3 Alpha Apps - Pendle's New Platform: Boros & More

Edition 10

Welcome to the alpha please newsletter.

Every week I scour all of crypto to find interesting apps and opportunities to bring you.

So once again, here are 3 more apps.

The last one is an easy opportunity for everyone, you simply need to connect your X account.

This newsletter is made possible by Mantle 🙏

Something that I don’t think many people realize about Mantle is how many opportunities it creates for MNT holders.

When you add it all up, the yield is quite significant, for example, $1.28 earned per MNT token held.

There are currently several ongoing reward events that are definitely worth checking out.

Pendle (HyperEVM focus)

By now, Pendle is a household name in DeFi.

I started using Pendle in early 2023. Two years later, it has grown to over $7.7B in TVL and has become the go-to protocol for anything yield-related. And rightly so, it’s a top-notch product, and I have nothing but admiration for what the team has accomplished.

At this point, I suspect I’ll be a Pendle user forever, and some portion of my net worth will always be earning yield there.

Even though most of you reading this likely already know about Pendle, I still think it deserves a spot on this list.

Quick TL;DR of Pendle

Pendle is a yield trading protocol that splits yield-bearing assets into two parts:

PT (Principal Token)

YT (Yield Token)

Pendle allows PT and YT to be traded separately via its AMM, where users can provide single-sided, impermanent-loss-free liquidity using LP tokens. This unlocks new ways to hedge, speculate on fixed or implied yield, and boost returns.

As a Pendle user, here are the three main plays:

PT: Gives you fixed yield for a given duration, locked in upfront to eliminate rate volatility. However, you won’t earn protocol points or airdrops since you’re foregoing implied yield.

YT: Gives you exposure to implied yield (points, airdrops, incentives). You’re essentially farming protocol upside with leverage and no guaranteed return. Think of it as airdrop farming on steroids—high risk, high potential reward.

LP: Lets you provide single-sided liquidity to support specific Pendle markets. LP tokens consist of the underlying asset + PT, meaning you earn a mix of:

– PT’s fixed yield

– The asset’s native yield

– Swap fees from Pendle’s AMM

Personally, I’m a big fan of LP’ing. It feels like the best of both worlds. It’s usually my go-to strategy when I’m bullish on a DeFi project and want to earn juicy yields while maintaining exposure to potential airdrops and token upside.

Pendle x HyperEVM

Pendle recently launched on HyperEVM, unlocking some of the best yield opportunities at the moment.

Indeed, the launch was exceptional. In less than a week, it reached over $92M in TVL, $87M in trading volume, and secured integrations with top DeFi protocols.

Some of of my favorite plays:

