3 Alpha Apps - A New Private Stablecoin Card

Edition 11

Welcome to the alpha please newsletter.

gm, we are back again with three more apps for you to try out.

The last two are pre-TGE 👀

This newsletter is made possible by Mantle 🙏

A lot of people don’t realize that Mantle was incubated by Bybit and has always been a direct supporter.

Now, they’ve announced a much bigger and more direct strategic alignment with Bybit.

The use of MNT for trading fees and VIP tiers on Bybit could be a massive utility boost, among other benefits. This also has a direct implication for MNT demand, estimated at $500M–$2B annually, purely from trading fees.

There’s a lot of alpha in Defi Maestro’s recap of the most recent AMA (linked above) that I think you should read.

Bybit is the #2 CEX by OI in crypto and has huge distribution. This is great news for Mantle and will help a lot with adoption.

1. Maple Finance

Maple is an onchain asset management platform building a comprehensive suite of financial products for crypto.

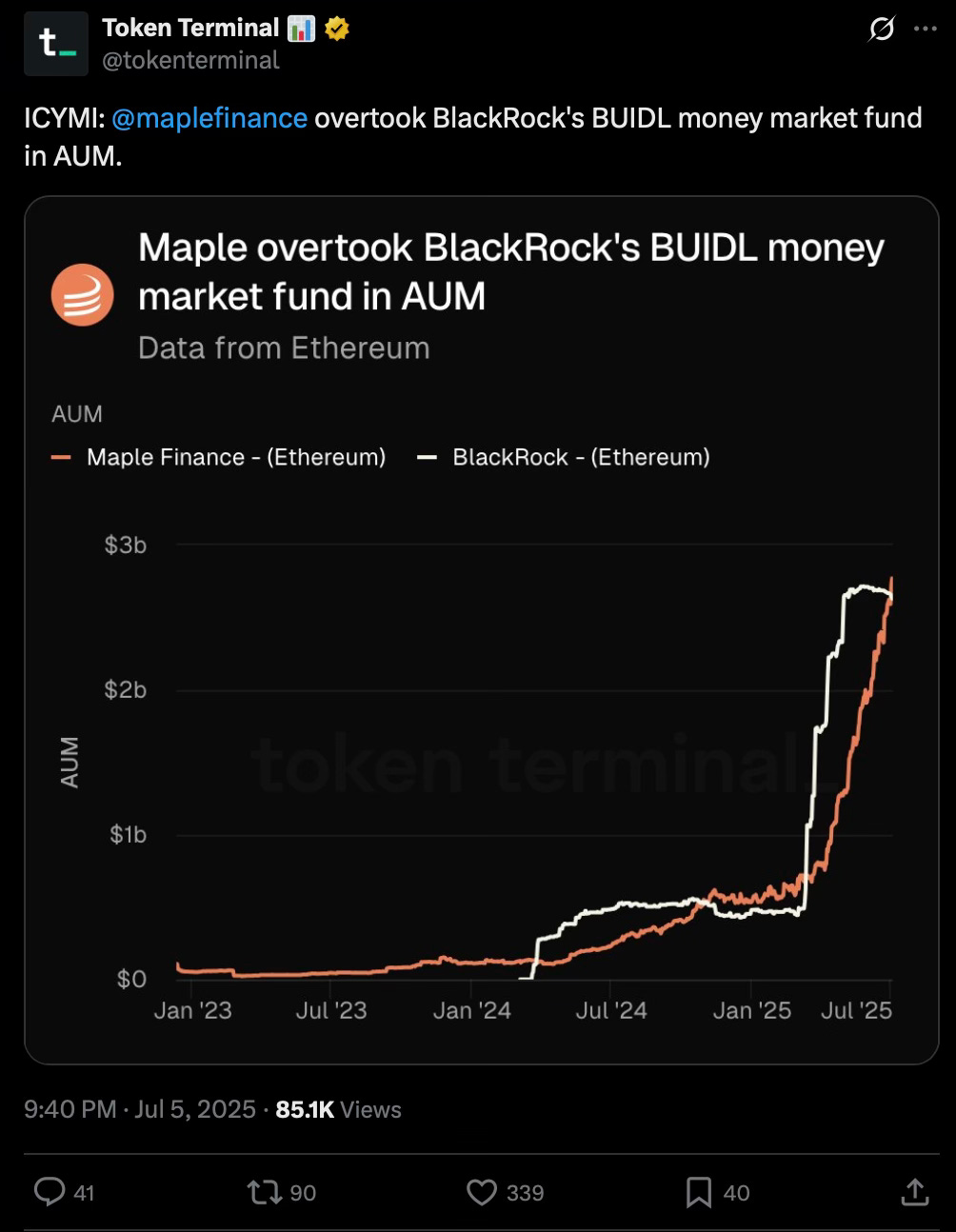

Over the past year, Maple TVL has surged from $225M to more than $2.1B, even surpassing BlackRock’s BUIDL money market fund in assets under management. This shows how competitive DeFi products are becoming with their TradFi counterparts.

Currently, Maple has two core product lines: Maple Institutional and SyrupUSDC/USDT.

Maple Institutional

As the name suggests, this is Maple’s institutional arm, built for professional investors seeking overcollateralized lending and asset management products.

