3 Alpha Apps - Real Yield on Hyperliquid, Tokenized Time & a Solana Debit Card

Edition 4

Welcome to the alpha please newsletter.

The point of this series is to help you click buttons and stay active onchain each week. There’s always something to do that could provide outsized rewards in the future. Yes, the market isn’t great right now, but keep clicking and stay curious.

Here are three more apps for you:

This newsletter is made possible by Bungee 🙏

Bungee recently launched on Solana and they are running a raffle campaign where you can win some SOL for just using the app.

If you have never tried Bungee then this is the perfect moment. Swap Stables or any token from EVM to Solana and vice versa.

Bungee is powered by SOCKET’s chain abstraction, allowing users to move seamlessly across 30+ chains without friction. That means:

No bridges

No juggling wallets

No network switching

Again, Bungee is pre-token (how much do I need to cough?) and Socket - the chain abstraction protocol behind it - is the industry leader, which Bungee is built on. Don’t fade.

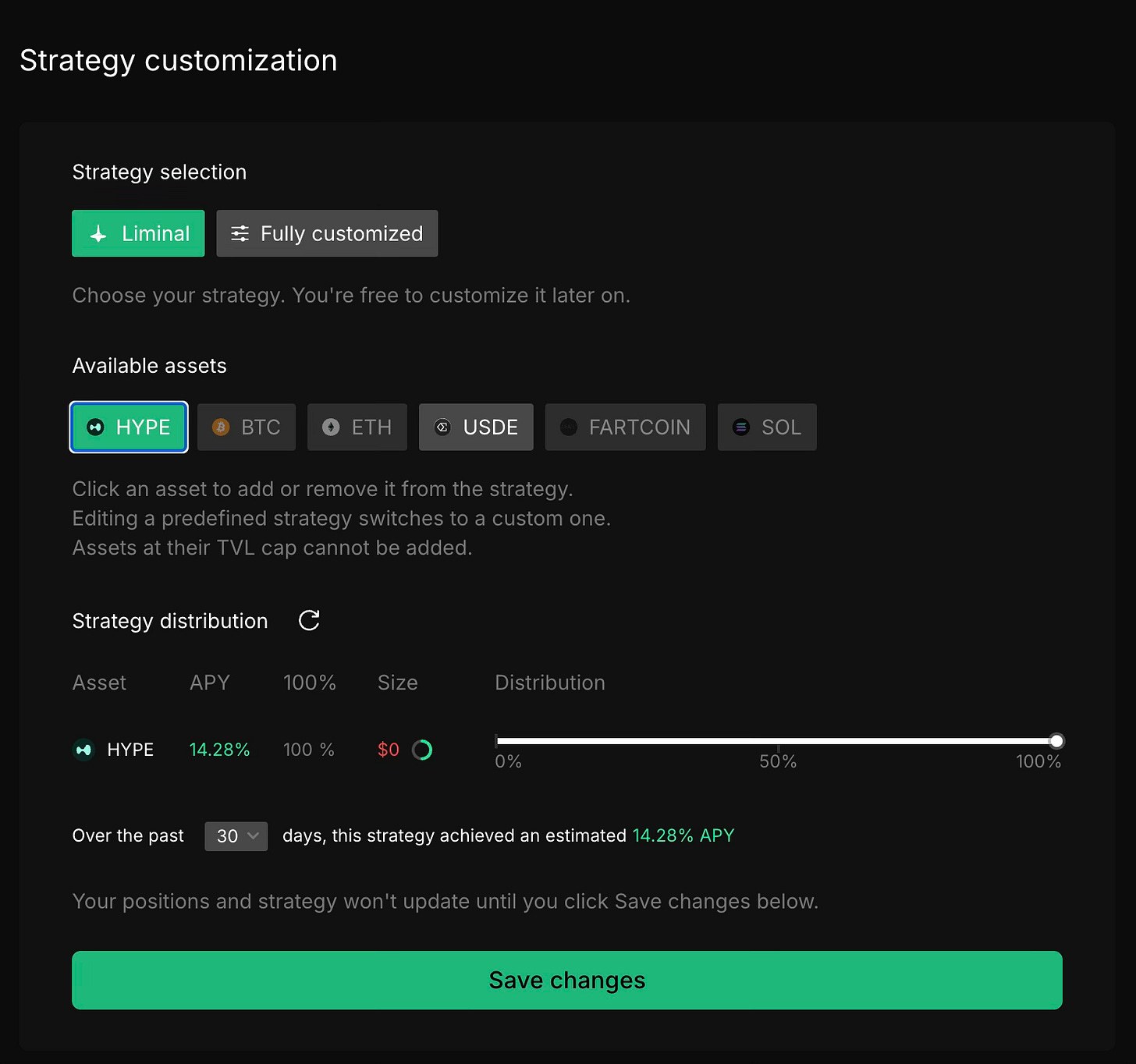

1.Liminal

Another HyperEVM protocol worth checking out is Liminal, a delta-neutral yield platform that enables users to earn real yield without market exposure. The concept is simple and similar to what Ethena is doing.

Here’s how it works:

Deposit USDC into Liminal via Hyperliquid’s native spot infrastructure or via Arbitrum, Ethereum, Base, or HyperEVM.

Liminal automatically deploys your funds into a delta-neutral strategy: a spot long (e.g., HYPE or BTC) paired with an equal-sized short perp.

This setup protects your position from market swings - the long and short offset each other - while you earn the funding rate on the short perp, which can be highly attractive.

