3 Alpha Apps - Ethena Special

Edition 8

Welcome to the alpha please newsletter.

Today’s edition is a special one, as we’re doing a deep dive into the Ethena ecosystem.

Ethena has been in the spotlight recently, and rightly so. I believe it has one of the best product offerings in crypto, and many people are still underestimating the ecosystem that’s building around it.

I think the next Ethena airdrop will be, once again, one of the best airdrops this year. There are many other opportunities within the Ethena ecosystem as well.

Lots of alpha in this one.

Let’s get into it.

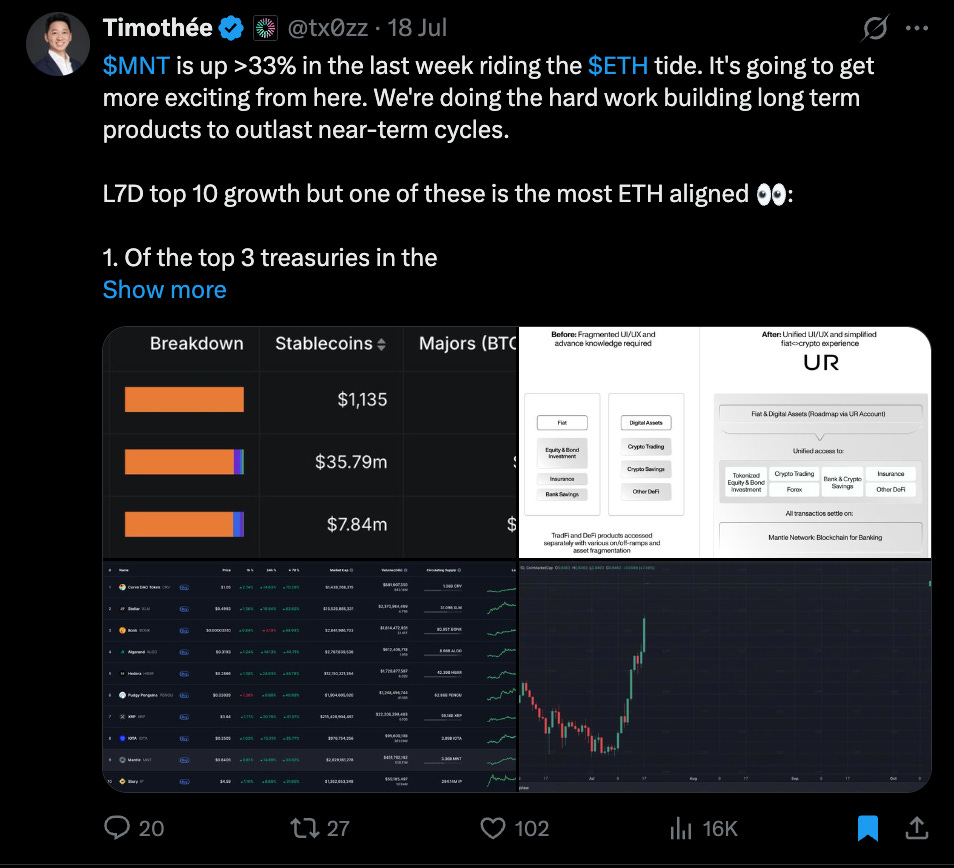

This newsletter is made possible by Mantle 🙏

ETH has been rocketing over the last few weeks, and I came across an interesting write-up about Mantle that I wanted to share.

Mantle has one of the largest treasuries in the crypto industry, and they’ve been actively putting it to work for the benefit of token holders.

Their new project, UR, is an exciting neobank aiming to provide crypto natives with a banking experience that hasn’t existed before.

1. Ethena

By now, it is becoming clear that stablecoins and digital dollars are one of the most important metas in crypto, but also in all of tradfi.

In a sense, this is the market opportunity that Ethena is here to capture. And so far, they have been doing an extremely good job at it.

In short, Ethena is building a synthetic dollar protocol that provides a crypto-native solution for money. Its core product is USDe, which is a synthetic stablecoins achieved by delta-hedging Bitcoin, Ethereum and Solana spot assets against its perps.

TL;DR of how Ethena works:

• You buy or receive 1 USDe.

Behind the scenes:

Ethena deposits $1 worth of ETH (or another supported asset) as collateral

It opens a short perp position on that asset to hedge the price

This creates a delta-neutral position (the value stays stable even if ETH moves)

In normal market conditions, the short position earns funding yield

Result: Your USDe stays pegged to $1, backed by a hedged crypto position.

Now, if you want to earn yield, you can stake USDe into sUSDe, which accrues rewards from both the perp funding and the staking yields of the underlying collateral (e.g., stETH).

