3 Alpha Apps - New Stablecoin Farm on Solana, Options on HyperEVM & Prediction Markets Mobile app

Edition 17

Welcome to the alpha please newsletter.

There’s a lot of cool new projects are popping up left and right. Time to lock in and make the most of these opportunities while they last.

Here are 3 new apps worth trying this week.

This newsletter is made possible by Mantle 🙏

MNT has a number of benefits which can optimize your trading on Bybit.

You can get to VIP tier by simply holding MNT, alongside getting discounts on your trading fees, and access to other rewards.

They have a special event running right now that is worth checking out.

1. Rysk Finance

When it comes to airdrop farming, the best strategy isn’t to start using a new protocol once the consensus thinks it’s going to cook. The nature of markets is such that if the average participant is already talking about an opportunity, it usually means the most asymmetric upside is likely gone (the kind of opportunity that can make you jump the wealth ladder).

Being an early user of Hyperliquid was far from consensus when it first launched. But those who saw the potential early made outsized returns because they were both early and right.

So while other perp DEXs might still deliver big airdrops, and while Hyperliquid may still cook one of the largest one (and still 100% worth farming) I don’t think the opportunity will be as asymmetric as the first HYPE drop.

Now of course, it’s very hard to know what the next big meta will be (and that’s why the potential rewards are huge). But personally, I have a few sectors I’m excited about, and one of them is options, which I still see as an untapped vertical in crypto.

One early stage opportunities that I particularly like in this sector is Rysk Finance.

Rysk Finance is an options protocol live on the HyperEVM that gives you access to options strategies on Hyperliquid assets. The two main strategies they offer are secured puts and covered calls.

