3 Alpha Apps – Top Play on Hyperliquid + Two More to Watch

Edition 1

Welcome to the alpha please newsletter.

gm friends, this is the first edition of a new series where I will bring you three apps each week that have caught my eye, are doing something innovative, or may offer outsized rewards for users.

Writing has always kept me very active onchain, so I’m committing to a new series to avoid getting lazy. I hope it proves to be useful. Let me know what you think.

Please do your own due diligence on everything shared in here. This should just be seen as a starting point for your own research. I have no affiliation with any of the apps below.

1. Unit

Unless you’ve been living under a rock you will be aware that HYPE has been one of the best performing tokens since crypto bottomed out. The HyperEVM is starting to pick up and it is still very early for testing out this new ecosystem, and using protocols for potential airdrops later down the line.

I think Unit is possibly the best opportunity when looking at how important it is to Hyperliquid.

Unit is the asset tokenization and bridging layer behind spot trading on Hyperliquid. It allows users to deposit and withdraw major crypto assets like BTC, ETH, and SOL directly into Hyperliquid from wallets or exchanges, without wrapping or manual bridging. These assets can then be traded or used on the platform’s native spot order book.

Hyperliquid already leads in onchain derivatives, but robust spot markets are essential to becoming a full-featured trading venue. Unit makes this possible by removing the usual friction around asset onboarding. This unlocks several new possibilities:

Spot and perpetual trading on one unified platform

Cross-margining across assets for greater capital efficiency

Native asset exposure with onchain settlement

Basis trades, delta hedging, and composable DeFi strategies

Trades settle instantly, with fees lower than most major CEXs

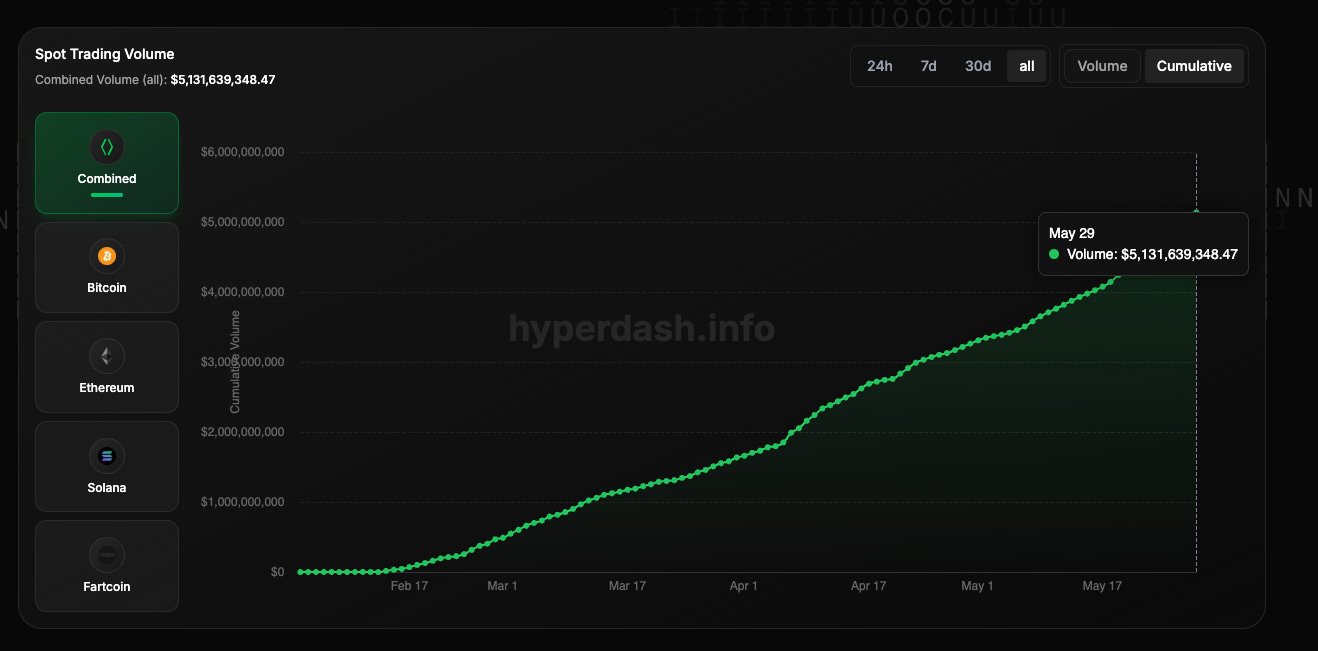

Since launching, Unit has already facilitated over $5 billion in cumulative volume and brought more than 1,100 BTC on-chain, signaling strong early adoption.

