3 Alpha Apps - 3 Big Airdrops

Edition 16

Welcome to the alpha please newsletter.

I had to skip Alpha Apps last week (life happens), but we’re back today with 3 new apps that caught my eye.

I think all three are huge opportunities, as they are running points programmes, and are likely to be significant airdrops when they TGE.

Do not fade.

1. Lighter

The perp DEX category is full of hype right now: CZ is pushing Aster, Jeff just blessed the Hyperliquid core community with a new round of magic money through a Hypurr NFT airdrop, and competition is heating up.

The perps space will continue to grow massively, and there will be a few big winners alongside Hyperliquid.

I’m very sure Lighter will be one of them, and I think there’s a very good chance it establishes itself as the #2 perp DEX in the long run, and executes one of the biggest airdrops of 2025.

Lighter is a perp DEX built as a custom L2 on Ethereum. It leverages zero-knowledge proofs of all operations including matching and liquidations (this is what makes Lighter special), and runs with a private sequencer, allowing it to achieve strong performance in both latency and finality.

It’s also the first perp DEX to introduce zero trading fees for retail users. According to the founder, this model is sustainable because Lighter still earns revenue by charging fees only to market makers. This is essentially the Robinhood model onchain.

Also worth noting: Lighter has managed to built a nice community among retail, but also with the support of sharp funds or bright minds like Jordi Alexander or Vlad from Robinhood.

Here’s a good podcast to watch if you want to dig more on the project.

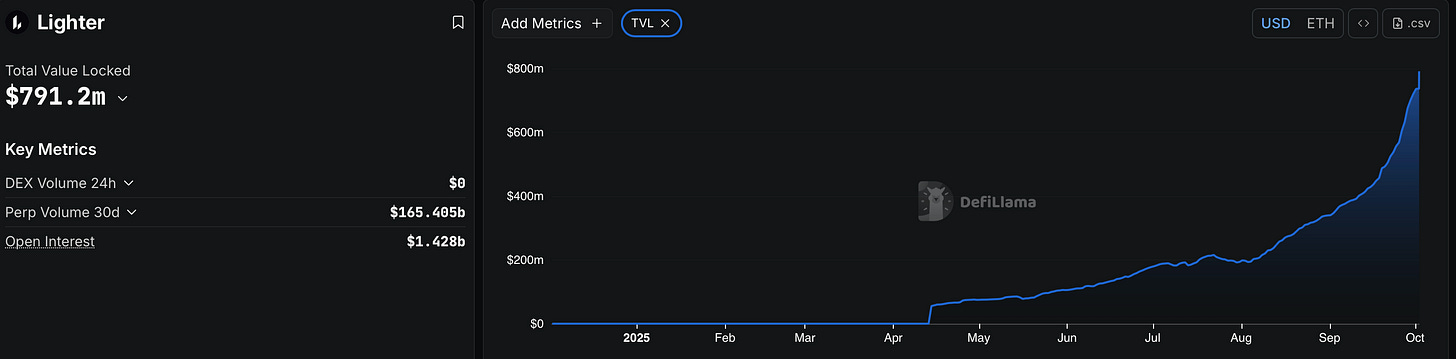

All in all, I think it’s the second-best perp DEX behind Hyperliquid right now and metrics are up-only.

Now, after 8 months of private beta and the close of Season 1, public mainnet is now live with Season 2 officially kicking off. Season 2 is set to run through 2025 (team have been hinting at a big airdrop allocation).

