5 Alpha Tweets - One of ETH's best weeks, Bitcoin thesis to retire your bloodline & More

Edition 161

Welcome to the alpha please newsletter. I curate five alpha tweets every week - that’s it, that’s the newsletter.

Gm friends, it’s been another great week. BTC is chilling in price discovery, and ETH has finally arrived at the party.

ETH has made a huge move in a short time, leading to a significant drop in BTC.D for the first time since last November.

Alts are benefiting, especially ETH beta alts.

My guess? ETH stays bullish for a while, which gives alts the oxygen they need for a fun run.

Join the alpha please Telegram channel. It’s free to subscribe for more market updates, DeFi & airdrop opportunities.

Your weekly reading:

*All screenshots will take you to Twitter if you click.

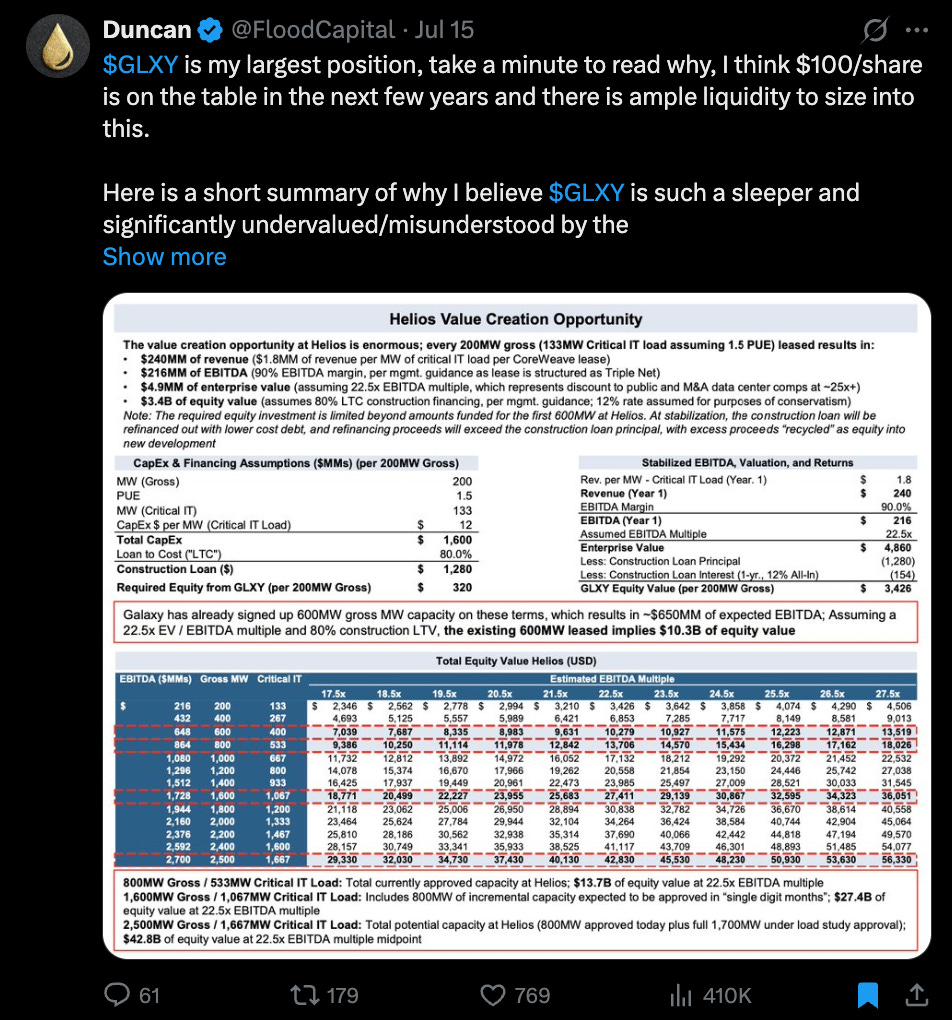

1. One of ETH’s best weeks

A simple, succinct bullish looking recap.

2. this bitcoin thesis will retire your bloodline

A provocative Bitcoin bull thesis.