1/ LP’ing

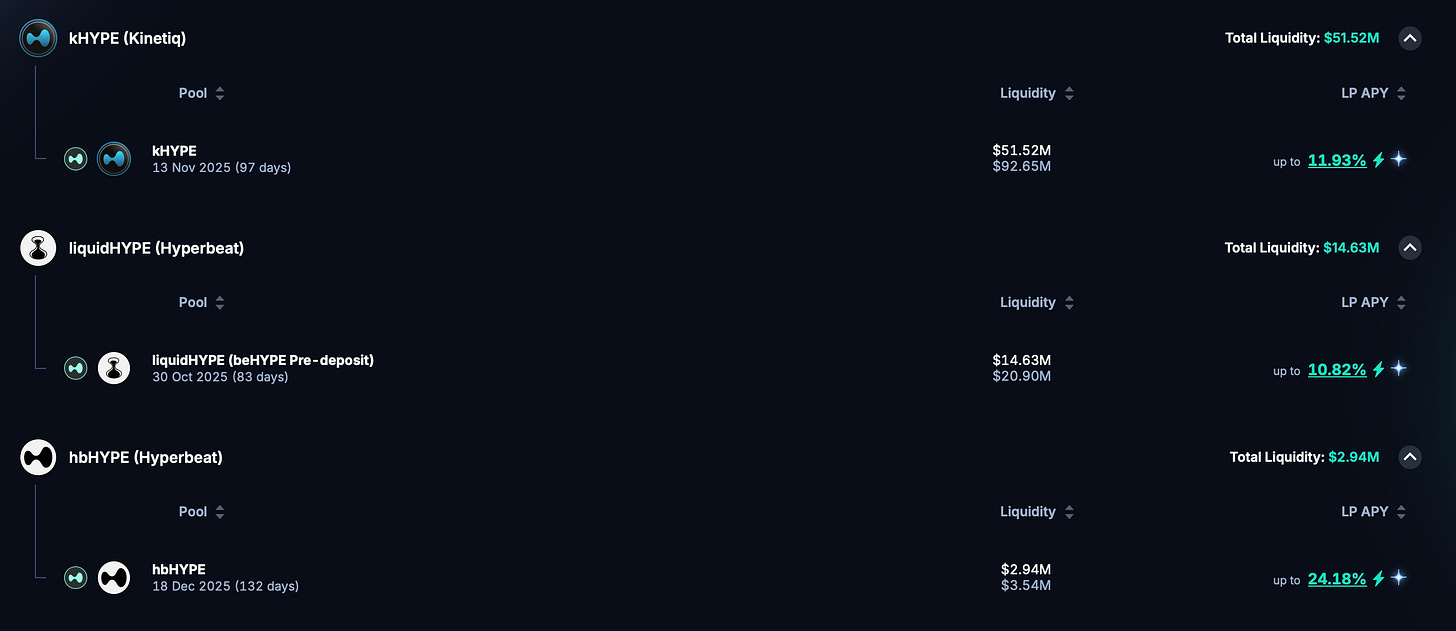

If you’re bullish on HYPE and want to earn a solid APY while maintaining exposure to a potential liquid staking protocol airdrop, you can LP with either kHYPE, liquidHYPE, or hbHYPE to earn between 10–17% APY.

My personal favorite is LP-kHYPE, because I’m most bullish on Kinetiq and believe the airdrop could be very rewarding.

You can also LP hbUSDT, Hyperbeat’s stablecoin vault, for 14% APY.

Additionally, Pendle recently integrated:

sUSDe (with 30x Sats bonus)

hwHLP (a yield-bearing token representing HLP, a vault powering market making and liquidation on Hyperliquid)

These two markets are still early with low liquidity, but the yields are extremely attractive.

2/ PT (with some extra looping)

If your goal is to maximize yield and you’re okay with foregoing airdrop exposure, then PT is for you. On the stablecoin side, you can currently secure 10–13% APY with PT-hbUSDT, PT-sUSDe, or PT-hwHLP.

If you want HYPE exposure, PT-kHYPE is a great option. It currently offers up to 10.41% fixed APY.

