5 Alpha Tweets - Crypto Cycle Tops, Solana Is Contrarian & More

Edition 166

Welcome to the alpha please newsletter. I curate five alpha tweets every week - that’s it, that’s the newsletter.

Gm friends, the market derisked ahead of Jackson Hole, but found itself slightly offside as Powell was more dovish than anticipated.

send.exe was initiated, and all markets rallied following the end of Powell’s speech.

It feels to me as though we have had a macro turning point, and if we zoom out then risk on for the foreseeable future - with rates very likely coming down in September - makes sense.

Join the alpha please Telegram channel. It’s free to subscribe for more market updates, DeFi & airdrop opportunities.

Your weekly reading:

*All screenshots will take you to Twitter if you click.

1. Bitcoin and Crypto Cycle Tops

Bigger picture thinking.

2. Solana is the contrarian play

mert with another eloquent Solana pitch.

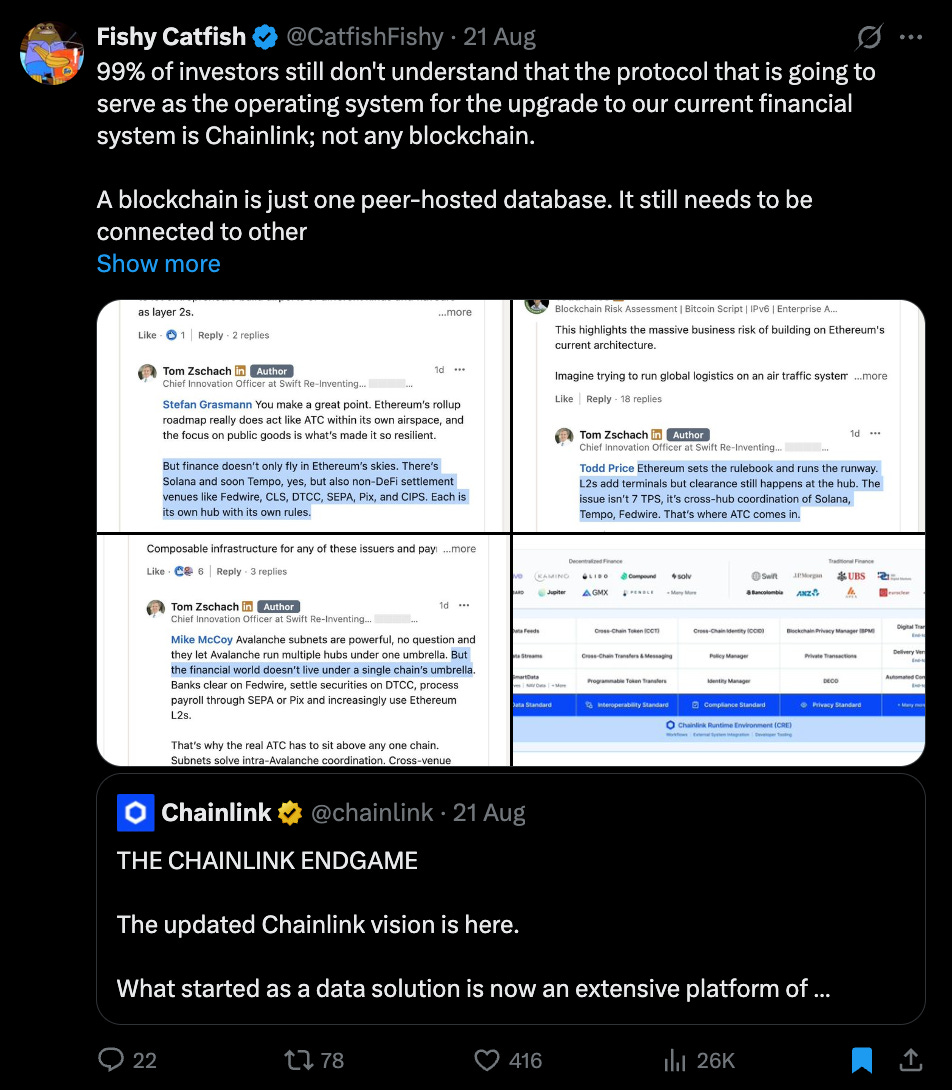

3. The Chainlink Endgame

Long form post expanding on Chainlink’s updated vision.

4. Pendle Bull Thesis

Deep dive into Pendle.

5. Guide to Digital Art

If you have any interest in digital art as an asset class then this is a must watch video for you.

Yield of the week (brought to you by Kamino)

I think it’s worth a reminder that JLP multiply offers exceptional yield on probably the best index in crypto this cycle.

With SOL moving up again recently, JLP has been doing very well, and Kamino helps you amplify that yield via multiply.