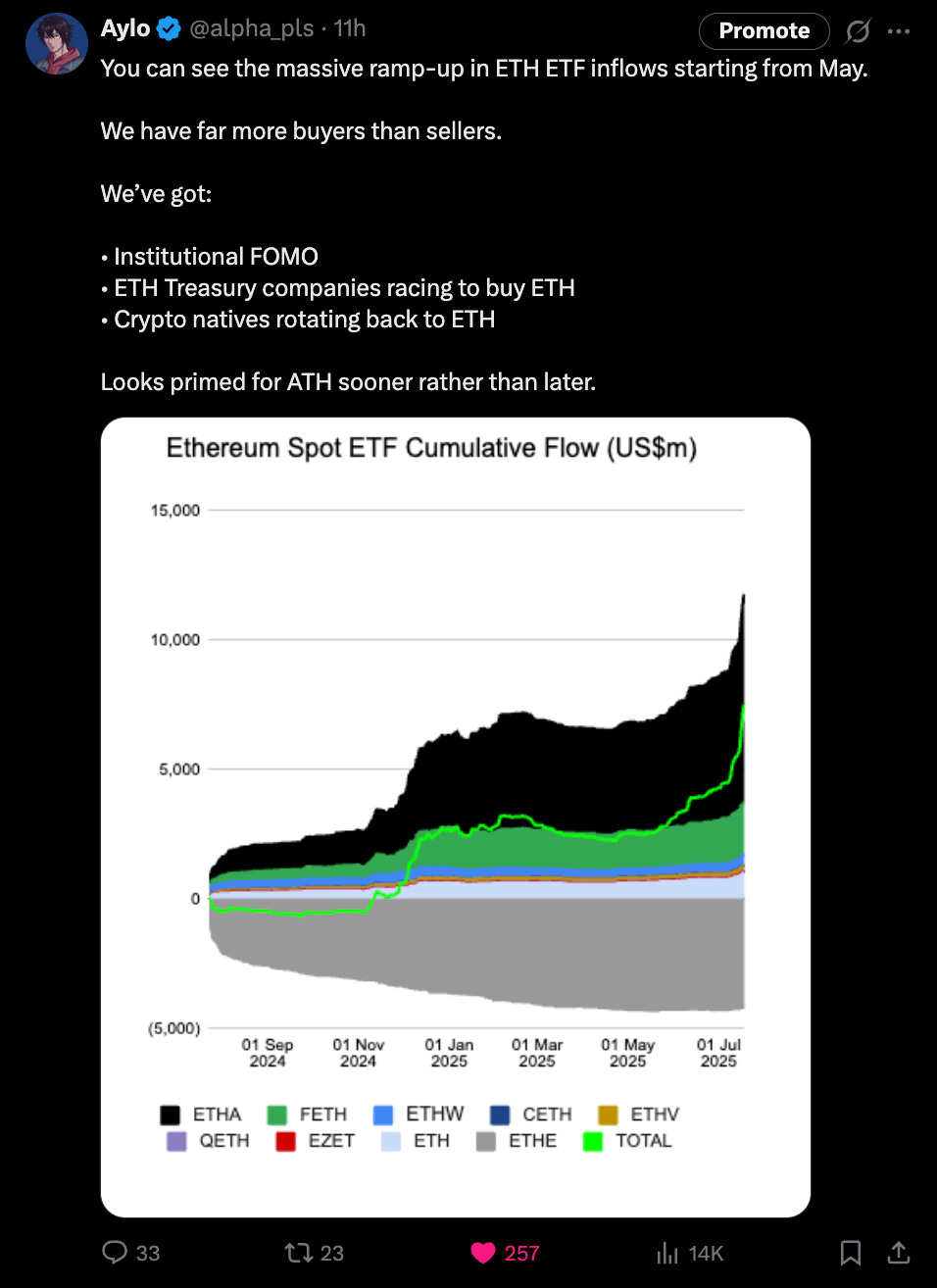

3. GLXY Thesis

Crypto stocks are running very hot - here is an interesting write up on GLXY.

4. How to understand market structure

Another great cheat sheet from Minty.

5. The Scarcity Trap

Most trading mistakes aren’t about strategy, they’re about fear, scarcity mindset, and the stories we tell ourselves about money.

Yield of the week (brought to you by Kamino)

Repeating this one because it’s still that good:

SyrupUSDC Multiply has been averaging ~15% APY over the past 30 days at max leverage for both the USDC and USDG loops. The USDG loop is a bit more volatile and has had a few brief negative spikes, but is currently at 18.05%, thanks to incentivized USDG borrowing.

For those unfamiliar: Kamino Multiply is a simple leveraged product that increases your exposure to SyrupUSDC yield (currently 6.64% APY). As you raise your multiplier, you increase exposure to both the yield and the USDC or USDG borrow APY.

This is arguably the best stablecoin loop on Solana, powered by two DeFi blue-chip protocols: Maple Finance and Kamino.

It’s incredibly easy to deposit, just choose your leverage and click once. Kamino handles the rest.

⚠️ Reminder: Leverage = risk.

Monitor borrowing rates periodically. If they spike in a frothy market for too long, consider unwinding.

alpha_pls tweet of the week

It’s looking good for ETH.

