Oracles and an aggregate of prices from leading volume exchanges.

It started life as Gambit Protocol on Binance Smart Chain with its primary tokens being $XVIX and $GMT, which were merged, migrated and swapped to $GMX on Arbitrum.

Similar to most DeFi leveraged protocols, GMX does not require KYC.

Rather than rehashing what many people know, here’s a great thread on GMX from Flood last year as a starting point.

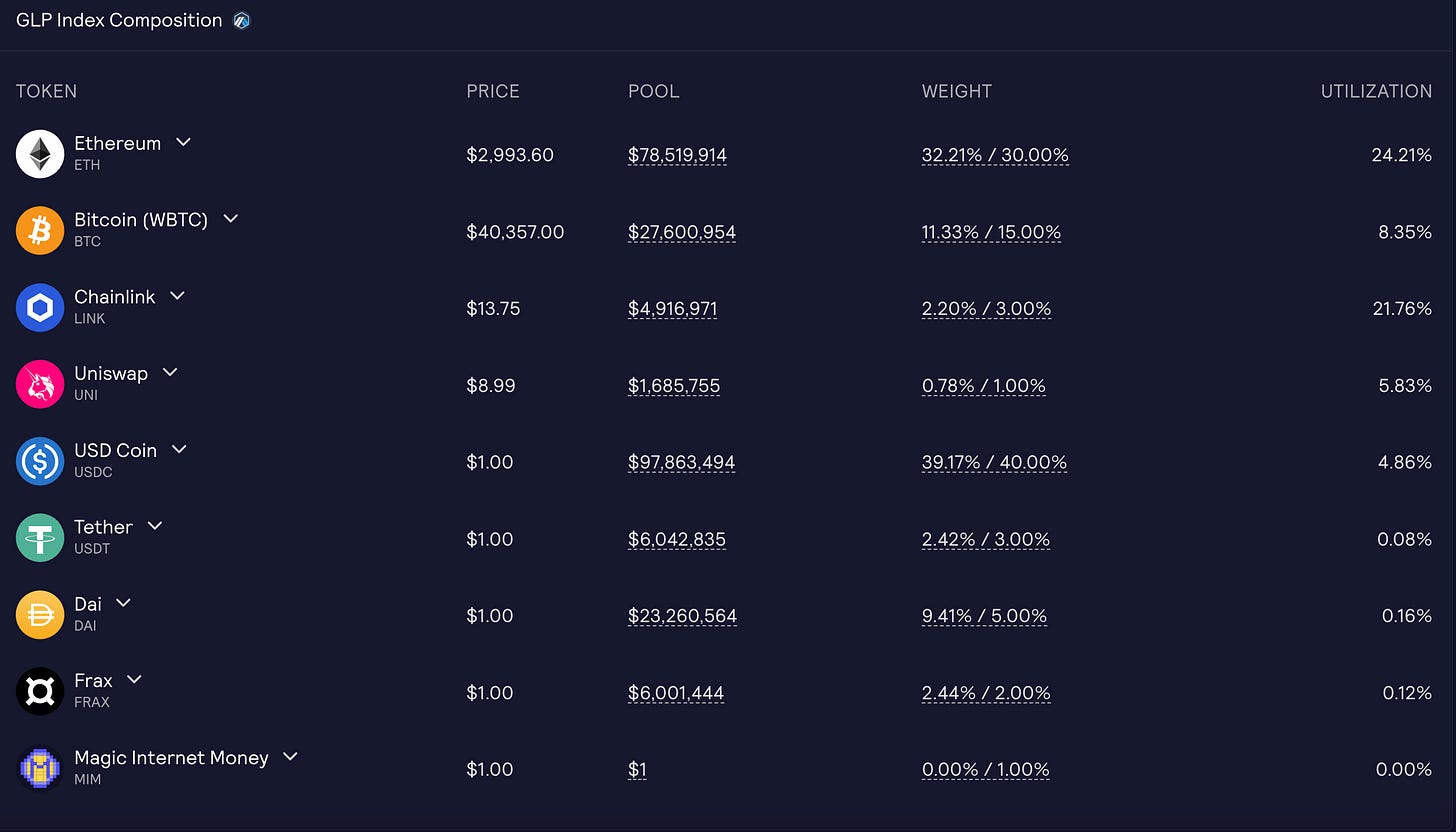

To summarise, GMX enables two main functions; up to 30x leveraged trading of spot assets (WBTC, ETH, LINK, UNI on Arbitrum, AVAX, ETH BTC on Avalanche), and very very low slippage/no slippage swaps between assets it holds as part of its index basket token, GLP.

