3 Alpha Apps - Polymarket Airdrop? Kamino’s V2 & Upshift Vaults

Edition 6

Welcome to the alpha please newsletter.

More apps. More opportunities. A bit more of a blend in here today: airdrop speculation + real yield.

Keep clicking those buttons.

This newsletter is made possible by Mantle 🙏

Mantle is one of the teams I respect most in the space. They’re building a powerful suite of products that are meaningfully advancing the global adoption of onchain finance.

From a high-performance Layer 2, to one of the best liquid ETH staking and restaking protocols, to FBTC, and a yield-bearing index offering easy exposure to the crypto asset class - Mantle just keep shipping. They’re also developing UR, which is a blockchain native bank. I’m currently testing it privately, and I can say with confidence that it is going to be huge for crypto natives. More on that soon.

I highly recommend reading their Q3 letter to token holders.

1. Upshift

At its core, one of DeFi’s founding principles was to remove intermediaries and democratize access to opportunities once reserved for institutions and accredited investors.

While there has been meaningful progress, DeFi remains a complex and fragmented world that can be difficult to navigate, especially for everyday users. This has created a growing gap in opportunities between professional and regular users, and it represents a key challenge that the space still needs to solve.

That’s where Upshift comes in.

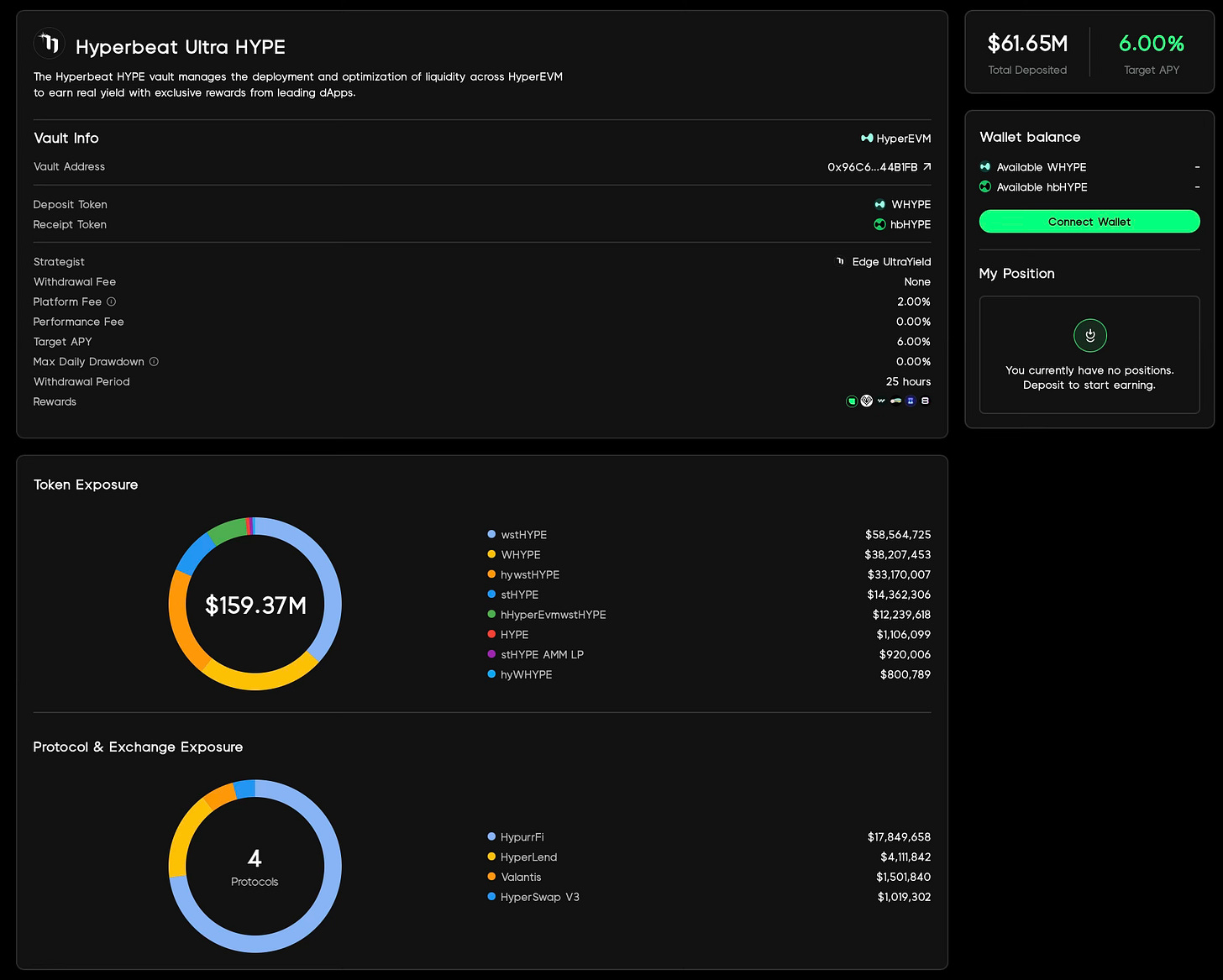

Upshift is a yield curation platform that makes institutional-grade DeFi strategies accessible to all. Its main products are DeFi vaults. Each vault targets a specific strategy and is managed by top-performing funds like MEV Capital, Ultrayield, and others. Strategies range from simple looping to more advanced setups like delta-neutral hedging, OTC options, and more, and offer access to top yield and point farming opportunities.

Each vault has a clear objective and provides a one-click, sit-and-forget way to get the most out of a particular DeFi play. The platform currently has around 20 active vaults over more than 5 different chains, and has grown to over $340M in TVL. That kind of traction shows there’s real demand for simplified access to top DeFi strategies.