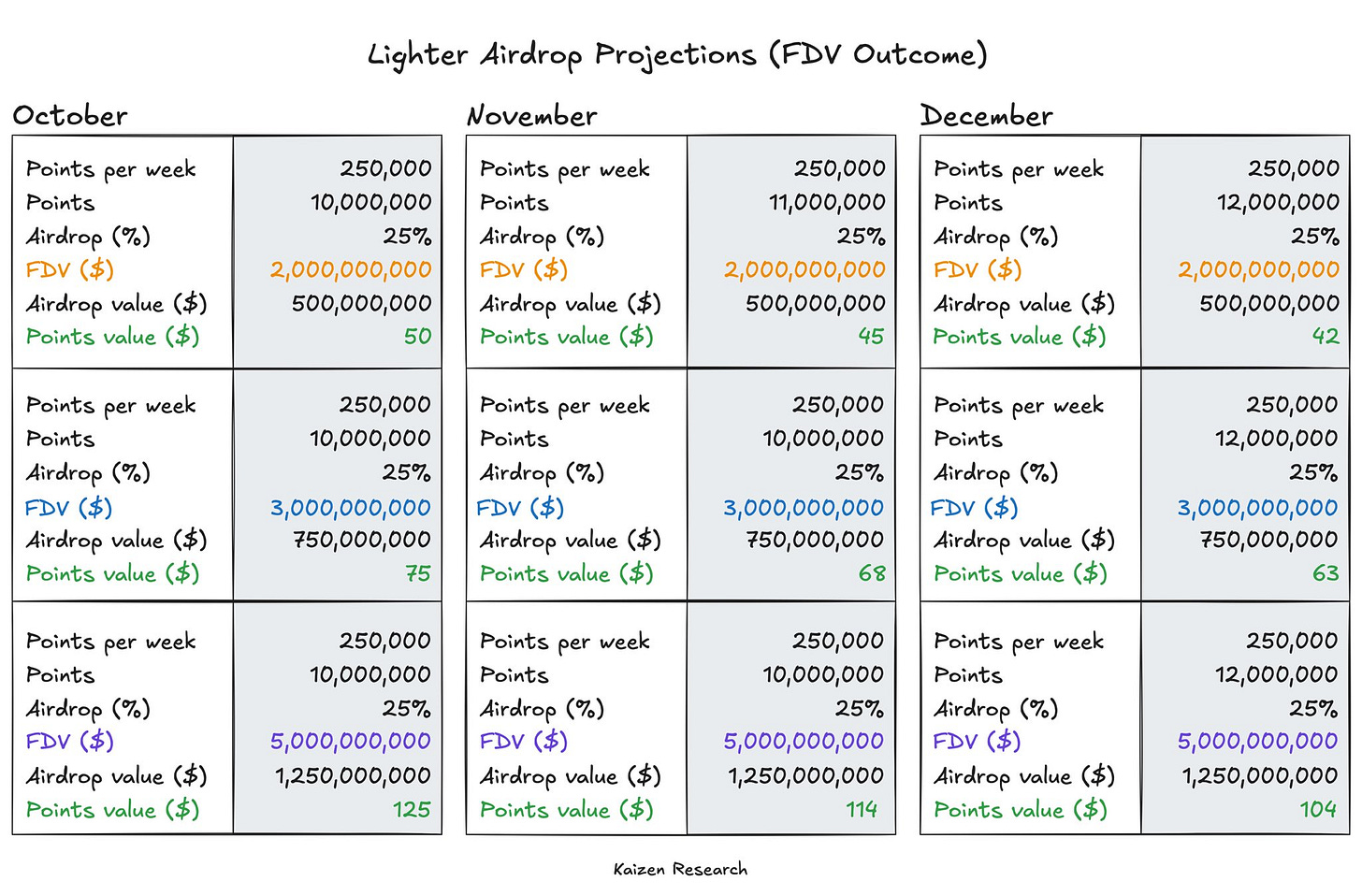

I strongly recommend you create some volume on Lighter, as we could be looking at anywhere from $42-150 per point. This will be one of the largest airdrops this year.

I have a ref link below, if you want to try and earn some points. You still have time.

