3 Alpha Apps - Liquid restaking on Solana + Two new perps product to try

Edition 15

Welcome to the alpha please newsletter.

gm friends.

Coming up again with 3 promising new apps that are worth trying. All pre-TGE.

This newsletter is made possible by Mantle 🙏

This week marks a defining moment for Mantle Network.

With the successful upgrade to Succinct’s OP Succinct on Mainnet, Mantle has become the first OP Stack Layer 2 to launch as a ZK Validity Rollup, and the largest ZK rollup by TVL.

What does this mean?

Ethereum-grade security with the efficiency of ZK proofs

1-hour finality & 12-hour withdrawals, reducing capital idle time

Faster, safer, more accessible settlement for DeFi, RWAs, and institutions

Mantle is more than just an L2 (should be aware of that now), it’s evolving into the Liquidity Chain, a platform where capital flows securely and efficiently between real-world and digital economies.

From optimistic rollup → ZK rollup.

Proud to have Mantle as a partner, who keep on shipping to improve their product offering.

1. Kyros

Kyros is the liquid restaking layer for Jito (Re)staking.

It acts as the coordination point between builders who want to leverage restaking to bootstrap the economic security of their projects, and DeFi users who want access to new yield opportunities.

I’ve been a big fan of Jito since day one, but I’ll admit I was skeptical when they first launched Jito (Re)staking, especially after the overhyped and under-delivered promises of EigenLayer.

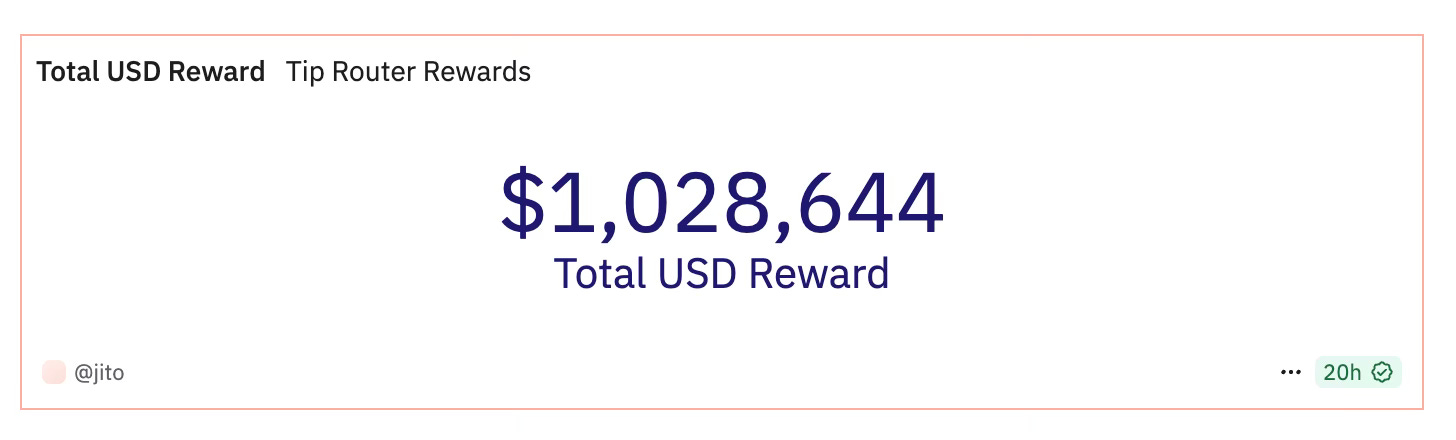

That said, Jito built its restaking infra with a product-first approach. They needed it to support TipRouter, the mechanism that distributes tips (the largest source of REV on Solana).

This has been a real success: TipRouter has already distributed over $1M to restakers, which makes it the first proven use case of restaking. This early win makes me genuinely optimistic about the future of restaking on Solana.

Now, among the different options to leverage restaking on Solana, Kyros is my personal favorite. Here’s why:

Good traction without being overfarmed: With $47M+ TVL, Kyros is the second-largest liquid restaking protocol on Solana (behind Fragmetric) but still has a lot of growth potential ahead.

Wide DeFi integration: Kyros is well-integrated into Solana DeFi and with solid secondary market liquidity.