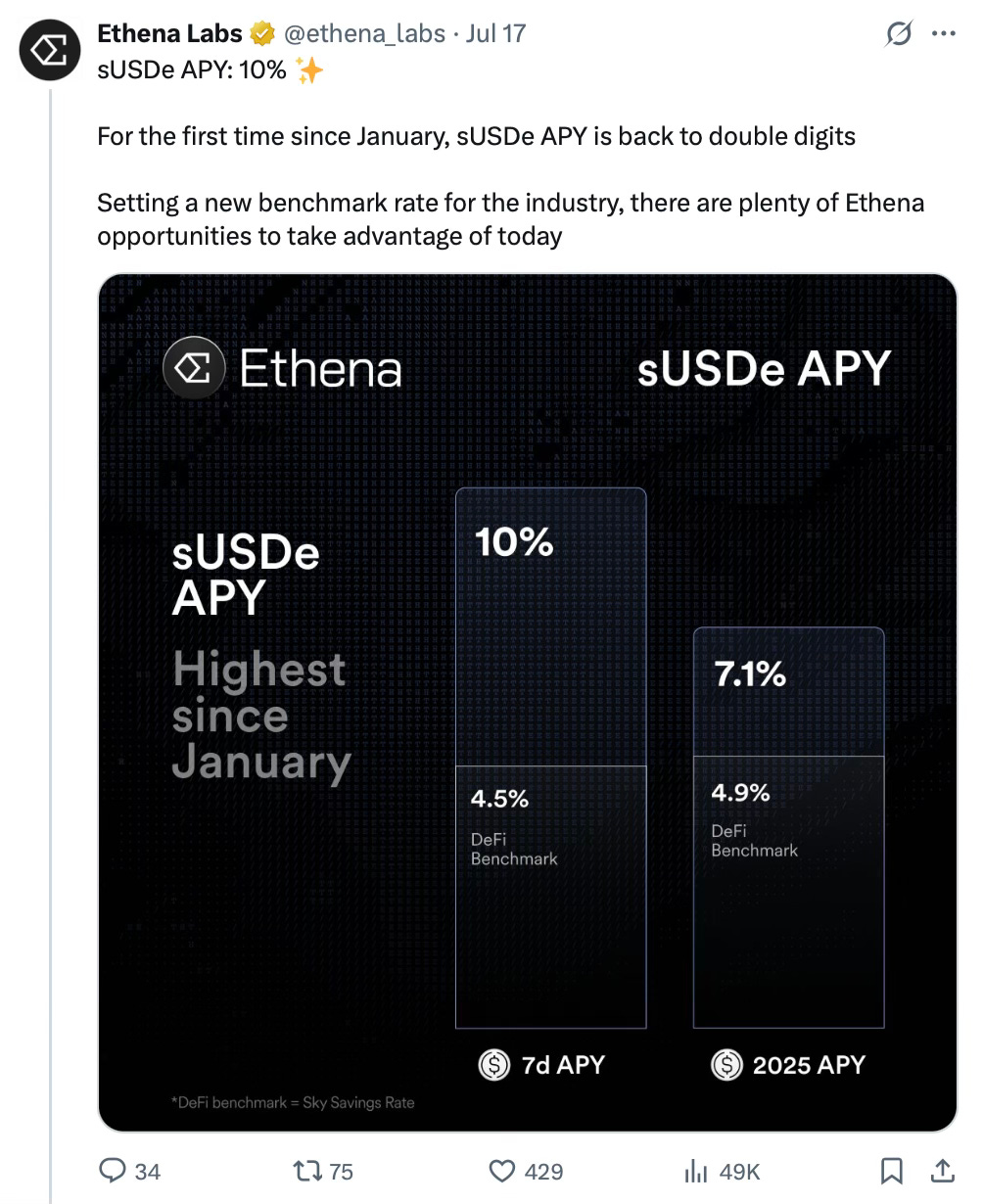

sUSDe has been one of the hottest products in DeFi this year. In fact, for the first time since January, its APY is back above 10%. That’s a compelling yield right now, especially considering:

It comes from real, scalable sources of yield

The product is simple and transparent

The risk profile is relatively low compared to more exotic DeFi plays

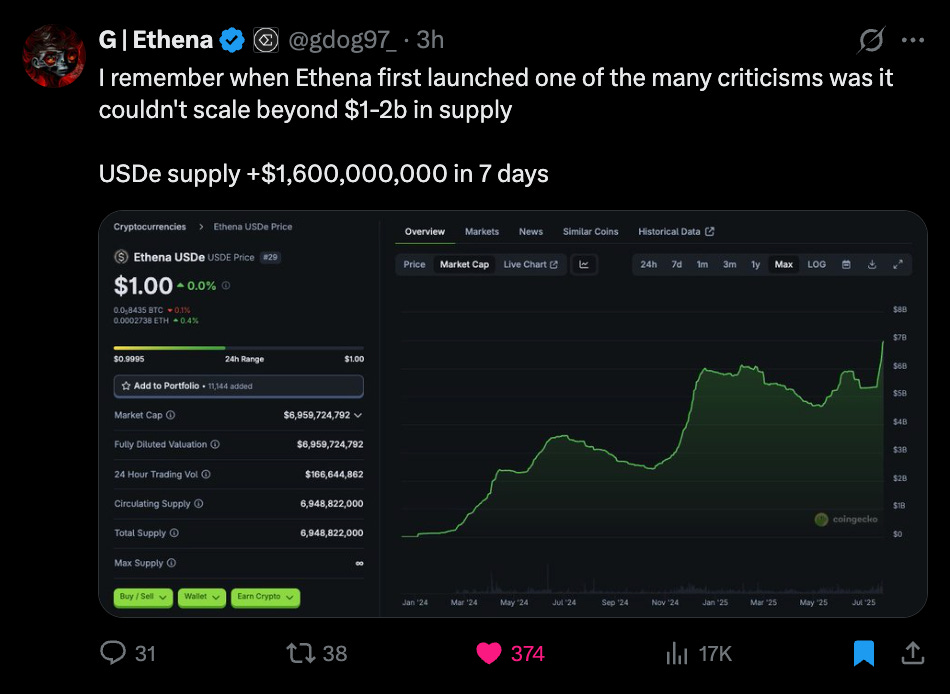

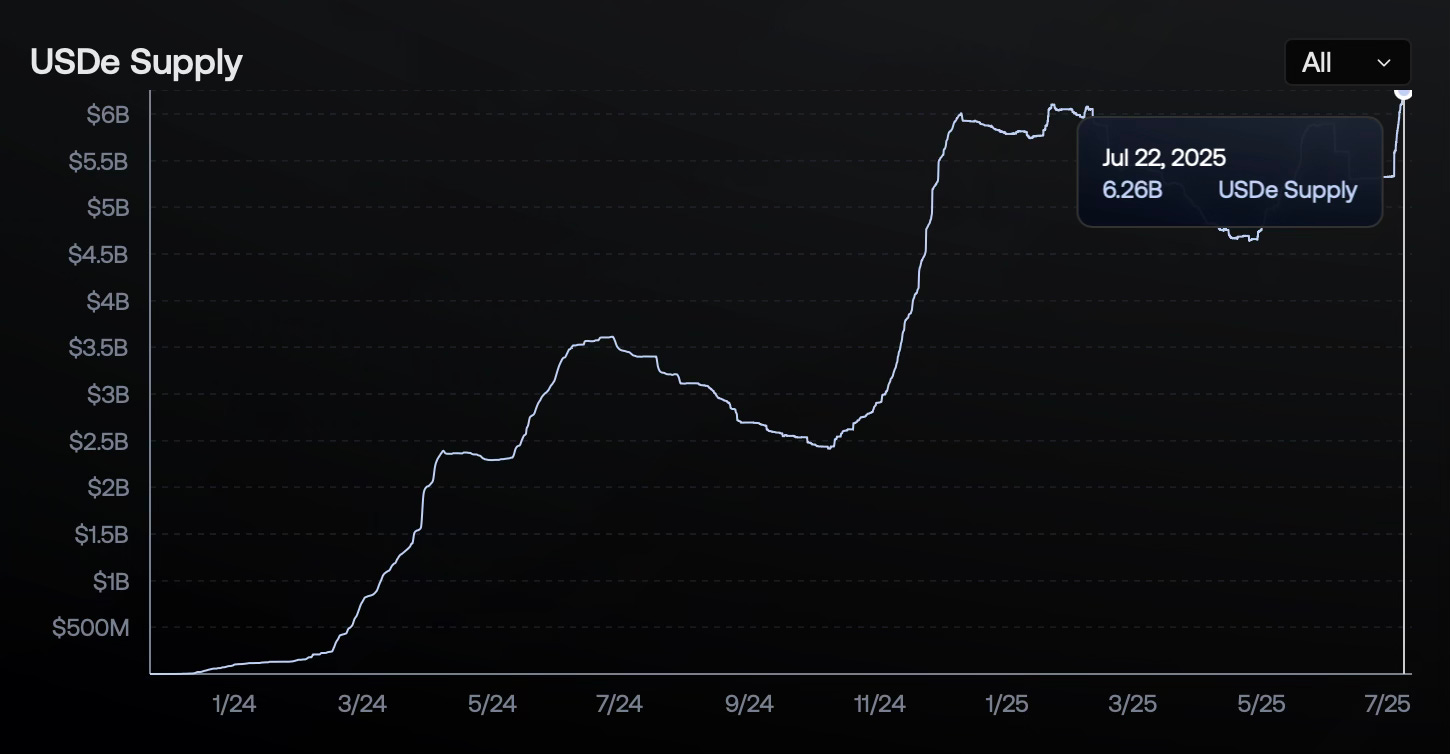

No surprise, then, that Ethena has been growing fast. The supply of USDe is at an all-time high above $6B.

What’s really impressive: Ethena is one of the few crypto protocols with clear product-market fit. It’s seeing real usage, steady growth, and strong fundamentals. It was also the second-fastest crypto startup to reach $100M in revenue, just behind pump.fun.

Ethena’s revenue comes from three core streams:

Staked assets

Perp funding and basis spreads

Fixed rewards on liquid stables

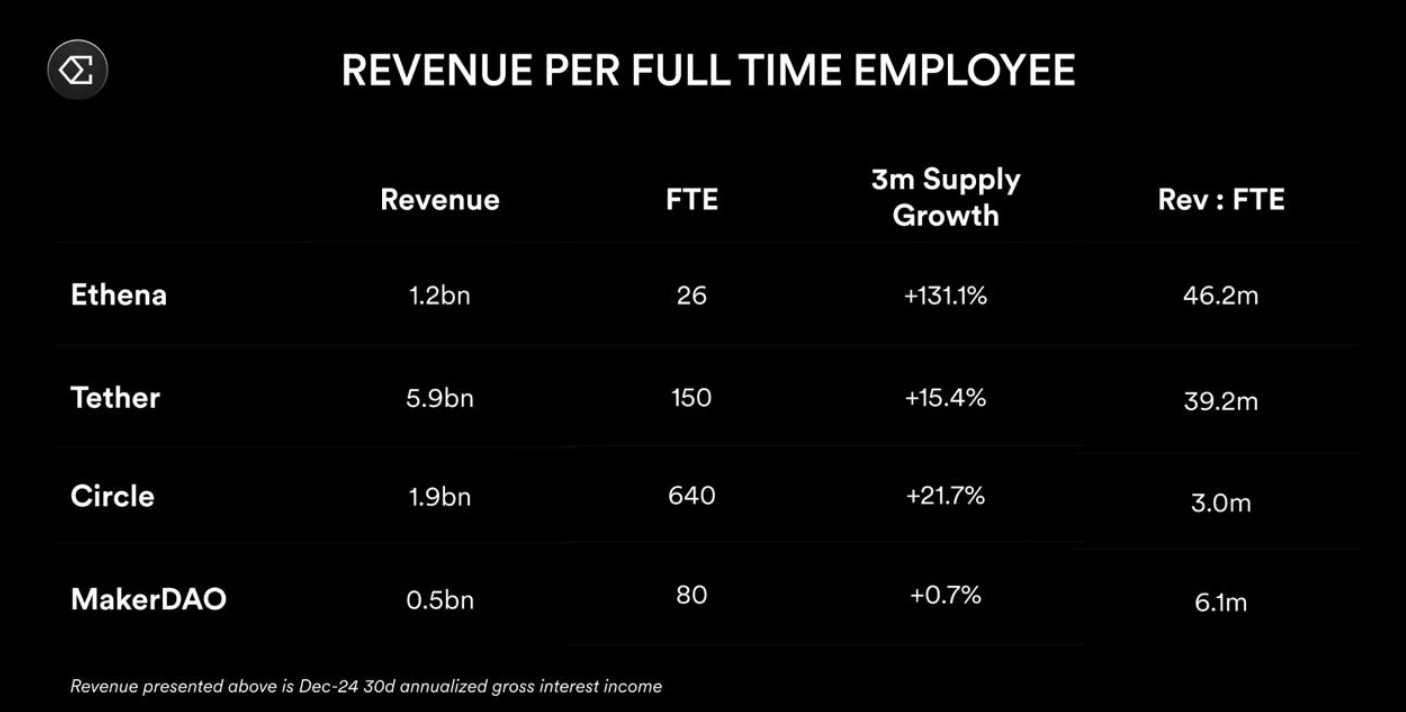

According to recent data, Ethena generates an average of $46.2M in revenue per full-time employee - which is massive.

The earning opportunity with Ethena

There are a lot of interesting things you can do with Ethena to earn some interesting yields, or even secure an allocation for a potential second ENA airdrop (as 20% of ENA is still reserved for reward incentives).

Here are some of the things to consider:

Simply holding sUSDE:

If you hold some stables, then you could consider holding some sUSDe to earn a juicy APY (+ exposure to ENA’s next airdrop).

Leveraging Ethena in DeFi:

You can also use USDe or sUSDe in DeFi. Ethena is very well integrated into all major DeFi protocols and on multiple chains so everyone should find its cup of tea.

One of my favorites play right now is LP’ing on Pendle. Lot of options to consider here and you can earn 20%+ APY.

USDe and sUSDe are also live on top DeFi protocols on the HyperEVM, making them a potential add-on to your current strategies. For instance, you can lend USDe on Felix or Hyperlend, or deposit it into vaults on Hyperbeat.

USDe arbitrage on Bybit:

Interesting post from Route2Fi that explains it all.

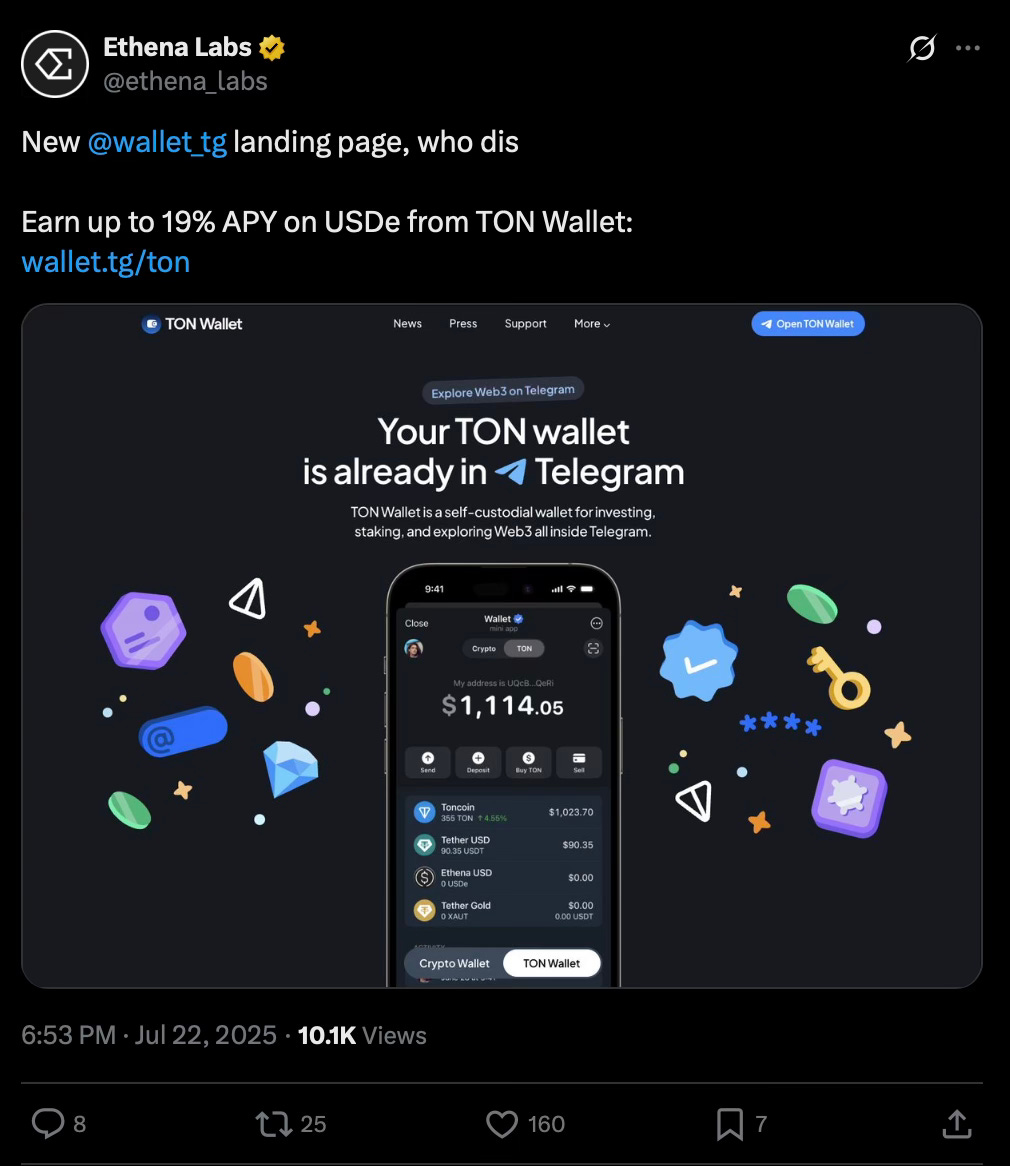

USDe on Telegram

Ethena has launched a dedicated use case for sUSDe inside Telegram, letting users send, save, and spend in a mobile neobank-like experience.