All vaults are non-custodial and built on August infrastructure (which is very trustworthy, imo). The next step for Upshift is to tokenize each vault and make them composable across DeFi. This is a big deal: you will soon be able to use your receipt token to borrow against your position or use it in protocols like Pendle, Euler, Morpho, and more.

This new product focus coincides with the launch of Season 2 of their points program. So if you haven’t already, hurry up and give Upshift a try (it is one of the easiest way to put your assets to work in DeFi, so there aren’t many excuses not to try it).

Personally, my favorite vault on Upshift is the HyperBeat Ultra HYPE. It dynamically allocates your capital across HyperEVM DeFi protocols using delta-neutral strategies, funding arbitrage, and other opportunities.

If you follow my writing, you know how optimistic I am about this ecosystem, and with this vault, you earn points across 7 different protocols plus around 6% APY in $HYPE. Hard to do better.

My ref link to give Upshift a try:

2. Kamino

If you’ve been around Solana DeFi, Kamino needs no introduction: a blue-chip protocol with one of the best UX in the space, a top-notch team, and a consistent track record of shipping the best DeFi products on Solana.

About a month ago, Kamino reached another major milestone with the release of its long-awaited V2.

V2 is a major upgrade introducing 5 core products/upgrades: curated earn vaults, pro borrow UX, a modular markets layer, margin leverage, and even RWAs. In practice, this means new yield opportunities, more flexible lending markets, and better risk management and security.

Kamino was already a very competitive DeFi platform, but V2 takes it a step further. This is going to drive even more institutional and retail adoption. It is really an inflection point for the protocol.

If you’re active in Solana DeFi, I think it’s worth diving into the new features and exploring what’s now possible.

Some of the new play that caught my eyes:

New vault opportunities: You can now deposit capital into curated vaults that earn yield by deploying funds across Kamino Lend Markets. Each Earn Vault is managed by third-party risk managers, follows a specific risk mandate, and automatically rebalances to optimize returns. An interesting one right now is the Elemental USDC Turbo, which earns 8.35% APY.