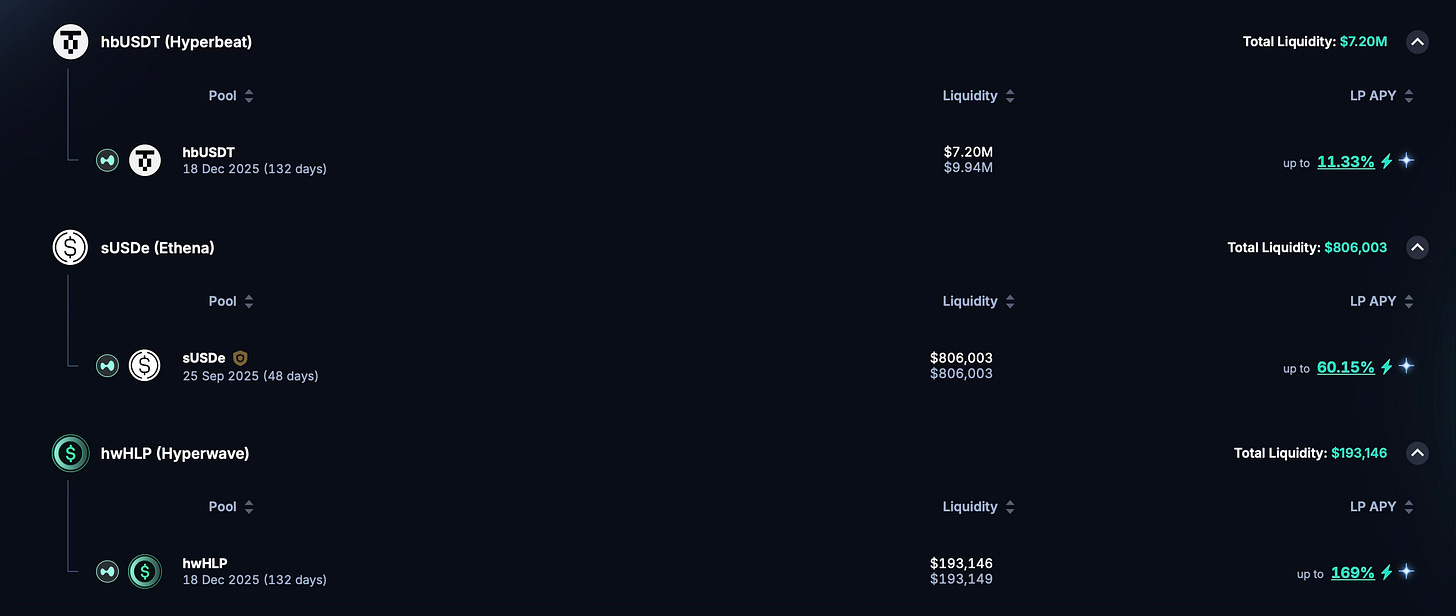

You can even take it further by using PT-kHYPE as collateral for looping strategies on DeFi protocols like Felix or Hyperlend, where it’s already integrated. This can push yields as high as 35%, making it one of the juiciest yield plays on HYPE right now.

Here’s a full breakdown of this play from the one and only Pendle Intern:

Pendle on HyperEVM is just getting started. I expect more assets and integrations to come soon.

Definitely worth keeping an eye on.