You can buy USDe directly on TON using wallet apps or bridge it over via Stargate. Then, stake it for tsUSDe and earn up to 19% APY (including a 10% Toncoin bonus for eligible users).

Opportunity with ENA:

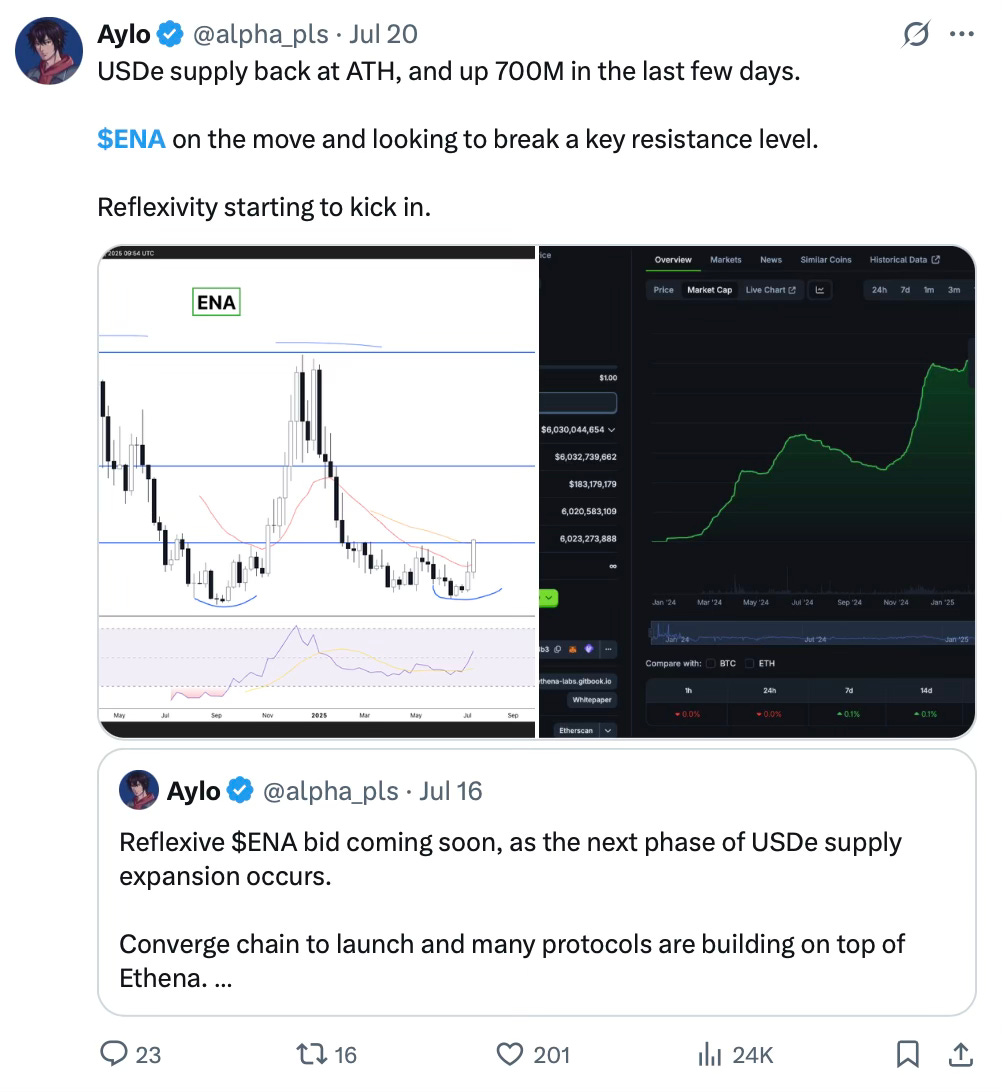

As I have said, Ethena already has its token, ENA. The latter has been on the rise lately, following the announcement of StablecoinX’s $360 million capital raise to purchase ENA. This planned buy represents roughly 8% of the circulating supply and is set to be accumulated over the next six weeks.

This means:

A massive capital injection

A structured, long-term buyer entering the market

And a lot of new eyeballs on Ethena

And when you couple that with:

Bullish market conditions and surge in yields

A protocol that is growing fast, shipping new products, and strong revenue model

Potential for more buybacks on the way

A strategic position as a new crypto native synthetic dollar play

It’s easy to see why the bullish case for ENA is strong. Yes, there are token unlocks ahead, but I believe the upside outweighs the risks.

I recently shared my view about ENA on X. I am personally bullish and believe there is significant upside potential ahead.

Definitely one to keep on your watchlist.