Traders can use any of the GLP assets which vary slightly on AVAX and Arbitrum, to open positions. There are fees associated with opening and closing positions and a ‘borrow fee’ which is similar to a funding fee on a traditional leverage exchange. The fees are small, but larger than Gains Network.

GLP

As mentioned above, GLP is the index token, which consists of the tokens listed above and various stablecoins. Weights and constituents vary depending on the Arbitrum or Avalanche version. It is a necessary part of the ecosystem as it allows all trading to occur, as well as enabling swaps. GLP holders are rewarded with 70% of fees earnt by the platform (converted to ETH) as well as escrowed GMX (esGMX). The combined APR of the rewards is currently around 35%, with about half of that in ETH rewards. People are encouraged to ‘mint’ GLP using underweighted assets by offering positive/no slippage. This helps to maintain weightings.

GLP exposes you to an index of relatively safe assets against roughly 50% stablecoins. As a basket to hold, this is relatively risk-off (within crypto…) whilst also providing a reasonable yield and crypto market exposure. Down moves in the broad market are minimised, but pumps are also blunted.

$GMX Value Accrual

The token is a hybrid governance and utility token.

In order to earn with your $GMX, you have to stake it. Staking gives returns of 30% of all fees earnt on the platform (converted to ETH) and esGMX. This currently stands at roughly 24%.

The real beauty of the token is in the ponzinomics of it.

I use that term as a compliment. The GMX team are doing something similar to the veToken model built up by Curve, but with more ‘sticky’ features to ensure high levels of token staking, minimal circulating supply and a ‘black hole’ effect. These features have been around since last year, and while likes of Platypus have received plaudits (including from me) for their improvements of the ve model, GMX were doing something similar already, and possibly better.

Let’s break it down.

As described above, when you stake $GMX or GLP, you receive esGMX.

Immediately, you’re incentivised to restake your esGMX to increase your APR/earnings. The process of vesting to release your esGMX to $GMX is long and you can’t simultaneously stake it. Additionally, to vest the esGMX and release it to tradeable $GMX, you have to have a certain amount of $GMX staked on the platform. The amount is dependent on how much you had staked when earning the esGMX.

This concept is tricky, so here’s another excerpt from the protocol docs:

Essentially, you’re highly disincentivised to vest your esGMX to become $GMX.

If you’re bearish on $GMX and want to exit your position, you’re able to do so, but you will leave your esGMX in the system. A rational actor wouldn’t keep their $GMX ‘hostage’ that they want to sell, in order to drip feed earn some more $GMX over the course of 12 months (from vested esGMX releasing).

If you’re bullish on $GMX, you’d restake your esGMX to increase your overall share, as well as to maximise your APR.

Now, to Multiplier Points (MP). Back to the docs:

Essentially, you earn MPs for staking $GMX or esGMX.

The longer you stake, the more MPs you accrue.

MPs boost your yield.

You lose MPs proportional to the amount of your GMX you unstake, such that if you unstake 100%, you lose 100%. If you restake, you start from 0 MPs and slowly start accruing again. This is very similar to the vePTP and veJOE models.

The combination of MPs and the esGMX staking and vesting system mean the longer people are in the staking ecosystem, the more likely they are to remain.

The data dashboard proves this, with roughly 6% of all GMX currently circulating, 8% LPed and the rest locked up.

This is Sticky².

Token issues and discussion

Because assets are real and not synthetic, only tokens in the GLP pool can be swapped or leveraged.

Again, because of the above, capital efficiency isn’t great and GLP has to grow substantially to meet the needs of larger whale participants.

The GMX team are exploring further assets to add to GLP to allow for a wider range of tradeable tokens. There have been murmurings of single asset GLP exposure, which may well swell the protocol holdings significantly.

There are other roadmap objectives upcoming:

The recent official announcement about X4, a novel AMM/asset allocation/swapping model has been released, which may well increase protocol revenues and thereby stakers’ earnings significantly if it works, and ultimately the token price.