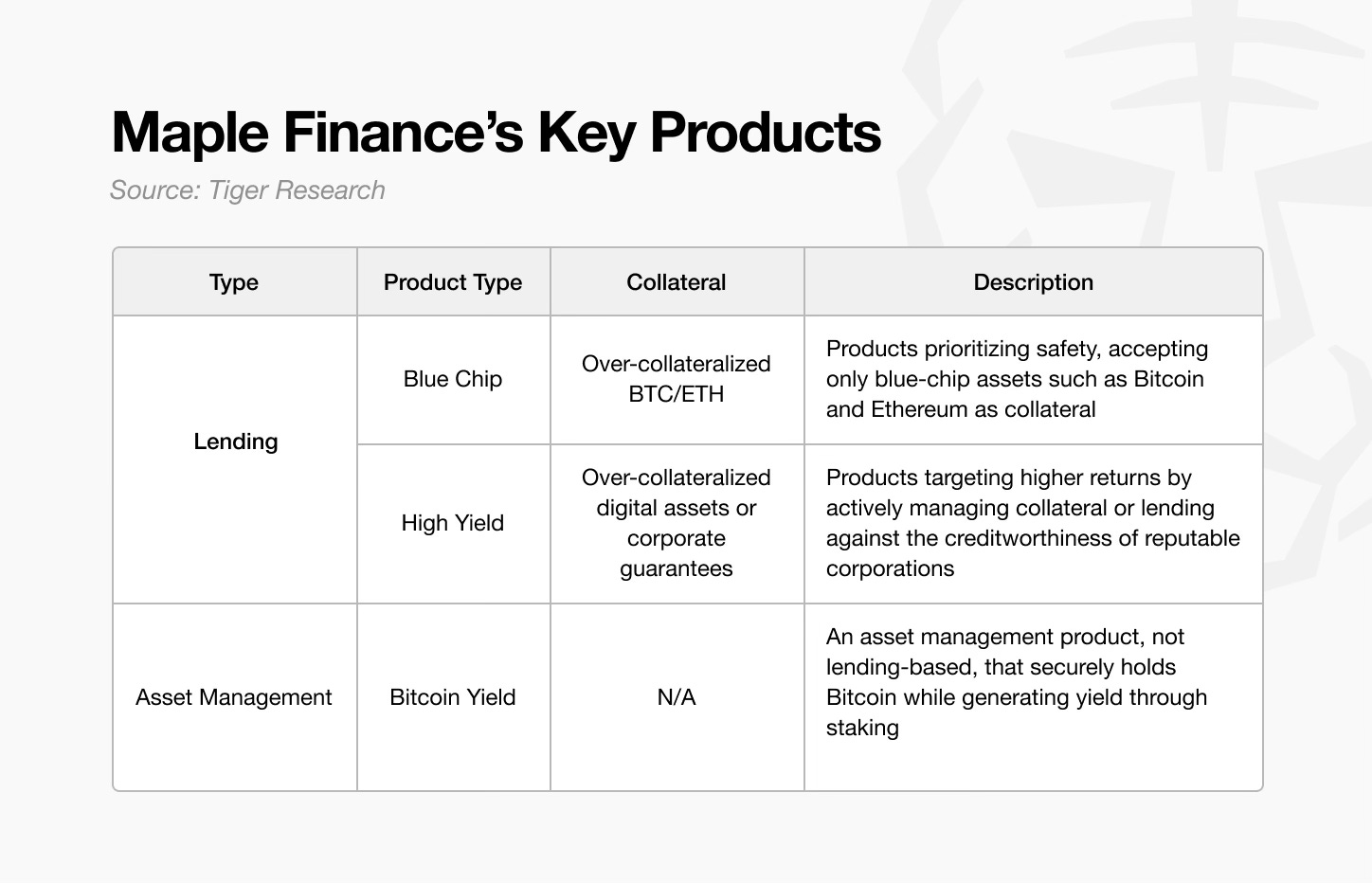

The lending side offers two main pool types: High Yield and Blue Chip, each designed to match different risk/return preferences.

On the asset management side, Maple recently launched a BTC Yield product, allowing institutions to deposit BTC and earn interest, effectively generating yield from idle assets.

SyrupUSDC/USDT

While Maple’s institutional products require KYC, legal agreements, and due diligence, SyrupUSDC and SyrupUSDT are open to everyone.

These tokens provide direct access to Maple’s lending pools through a simple interface and smart contract router.

Here’s how it works: Capital deposited into SyrupUSDC is lent to institutional borrowers from Maple’s Blue Chip and High Yield pools, following the same rigorous credit checks. Interest from these loans flows back to SyrupUSDC holders as yield.

SyrupUSDC/USDT has been a huge success, driving much of Maple’s growth over the past few months and opening the door for retail users to participate in what was previously an institutional-grade credit market.

