5 Alpha Tweets - Remaking the case for ETH, The beginning of crypto culture & More

Edition 160

Welcome to the alpha please newsletter. I curate five alpha tweets every week - that’s it, that’s the newsletter.

Gm friends, it’s that beautiful time in the market: Bitcoin is in price discovery. There’s really nothing quite like it.

I’ve stayed bullish on Bitcoin through all the macro and geopolitical uncertainty, so I hope you’re sitting on a solid position right now.

ETH has also woken up from its slumber, with the stablecoin narrative coming to the forefront. That’s great news for alts. HYPE is the fastest horse right now, which should’ve been obvious if you’ve been reading this newsletter.

Join the alpha please Telegram channel. It’s free to subscribe for more market updates, DeFi & airdrop opportunities.

Your weekly reading:

*All screenshots will take you to Twitter if you click.

1. Remaking the case for ETH

An updated ETH thesis.

2. On Fiat Culture

“It is the beginning of crypto culture, the beginning of the end of fiat culture.”

Another fascinating read by 6529.

3. the jackpot age

“We’re becoming a culture that worships the jackpot and increasingly prices survival at zero.”

4. Jane Street and Alt Season

Interesting thesis about where an alt-szn is going to emerge from.

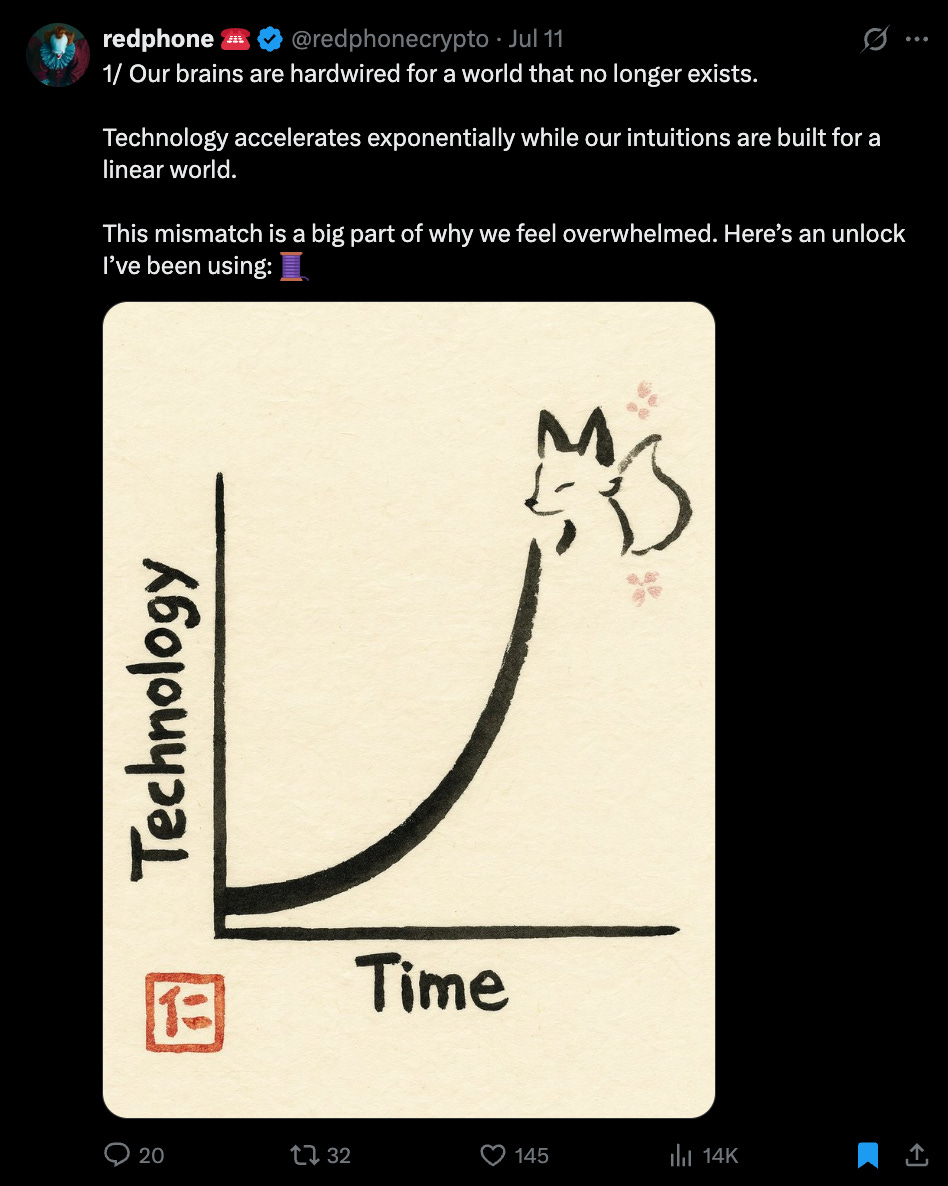

5. The world now runs on curves

Why you should shorten your time horizon in a world changing at an exponential pace.

Yield of the week (brought to you by Kamino)

SyrupUSDC Multiply has been averaging around 15% APY for the last 30 days at max leverage for both the USDC and USDG loop. The USDG loop is a bit more volatile and has seen a few big negative brief spikes, but is currently 23%, as USDG borrowing is being incentivized.

For those who are unaware, Kamino Multiply is a simple leveraged product that gives you increased exposure to SyrupUSDC yield (6.34% APY). As you increase your multiplier, you increase your exposure to both the SyrupUSDC APY, as well as the USDC or USDG borrow APY.

This is the best stablecoin loop in Solana powered by two DeFi bluechip protocols: Maple Finance and Kamino.

It is incredibly easy to deposit. Just choose your leverage and it is one click. All the magic is done by Kamino.

Just be aware: leverage = risk. Monitor the borrowing rates periodically. If borrowing rates spike too much for too long due to a very frothy environment then you will want to unwind.

alpha_pls tweet of the week

Fluid volume continues to rise, and I think it is one of the DeFi projects to pay attention to in this risk on environment.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Some excellent reads this week! 😀Perfect for killing the time before the Wimbledon final whilst hiding from this ridiculous heat over this weekend.