Low risk: Kyros relies only on Jito’s restaking stack, which minimizes DeFi and composability risks compared to competitors.

Strong partners: Support from SwissBorg (~$2B AUM, 888k users) is giving Kyros a powerful distribution channel.

No private funding: Kyros is also fully bootstrapped, which is a nice add on.

Clear roadmap: You can check out this article for more info.

How to take advantage:

The main product offering of Kyros is kySOL, a restaked version of JitoSOL.

With kySOL, you get all the benefits of JitoSOL but with added yield from restaking while remaining fully liquid.

If you’re bullish on SOL (you really should be), the simplest move is to mint kySOL directly on Kyros. You’ll earn a nice yield and Kyros points. A real win-win.

You can also go a step further and use your kySOL in DeFi. For example, yield trading on Exponent is an interesting strategy (and might also give you exposure to an Exponent airdrop).

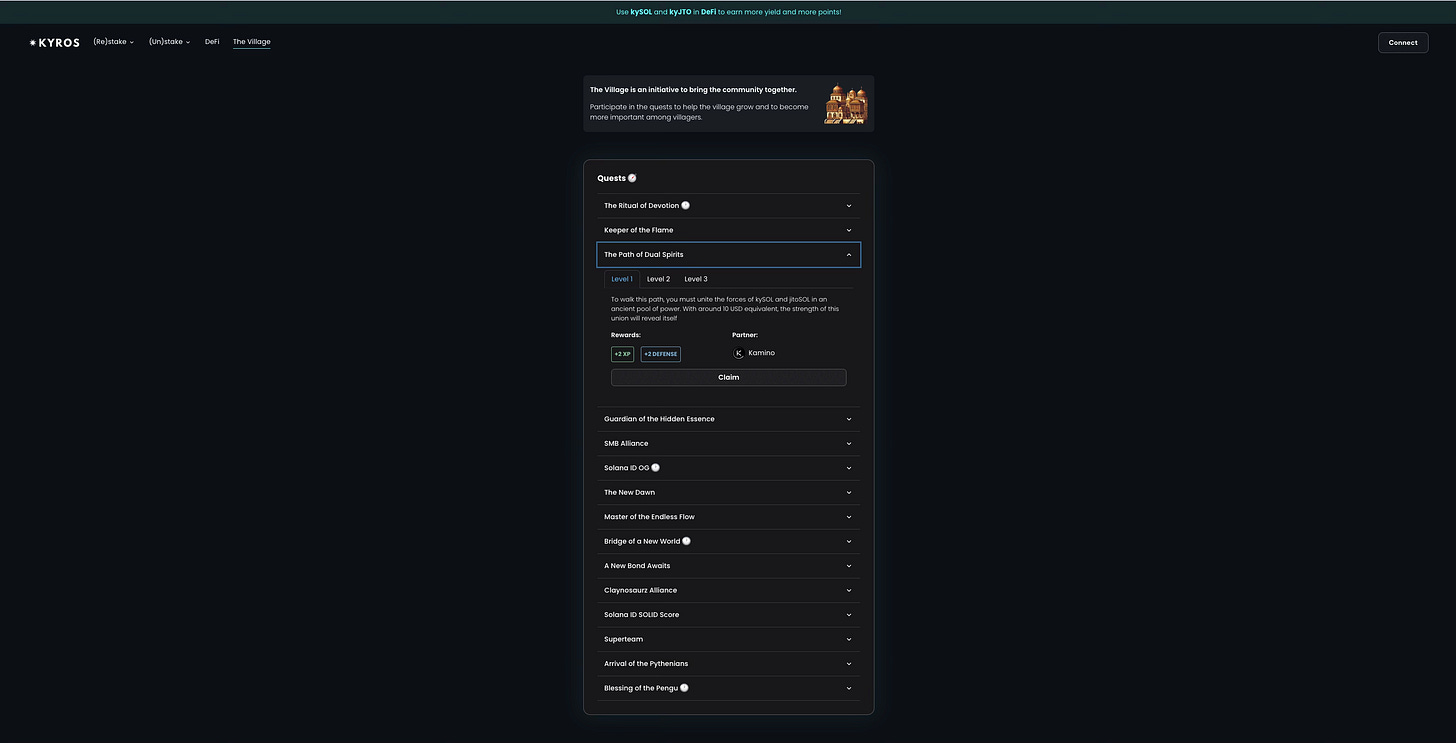

Last but not least, Kyros also has a quest system called The Village, with 10 different ranks to climb. Maybe that could lead to something interesting down the line.