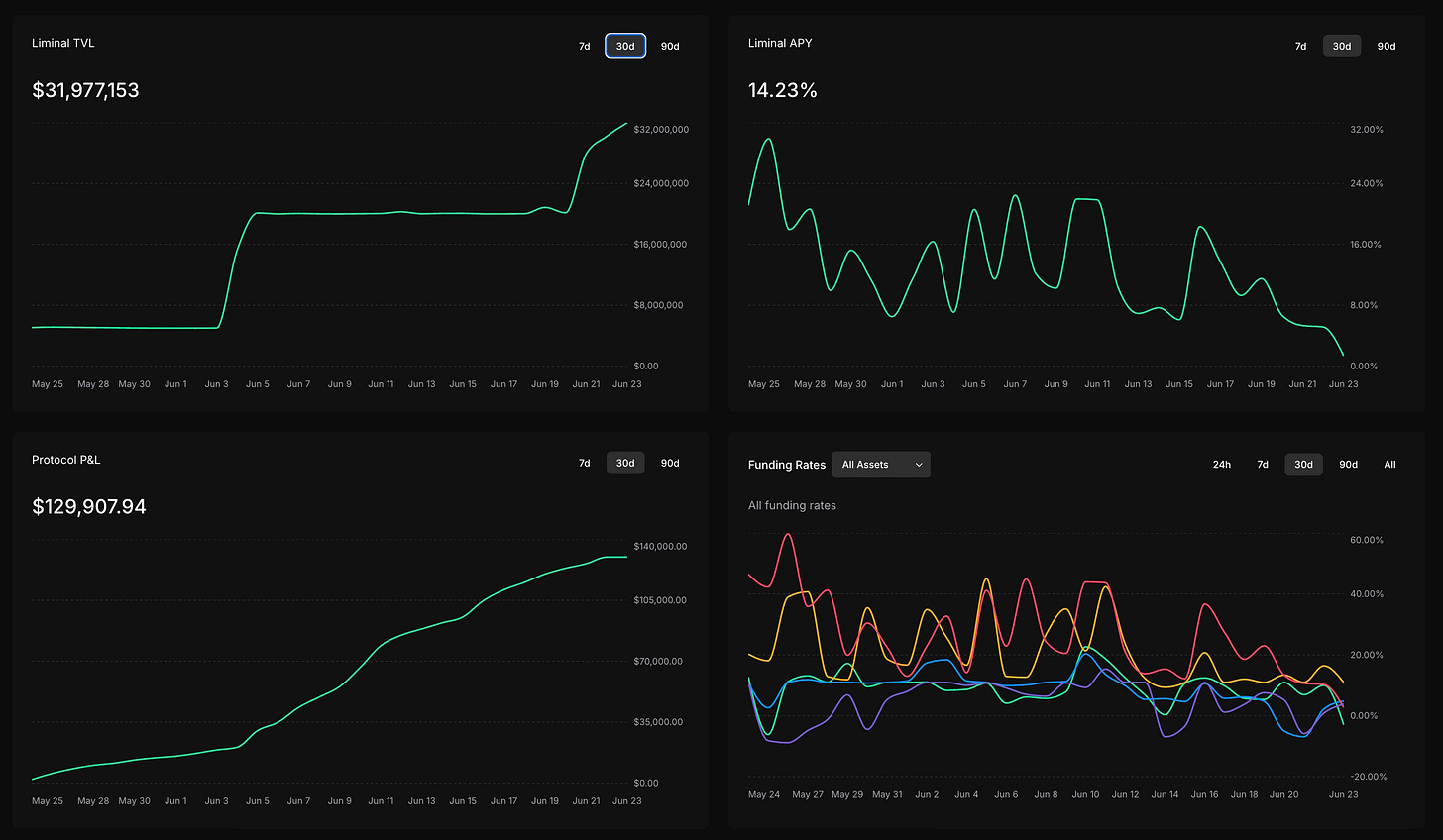

Liminal handles everything: it opens positions, optimizes entries, rebalances in real-time, and manages risk to avoid liquidations. There’s a live dashboard to track performance. The UX is clean and intuitive. You can withdraw funds at any time - no waiting, no deposit or withdrawal fees. The only fee is a 10% performance fee on the net funding you earn.

You can also customize your delta-neutral strategy - allocate across SOL, BTC, HYPE, or others. For example: 20% SOL, 50% BTC, 30% HYPE. Really cool, imo.

Why I like it:

Liminal is focused and simple. The strategy is sustainable, the yield is real, and everything, from strategy logic to fees, is transparent.

Risks to be aware of:

Funding can flip during sharp dips, making yield negative or minimal.

Spot-perp divergence during volatility can affect short-term PnL.

There’s general protocol risk, as with all of DeFi.

Still, I think the risk is relatively low. Hyperliquid is solid, and Liminal’s tech stack looks strong.

Current stats:

14.23% 30-day APY

$30M+ TVL

Pre-token

They also just introduced an epoch mechanism with asset caps and more features coming soon. Worth keeping a close eye on.

