5 Alpha Tweets - “Bitcoin for Corporations” bubble is far from over, Crypto trading strategies & More

Edition 156

Welcome to the alpha please newsletter. I curate five alpha tweets every week - that’s it, that’s the newsletter.

Gm friends, after a huge Bitcoin run we are now getting a correction, which is to be expected.

However, it’s still very tough times for alts, which continue to give back a lot of their gains whenever Bitcoin sneezes.

Barely any alt/BTC pairs look strong right now, so if you’re holding underperforming coins, you need to have very strong conviction in the future of those projects.

Alt returns will continue to be very sporadic. Markets trend towards being more efficient and less irrational over time, and crypto is no different. We are seeing certain crypto premiums disappear.

Join the alpha please Telegram channel. It’s free to subscribe for more market updates, DeFi & airdrop opportunities.

Your weekly reading:

*All screenshots will take you to Twitter if you click.

1. Why transparent trading wins

Hyperliquid founder argues whales often get better execution by trading transparently because when the market sees your flow, liquidity providers can compete to fill it more efficiently.

2. “Bitcoin for Corporations” bubble is far from over

Unlike retail-driven altcoin cycles, the ‘Bitcoin for Corporations’ wave is built on long-term capital, structural incentives, and balance sheet logic.

3. Trading strategies

Nice cheat sheet outlining different crypto trader types.

4. How to Capture Value

In crypto, it’s not the best product that wins, it’s the one that controls distribution. This case study shows why.

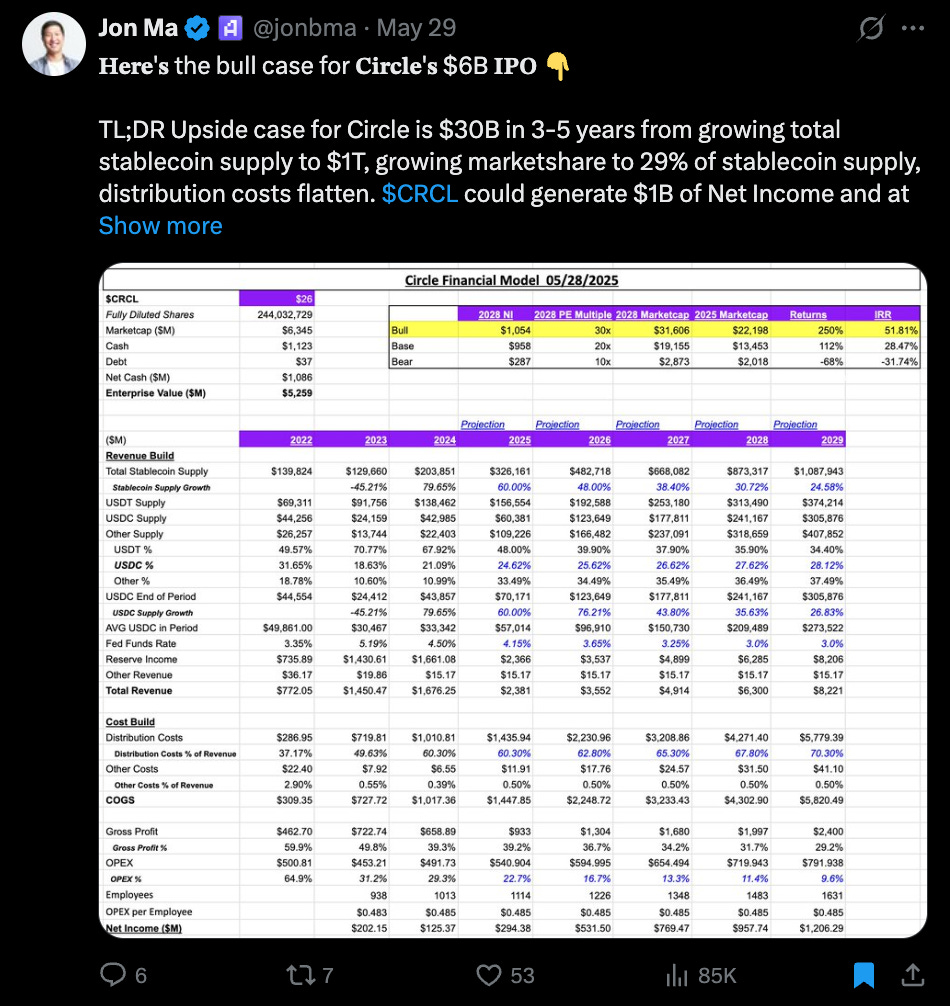

5. Bull case for Circle

Deep dive on the upcoming CRCL from the founder of Artemis.