2. Euphoria

Euphoria is a new project building a mobile-first derivatives trading app on MegaETH.

Their goal: do for crypto derivatives what Robinhood did for stock options. Or in other words, democratize access to crypto derivative trading through a seamless, intuitive experience that can onboard the masses.

Key features of the future app:

Tap Trading: One-tap interface that makes derivatives trading approachable.

Gamification: Points, streaks, leaderboards, and social elements that makes trading more engaging.

Social features: Ability to follow, compete, and collaborate with friends or top traders directly in the app.

Minimum friction: All the complexity is abstracted away to deliver users a smooth, mobile-native experience.

Why the opportunity is clear:

Crypto derivatives account for around 80% of all exchange volume, yet no true mobile-first app exists that is focused on making derivatives trading simple and accessible.

From experience, it’s very tough to onboard normal people to perps or options if they don’t have some solid finance background as the UX alone can feel intimidating. But if Euphoria can reduce the friction and make derivatives trading feel natural to everyone, not just crypto-natives, it could unlock an entirely new and untapped market.

Last but not least, Euphoria is also building on MegaETH which is a new ecosystem that I am bullish on. They’ve also raised $7.5M from top tier investors which adds a layer of confidence in what they can achieve.

Indeed, they even managed to onboard Seraphim. And if Seraphim is bullish and decided to invest in Euphoria (he is usually very selective) it means there is something big going on. I wouldn’t fade that.

Euphoria is not live yet. For now, the best thing you could do is to just join their Waitlist, Discord, or TG, and wait for the platform to be live.

The earlier you are in, the better.