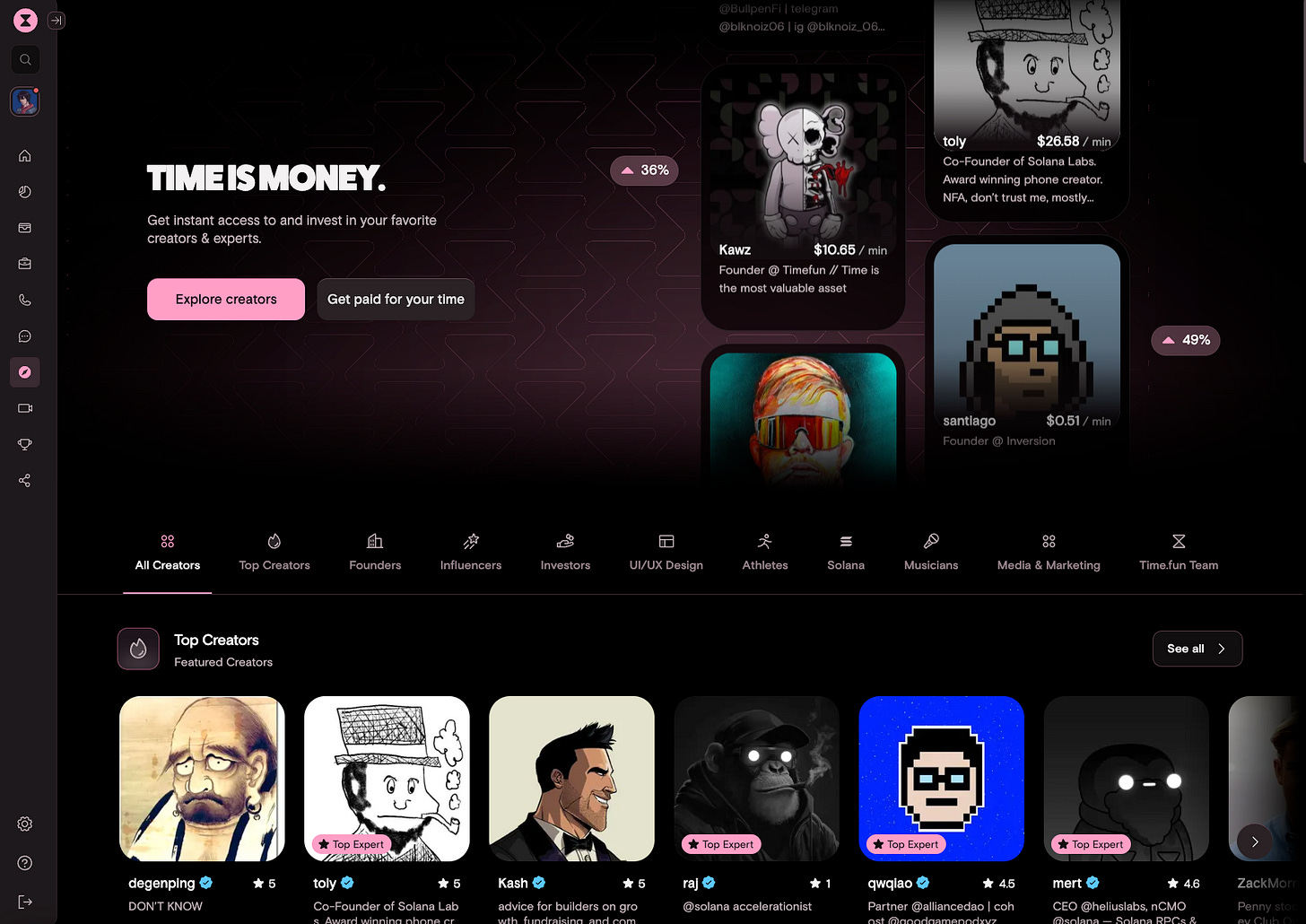

2. time.fun

In a world where attention is currency, time.fun is turning the concept literal. The platform allows anyone to buy, sell, and redeem minutes of creators’ time - transforming fan engagement into a liquid market.

Creators can tokenize their availability, letting fans trade or redeem minutes for exclusive access: from DMs and group chats to voice calls and future auctions.

The underlying mechanics resemble those of decentralized exchanges: trades occur along a bonding curve with a 2% fee, split between the platform, creator, referrer, and an award pool.

The platform originally trialled the concept on Base and then fully launched on Solana.

I think it’s one of the more interesting and novel apps we have seen recently, and it has picked up steam with leaders, builders and creators in the crypto space.

I signed up yesterday to test it out. You can buy my minutes, send me a DM, or hop on a call - I will do my best to answer every message.

Twitter DMs are fairly useless for me, as I just get spammed nonstop and scammers try and steal my money lol, so time.fun’s DM feature is a really great option for filtering noise and funnelling only serious messages.

There are some other features just launched like live streaming, and Q&A’s. I am going to have a think about how I utilize the platform.

time.fun is pre-token and they have a points system, so it is worth playing around and even buying some minutes of people that you like. Maybe there is a founder you would like to DM, or a trader that you would like to ask a question.

3.Kast

Once upon a time the dream was to buy anything using crypto, from your daily coffee to food or plane tickets, without needing to off-ramp through a bank. While we’re still far from a world where every shop accepts crypto or stablecoins directly, the rise of crypto card providers is bringing us a step closer to that reality.

Today, there are already a few solid options out there (and I’ve already covered EtherFi’s card, which is one of my go-to options). But until now, I hadn’t seen a strong card offering live on Solana, and Kast is the first great mobile app I’ve seen.

It is a new crypto card provider live on Solana that lets you save in stablecoins and spend them anywhere VISA is accepted. It is backed by a strong team and has raised $10 million to develop the project.

