Welcome to the alpha please newsletter. I curate five alpha tweets every Friday; that’s it, that’s the newsletter.

Sigh. Another tumultuous week in crypto. At this point, it feels like any lack of drama is more concerning given how eventful the last few weeks have been. But we’re still here, learning, absorbing, sharpening our edge. And you are too. That’s no mean feat and you've certainly earned your stripes. For what it’s worth, this is where real wealth is made. Remember to review your OPSEC as exploits tend to be rife during the bear.

1. What makes great token design?

This is the perfect time to re-evaluate your holdings and/or critically appraise the next investment you want make. Spencernoon has highlighted seven simple things to consider when thinking about the value of a token.

2. Crypto Classics

A long list of crypto reads to remind yourself why you are still here.

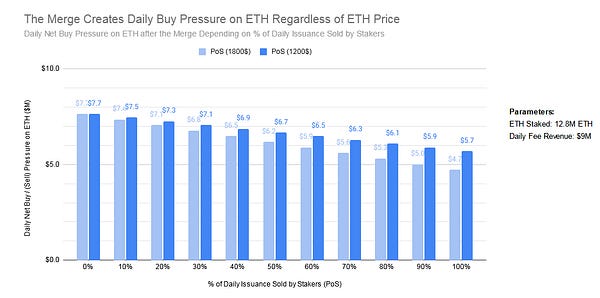

3. The effect of volatility and plunge in ETH price on the merge

We’ve made it clear that we are bullish on ETH in the long-term. We’ve also included Korpi numerous times in our previous newsletters but how can you not with his easy-to-understand educational threads. He covers how the recent ETH price action affected the merge.

4. The Three Arrows Capital insolvency

3AC are one of the largest VCs in the space and their insolvency could have significant impact on the crypto markets. Turn’s out, their risk management was akin to most degens’ in the space. I know everyone doesn’t spend their lives on Twitter and may be oblivious to what is going on so The DeFi Edge has broken down the timeline of events.

5. Japan doing Japan things

Japan is known for its vending machines. But, a vending machine for NFTs!? Is this a glimpse into the future, or an anomaly? Time will tell. There is only one of these machines selling The Laughing Man NFT. I kinda want it…

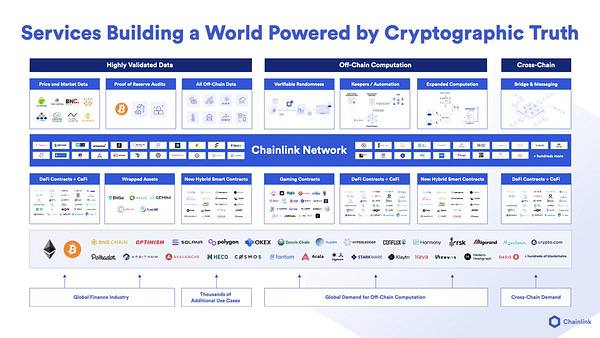

@alpha_pls tweet of the week

Liquidations, insolvencies, surging gas fees yet DeFi keeps DeFing the crazy volatility using the Chainlink price feeds. They have all worked as intended, mitigating for outliers and delivering the data as expected. We remain bullish on Chainlink and Aylo explains why.

And that’s your alpha.

If you are looking to trade on-chain, we’re big fans of GMX.

Use our referral link to get a 10% rebate on fees: gmx.io/?ref=alphaplease

https://gmx.io/?ref=alphaplease

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.