How to position yourself for UNIT & a future HYPE airdrop:

Use the interface at app.hyperunit.xyz or via Hyperliquid to deposit BTC, ETH, SOL or Fartcoin (lol) natively

Trade these assets on Hyperliquid’s spot markets with low fees and deep liquidity

Get early exposure to a potential $UNIT airdrop by engaging in activities such as:

Spot trading with Unit-supported assets (spot trading is very important for Hyperliquid and likely gets a good weighting in a future HYPE airdrop)

Bridging assets to and from Hyperliquid

Engaging with the HyperEVM (e.g. staking or LPing Unit assets)

Unit brings native spot trading to the onchain world without compromising on user experience, cost, or transparency, a key step toward merging the best of centralized and decentralized finance.

If you are keen to trade and try out Hyperliquid (you really should be keen), then here is a ref link that will get you a discount on fees.

2. infiniFi

Not very often do I see a new DeFi launch that I am actually excited by, but infiniFi is one of them.

infiniFi is a next-generation stablecoin protocol that brings the power of fractional reserve banking on-chain. Users can deposit stablecoins like USDC and either keep them liquid or lock them to earn significantly higher yields.

In a regular bank, you put in money and they lend it out to make more. The bank keeps most of the earnings. infiniFi does something similar but lets you keep the upside, offering up to 21.8% APY depending on how long you’re willing to let your money sit.

Traditional banks guess how much money people will withdraw using old models. If they guess wrong, they can go bankrupt, that’s what caused a bunch of bank failures in 2023.

infiniFi solves this by asking users directly how long they want to leave their money in the protocol. If you’re okay waiting a few weeks to withdraw, infiniFi uses your money in higher-yield investments and pays you more.

infiniFi applies the principle of fractional reserve banking to DeFi. Rather than requiring full collateralization, it allows a portion of liquid deposits to be deployed into higher-yielding, longer-duration assets. This means the same dollar can do more effectively amplifying yields across both liquid and illiquid capital without increasing systemic risk.

Getting started is simple: deposit USDC into infiniFi and choose your strategy:

Earn 10.83% APY by minting and staking iUSD - your funds stay liquid and can be withdrawn at any time.

Earn up to 21.80% APY by locking your iUSD with an exit timer (e.g. 1 week = 19.58%, 4 weeks = 21.05%, 8 weeks = 21.80%).