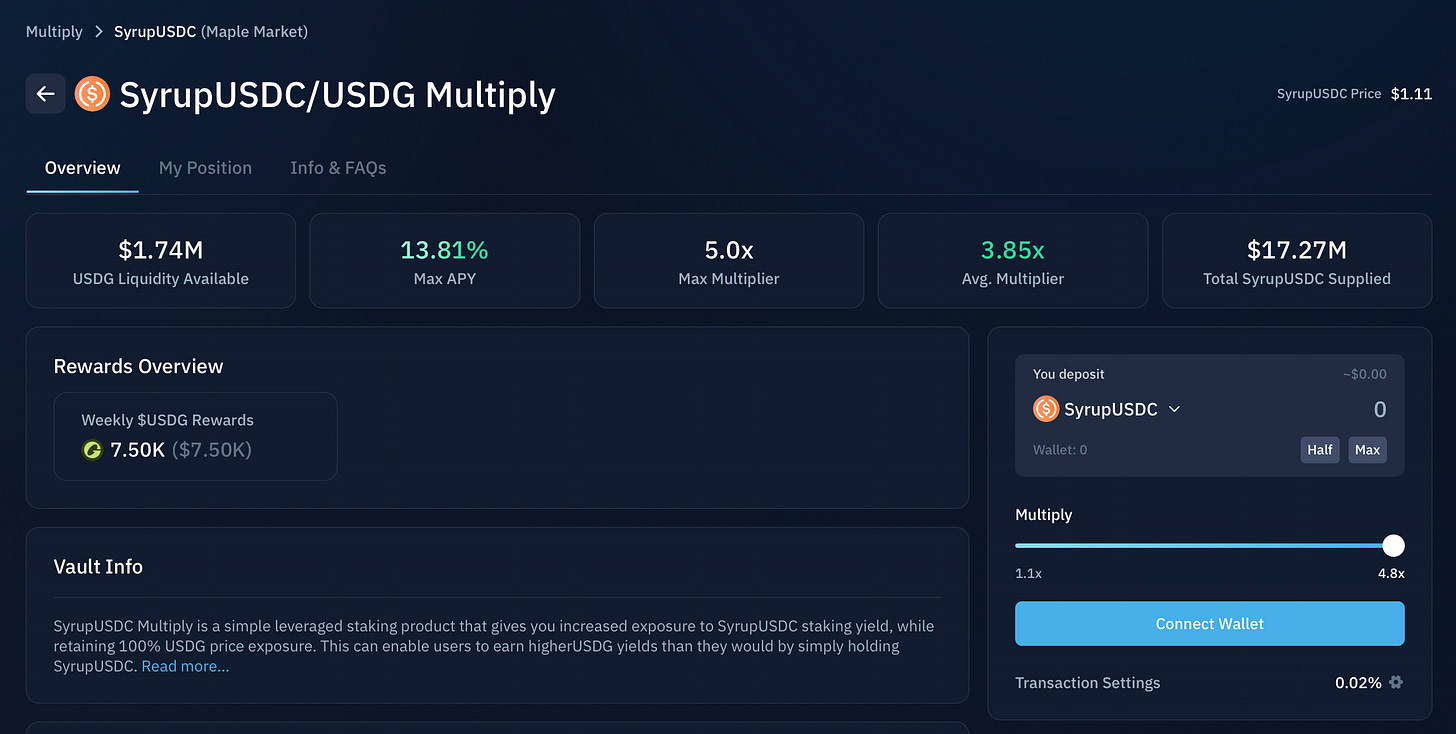

SyrupUSDC/USDG Multiply: One of the best opportunities in all of DeFi right now. The yield is a bit volatile but averages around 13-15% APY. I would definitely recommend you check it out.

PT looping with Exponent market: V2 also introduced new markets and one particularly interesting one is the Exponent Market, where you can loop your PT assets. This is giving rise to some of the highest yields on Solana. Currently, the two main assets being looped are PT-fragSOL and PT-kySOL. My favorite one is PT-kySOL as it offers the highest yield and with the longest maturity.

xStocks on Kamino: Another killer feature is the integration of xStocksFi on Solana. You can now go to Kamino Swap to buy and sell your favorite stocks, 24/7, and fully on-chain. Soon, these stocks will also be onboarded as collateral on Kamino Lend. The vision of trading the S&P 500 and other major stocks entirely on-chain and using them in DeFi is finally becoming a reality, and Kamino is helping power that revolution. This is a big deal.

There is a lot more interesting play to discover. But one thing is for sure, don’t fade Kamino.

3. Polymarket

Finding product-market fit is really hard in crypto, let alone gaining real organic traction afterward. So when you come across a project that has developed a killer new use case, nailed distribution, and built a solid, sustainable revenue model in crypto, you should not fade it.

Hyperliquid was a good example of that. But the more I study Polymarket, the more I realize it’s actually a killer app.