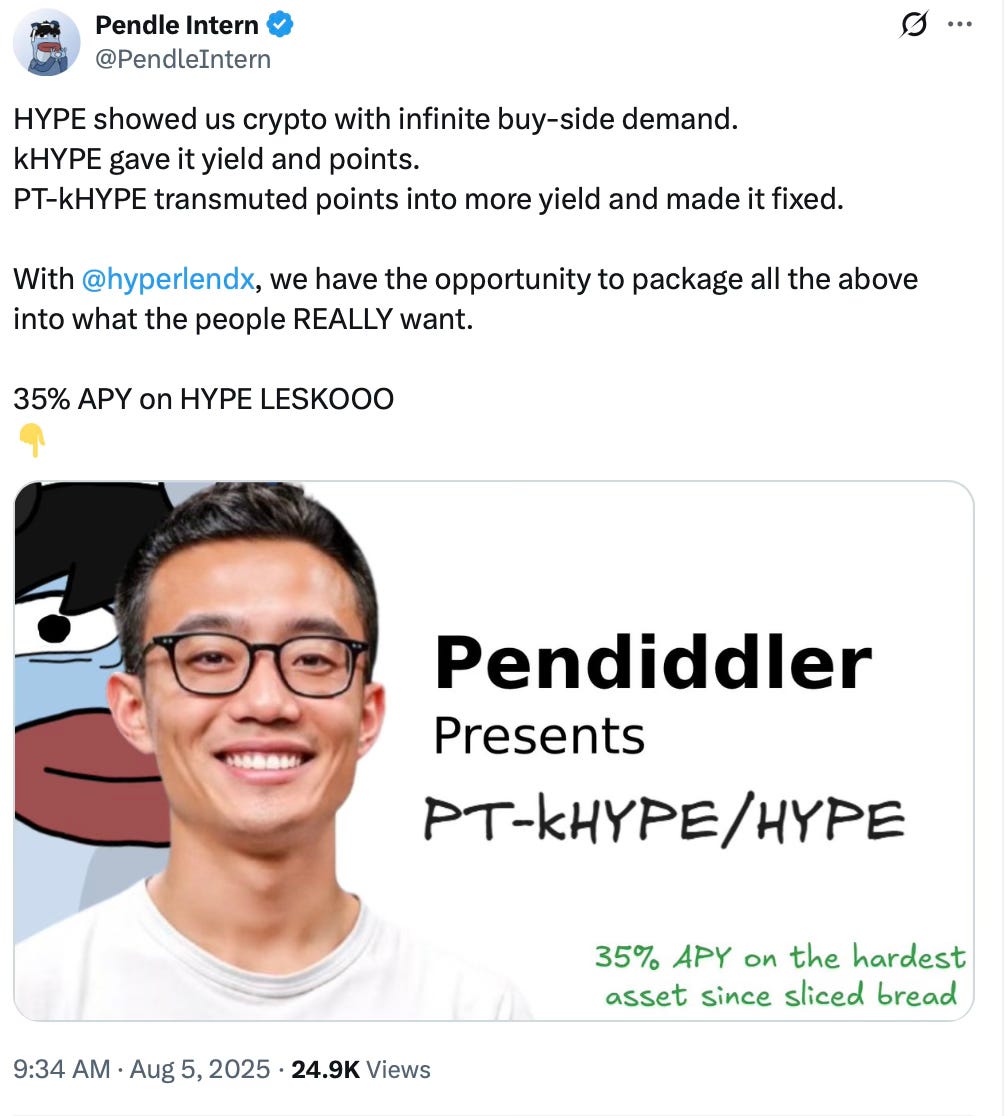

Boros

Thought we were done with Pendle? Not quite.

Pendle recently launched Boros, an exciting new product that deserves attention.

Boros is a yield trading platform that lets you trade funding rates, both onchain and offchain. Just like an exchange lets you trade an asset, Boros enables you to buy and sell funding rates across markets.

Funding rate 101

Put simply:

Funding rates are what traders in perpetual contracts pay to each other at regular intervals.

Their purpose is to align the perpetual price with the spot price.

When longs > shorts, funding is positive (longs pay shorts).

When shorts > longs, funding is negative (shorts pay longs).

How does Boros work?

Boros tokenizes funding into what it calls Yield Units (YUs). Each YU represents the funding rate of 1 unit of an underlying token on a specific exchange, until a set maturity. (If you’re familiar with Pendle, it’s similar to a YT.)

Example:

In a BTCUSDT (Binance) market on Boros, with BTC as collateral, one YU represents the funding rate of 1 BTC on Binance.

Boros then enables trading of YUs:

If you’re bullish on funding rates, you can go long.

If you’re bearish, you can short them.

This unlocks powerful new yield primitives.

While speculating on funding rates is the clear first use case, Boros also enables:

Hedging for perp traders with floating rate exposure

Locking in funding yield for large cash-and-carry traders

Rate hedging for protocols (e.g., Ethena) that want to manage funding volatility

One day it could even become a very useful feature for massive protocols like Ethena, who could potentially lock in future funding rates during specific moments or hedge when they anticipate periods of negative funding (like during a bear market).

All in all, this is a killer protocol, and I’m genuinely excited about it. This new launch also reinforces Pendle’s position as a top-tier DeFi venue. Truly a top team and a top protocol.

The Alpha

I must admit, if you're not familiar with perps or Pendle, this can be a tough protocol to grasp at first. But I highly recommend digging into it and giving Boros a try.

As perps continue to grow in volume relative to spot markets, funding rates are becoming increasingly important, and that is creating some interesting opportunities and Boros will be at the center of that.

Last but not least, to keep expectations in check, it is worth noting that Boros is launching under the same hood as Pendle, so it's unlikely there will be an airdrop for using it.

But PENDLE will benefit from it.

Vibes

We already covered a lot of info in today’s piece, so I am going to be quick on this one.

Vibes is a new perp DEX that aims to let you directly long and short mindshare, narratives, and sentiment.

The idea is both cool and ambitious. But for now, the product is still in its early stages and not yet ready for full public release. So it is difficult to assess its true potential or how well it will actually perform. Still, it is an interesting experiment worth following.

Vibes has recently launched its first big campaign where you can start earning Vibes simply by connecting your X account to the app. It is low effort, and you have absolutely nothing to lose by doing it.

How to earn Vibes?

Connect your X account to the platform

Keep using X as usual, and try to post regularly about market sentiment

Claim your Vibes

It is simple, costs nothing, and who knows, maybe something good happens in the future with Vibes.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Great alpha, do you have an invite code for vibes?

Gm bro.

I'm seeing there are lots of opportunities in the Abstract chain that many people are talking about. We'll be grateful if you can cover it also Sir 🙏🙏. Thanks