3 Alpha Apps - New LST on Hyperliquid, BTCFi & Pokémon Card Flipping

Edition 7

Welcome to the alpha please newsletter.

The market is heating up and everyone is starting to get excited. But that’s not a reason to stop exploring and trying new apps. Remember, fortune rewards consistency.

So here are 3 more apps for this week (all pre-token):

This newsletter is made possible by Mantle 🙏

There are some pretty cool ways to put cmETH to work on HyperEVM, and potentially land multiple airdrops.

You can earn APY on your ETH, qualify for the COOK airdrop (Season 3), earn points in various HyperEVM protocols, and maybe (hopefully) even receive a HYPE airdrop one day.

Definitely worth checking out what you can do with your cmETH.

Kinetiq

You know the drill by now, each week I like to highlight a HyperEVM app I think is worth trying out (didn’t I say it’s one of the most exciting ecosystems in crypto?).

This week, I am covering Kinetiq.

Kinetiq is a top protocol building liquid staking on Hyperliquid where you can stake HYPE and receive Kinetiq Staked HYPE (kHYPE) in return. kHYPE is fully liquid, usable across DeFi, and automatically accrues staking rewards. In a sense, Kinetiq is similar to what Jito is for Solana.

Today, liquid staking has become a key part of PoS blockchains as it democratize access to staking and help makes networks more resilient. On Hyperliquid, kHYPE is one of the most anticipated LSTs, which makes the opportunity even more appealing. Here's a good article from Felix which explains well why they are excited about it.

The Kinetiq mainnet launched yesterday (15th July) and made a lot of noise, with already over $425M in TVL in the protocol. That tells you just how much hype there was around it.

Yesterday also marked the beginning of their points program, which distributes 800k points weekly. This means you’re still really early if you want to try out the protocol.

If you have some HYPE, it could be a wise move to stake some of it there. Plus, since kHYPE is (and will be) integrated into all major DeFi venues on HyperEVM, you will be able to use it in all your DeFi strategies on Felix and other protocols. This means there is no real opportunity using Kinetiq.

TL;DR: Staking rewards on HYPE + Kinetiq points (tier-1 protocol on Hyperliquid) + full DeFi compatibility. Not a bad combo.