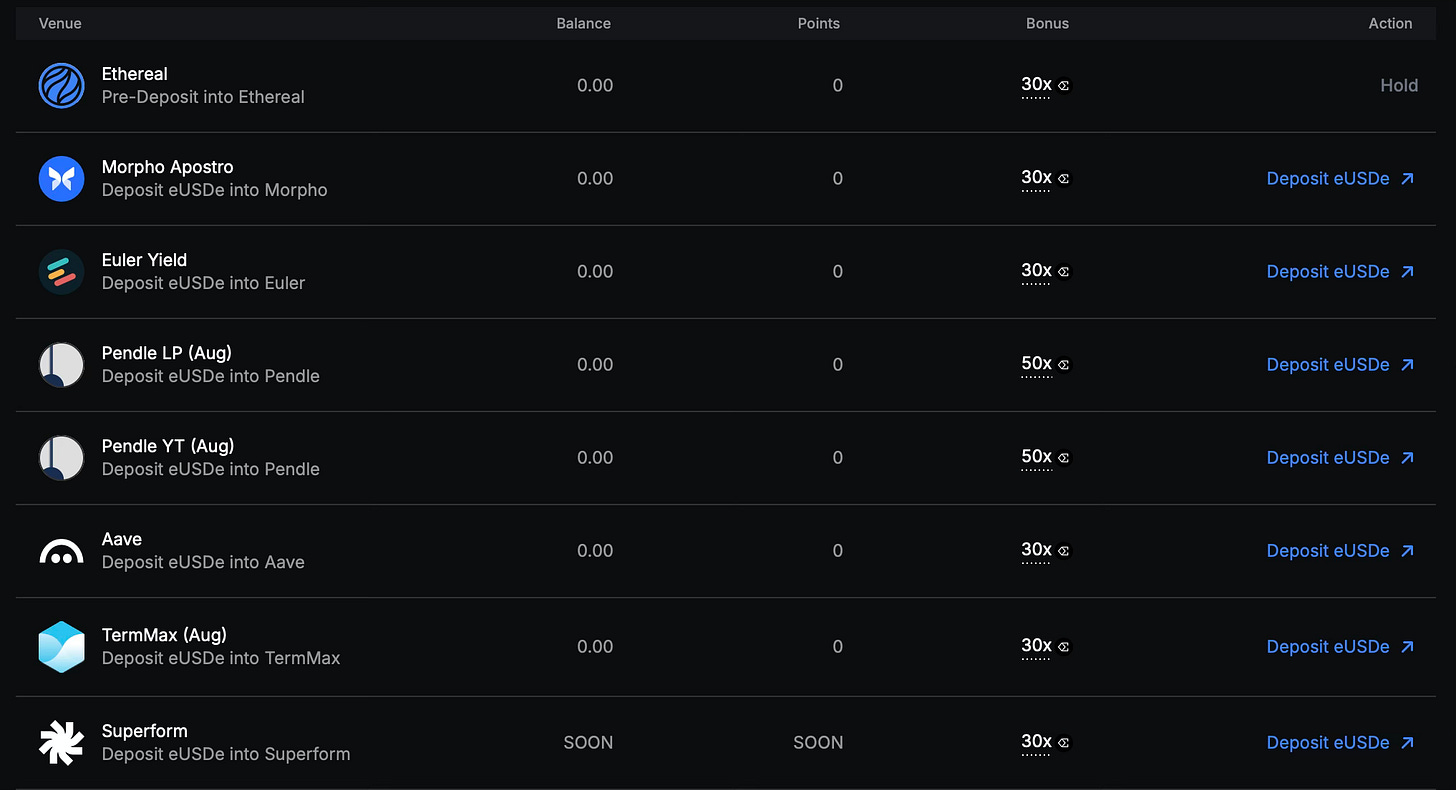

You can find many Ethena sats earning opportunities here:

Ethena Is More Than Just a Stablecoin Protocol:

While most people know Ethena for USDe and sUSDe, the project is building out an entire crypto-native financial stack.

Let’s look at three standout apps in the ecosystem:

2. Ethereal

One of my favorite apps building with Ethena right now is Ethereal.

Ethereal is a decentralized exchange for spot and perpetual trading, built on its own appchain. It runs an integrated orderbook powered by sUSDe, with Ethena providing hedging and liquidity flows.

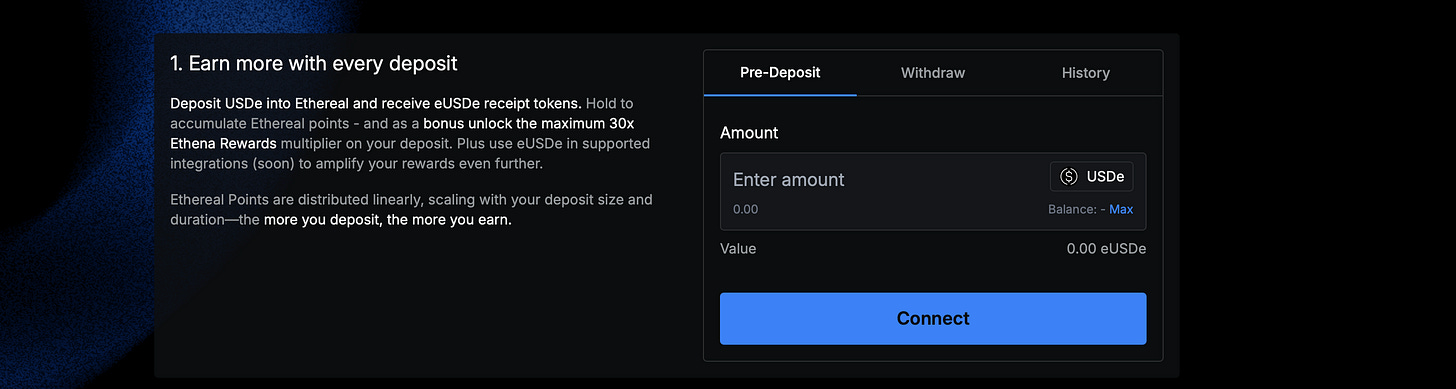

The testnet is live, and Season 0 is underway - so you can start earning Ethereal Points now.

To participate:

Deposit USDe to receive eUSDe

eUSDe earns points passively

You can withdraw anytime

Bonus: deposits also receive a 30x multiplier on Ethena Sats, which could matter for a future ENA drop.

eUSDe is also usable across DeFi. For example, you can LP with it on Pendle - meaning you get yield, points, and future exposure.