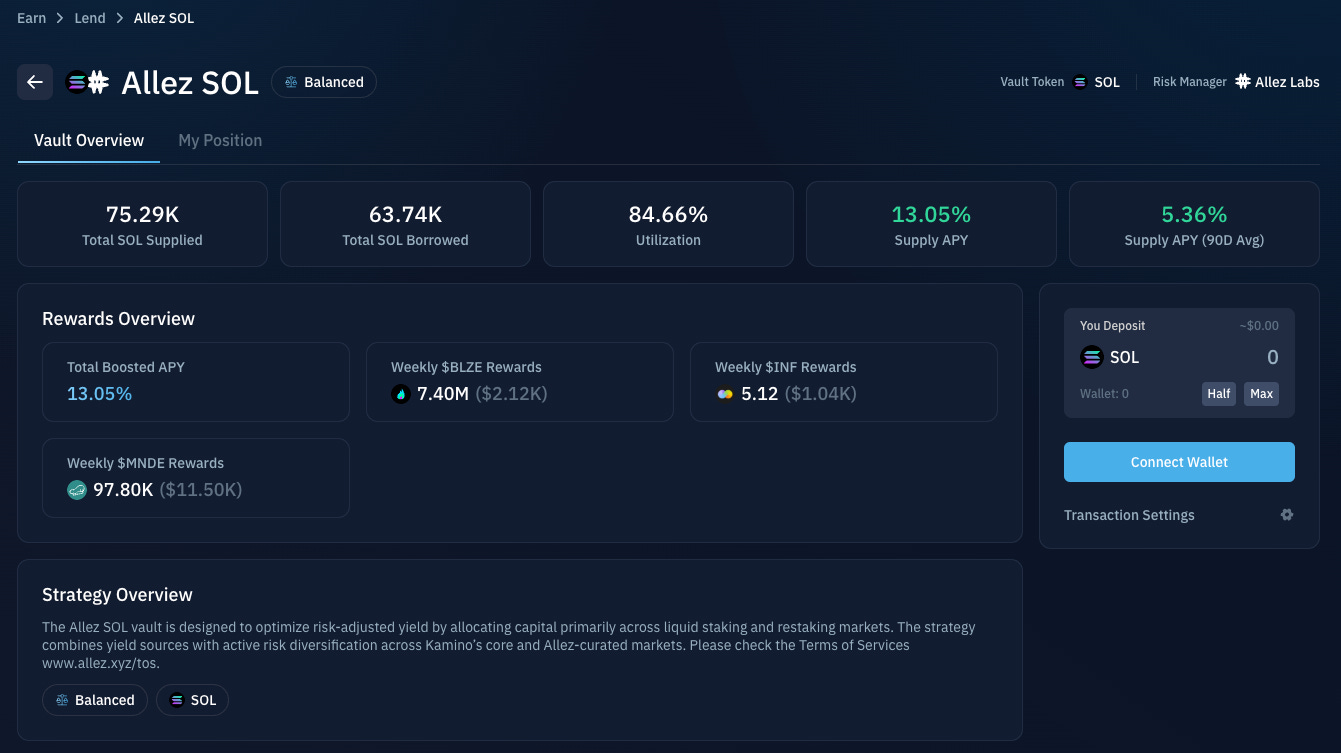

Yield of the week: Kamino

Kamino’s V2 introduces modular lending markets with many new vaults managed by curators.

The Allez SOL vault is sitting at 13.05% APY currently and offering rewards across many tokens. A pretty decent yield for lending out your SOL, and without having to manage leverage etc.