The Gigantic One: dYdX and $DYDX

Market Cap: $420m ($4.5b FDV)

dYdX is the Goliath to everyone else’s David when it comes to decentralised leveraged trading/perpetual swap protocols.

It has had the most volume of any since launch in 2018 with a staggering 560 billion dollars traded since inception. It clears 1 billion most days, and can reach near 10 billion on high volatility days.

Compare that to all three other protocols discussed, which are typically less than 80m million dollars per day for gTrade and GMX, and less than 150m for Perpetual Protocol.

It is built out on a StarkEx implementation from the Starkware team, which is a permissioned ZK Roll Up solution. It essentially sits on its own L2 without any real composability, but chooses this trade off in order to have ‘instant finality’ and gasless trading.

It uses a typical orderbook found on traditional leveraged trading exchanges such as Bitmex and functions in most other ways the same as they do, with cross-margin baked in.

Trading requires USDC collateral, and the 30 or so assets are synthetic, traded against other traders and market makers. Index prices are directly sourced from several exchange APIs for normal functioning and Chainlink is utilised for accurate liquidation pricing.

For people who prefer a traditional centralised exchange interfaces, the UX from dYdX is ideal.

$DYDX Value Accrual

The token and governance are clearly separate from the exchange and trading arm, and pop-ups drive this point home when trying to click through to the governance homepage from the dYdX landing page. The obvious reasoning is to try and mitigate potential SEC scrutiny at a later date.

The token was released in September 2021 as an airdrop for users of the platform, depending on volume of trades made prior to the airdrop snapshot date, and released after committing a certain amount of trades after the token release (‘claim milestone’).

Those in certain jurisdictions were unable to claim the drop (such as the USA) due to aforementioned securities law concerns.

1 billion tokens have been minted.

For more details on unlocks, see the full tokenomics page. 18 month post token release, there will be significant unlocks occurring.

Once you have acquired your $DYDX tokens, there are a few things you can do with them.

Stake them in an insurance module, which could be slashed as a consequence of protocol problems to make traders whole. APR is roughly 16% currently, in further $DYDX issuance.

Use them to vote on governance (the whale share is controlled by early investors so community participants have little ability to change things here).

Get discounts as a trader depending on how much is held.

LP in a Uniswap pool.

dYdX is a great platform to use, of the ones discussed today, it probably has equal to if not the best UI/UX.

The token however has numerous glaring problems:

Staking it does not provide a revenue share of fees earnt on the trading platform, these all go to the exchange as a separate entity, or the traders/market makers themselves.

The continued inflation of the circulating $DYDX through liquidity mining for those trading on the platform benefit only the traders and the exchange, at the expense of the token holders.

There are significant early investor unlocks coming up, many of whom are in huge profit and will likely choose to exit some of their position.

In short, the tokenomics need an overhaul. Badly.

The Forgotten One: Perpetual Protocol and $PERP

Market Cap: $280m ($610m FDV)

Perpetual Protocol started life on Ethereum in 2020 and shortly after moved to the xDAI sidechain where v1 still resides. v2 launched on Optimism towards the end 2021. The video below is a good explanation of how it works, and is generally a fantastic overview of perpetual swap/leveraged trading mechanics. The primary source of information is the v2 docs. Their Medium posts cover perpetual swaps and derivatives and are a good introduction to concepts used across all exchanges providing those functions.

Volume is typically around 100m daily on v2 and 1/3 of that on v1. This is roughly 1/10th of dYdX but more than GMX and gTrade.

v1 used a virtual AMM model for liquidity, and v2 uses a more novel model involving Uniswap v3 concentrated liquidity pools. Maximum leverage is 10x with roughly 20 tokens listed.

In essence, synthetic asset pools are created on Uni v3, through which market makers can provide liquidity which allows traders to use the actual perp exchange. There is a pool available for every traded asset. Liquidity provision, like all Uniswap v3 pools, are not for novices and will likely result in losses. Perp posted a useful article to help potential LPers. Uniswap v3 liquidity providing protocols which aim to make LPing more accessible, such as Popsicle and Visor, will hopefully make this process profitable for normal users.

One of the greater benefits of Perpetual Protocol v2 over some exchanges mentioned, is greater composability thanks to being built around Uniswap v3, meaning future possibilities with its design include permissionless private markets, which could become quite popular.