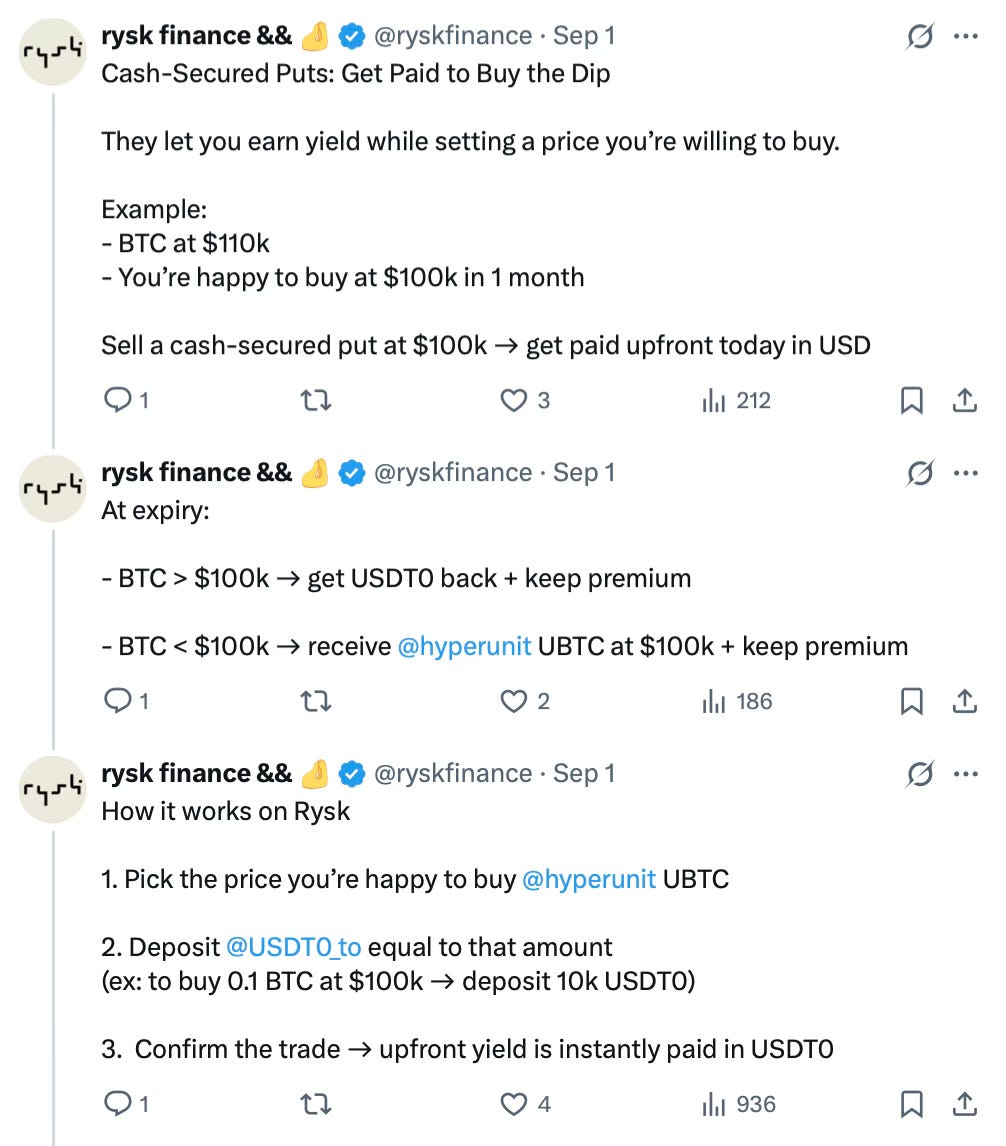

Secured Puts:

You can think of it as “getting paid to buy the dip.”

You lock up stablecoins and choose the price at which you’d be happy to buy an asset (like HYPE or BTC). If the market dips to that price, you automatically buy it. If it doesn’t, you simply keep the premium you earned for selling that option.