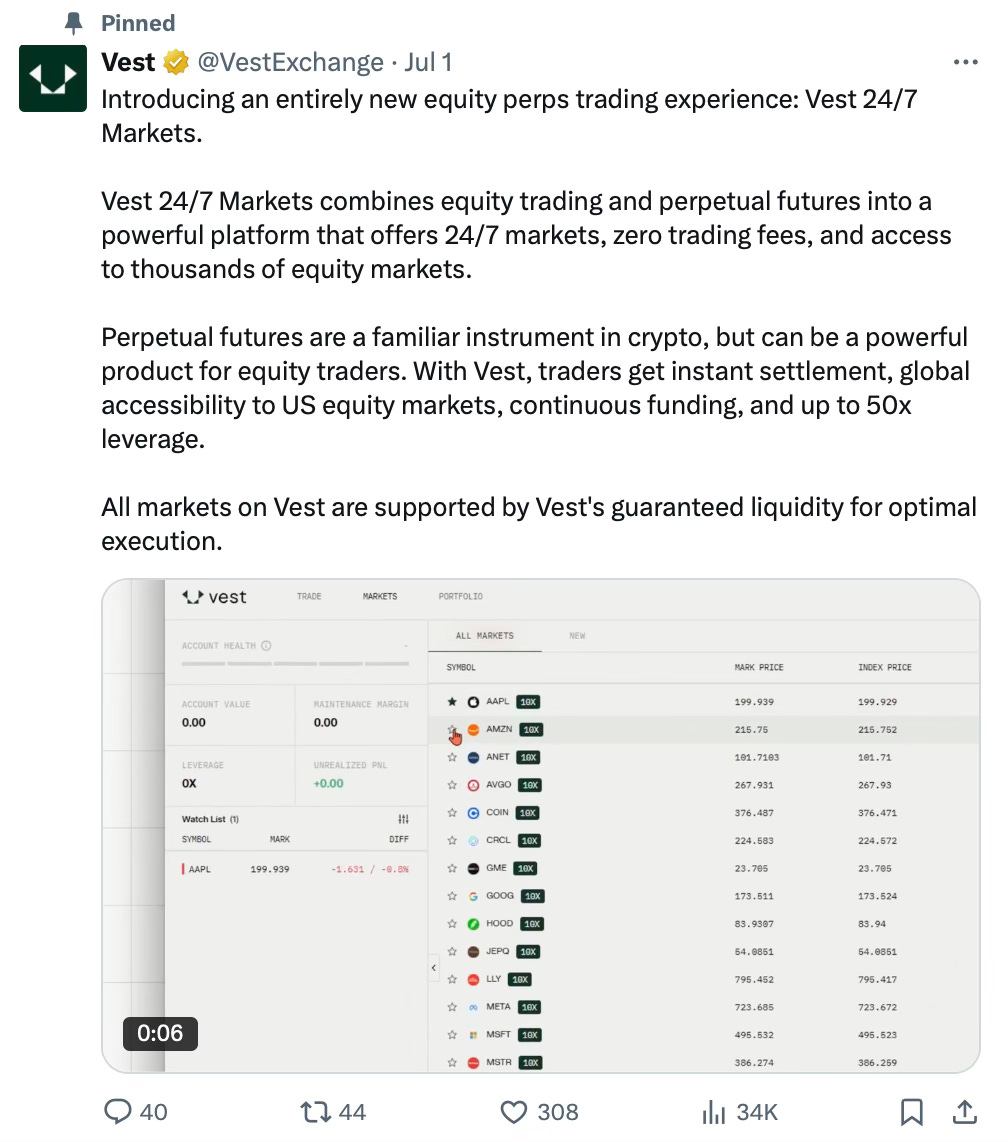

2. Vest

It’s perp DEX season and I have yet another protocol I want to share, which sits in a slightly different category to Lighter. This one is backed by Jane Street, and it’s very early.

Vest is an interesting new perps Dex for the TradFi market where you can trade stocks, indexes, and more, 24/7 and with leverage.

Arguably stocks are much easier to trade than crypto right now. Vest lets you do that with perps.

It’s still relatively early and under the radar, but liquidity looks solid with $20M+ in the LP vault and active MMs on every book.

The TAM for this kind of product is really significant here imo, since the product lets anyone with a crypto wallet trade stocks 24/7 with leverage. That’s a powerful unlock.

Personally, I’m bullish: the UI/UX is good; it is backed by Jane street which adds a layer of confidence; and last but not least not least, I don’t see anyone talking about it on my feed which is a good sign.