$PERP Value Accrual

As things stand, $PERP token has minimal value accrual mechanisms. It is rewarded to market makers in v2 who provide liquidity on Uniswap v3 and as a gas rebate for trader’s using the platform.

v1 of the platform has a staking mechanism, where you can stake your $PERP for 8.9% APR at the time of writing. Rewards are received in $PERP from a special pool to reward stakers. The amount of $PERP issued is dependent on the fees accrued by v1 exchange, but those fees themselves (in USDC) go to the protocol itself and not $PERP stakers. In addition, $PERP is a governance token.

Essentially, it is a liquidity mining token with some bells and whistles as it stands.

But wait.

The team are intending to update the tokenomics, and proposals are up for discussion.

In addition to this, the team have confirmed that they’re working on a limit order option on the v2 platform.

A lot could change between now and actual implementation, but the potential move could make $PERP more integral to the function if the platform, and include a fee distribution model.

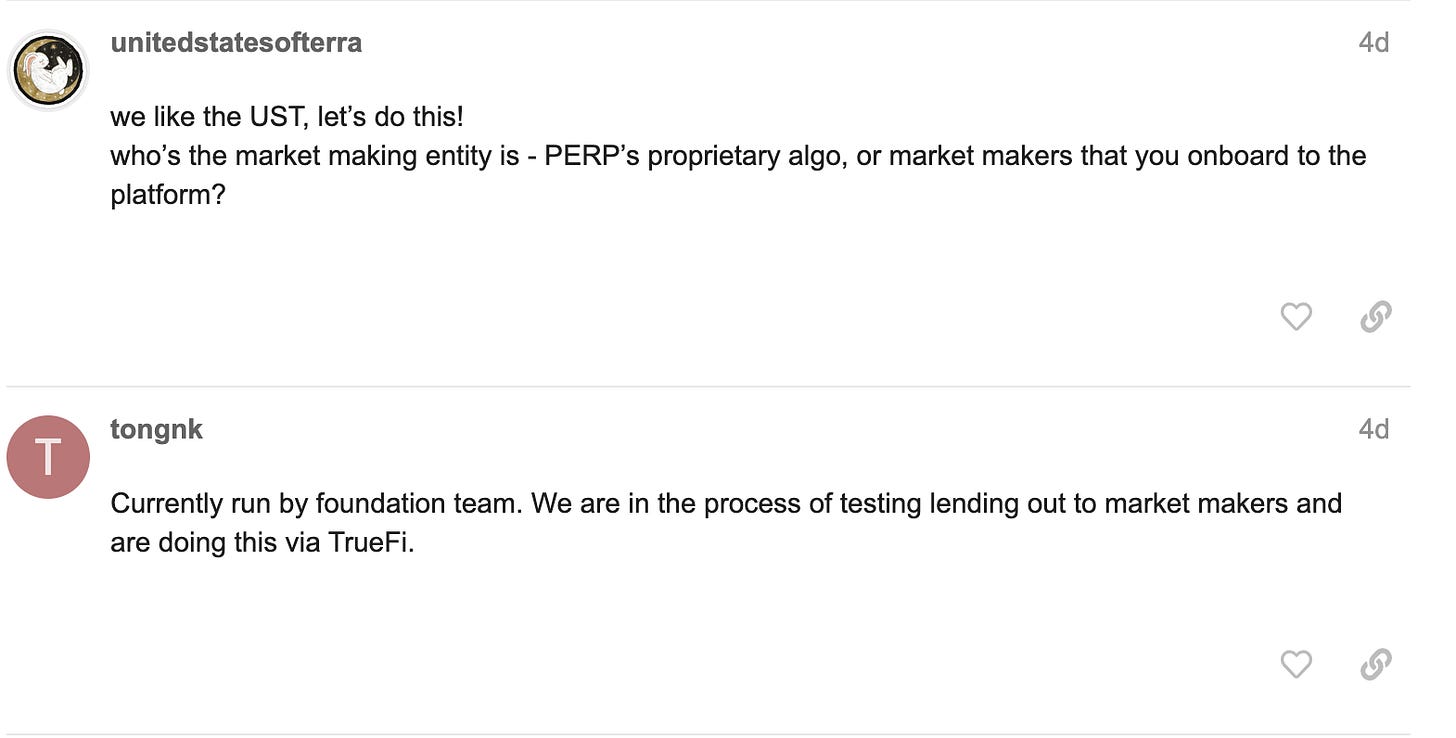

There is also a Perp x Terra proposal to improve UST liquidity on Optimism via the team’s market making arm. They will be onboarding FRAX through similar means.

