3 Alpha Apps - The Best DeFi Credit Card + Two Airdrop Opportunities

Edition 2

Welcome to the alpha please newsletter.

I'm continuing this new series where I bring you three apps each week that I think are worth checking out. So without further due, let’s dive into today’s 3 alpha apps:

This newsletter is made possible by Bungee 🙏

Bungee would have easily made the list of today’s alpha apps, but instead, they’ve chosen to sponsor this newsletter and make it free for everyone. So let me tell you why they’re my go-to platform for cross-chain swaps.

Why I Use Bungee Every Day

I use Bungee daily because it’s simply the most seamless and efficient way to move across chains without the usual friction. With BungeeAuto, every swap is gasless, MEV-resistant, and backed by smart contract safeguards that eliminate failed transactions. I don’t need to worry about native gas or worrying about complex approvals. It’s become my default for any cross-chain activity, not only because it works, but because it works reliably, regardless of the chain, token, or size of the swap.

Bungee v2’s Open Liquidity Marketplace changes the game by letting any agent compete to fulfill your swaps. Bungee will be what you use to swap tokenized Pokemon cards to the next memecoin you think is going 100x - it’s built for the future of tokenized everything.

Also cough cough no token yet.

1. Felix

As I mentioned last time, I think HyperEVM is a very interesting ecosystem to keep a close eye on. Many promising protocols are already live, with potential airdrop opportunities down the line. My gut says there are going to be a few very profitable plays, but it’s better to act fast before things get too crowded. All HyperEVM usage will also likely the next HYPE airdrop.

One of the protocols I like on HyperEVM is Felix. It’s a modern money market protocol offering a full suite of borrowing and lending products. Currently, the main offering is a CDP where you can deposit assets like HYPE or UBTC to borrow feUSD. There’s also a vanilla model built on the Morpho stack, letting you lend and borrow stablecoins like USDe or USDT0. Additionally, Felix has an Earn section where you can deposit feUSD into a stability pool vault to earn borrower interest and liquidated collateral.

They are also launching USDhl very soon, which will be a native tokenized dollar on Hyperliquid, with yield redistributed directly to holders in the form of HYPE. Details can be found here:

I think Felix is really set to become a pillar of HyperEVM. There is already a decent amount of TVL and active borrows in the protocol.

Their points program is live, and it is still early. While there’s no public end date or clear guidance on how to earn points, key actions seem to include: depositing HYPE or UBTC to borrow feUSD, or participating in stability pools, and lending stables and other assets. Keep an eye on the upcoming USDhl launch, Felix might adjust its points program to favor this asset.

As always, a quick word of caution: DeFi can be complex and carries risk, especially with borrowing. Make sure you understand the full mechanics before getting involved.

2. Cookie

Cookie is an InfoFi project building an AI-powered data aggregation layer for crypto. They recently launched their V1, which is somewhat similar to Kaito, in that they index data from CT (Crypto Twitter) to provide real-time sentiment and mindshare insights for any crypto project. I think it is a valuable research tool for assessing the strength of narratives and projects in real time.

So far, Kaito has dominated the InfoFi narrative and still seems like the strongest product. But it’s refreshing to see new players like Cookie entering the space. What was once a monopoly is now turning into a competitive landscape. This should encourage innovation, better pricing, and faster iteration. It’ll be interesting to watch how this meta evolves over the coming years.

As part of their launch, they introduced Cookie Snaps, a rewards system similar to Yaps, where creators can earn Snaps. If you’re active on CT, it might be worth joining. It’s free and could lead to some nice rewards down the line.

Their first campaign is live in partnership with Spark. Details on duration and rewards are still unclear, but it’s worth exploring.

3.EtherFi

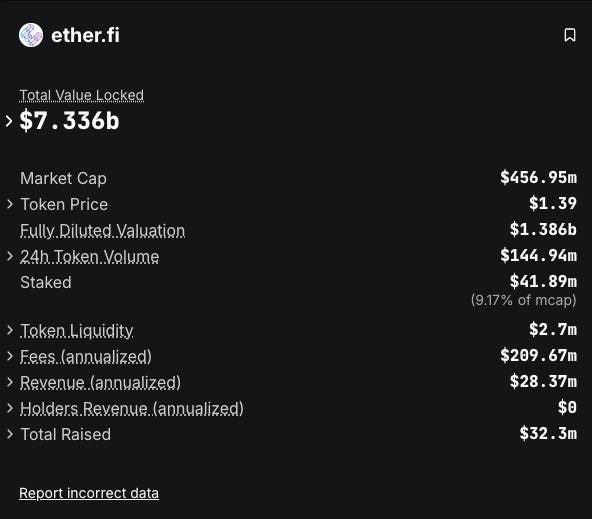

By now, EtherFi needs no introduction. It’s an OG protocol that has grown into a pillar of Ethereum DeFi. It was the first liquid restaking protocol on Ethereum and has since evolved into a top-tier platform where users can save, earn, and spend their crypto.