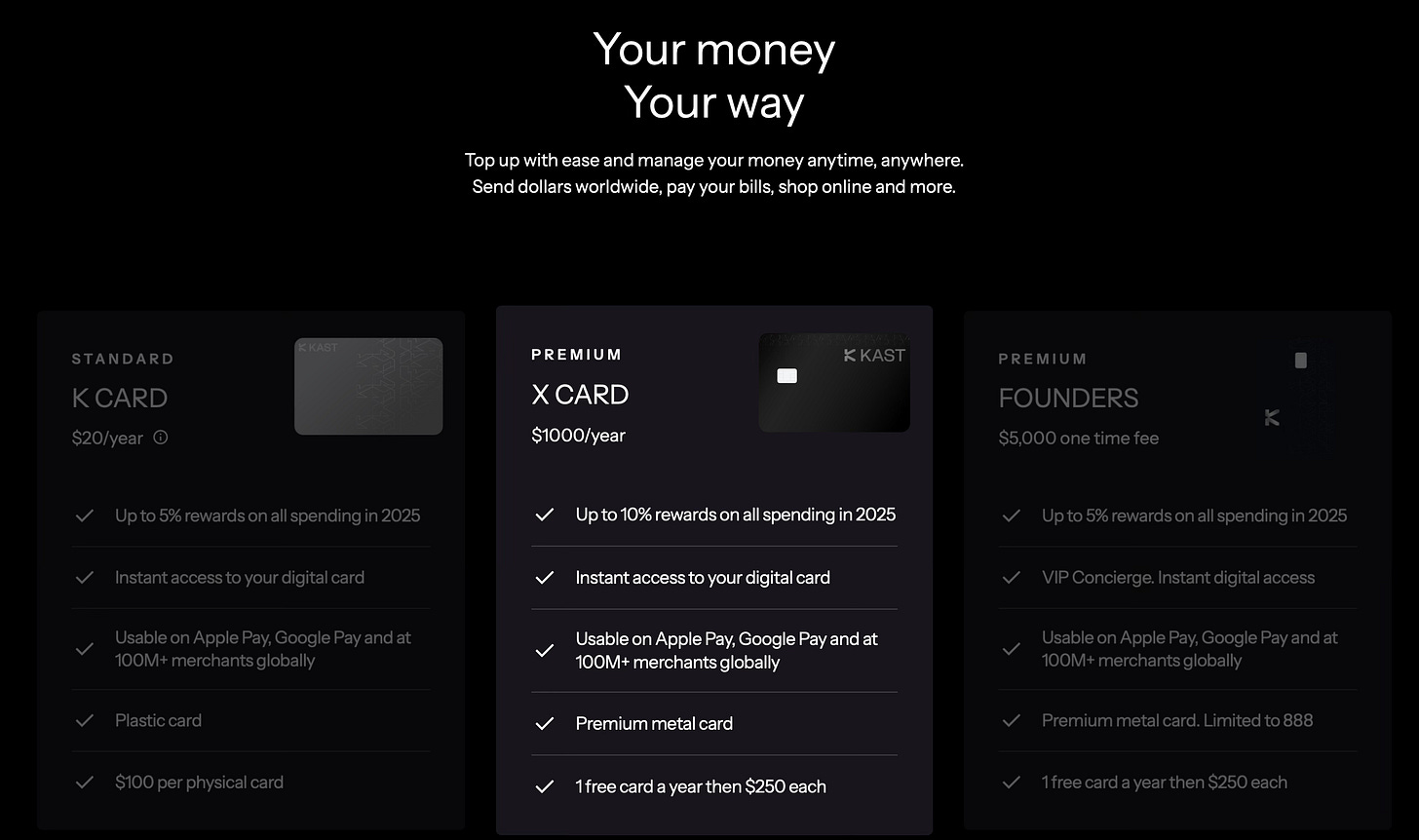

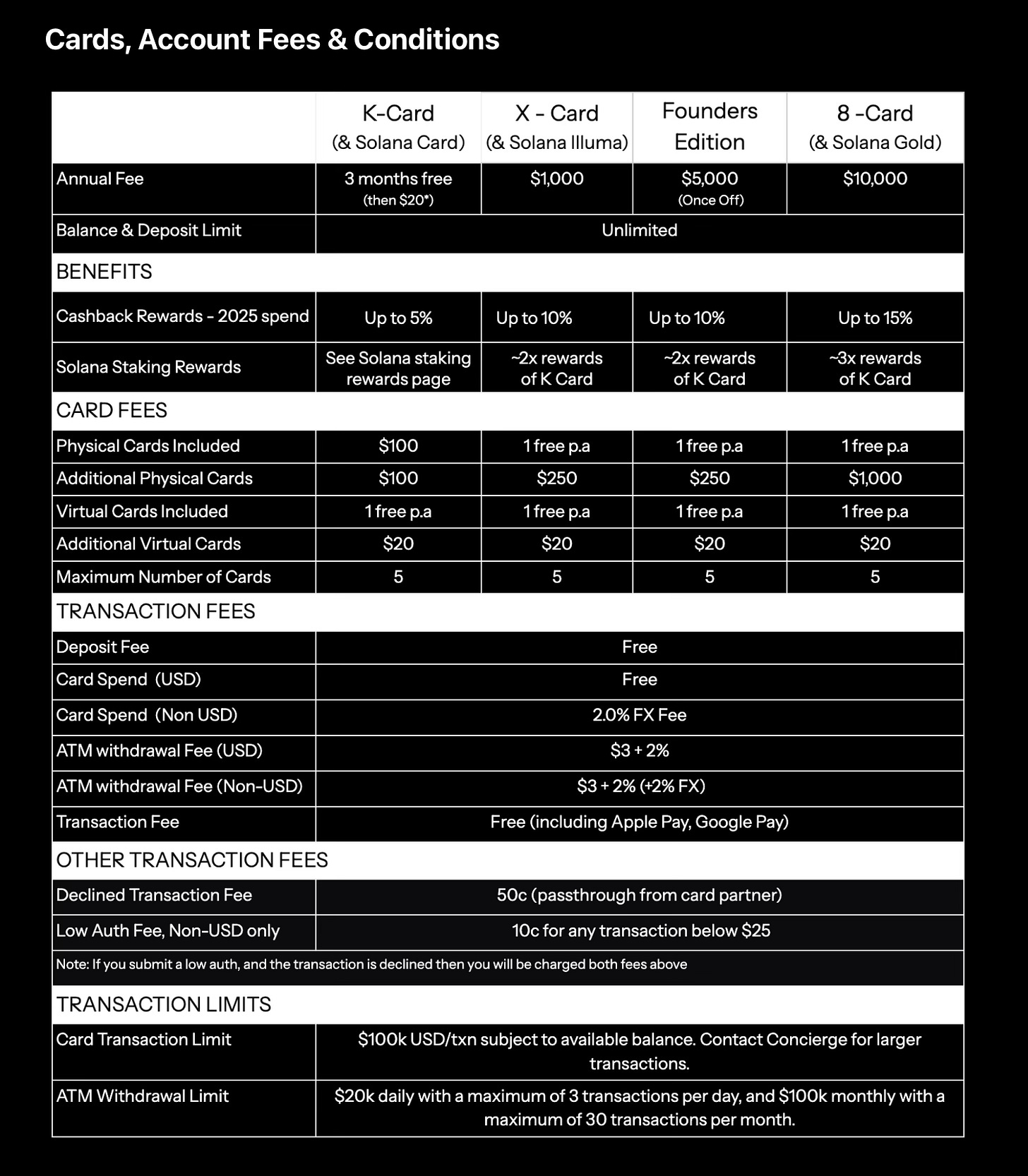

Onboarding is easy, UX is seamless, and the KYC process is straightforward. They offer different card options, both virtual and physical. Prices range from $20 per month for the basic card to a one-time fee of over $5,000 for the card with the highest benefits. They also have a special Solana Card collection as well.