Please make sure you understand how Kamino Multiply works, and the basket of assets that makes up JLP.

alpha_pls tweet of the week

Four-Year Cycle Top vs Extended Cycle to 2026.

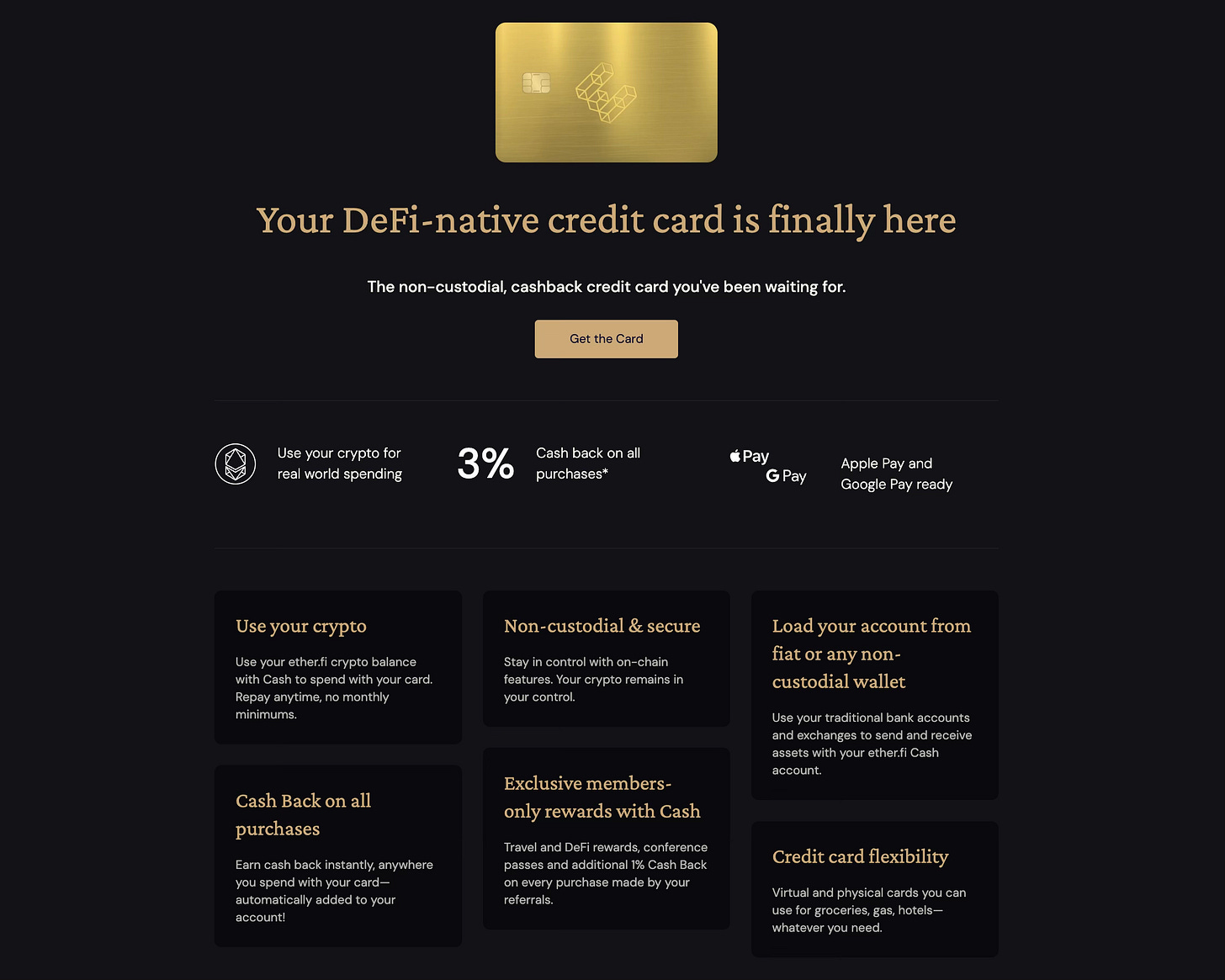

DeFi Credit Card I like

EtherFi offers a DeFi-native credit card that lets you spend your crypto on real-world purchases, just like a traditional card.

What’s especially interesting is that you can borrow against your EtherFi balance (ETH, BTC, stables) to fund purchases - non-custodial and secure.

IMO, this is one of the best crypto cards out there. Onboarding is smooth, UX is great, and KYC is quick. They offer both virtual and physical cards with a transparent fee structure. Cashback ranges from 2–3%, which often offsets the fees.

Imagine this:

You’re earning double-digit APY in the Liquid USD vault, using your card in borrow mode (no tax), buying what you want, and earning 3% cashback.

Pretty wild, and a no-brainer if you’re serious about using crypto in real life.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Solana topped against Bitcoin