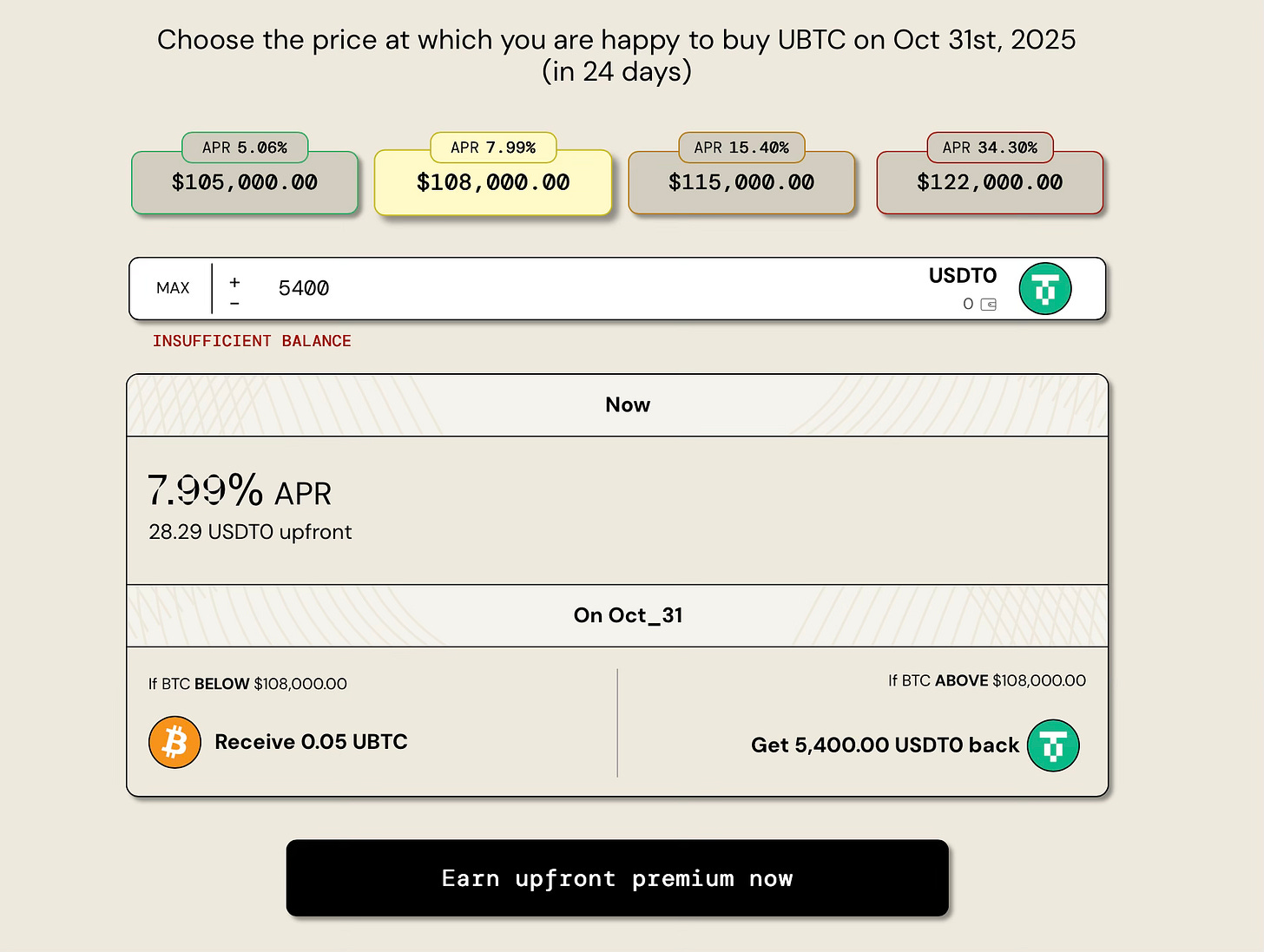

For instance, if you want the option to buy the dip (while still earning a premium and Rysk points), you could set up a secured put to buy BTC below $108k until October 31 by locking some USDT0 now. If BTC doesn’t drop to that price, you simply keep your funds and the premium you earned.