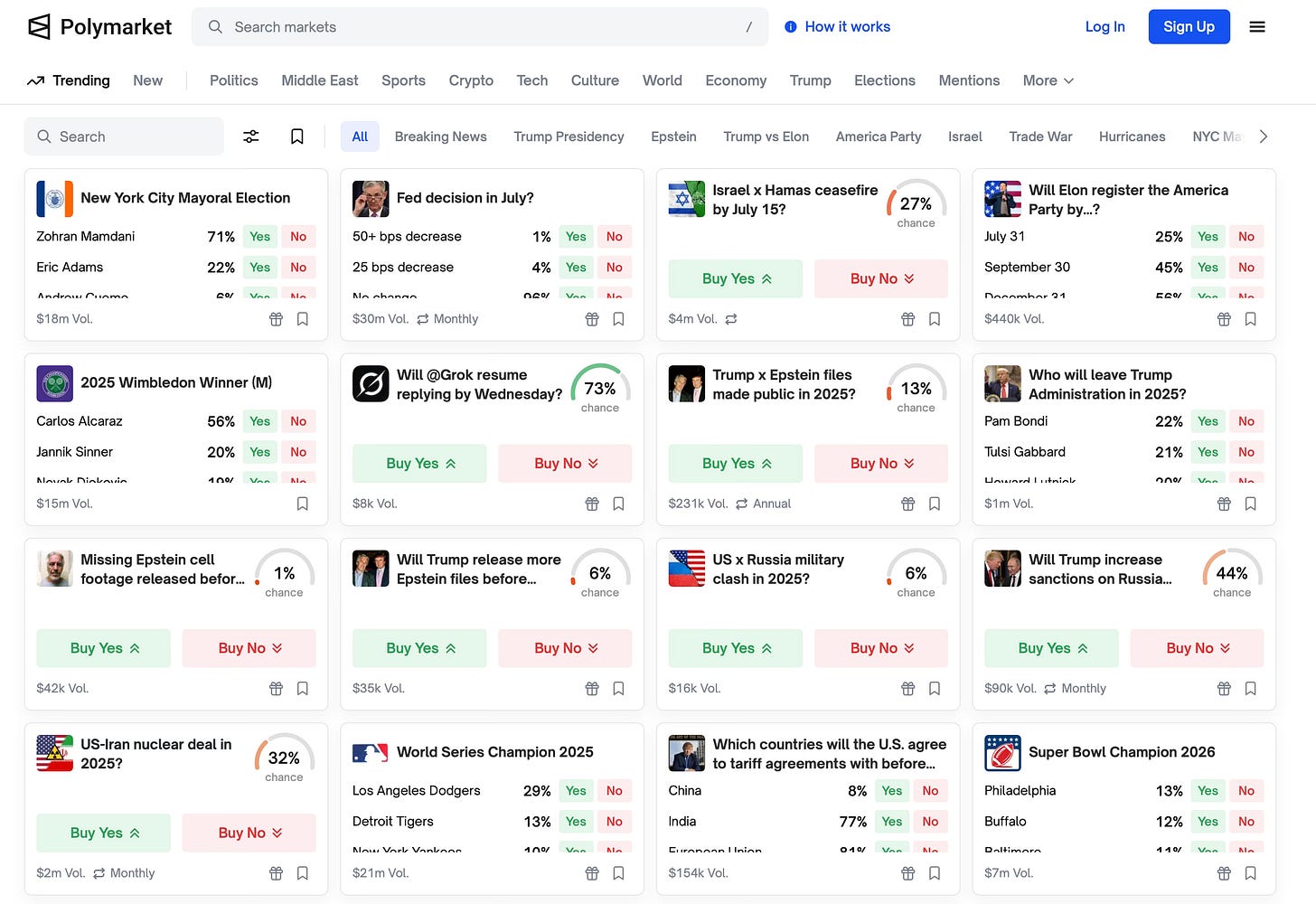

Polymarket is an onchain prediction market platform that allows everyone to speculate on the outcomes of real-world events, such as political elections, sports results, and even a lot of crypto related stuff.

While prediction markets are not necessarily a new concept and have existed for a long time, Polymarket is the first app that actually went mainstream. Indeed, it became particularly popular during the last US election, where Polymarket proved to be a far better indicator than the so-called experts on who was going to be president, reacting in real time to every new piece of news. In a sense, the accuracy of its markets and its controversies were one of the big reasons why it became so popular. Since then, the platform continues to grow.

Anyway, we are here for the alpha, so I won’t spend more time explaining what Polymarket is, but rather highlight the opportunity I am seeing.

As I mentioned, Polymarket is one of the rare crypto apps that checks all the boxes: real use case, strong traction, and a solid revenue model. On top of that, given the nature of the platform and the need for an arbiter of truth, I think it actually can make a lot of sense for it to eventually have its own token (some good thoughts from Ignas below).

If they do release a token and decide to run an airdrop (nothing confirmed, just pure speculation, but they did raise a lot of money), I think it could turn out to be pretty huge one.

Trying Polymarket is really easy. You just to visit the app, connect your wallet, send some funds, and start exploring the different markets. There are plenty of interesting options if you want to start trading.

Speculating on the airdrop:

One simple strategy you could do is to place bets on outcomes with near-certain probabilities, as this lets you generate volume while minimizing your risk.

Alternatively, another thing you could do is try out Polycule. It is a bot that lets you trade on Polymarket directly via Telegram. That may offer an additional airdrop one day. You just need to try out the app and follow the steps.

Of course, there is no guarantee they will actually launch a token or do an airdrop. And as always with crypto, there is risk involved and you can lose funds, so be careful and only put in what you are okay losing.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.