3. Paradex

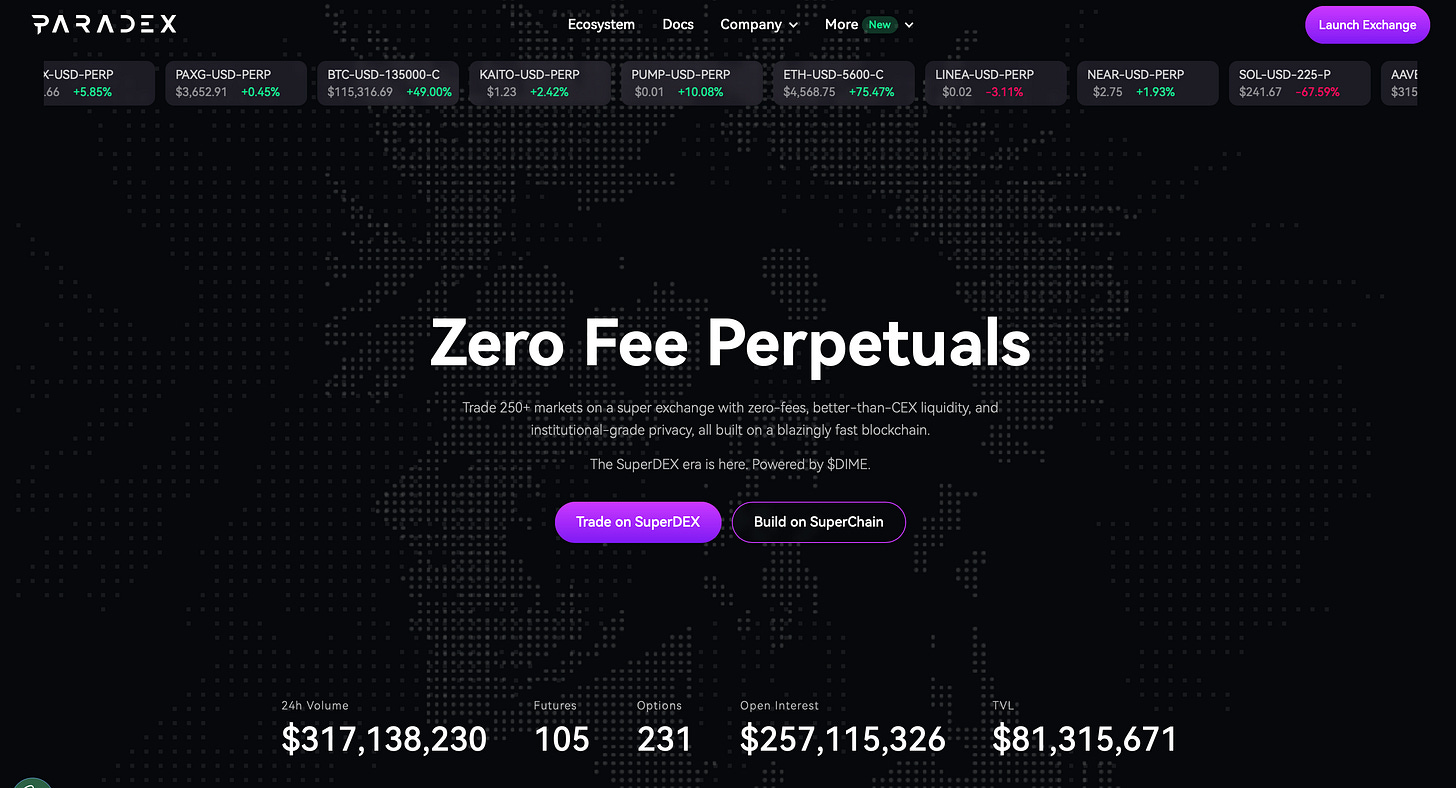

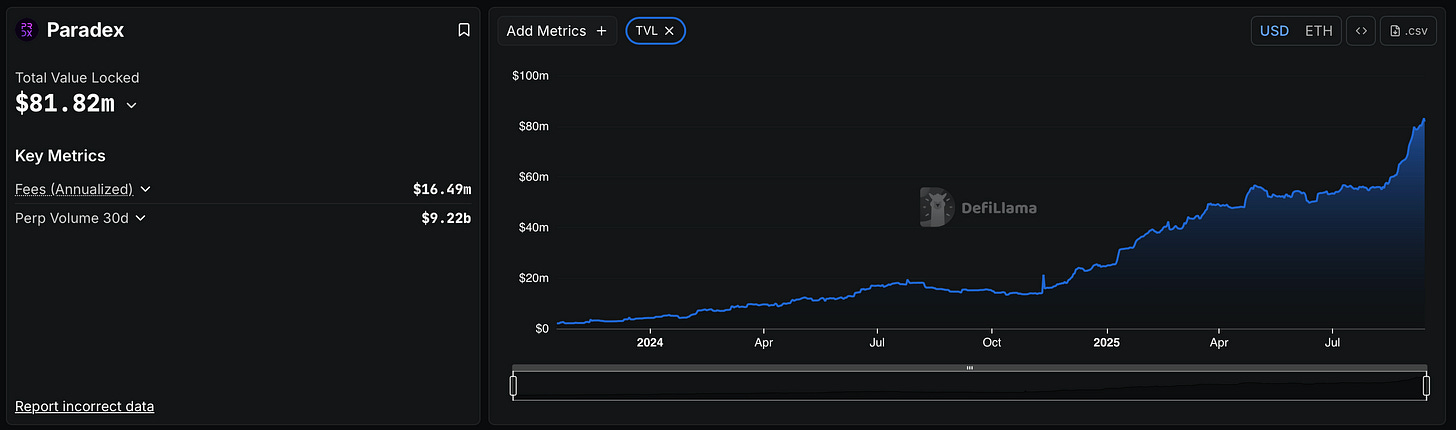

The third app for today is Paradex: a perp DEX built on Starknet.

While I think Hyperliquid is the clear market leader in perp DEXs, with no clear second best, Paradex is nonetheless an interesting protocol to follow with a nice product offering. It’s also showing a bit of traction in recent month.

One particular thing I like is their perps option product. You can think of it as a daily option that does not expire. Your max loss is the total funding you pay for the time you keep the position open and the only way to get liquidated is if you can't pay funding anymore.

Right now, you can earn points from trading on Paradex, which will convert into an airdrop.

I would definitely not switch from Hyperliquid to Paradex, as I think the upside of a potential HYPE season 2 airdrop + HyperEVM ecosystem is still way higher.

But if you wish, you could allocate a small amount to try Paradex yourself and then decide if it’s worth more attention.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.