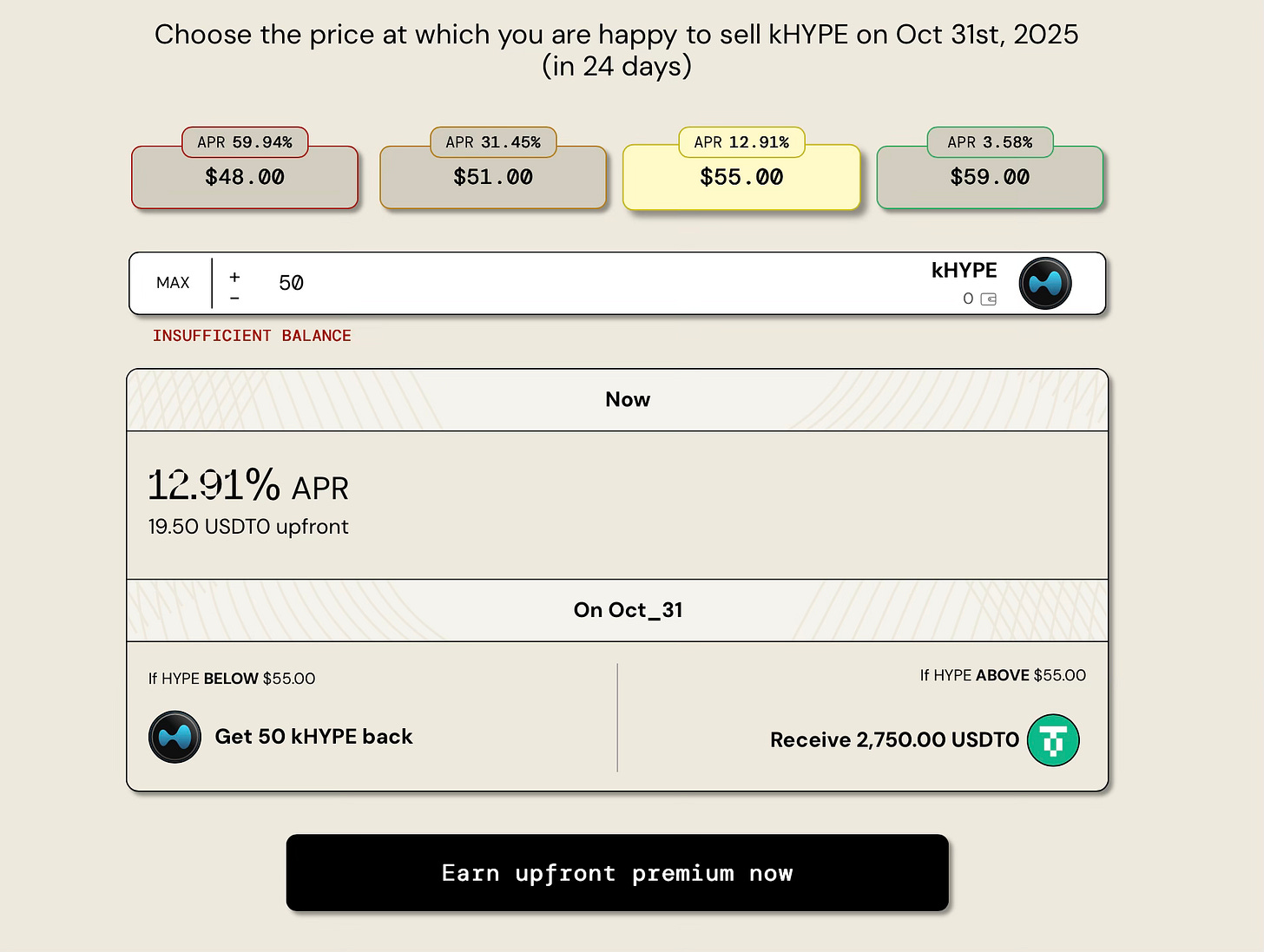

Covered Calls:

This one is the opposite, it’s like “getting paid to sell the top.”

You lock up your asset and agree to sell it if the price reaches a target level. If it does, your position sells automatically. If it doesn’t, you keep your asset and also earn the premium.

For instance, you could set a target to sell your kHYPE at $55 until October 31. You just need to lock your kHYPE and earn 12.91% APR upfront. If kHYPE crosses $55, you sell it automatically at that price. If it doesn’t, you simply get your kHYPE back (and you’ll also earn Kinetiq points in the process).

Honestly, Rysk has some great earning opportunities right now, and it’s still a super early project. The UI is intuitive, so even if you know nothing about options, you can quickly figure out how it works.

The only drawback is that the entry barrier is a bit high. For example, you need at least 50 kHYPE or around $5k to open a BTC secured put. But in a way, that also filters out the noise, meaning less competition for early farmers if you have the funds.

If you’re interested, I highly encourage you to check out their docs to better understand how everything works, then try it for yourself.

As always with DeFi and especially derivatives, remember that this carries risk, so only move forward if you fully understand what you’re doing and are comfortable with the downside.