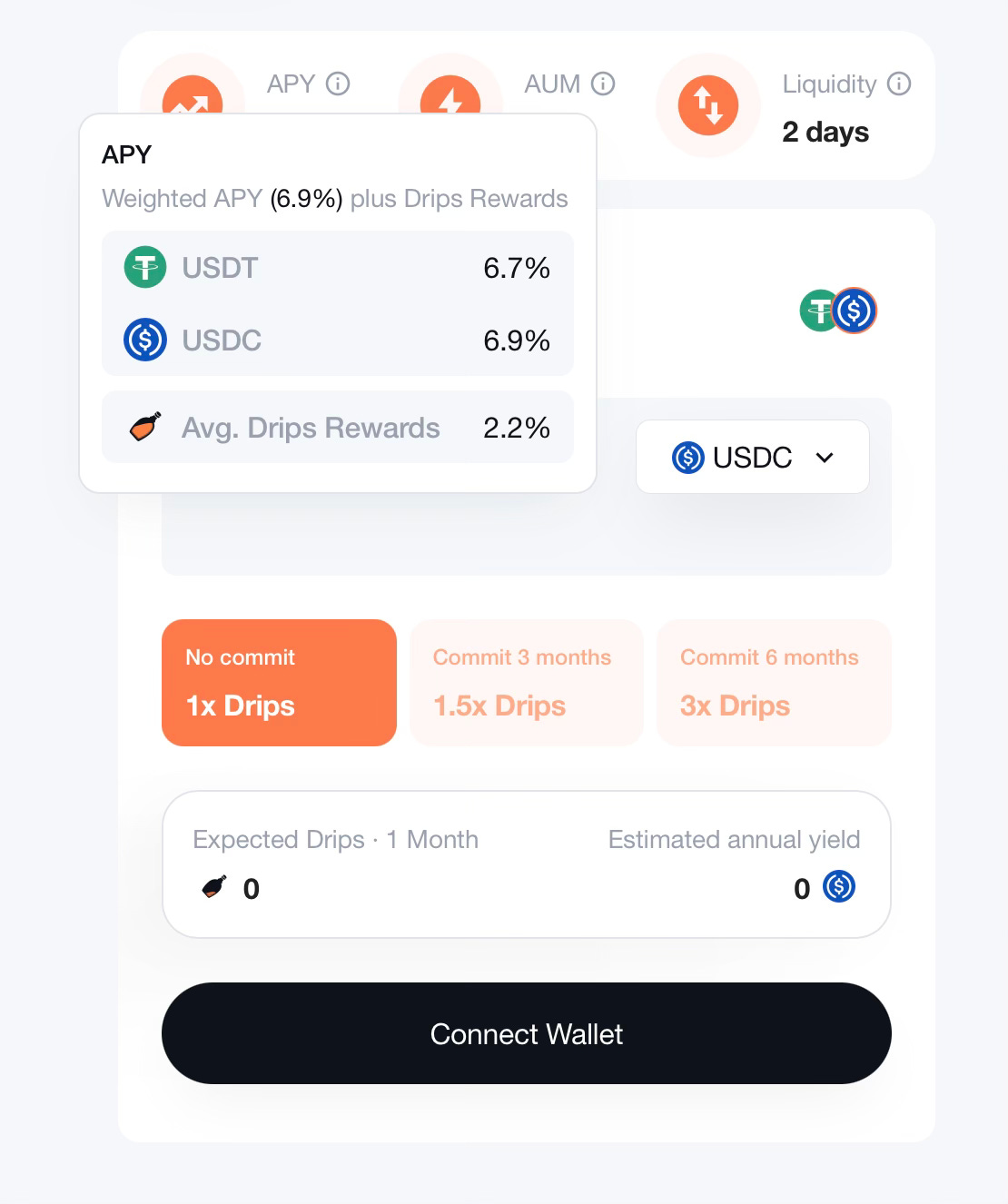

And rightly so, as syrupUSDC is currently home to some of the best yield for stables. With no commits period, here’s what you can earn right now:

SyrupUSDC/USDT is available on both Ethereum and Solana, with strong DeFi integrations. It can be a solid option for parking stablecoins or deploying them across DeFi.

Some of my favorite plays with SyrupUSDC:

1/ Looping on Kamino

I’ve mentioned this before, but it’s worth repeating: I still think it’s one of the best stablecoin yields in DeFi right now.

Currently, the max APY (with 5x leverage) on SyrupUSDC Multiply via Kamino is ~26.46%, with an average of ~15% APY since launch, very attractive.

If you have stables on Solana, this is a great option to consider. It is incredibly easy to deposit: simply choose your leverage and click once. Kamino handles the rest.

As always, looping carries inherent market risk. Monitor borrowing rates periodically. If they spike and remain high in a frothy market, it may be time to unwind.