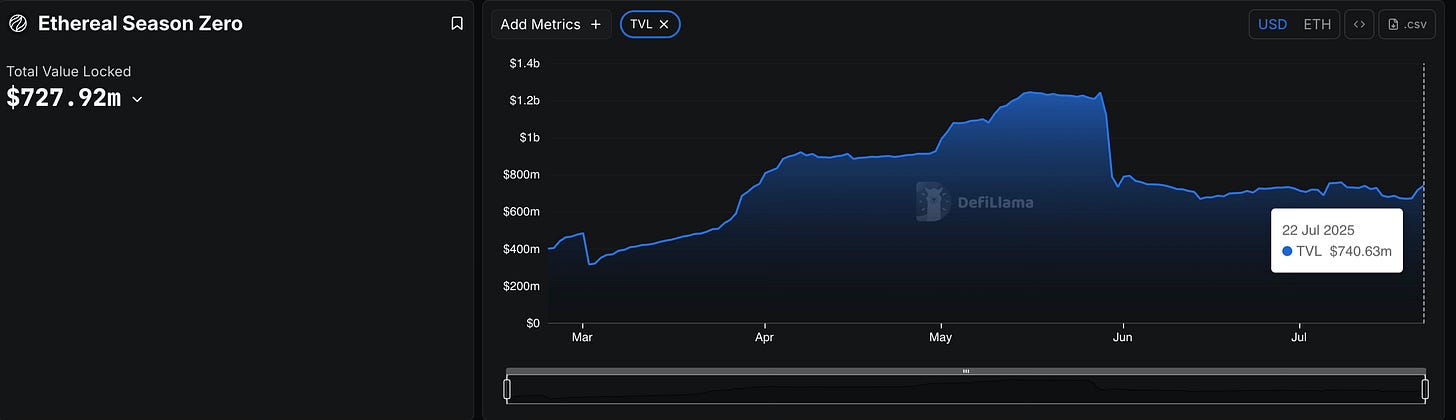

Ethereal already has over $740M in TVL (down from $1.25B), which is huge for a project that hasn’t launched yet.

Also worth noting: Staked ENA (sENA) earns a portion of any future Ethereal token. The team has committed to distributing 15% of any future token supply to sENA holders.

Try out Ethereal:

3. Strata

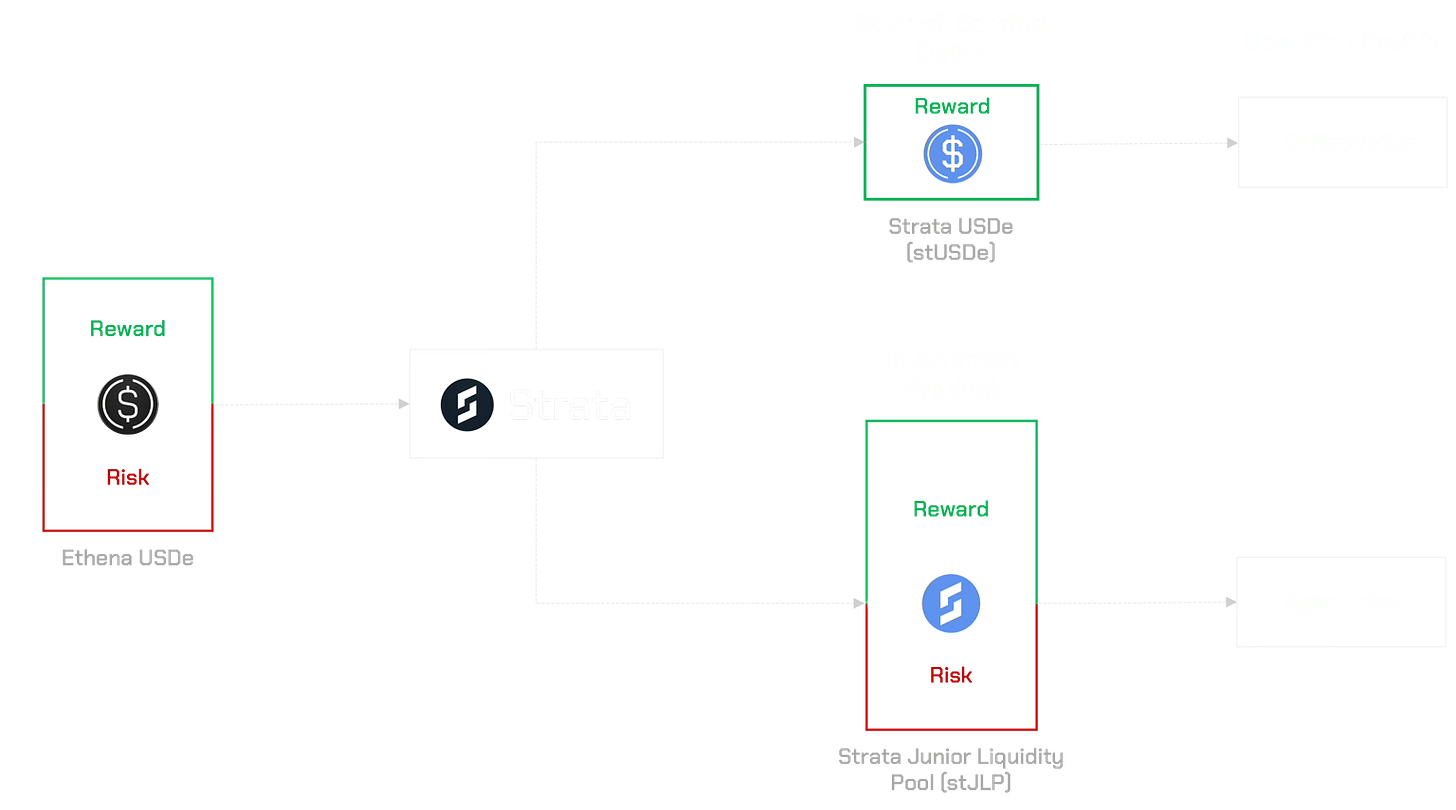

Strata is a perpetual yield tranching protocol designed to offer structured yields on USDe.