2. Solstice

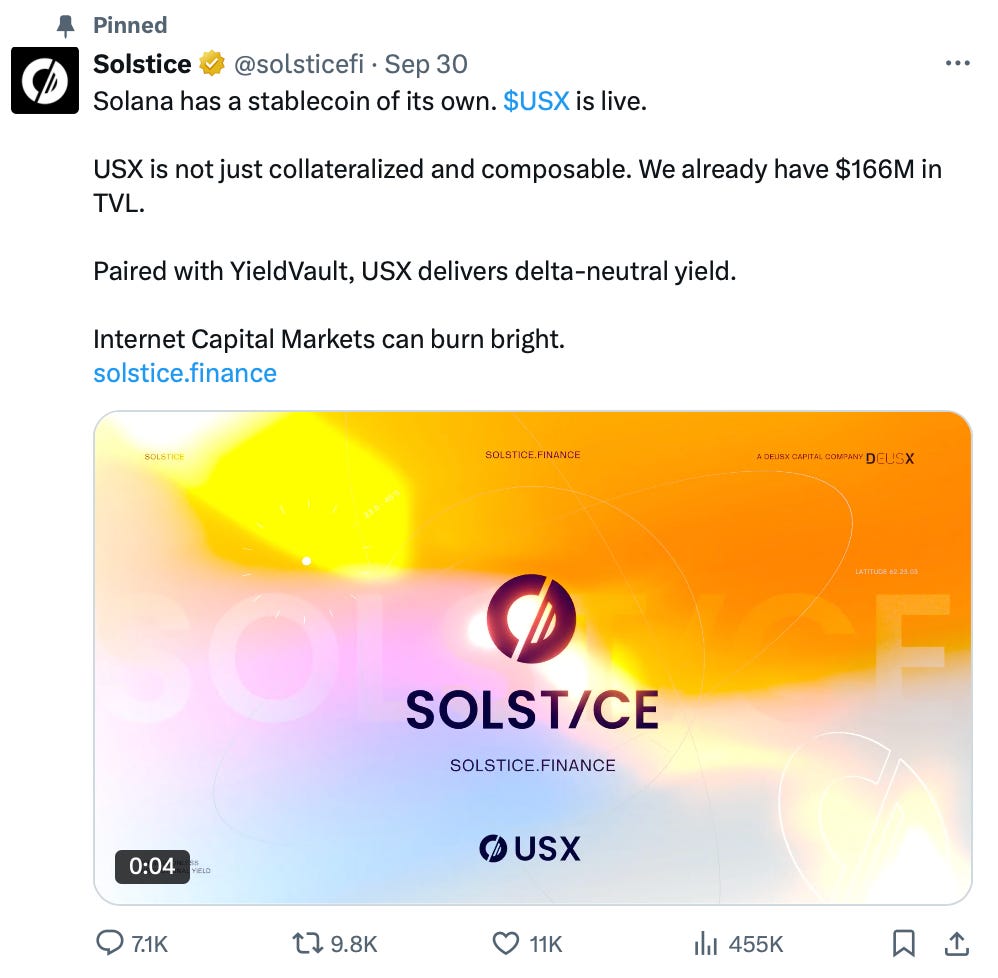

Stablecoins are a hot topic right now. Among the new protocols, one interesting one that just launched on Solana is Solstice.

You can think of Solstice as a Solana-native version of Ethena. Its main product is USX, an over-collateralized synthetic stablecoin designed to stay pegged to $1 through delta-neutral positions. On the other hand, eUSX is the yield-bearing version the yield-bearing version of USX and accrues the yield from the trading strategy.

Solstice launched just over a week ago and has already amassed over $200M in TVL, which is a strong start. While I have some doubts about whether it can grow enough to become a leading stablecoin on Solana, I still think it’s an interesting project worth farming: it has strong support from the Solana ecosystem, good yields, low risk, and a nice airdrop potential.

How to take advantage:

Deposit USDC to mint USX.

Stake USX into eUSX to earn around 10.2% yield.

Use my code xyz to get a multiplier on Flare points.

Last but not least, you can even put those assets to work in DeFi (for instance, you can LP on Raydium for a 10× multiplier).

What is interesting is that the team already mentioned that the SLX TGE is expected to happen by EOY, so it can be a good play if you have some stables on Solana.

As well, the tokenomics of the project are also super interesting, as SLX only unlocks when TVL milestones are hit - no VC cliffs, no time-based unlocks. The community grows the supply through TVL, and as project KPIs increase, more tokens are issued.

This is a very interesting and new approach for a protocol, which aligns all the project’s key stakeholders in a clean and transparent way.