EtherFi began with liquid restaking: users deposit ETH (or other assets) and receive a liquid restaked token in return, which accrues staking yield and restaking rewards. This provided relatively low-risk yield and easy DeFi participation. During the early EigenLayer hype, this drove explosive growth in both users and TVL.

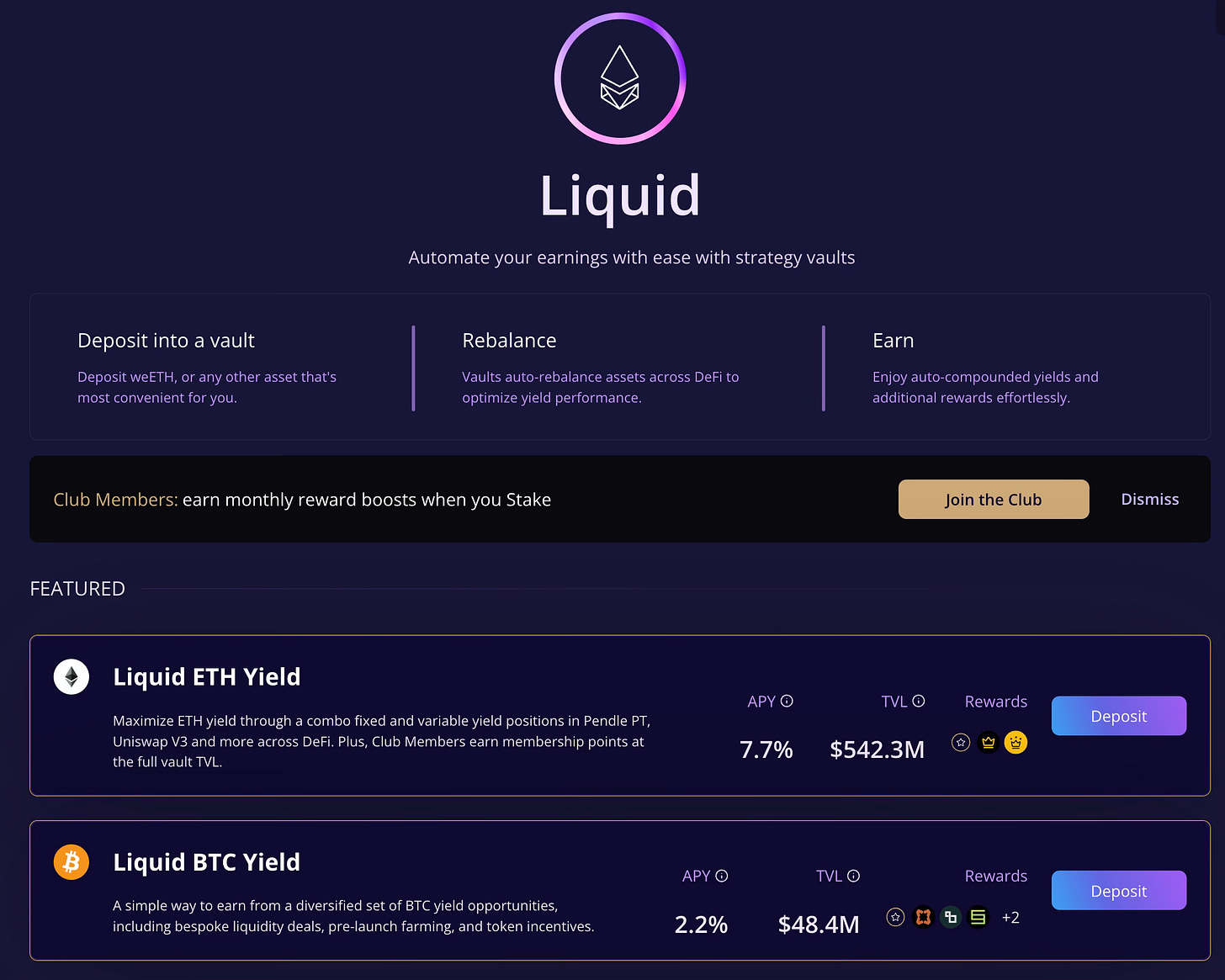

They then launched Liquid: a suite of fully automated, non-custodial vaults that put DeFi strategies on autopilot. Each vault is curated by a top strategist with clear objectives. You just deposit the assets, and the vault handles the rest, optimizing for risk-adjusted yield on ETH, BTC, and USD.

This solves a key pain point in DeFi: how do non-expert users access top-tier yield strategies without complexity?

For instance, the ETH Liquid Vault currently earns ~7.7% APY by deploying across a basket of strategies curated by Seven Seas.