There are some concerns regarding v2, as highlighted by @crypto_noodles. It appears a lot of the trading volume and market making is done by a few entities, most of whom appear to be aligned with or part of the team, and they may well be suffering losses as a result.

Nick Tong from the team responded in the thread initiated, and has made it clear the intention of the team reducing their direct market making role, whilst also highlighting it’s impossible to be certain of the team’s PnL.

What’s the play?

I think from my above analysis, it can be said that whilst I’m a fan of the dYdX platform itself, the $DYDX token is not something I would consider to be investable in its current state. Things may change in the future and a revamp could occur.

Perpetual Protocol and $PERP has a promising change to its tokenomics proposed, but viability of its platform to sustain sufficient liquidity and volume without the team having to intervene is a possible issue. They have shown dedication and willingness to keep pushing, innovating and iterating over the past three years which gives me confidence that they’ll resolve these issues. Numerous entities are working to optimise Uniswap v3 liquidity provision which will also help them. Additionally, being on Optimism means they’ll likely benefit from an ‘Optimism season’ once the presumed $OP token launches, which may well increase use of dApps on the L2 and incentivise trading on Perp through potential ecosystem rewards.

GMX, as I’ve clearly stated, have one of my favourite token design models. $GMX staking, esGMX vesting/staking and multiplier points combine to ensure those who buy into the ecosystem and stake are very likely to hang around a long time. The ongoing developments of the protocol (which I didn’t go into much depth about, but can be explored on their Medium) will result in more revenue streams for token stakers. The volume it has is not due to liquidity mining incentives or token inflation, and so the growth you see on their analytics page is all genuine.

I think it’s also worth mentioning GLP here again, which I see as a potential farming opportunity for those who want reasonable APR, some ‘bluechip’ exposure, but with a large amount of stablecoins to offset future market dips. It’s a good alternative to just holding stablecoins alone in other yield farming opportunities.

Gains Network and $GNS is something I’ve been aware of since the end of last year. I initially didn’t pay it much attention as I didn’t hear much chatter and presumed (wrongly) it must not be very good. Diving into it properly in the past few weeks, I’ve realised that was a huge mistake. The $GNS token is absolutely integral to the way in which the platform functions. Being fully diluted and deflationary helps create scarcity and drive up price. Having the best fee structure for traders and a rapidly expanding array of assets to trade makes it likely that volume will keep increasing. The plans beyond simply the gTrade platform, with expansion into casino/gambling games as per the roadmap, alongside imminently going multichain, will likely further improve token value accrual and market share.

Closing Thoughts

As you can see above, the landscape for leveraged trading protocols is vast and complicated. There are many different paths to development, both for how the exchanges function and how useful their tokens will be. I omitted several other projects and their tokens in this space, such as Drift on Solana and Injective Protocol within the Cosmos Ecosystem, because the article would become never-ending, but I’m sure they also have their significant merits as well as downsides.

Given how varied the approaches to this sector are and given how rapidly web3 is developing, I think it’s impossible to say that any of the aforementioned tokens and protocols (and those not discussed) have found their final form. Everything will look very different a few years from now. Hopefully I’ve provided you with a reasonable comparison of some notable protocols, to help inform your decision making.

And that’s your Alpha.

If you’re intending to use the protocols discussed after reading this article, consider using our referral links, proceeds of which will go to alpha please team (who are entirely self-funding at this time) to help continue producing content such as this.

Alternatively, if you found this and other alpha please articles helpful and would like to donate then here is our EVM address (payments accepted on all chains).

0x8d1c77B0b93783CEC6b5930B12846A3c3a869c51

Special thanks to Lunaman for taking time to speak to me regarding Gains Network.

If you enjoy this content, please follow myself and the rest of the Alpha Please team on Twitter and consider subscribing to the substack!

Not financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Great write-up. $GMX just launched its referral program so you might want to add a link at the end of the article too.

Amazing read. Thanks!