Try Solstice now and use my referral code to start earning Flares: 5uJSssXVfE

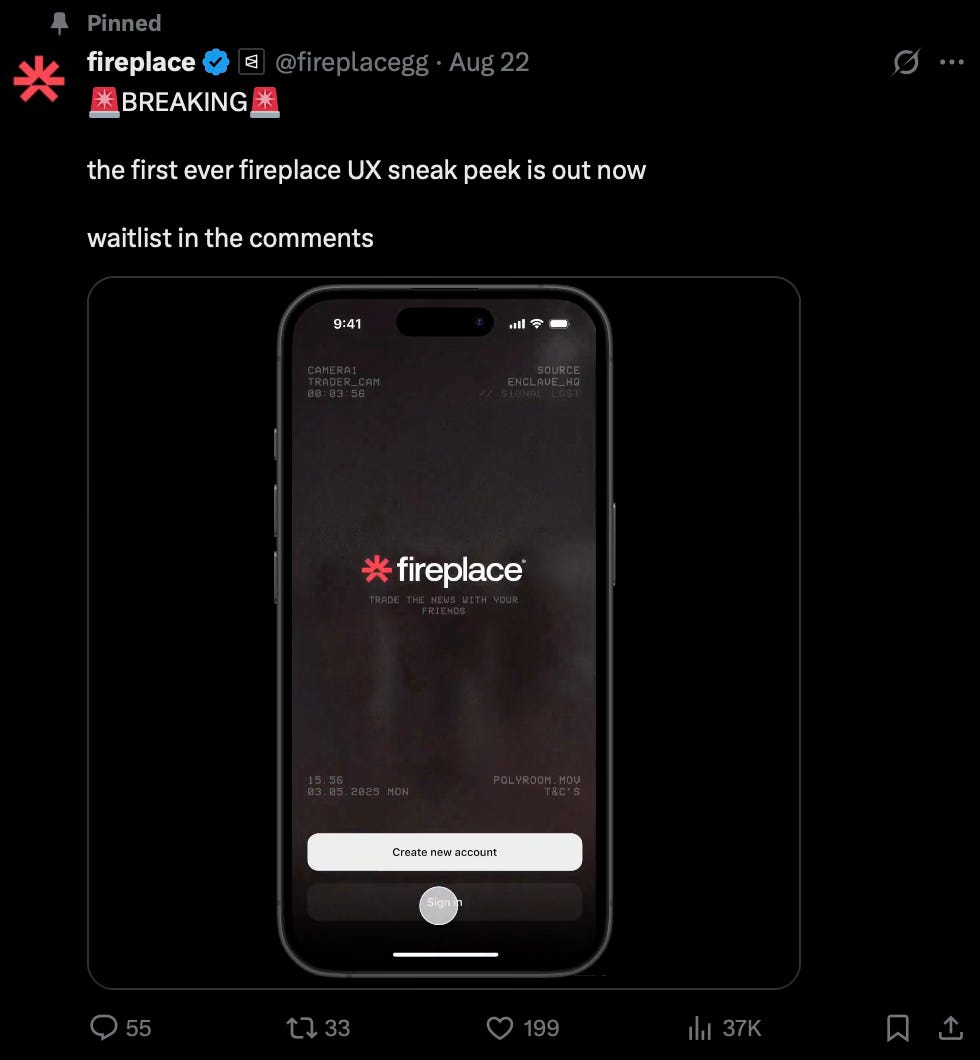

3. Fireplace

For today’s third app, I’ll cover a new project in another sector I’m really bullish on: prediction markets.

Fireplace aims to become the most normie-friendly app for participating in prediction markets.

To do so, they’re building a mobile-first app designed for seamless UX, with features like hyper-personalized feeds and unified deposit addresses (so you can deposit any token from any chain, no need to bridge).

Under the hood, Fireplace aggregates markets from Polymarket and Kalshi to give users the best experience, and it also integrates social features, making the experience more interactive and fun with your friends.

This is an interesting project in a very promising market. However, it’s still early-stage, and the team has everything to prove, so it’s difficult to assess how well it will perform just yet. But, it’s definitely one to keep an eye on.

You can join their waitlist today to make sure you don’t miss out when they go live.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.