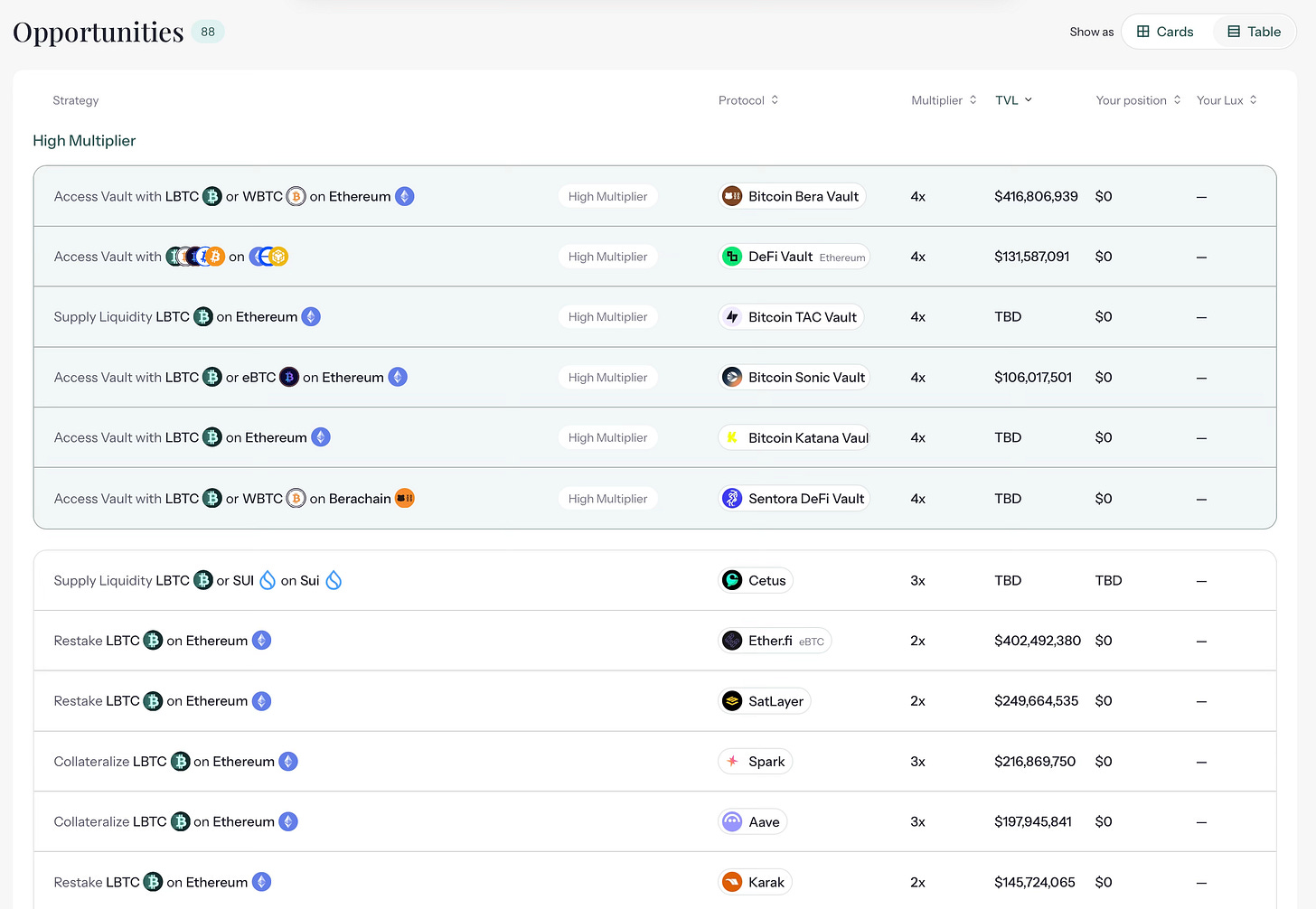

Lombard

We are in the first cycle where there is real momentum behind making BTC a more productive asset - one that can earn yield and be fully usable in DeFi. Because when you think about it, BTC is a $2.4 trillion asset that is mostly idle, with no yield and limited DeFi utility.

Now, I get the argument that BTC is the ultimate store of value and should only stay in cold storage. But even if just 5% of BTC were used in DeFi, that already represents a $120 billion market. That’s a massive opportunity, and that’s what Lombard targets by building a security-first protocol to make BTC more alive.

Their flagship product is LBTC, a liquid, yield-bearing, natively cross-chain, and 1:1 backed by Bitcoin. LBTC earns yield through Babylon staking, where PoS chains borrow BTC-backed security to bootstrap their networks. In return, LBTC holders accrue yield for providing that security.

Lombard has worked hard to make LBTC usable across chains and DeFi platforms. For example:

You can collateralize LBTC on Ethereum through Maple

Or lend LBTC on Base via Morpho

They’ve also built DeFi vaults for one-click access to yield strategies using LBTC and other assets

With over $1.6B in TVL, Lombard is currently the leader in BTCFi. It’s a solid team and protocol and I think they have all it takes to retain their position. So if you want to make your BTC work for you, Lombard is one of the best and most secure places to do so.

Last but not least, it is worth noting that the protocol is pre-token and running a points program. This makes the opportunity to try out their protocol even more compelling.

My ref link to Lombard:

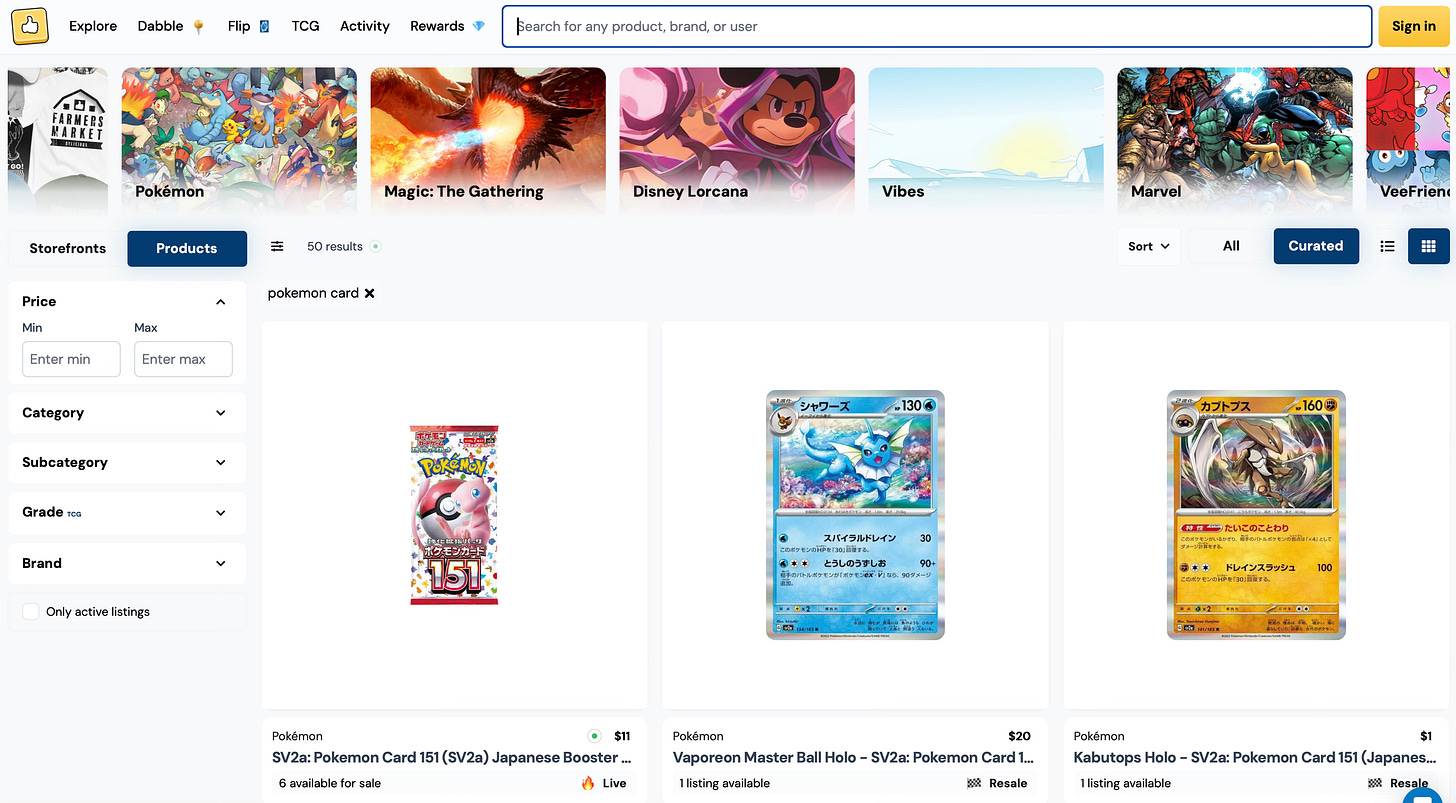

DYLI

To finish off today’s newsletter,I want to share a cool new app I tried this week. It is called DYLI, and it is built on Abstract.

Why I think Abstract could be an interesting ecosystem to monitor:

There are a few founders in crypto you don’t want to bet against, and Luca Netz is one of them. He is a relentless builder with a clear vision for the space and a strong execution track record, both in Web2 (with multiple successful businesses), and in Web3, where he literally turned Pudgy Penguins into one of the most recognized brands in crypto.

Lately, his main focus has been on bridging the gap between Web2 and Web3 through a consumer-oriented approach to crypto. Ultimately, that’s what got him to launch his own chain, Abstract.

It is still early, and there’s a lot to build, but Abstract is shaping up to be an ecosystem worth watching. I think getting in early on apps built on it could be a smart move r/r wise.

What is DYLI?

DYLI is a collectible commerce platform that lets you buy, sell, grade, and manage physical collectibles like cards, packs, and more.

You can think of it as a mix of a marketplace, and loyalty system that allows creators to interact more seamlessly with their communities and collectors. And it allows collectors and resellers to manage, buy, sell, and trade in one place.

For instance, you can use DYLI to shop your favorite Pokemon cards, the way you already do, by buying packs, single cards, or sealed product, and get it shipped to you.

DYLI also gamifies the user experience with features that make every interaction on the platform more engaging. I won’t go into all the details here, but one that standout is the “Slab Flip,” where you can pay $35 to receive a guaranteed slabbed card. TCG collecting is absolutely huge at the moment, and this is an appealing features for collectors.

You can also pay $1 for a random Pokemon card and then get an immediate buyback offer if you want to flip it. Warning, this is quite addictive.

Last but not least, they are also running a campaign where you can earn Diamonds just by using DYLI (trying out the app might also give you exposure to a potential Abstract airdrop). So if you like collecting stuff, are bullish on Abstract, or simply curious to try out a consumer crypto app, this is a pretty interesting opportunity to check out.

Here’s a cool guide from Abstract on how to use DYLI:

My ref code to get you started:

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.