This means being early there could carry a real upside if the protocol manage to get solid traction.

You can already earn points by trading and providing liquidity on Vest (equity perps give you a 1.5x boost) so I wouldn’t fade that.

If you’ve ever wanted to trade stocks with leverage directly from your crypto wallet, you know where to go.

I have started to low leverage long major tech stocks and indexes on any small dip.

Here’s my ref link to try it out.

3. USD.ai

USD.ai is a synthetic dollar protocol designed to finance the physical infrastructure of AI (Compute) and other emerging sectors.

Here’s the best explanation I found of how the protocol works:

TL;DR:

USDai: A low-risk, fully backed synthetic dollar collateralized by T-Bills and infra assets. It doesn’t pass yield to holders, but offers deep secondary market liquidity across DeFi and CeFi.

sUSDai: The yield-bearing version of USDai, backed by income-generating compute infra like AI compute.

This means the yield from sUSDai comes from real-world borrowers who need compute and infra (GPU clusters, node networks, etc.), but are too small to raise money from banks or big VCs.

However, worth noting that as these assets are inherently less liquid than stablecoins, there is a risk factor involved and it can also be subject to redemption periods.

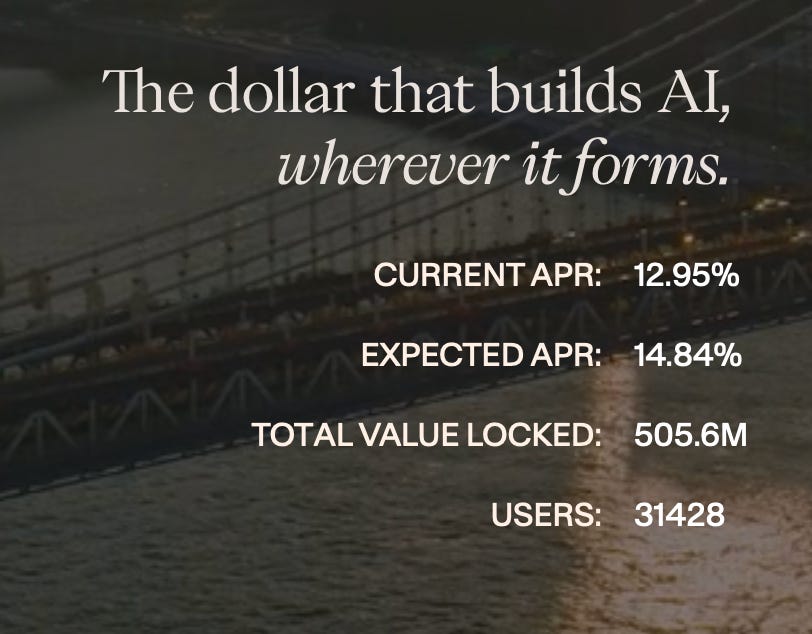

Given the rise of AI and the need for more and more compute, I feel this is an interesting concept that can scale if executed properly.

How to take advantage:

Simply stake USDai: Deposit USDC or USDT → mint USDai → stake it as sUSDai → earn 13% APY + exposure to a potential token yield.