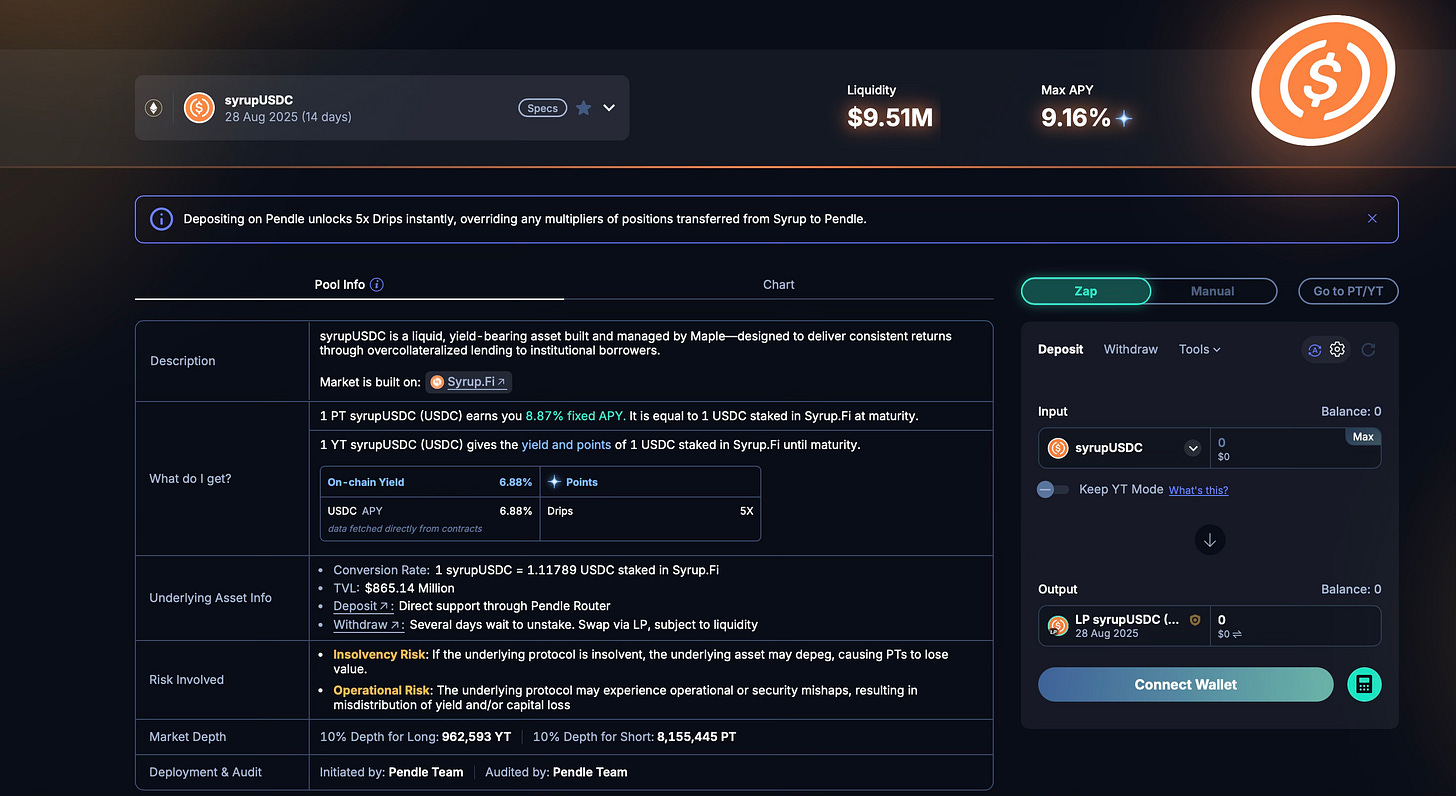

2/ LP’ing on Pendle

Another interesting play: lock in up to ~9.16% APY by LP’ing SyrupUSDC on Pendle. Simple and effective.

2. Payy

Crypto cards are a huge opportunity, they bridge your digital assets with everyday spending. But most come with a major drawback: your card activity can be directly linked to your onchain history, leaving a fully traceable record of everything you spend.

Payy fixes this with a crypto card + onchain banking platform fully focused on preserving privacy.

They’re building an entire ZK-powered chain, the Payy Network, ensuring all your onchain activity and balances remain fully shielded by zero-knowledge proofs.

With Payy, you can deposit/withdraw funds, send/receive payments, and spend stablecoins via a card - all privately.

