5 Alpha Tweets - Why Q4/Q1 will be bullish, Memecoin Supercycle Thesis & More

Edition 131

Welcome to the alpha please newsletter. I curate five alpha tweets every week; that’s it, that’s the newsletter.

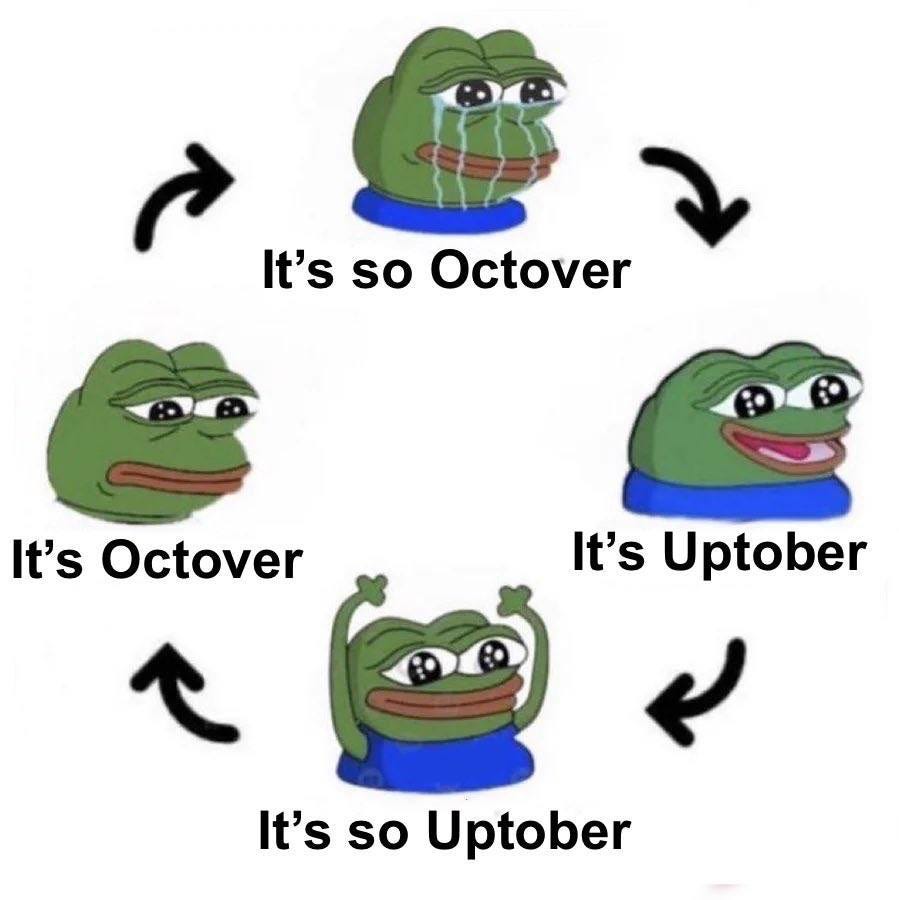

gm friends, the market has a way of trying to make people give up.

There are so many reasons to be positive in Q4, despite the rough start to October. Never forget that the crypto market will take the path that ensures as many people lose as possible.

September 2024 was officially the biggest month of monetary easing since April 2020 (COVID), with a total of 21 cuts from central banks around the world. So more than just a FED easing cycle, it seems that we are at the beginning of a global synchronous monetary easing cycle.

Avoid leverage. Be patient.

Join the alpha please Telegram channel. It’s free to subscribe for more market updates, DeFi & airdrop opportunities.

Your weekly reading:

(*All the screenshots will take you to Twitter if you click.)

1. Why Q4/Q1 will be bullish

Detailed analysis from CryptoAmsterdam.

2. The Psychological Stages of a Trend

Very useful framework shared by Doc. Well worth committing to memory.

3. Blockworks ideas

Blockworks ideas from the last month.

4. Memecoin Supercycle

Whether you agree or not, this presentation is a must watch. No thesis has garnered this much attention in a long time.

5. Identifying Moats in Crypto

Interesting read that looks at what constitutes a sustainable moat.

alpha_pls tweet of the week

Not taking enough risk now might be the riskiest thing you can do.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.