The protocol introduces two liquid and composable tokens built on Ethena: Strata USDe (stUSDe) and Strata Junior Liquidity Pool (stJLP).

Basically, what Strata does is that it re-packages USDe rewards into two liquid, composable tokens, introducing a meaningful shift in risk management by splitting yield and risk exposure into distinct senior and junior tranches.

Here is a great thread that explains what they do:

The protocol is still very early and just launched its pre-deposit campaign yesterday. So far, it has already amassed over $18M in deposits, which is a good start.

To start earning points:

Deposit USDe or eUSDe

Receive pUSDe, the receipt token

Use it across DeFi integrations coming soon

pUSDe earns points from Ethena, Ethereal, and Strata, and can be deployed into DeFi - making it a high-leverage play for users already holding USDe.

4. Terminal (Bonus)

Yield-bearing stablecoins like sUSDe are powerful, but until now, they’ve lacked proper infrastructure for large-scale trading.

Terminal solves this.

It’s a new decentralized exchange built specifically for trading yield-bearing stablecoins efficiently. Its design preserves yield while allowing tokens like sUSDe to maintain dollar parity.

This unlocks deep liquidity and enables capital to flow freely across DeFi and institutional markets.

Terminal will be the primary liquidity hub for Converge, the new chain from Ethena and Securitize, built to connect TradFi, DeFi, and CeFi.

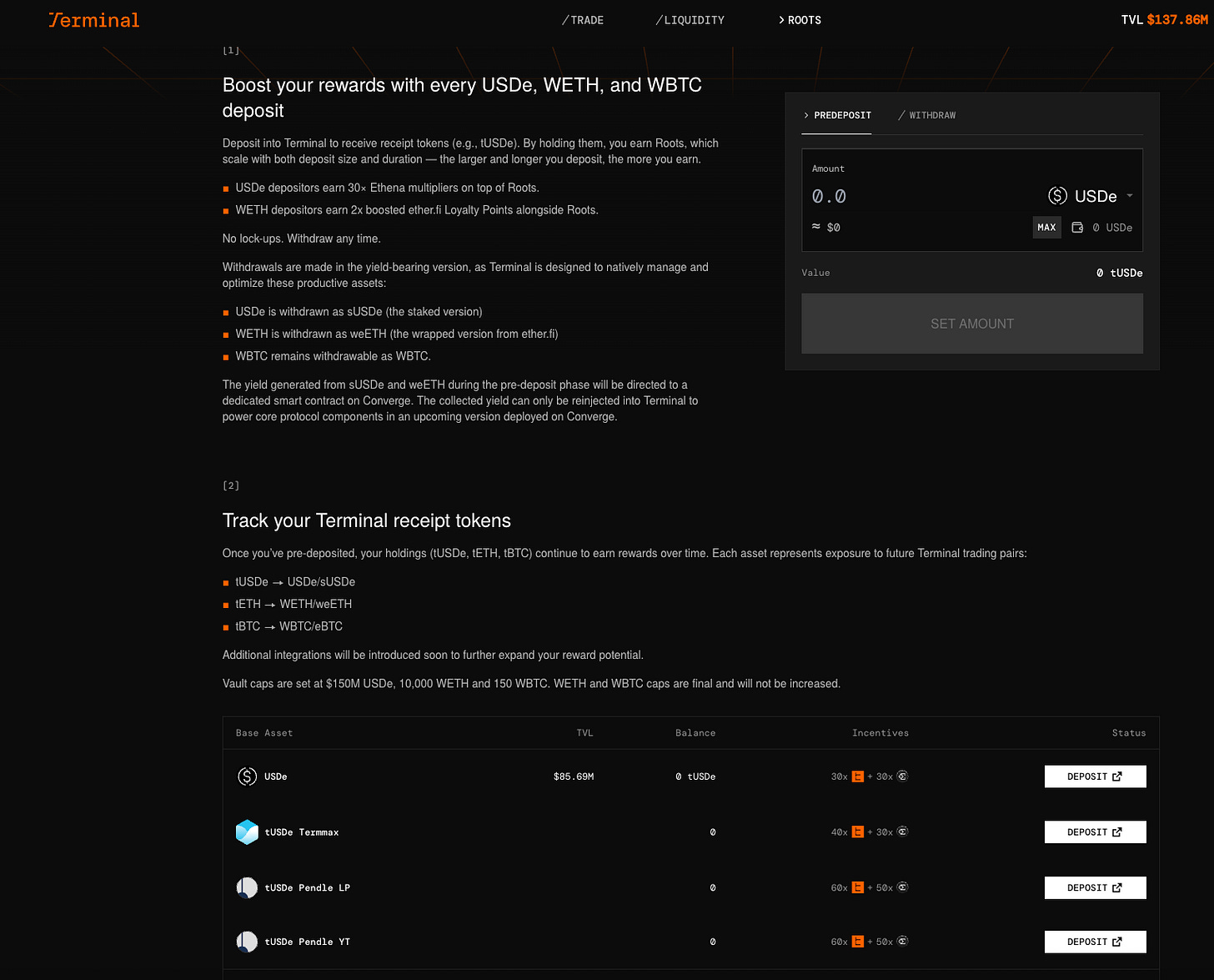

Terminal pre-deposit campaign

You can pre-deposit USDe, wETH and wBTC to earn points before Terminal launches, you will of course also earn Ethena Sats, which will qualify you for the next airdrop.

Terminal has already hit $130M in TVL, showing how bullish people are on Ethena’s ecosystem, and this being the main liquidity hub on Converge.

There are many more interesting apps being built on top of Ethena that are on the way. I think many are underestimating the size of the opportunity with Ethena and their ecosystem.

I will likely do an update about this ecosystem in a future post.

The best place to start with Ethena is here:

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Alpha

Great piece, thanks.