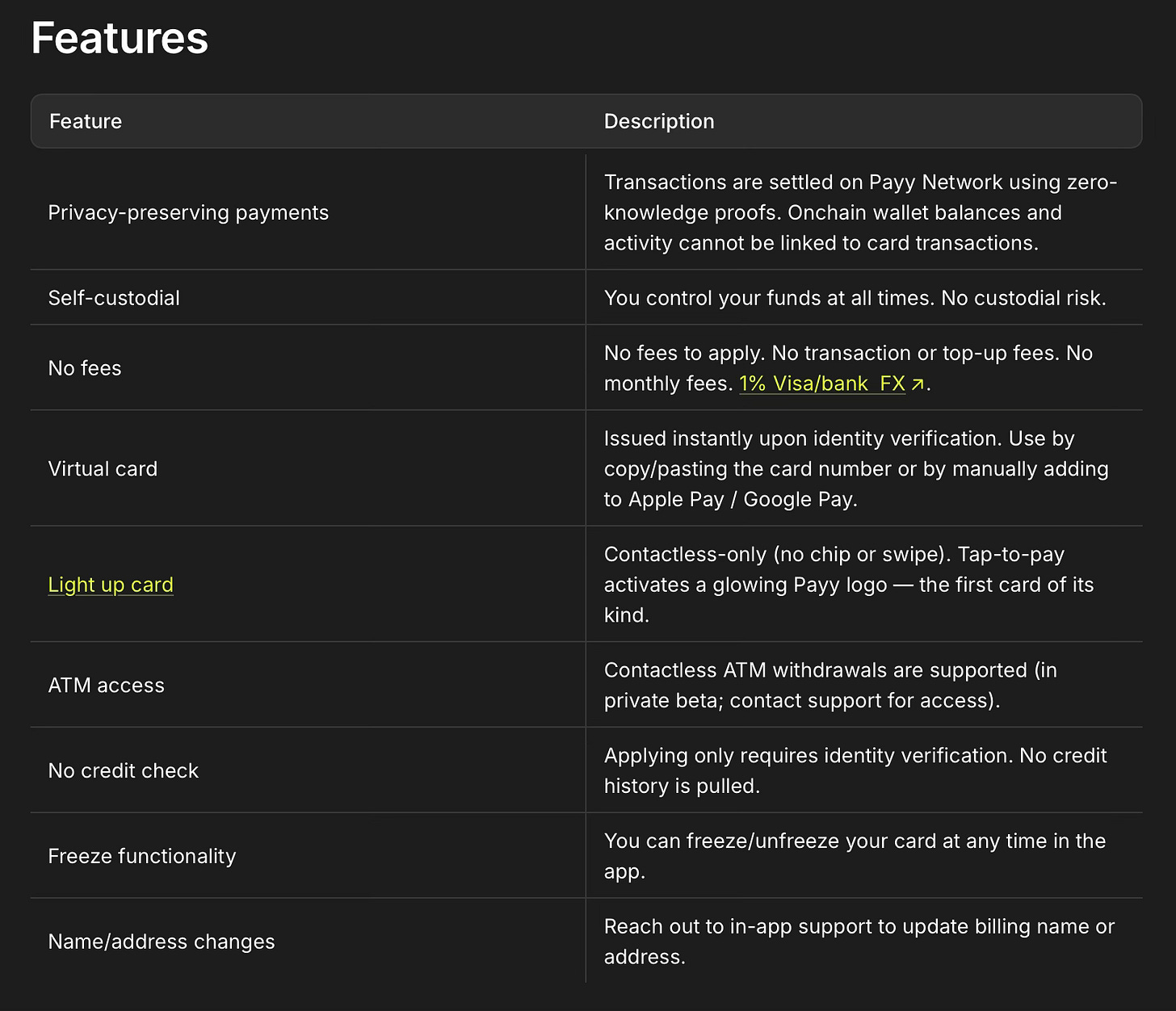

The main features of Payy card:

The Payy card is a self-custodial Visa card that allows you to spend USDC from your Payy Wallet in stores or online.

How to get your Payy Card

It is super simple and easy to start using Payy. You simply need to:

Complete KYC

Receive your virtual Payy Card

Deposit funds to your Payy Wallet from banks, crypto exchanges or blockchains

Start using your Payy Card.

Worth noting: you also earn points for using Payy. Currently, you earn 1 point per dollar in your balance each day, which adds a nice extra carrot on top.

3. Bullpen

Bullpen is an onchain trading platform supporting both Solana and Hyperliquid, available on Desktop, Mobile, and Telegram.

You can bridge to Hyperliquid in seconds to trade perps, or hunt the hottest memecoins on Solana, all through a single, simple interface.

