5 Alpha Tweets - ENA is CRCL's Catch Up Trade, Hyperliquid Staking Black Hole & More

Edition 162

Welcome to the alpha please newsletter. I curate five alpha tweets every week - that’s it, that’s the newsletter.

Gm friends, we were due a correction and we got it.

Equities pulled back, Trump said some crazy things (moving nuclear submarines), and Powell was hawkish in his last FOMC.

I am personally still bullish HTF, and see this is a natural correction which also coincides with a weak seasonal period (August). Plus, beginning of the month tends to see repositioning.

The positive news we saw was an historic SEC speech that outlined a vision to bring all US markets onchain.

Join the alpha please Telegram channel. It’s free to subscribe for more market updates, DeFi & airdrop opportunities.

Your weekly reading:

*All screenshots will take you to Twitter if you click.

1. ENA is CRCL’s Catch Up Trade

Bullish Ethena thesis.

2. SEC’s new Project Crypto

Haseeb’s TLDR on the SEC’s speech this week.

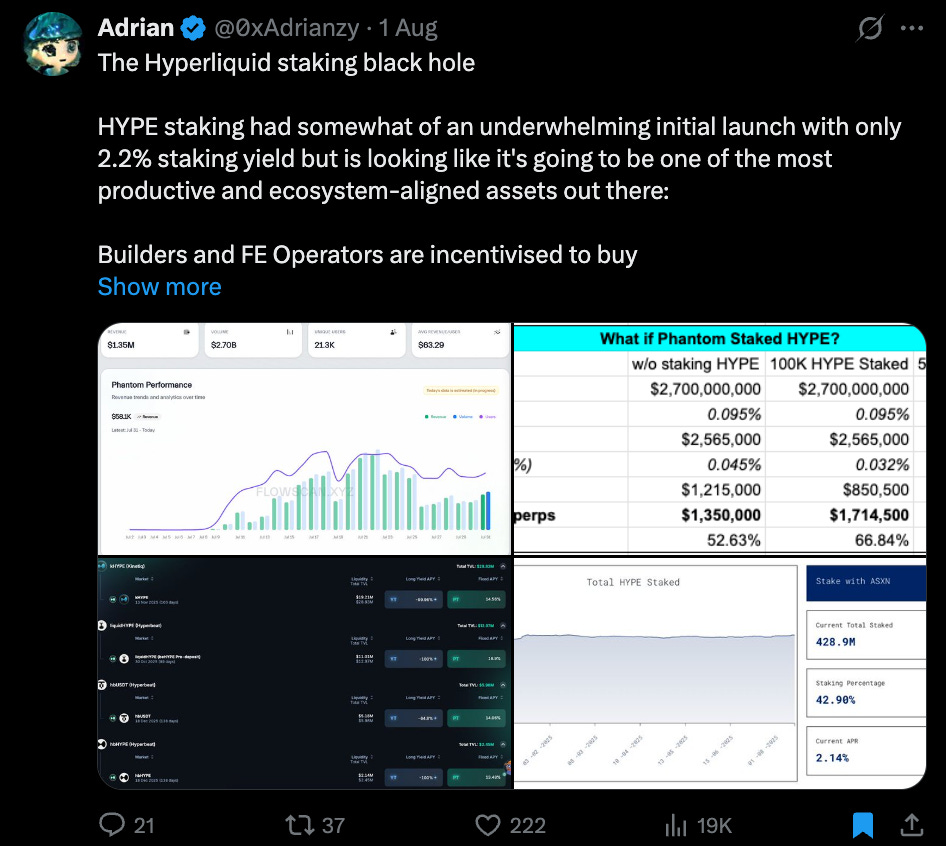

3. The Hyperliquid staking black hole

Hyperliquid is currently sitting at ~43% staking rate, with LST penetration growing rapidly at 6.6% of total supply.

4. Coming Back From Zero

Interesting account of a trader’s journey and the lessons learned.

5. What The F*ck Happened to Crypto x AI?

A review of the crypto x AI meta, and where the value is now.

Yield of the week (brought to you by Kamino)

You now have three choices for leverage looping SyrupUSDC. USDS has come to the party.

SyrupUSDC looping has consistently offered >15% APY for the last two months.

For those unfamiliar: Kamino Multiply is a simple leveraged product that increases your exposure to SyrupUSDC yield (currently 6.98% APY). As you raise your multiplier, you increase exposure to both the yield and the USDC, USDG, USDS borrow APY.

This is arguably the best stablecoin loop on Solana, powered by two DeFi blue-chip protocols: Maple Finance and Kamino.

It’s incredibly easy to deposit, just choose your leverage and click once. Kamino handles the rest.

⚠️ Reminder: Leverage = risk.

Monitor borrowing rates periodically. If they spike in a frothy market for too long, consider unwinding.

alpha_pls tweet of the week

It was a big week for Ethena.

Airdrop Opportunity

High stablecoin yield + LIMINAL, UNIT & HYPE airdrop

Liminal is one of the best DeFi apps I've used (on any chain), so slick.

Here’s how it works:

Deposit USDC into Liminal via Hyperliquid’s native spot infrastructure or via Arbitrum, Ethereum, Base, or HyperEVM.

Liminal automatically deploys your funds into a delta-neutral strategy: a spot long (e.g., HYPE or BTC) paired with an equal-sized short perp.

This setup protects your position from market swings - the long and short offset each other - while you earn the funding rate on the short perp, which can be highly attractive.

I’ve averaged 19% APY over the last month, whilst making myself eligible for LIMINAL, UNIT & HYPE airdrops.

Here's my ref link if you didn't managed to get in yet:

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.