You can get check out the strategy overview to get an understanding of how they are generating the yield.

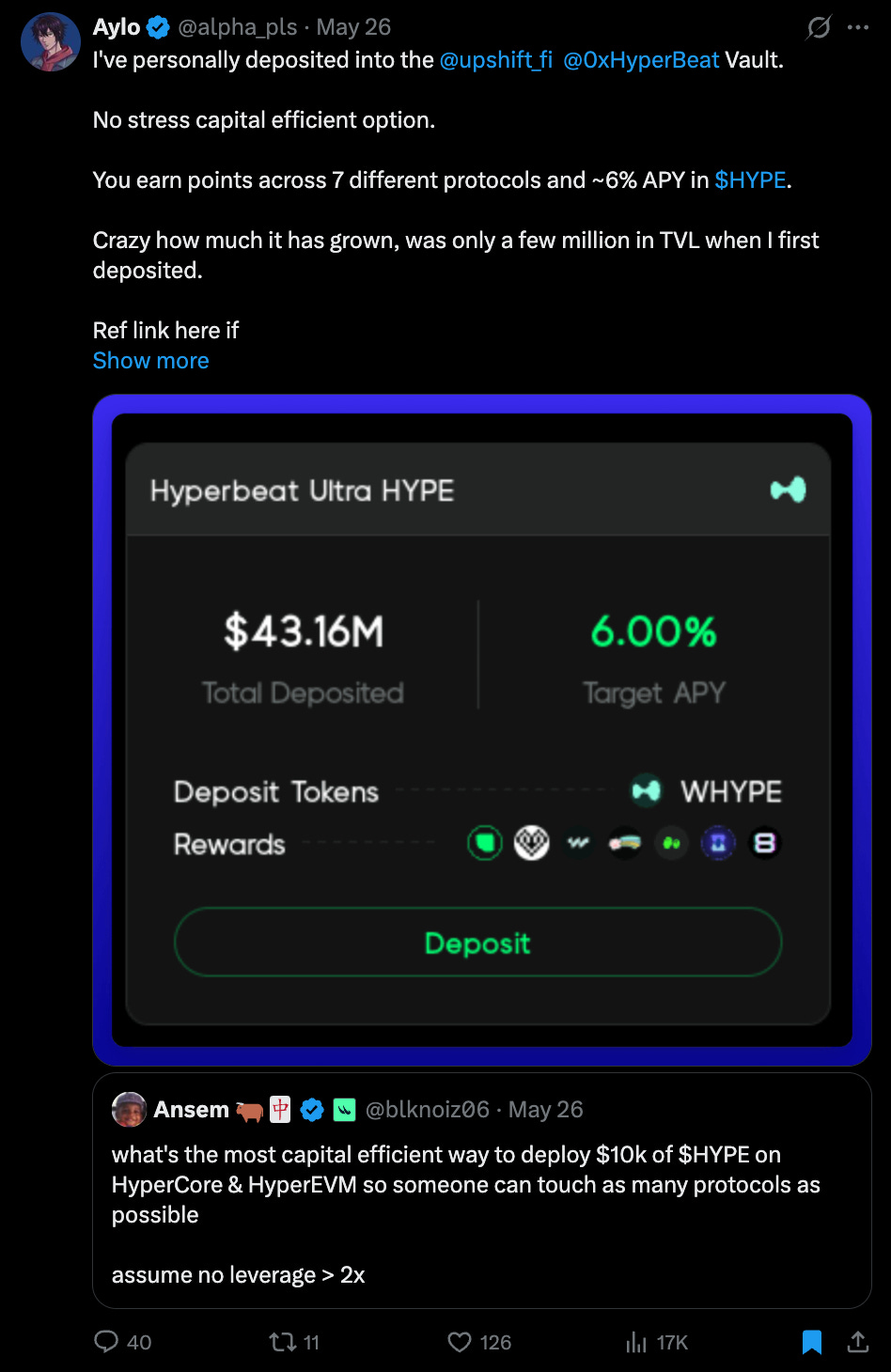

alpha_pls tweet of the week

HYPE farming strategy.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

dope week. ty for the summary!