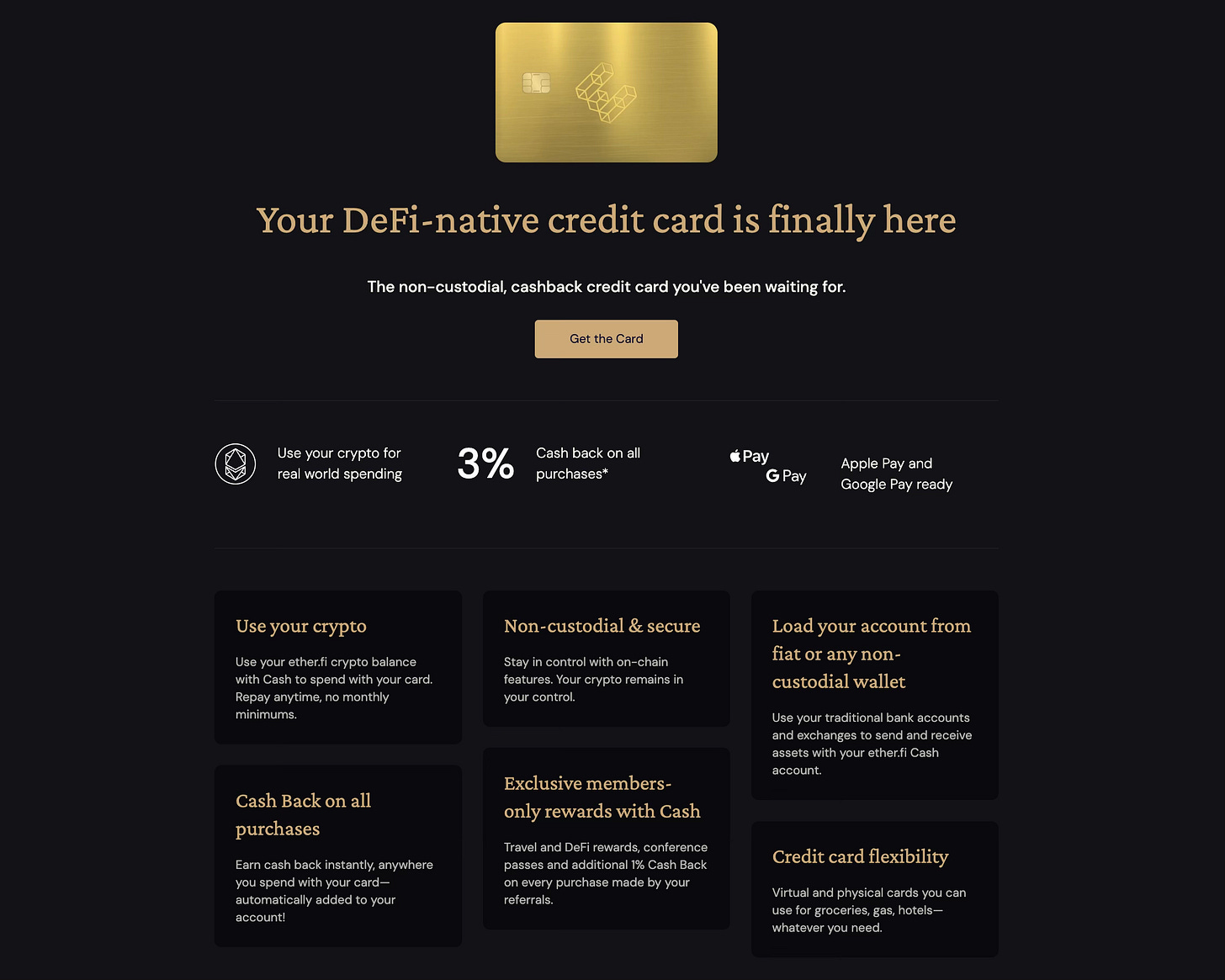

More recently, they introduced a killer product: Cash a DeFi-native credit card that lets you spend your crypto on real-world purchases, just like a regular card. What’s especially interesting is that you can borrow against your EtherFi balance to fund your purchases, all while staying non-custodial and secure.

In my opinion, this is one of the best crypto cards out there. Onboarding is smooth, UX is great, and KYC is fast and simple. They offer both virtual and physical cards, and the fee structure is transparent. The cashback program ranges from 2–3%, effectively offsetting the card fees.

And one last perk - EtherFi Hotels. Through their portal, you can book hotels with up to 65% off plus an extra 5% cashback on each booking.

So imagine this: you’re earning double-digit APY in the Liquid USD vault, using your card in borrow mode to pay for a hotel on EtherFi Hotels with a 65% discount and 5% cashback. Pretty wild and a no-brainer if you’re serious about using crypto in real life.

If you were always dreaming about a way to pay for everything with crypto, I would recommend you try this out.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.