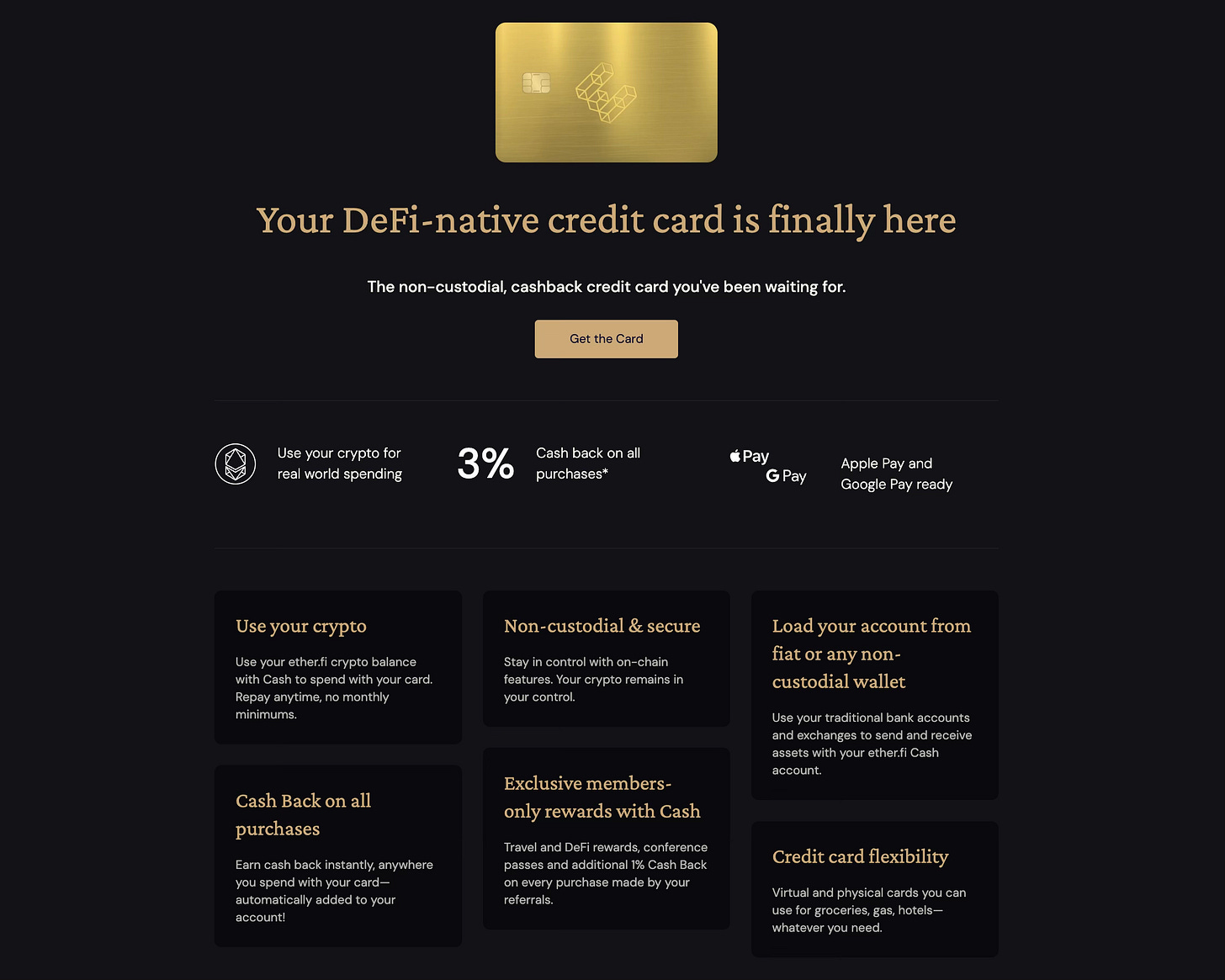

DeFi Credit Card I like

EtherFi offers a DeFi-native credit card that lets you spend your crypto on real-world purchases, just like a traditional card.

What’s especially interesting is that you can borrow against your EtherFi balance (ETH, BTC, stables) to fund purchases - non-custodial and secure.

IMO, this is one of the best crypto cards out there. Onboarding is smooth, UX is great, and KYC is quick. They offer both virtual and physical cards with a transparent fee structure. Cashback ranges from 2–3%, which often offsets the fees.

Imagine this:

You’re earning double-digit APY in the Liquid USD vault, using your card in borrow mode (no tax), buying what you want, and earning 2–3% cashback.

Pretty wild, and a no-brainer if you’re serious about using crypto in real life.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.