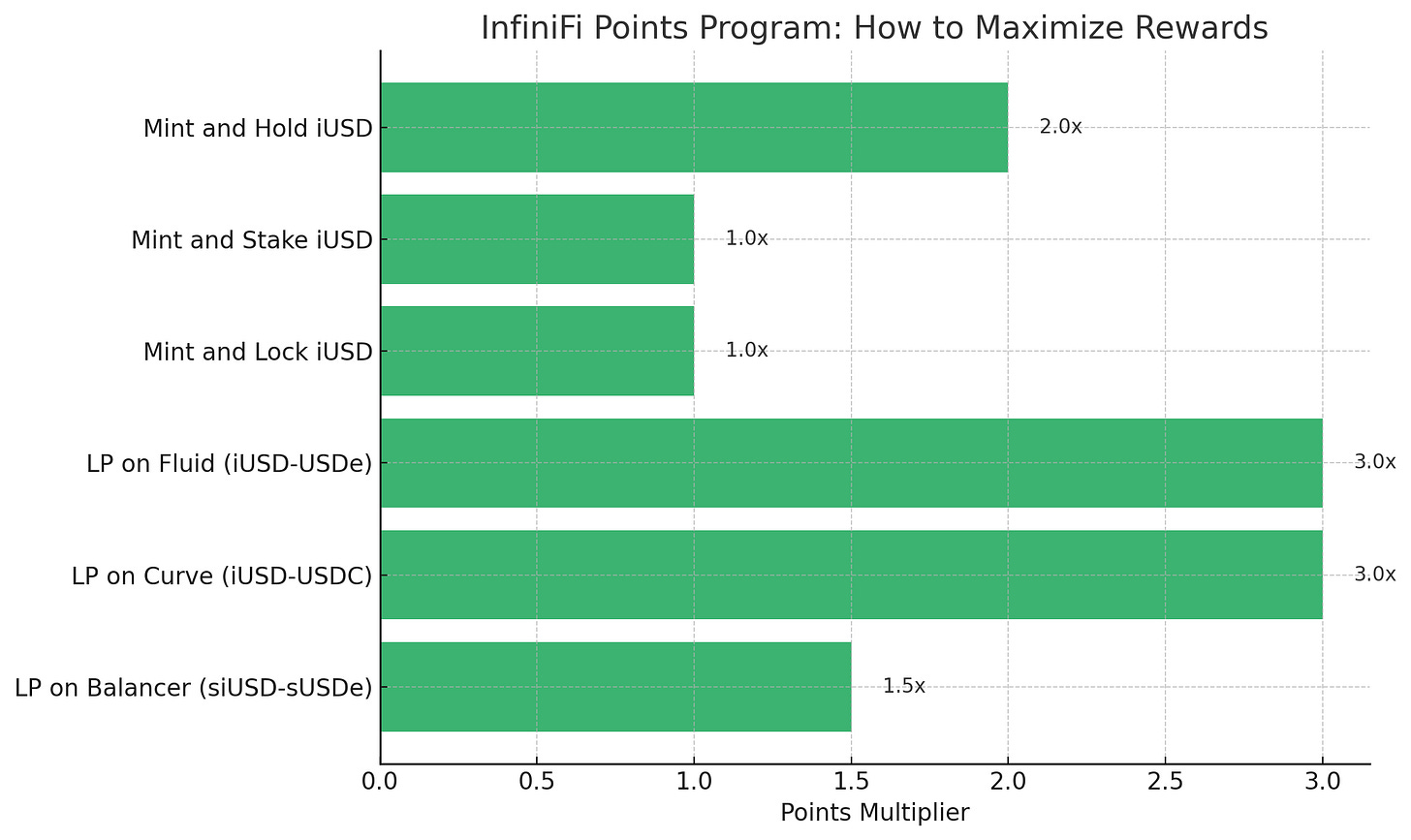

infiniFi also runs a Points Program that rewards users with additional benefits for contributing liquidity and participation (airdrop at some point which adds to the yield). Here’s how you can boost your points:

You will need an invite to use the app, you get in by clicking the button below:

Please DYOR here, read the docs, and don’t risk too much at this point in the protocol’s life cycle as it is novel and very early. Anything not battle tested is risky in DeFi.

A few potential risks I can see:

• All liquid users try to withdraw at once then there would be a likely temporary illiquidity situation. The iUSD would depeg, but arbitrageurs would buy below peg and redeem later, profiting once assets mature. The peg recovers if users believe in long-term solvency.

• A large allocation (e.g. Pendle or tokenized T-Bills) defaults (losses socialized to illiquid users).

3. Infinex

Infinex is a one-stop crypto app, created by Synthetix founder Kain Warwick. You can think of it as an on-chain UX layer with one mission: bridge the gap between CeFi and DeFi. This means making the Infinex app so intuitive that any CeFi user could go on-chain without having to learn anything new.

Let’s be honest, the future of crypto is on-chain, and if you’re not there yet, you’re only scratching the surface of what’s possible. But today, the UX is still so bad that it’s almost impossible to onboard new users without them spending hours learning about bridges, chains, wallets, and all the rest.

Infinex wants to solve this issue by abstracting away all the pain points that crypto newcomers experience. This makes it an attractive option for anyone who just can’t be bothered worrying about on-chain tricks that are second nature to us.

Once an account is created on the Infinex platform, a user has access to their cross-chain wallet, which acts as a non-custodial way for them to get involved in DeFi on a lot of different chains. Within the Infinex platform, users can send, receive, trade, buy, swap, stake, and bridge coins without the need for many of the complicated aspects that have long been a barrier for most.

A new product update: Infinex Connect, was recently announced. This is a new way to connect your account and cross-chain portfolio to third party apps. A new feature, Infinex Connect, was recently announced. This is a new way to connect your account and cross-chain portfolio to third party apps. This new feature means Infinex users will be able to track:

Positions and assets in real time

Rewards and earnings across protocols

All on-chain activity without jumping between apps

At the end of the day, any new tech that integrates the ridiculous number of existing crypto networks into one seamless interface, allowing users to jump between chains at the click of a button, is a win for everyone. This is how crypto is going to go mainstream.

I really encourage you to try it out if you haven’t already. Ref link here if you want to use it.

There are also plenty of opportunities on the platform: Yaprun, Bullrun, and more. And here’s a complete guide to Infinex that I found particularly interesting:

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Thanks for this Alpha chad, I am going to check on Uni

Thanks for the awesome Alpha, I wish to subscribe financially soonest 🙏