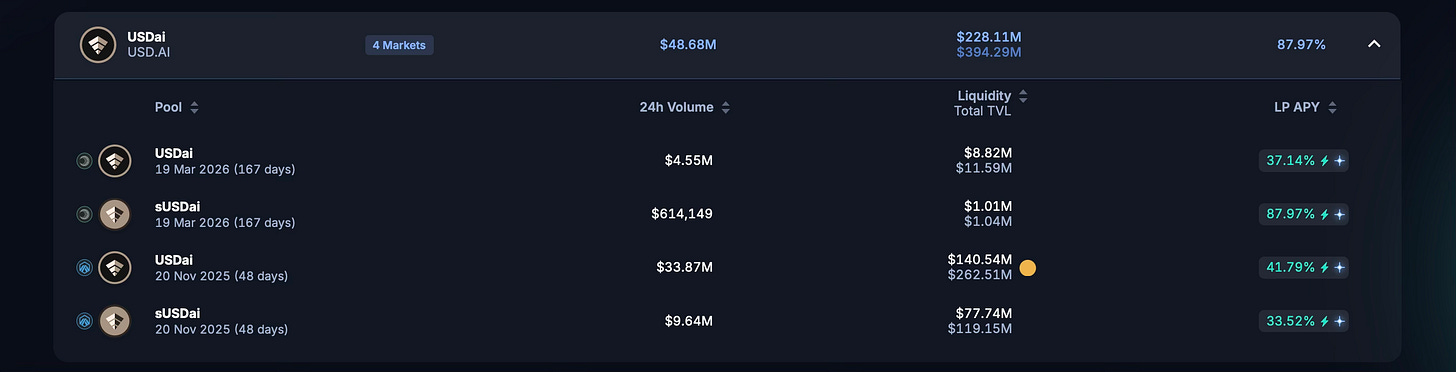

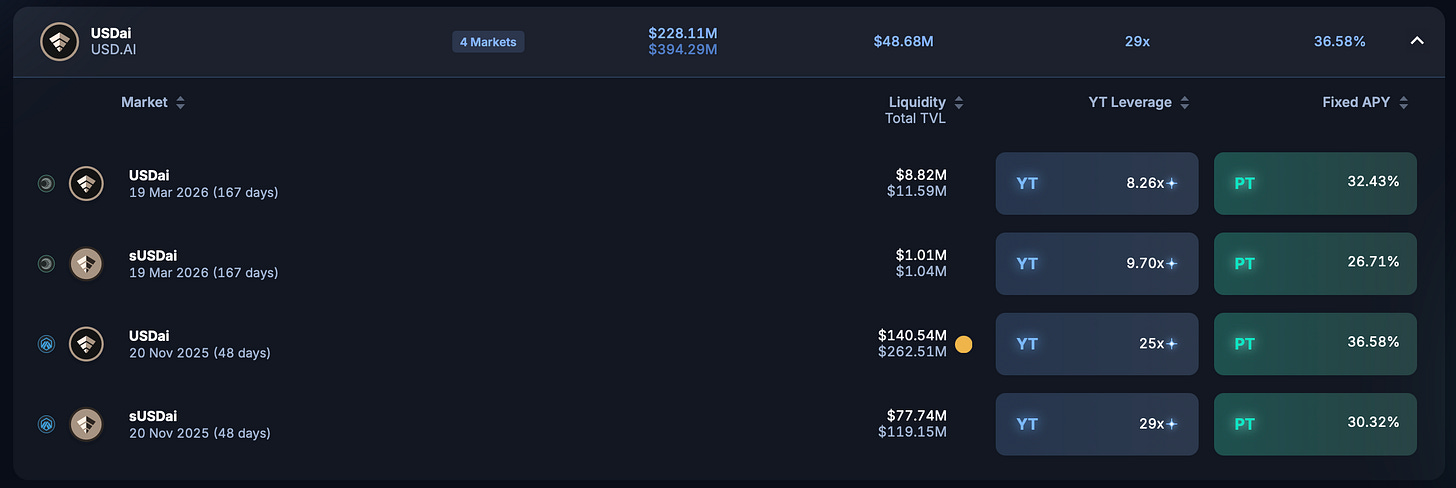

Yield trading: Pendle markets for USD.ai just launched, which opens the door to some interesting opportunities.

One thing I always like to do with stablecoins product is LP’ing to get exposure to both yield, trading fees, and protocol airdrop.

Alternatively, if you’re comfortable foregoing the potential airdrop, you can buy PT to lock in a juicy fixed yield.

Only Caveat: The current deposit cap for USD.ai has already been reached.

If you’re interested, the best move for now is to wait for the next cap increase and follow them on X to be among the first to know when deposits reopen.

You can join my USD.ai team so you are ready when the deposit cap is raised.

And that’s your alpha.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Crypto currencies are very risky assets and you can lose all of your money. Do your own research.

Alpha