Notable tools:

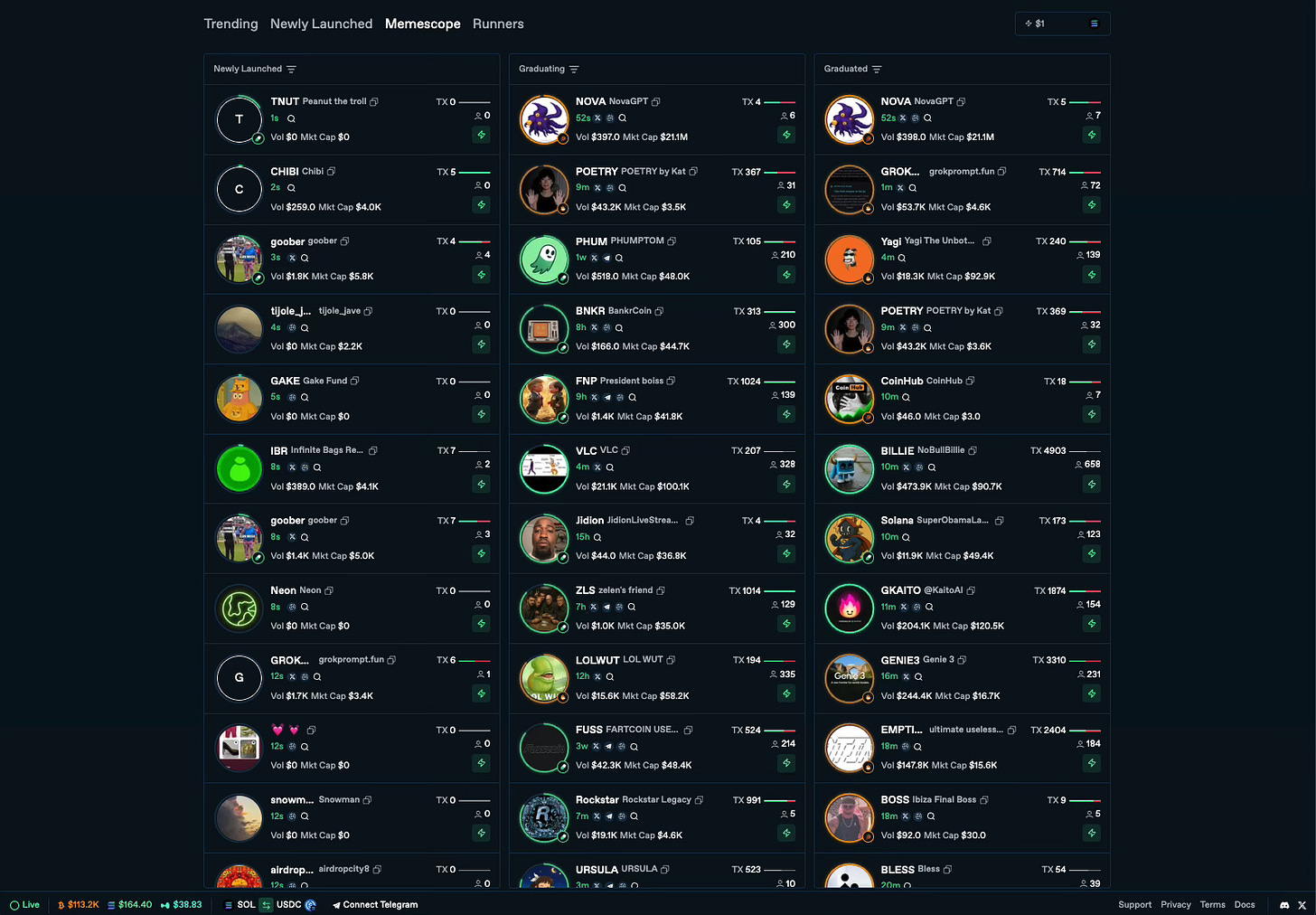

Memescope → filters new Solana coin launches

Runners → algorithmically identifies tokens with strong momentum

Those tools can be a good add-on if you are active in the Solana trenches.

Additional features like a portfolio tracker are coming soon.

If you run a TG channel, you can also add the @BullpenFiBot for in-chat token insights, leaderboards, and trading.

All trading volume currently counts toward an ongoing points program, plus, you can save 10% on trading fees using my ref link.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Non kyc cards all the way