In terms of fees, USD payments have a 0% fee, while non-USD transactions incur a standard 2% foreign exchange fee. A full breakdown of the fees can be found here:

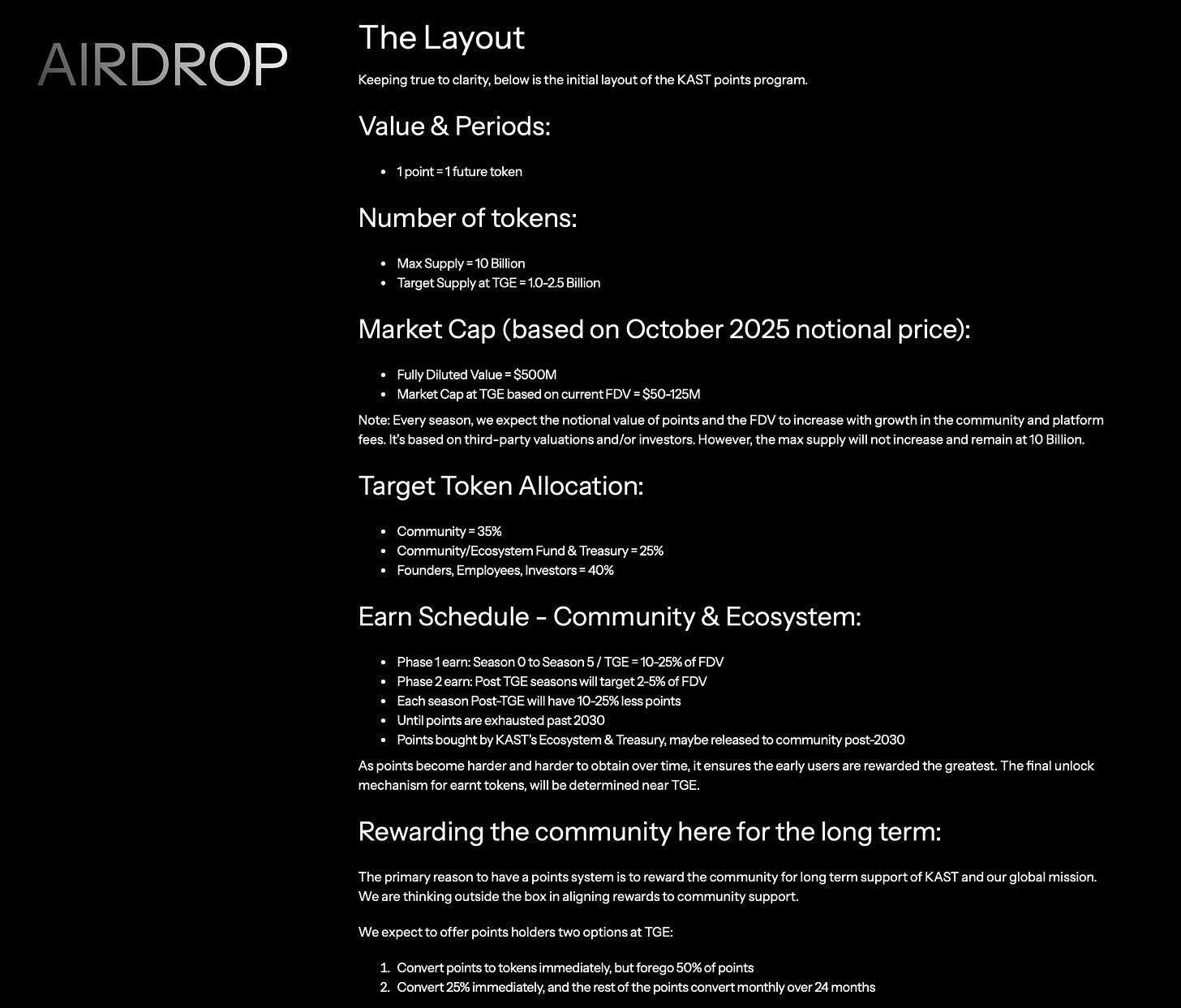

They also launched a points program: you earn points when you spend, and it’s fully transparent how these convert to tokens. Assuming a $500M FDV at TGE, cashback ranges from 5–15% depending on your card tier.

At TGE, you’ll choose between:

Convert all points now, but forfeit 50%

Convert 25% now, with the rest vesting over 24 months

So the airdrop won’t be fully liquid upfront.

TL;DR: Kast is worth considering if you’re looking for a new crypto card, especially if you use Solana. $20 per year for the basic virtual card is very reasonable.

Use this link to try out Kast (or scan the QR code with your phone).

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.